|

Index investing and long-term wealth!

This week we bring together all of the questions about investing from last week and work it into a simple strategy that we can all follow to buy assets over time and create passive income for ourselves. Before we dive into this, we had a question from one of the audience... |

|

What is the [insert country] version of the FTSE Global All Cap fund? You talked a lot about investing in that fund last night, which is fine if you are British, but what about a version in the US, Ireland, India, New Zealand, etc? This question has come up multiple times in the Facebook group since.

The simple answer is that if you live elsewhere in the world then don't search for a version of the FTSE Global All Cap fund; rather, look for a global tracker because it will be called something different where you are. DON'T have home country bias - where you just invest in your country: this is BAD for most of us! The exception is if you're in the US because US companies are mostly global and the US accounts for such a big part of the global fund. So look for a simple global tracker such as the Vanguard FTSE Developed World Ex UK or the Vanguard FTSE Global All Cap Index Fund and just start there.

If you are in the US then you can use something simple like VTSAX.

The simple answer is that if you live elsewhere in the world then don't search for a version of the FTSE Global All Cap fund; rather, look for a global tracker because it will be called something different where you are. DON'T have home country bias - where you just invest in your country: this is BAD for most of us! The exception is if you're in the US because US companies are mostly global and the US accounts for such a big part of the global fund. So look for a simple global tracker such as the Vanguard FTSE Developed World Ex UK or the Vanguard FTSE Global All Cap Index Fund and just start there.

If you are in the US then you can use something simple like VTSAX.

Week 7 in 4 minutes

|

We have created something new for this week. A 4-minute YouTube video that recaps almost all of the major points from week 7. This is NOT a substitute for watching the whole of week 7 but is meant as a quick reminder.

We would love to know what you think. Please leave a comment and like on the video in YouTube and tell us if you like the recap videos. If you enjoy them and we get some comments then we might go back and create them for every single week! |

|

The impact of fees

|

We met back up with Early Ellie and Late Larry who we first met in week 4 when we talked about the power of compounding. The moral of the story in week 4 was to invest as early as you can. We revisited Ellie this week to see the impact on her investments of choosing between an actively managed fund and an index fund. Fees MASSIVELY eat into your returns. Of course, Early Ellie and Late Larry are still doing better than Never Bothered Ned who never bothered investing and has a big fat ZERO.

For a full break down of how fees impact your financial article read this article which Katie did the maths for and Alan wrote the words for: |

The impact of fees tool

|

Katie created a tool that helps you analyse the impact of fees on your current investments. This tool can take two investments with different providers and analyse the difference over a 30-year period.

The video to the right is a 'how to use the tool' guide. To find the tool and have a play around, click on the link below. Look up the fees for your existing pensions (SJP, Aviva, Nest, etc) and see what impact they have |

|

Week 7 - homework

To get the most out of this course you must do the homework (plus homework is fun! Or that's what Katie tells me....)

So here is the homework for week 7...

1. Have you done the homework from week 6? If not, go back and do it now! We are going to ask you these questions repeatedly over the next few weeks. What funds do you have? What platform are they on? What are the fees?

So here is the homework for week 7...

1. Have you done the homework from week 6? If not, go back and do it now! We are going to ask you these questions repeatedly over the next few weeks. What funds do you have? What platform are they on? What are the fees?

|

2. Last year we did a bonus workshop called Deciphering Fund Fact Sheets. A lot of you are asking us how to understand your existing investments, and this workshop will help you understand the paperwork your pension provider, IFA, or fund manager sends you. Your homework is to get out your existing paperwork and watch this video to help you translate it into plain English!

3. Chat to someone about index funds or teach a kid about index investing. The quickest way to check your own knowledge is to try and teach someone else. If you end up getting frustrated then that means you don't quite know the subject well enough to explain it! Have a go at explaining what you have learnt to someone and note down the questions they ask you! |

|

Where are we in the investing weeks?

The investing course

This was part 2 of the 3 weeks we are spending on investing.

Coming up in week 8

You might be thinking...

"This is all very well, Donegans, but I'm now sitting at my laptop, ready to invest, and wondering how to actually do it? What are the different accounts I can get? What are the different fees you have to pay, and how can you minimise these?"

Well, in week 6 we covered some of the theory of investing. This week, we explained more about index investing and building long-term wealth. Next week (week 8) we're going to talk about how to implement all of this! Stick with it, we're building week on week. We have one more week of content to cover this investing stuff. Hang tight. You don't need to implement anything yet! We have more to tell you.

We will go through platforms, accounts (ISAs, SIPPs, and other versions), and how to actually get your first investment going. We also have a whole series of YouTube videos coming for you to show EXACTLY how to open a SIPP and an ISA, step-by-step.

Disclaimer

We are NOT financial advisers. The content of this course, the articles on this blog, and these articles are NOT financial advice. This is our opinion and we are just sharing what we are doing. DO YOUR OWN HOMEWORK.

This was part 2 of the 3 weeks we are spending on investing.

- Part 1. Week 6. The theory. Introduction to assets, diversification, and what are stocks and shares?

- Part 2. Week 7. Index investing in detail and building long-term wealth

- Part 3. Week 8. Putting it into practice. What type of account should you open? How do you actually implement this stuff?

Coming up in week 8

You might be thinking...

"This is all very well, Donegans, but I'm now sitting at my laptop, ready to invest, and wondering how to actually do it? What are the different accounts I can get? What are the different fees you have to pay, and how can you minimise these?"

Well, in week 6 we covered some of the theory of investing. This week, we explained more about index investing and building long-term wealth. Next week (week 8) we're going to talk about how to implement all of this! Stick with it, we're building week on week. We have one more week of content to cover this investing stuff. Hang tight. You don't need to implement anything yet! We have more to tell you.

We will go through platforms, accounts (ISAs, SIPPs, and other versions), and how to actually get your first investment going. We also have a whole series of YouTube videos coming for you to show EXACTLY how to open a SIPP and an ISA, step-by-step.

Disclaimer

We are NOT financial advisers. The content of this course, the articles on this blog, and these articles are NOT financial advice. This is our opinion and we are just sharing what we are doing. DO YOUR OWN HOMEWORK.

Further resources

This is not an exhaustive list of the course. Also, you don't have to read/watch/listen to all of these. Just pick ONE and start!

- When we ran the course last time we didn't give enough information on how to choose an index fund and how to actually get going. During lockdown we wrote a whole series of articles covering this and they go into way more detail than we have time to cover on our calls. Here are some articles about index investing.

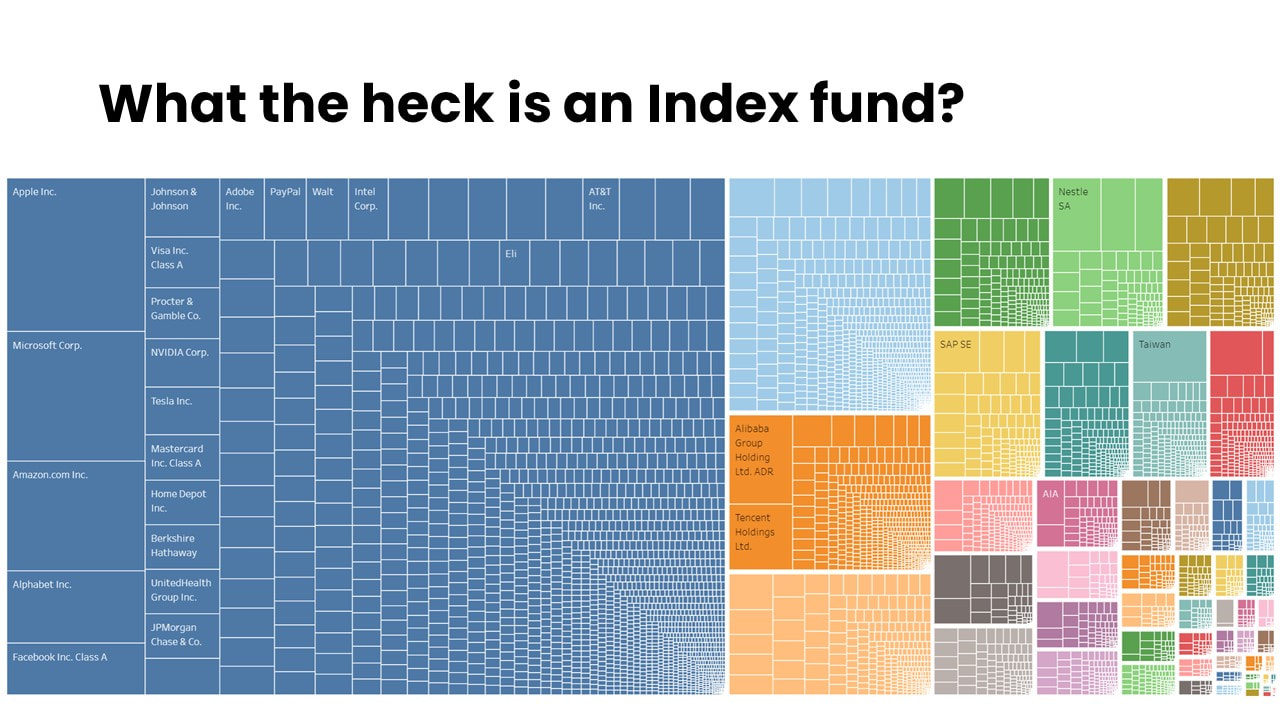

- "What is an index fund?" - Watch the video we made that answers the question

- Last year on Rebel Finance School we had JL Collins come on and talk to us about investing. It is a great video to watch to go through the fundamentals of index investing.

|

|

|

Ask for help

Remember to reach out in the Facebook group with any questions you have or if you get stuck. Don't let confusion be an excuse for not progressing with this stuff. We are here to support you!

Alan and Katie

Remember to reach out in the Facebook group with any questions you have or if you get stuck. Don't let confusion be an excuse for not progressing with this stuff. We are here to support you!

Alan and Katie