Week 4: Debt and the power of compounding

|

Debt, Debt, Debt. It pulled Alan's family apart and the Donegans are on a mission to stop it doing the same to other people. This week we discuss how companies put you into debt, how they market it, profit from it and how you can avoid it. Katie also goes through the mathematically best way to get rid of debt!

Even if you don't have debt, this week will be useful to help others, protect your family and avoid future problems. Let's get out of debt and start taking control of our own finances! |

|

Debt

This is a big topic! We think about this in two parts....

- How we get into debt

- How we get out of debt

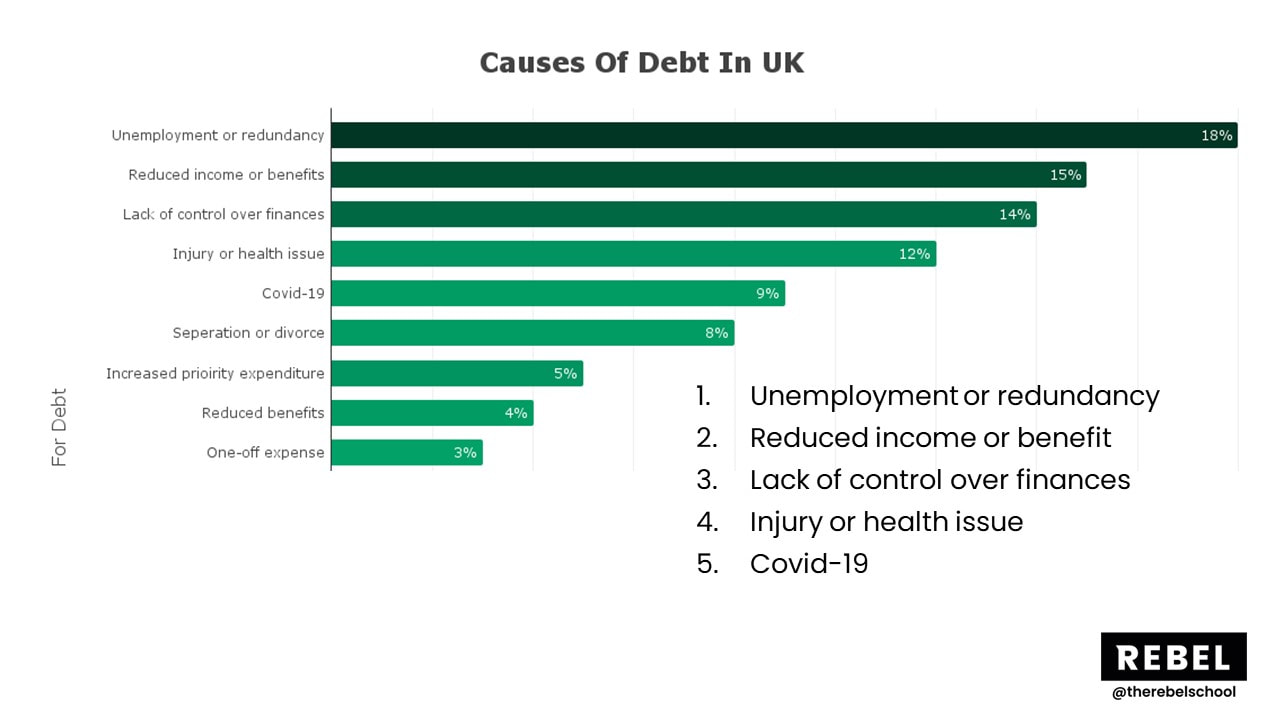

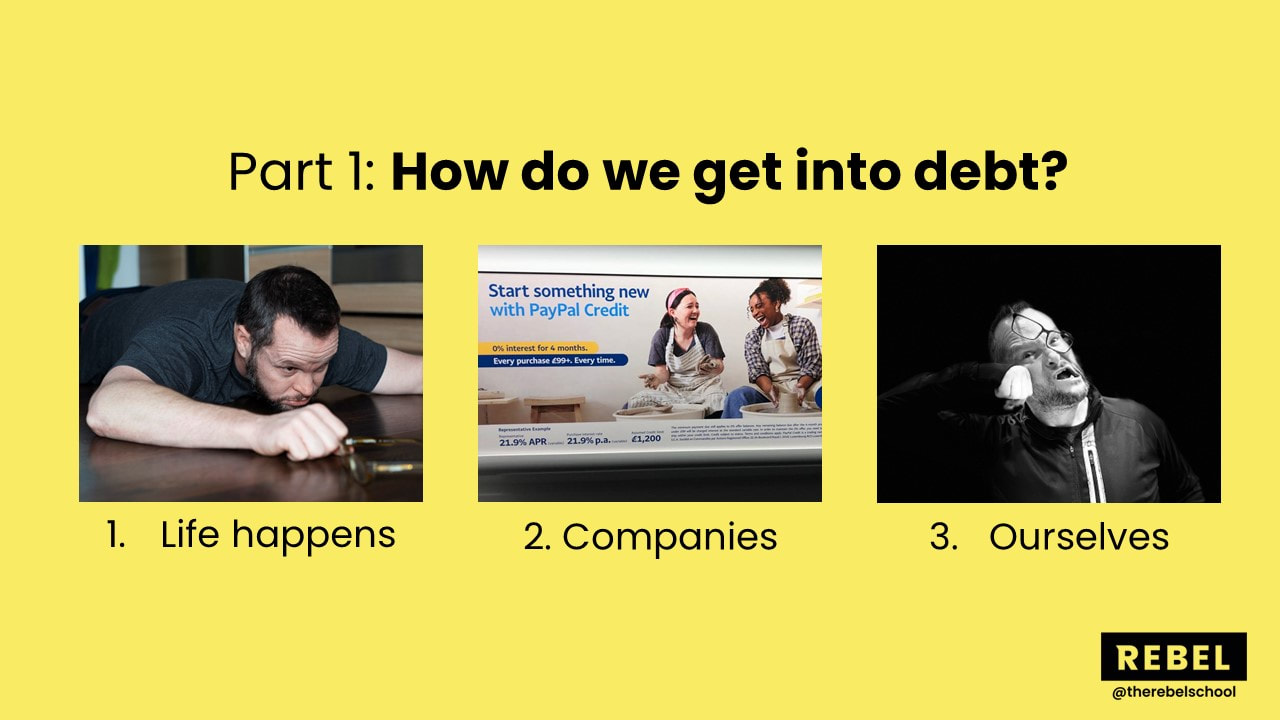

How do we get into debt?

|

It's so easy to get into debt!

There are three main ways we go into debt......

|

How can we protect ourselves?

We can protect ourselves from this by building an emergency fund in the good times, changing our spending strategies and learning how companies sell us debt.

8 ways to stop debt happening to us again. it is SO IMPORTANT we have a good defence against debt happening to us again. if we don't cure the problem then it is something that is bound to repeat again! A good defence starts with a strong emergency fund

- Have an emergency fund - This protects you against so many things. if you lose your job, the car breaks down or you fall ill, the emergency fund protects you and stops you going back into debt. This is SO important to build

- Sell off big liabilities - If you own big liabilities like cars, motorbikes, bike or houses, then these not only lock away money you could use but COST you money in maintenance and insurance each month. SELL off the big liabilities in your life and use the money to stock your emergency fund.

- Buy small liabilities - if you are going to buy a liability like a car then buy a small one that doesn't cost too much to run. This way less money is drained away from you each month

- Create a huge gap - do everything you can to create a huge gap between your expenditure and income. The bigger the gap the easier you will find it to ride problems and avoid going back into debt

- Change your spending strategy - we talked a lot about spending strategies. Instead of 1-click purchasing on Amazon put it in your basket, set a reminder for a week and ask if you really need it a week later before buying it. Instead of just buying things now ask; can I afford this from positive balance not credit? Can I get the same value for less money? and could I buy my freedom instead?

- Cut up your cards - as you saw Jason do on the call cut up the cards. If you can't resist the temptation then cut them up and get rid of them all!

- Monthly finance meetings - we will be going into how to run these in week 5. What get's measured get's improved so track your progress each month and discuss what has happened!

- Teach your family sales - the more you understand sales the more you will be able to defend yourself from the sales techniques companies use against you. Learn sales and teach your family. Maybe start with Influence by Robert Chaldini

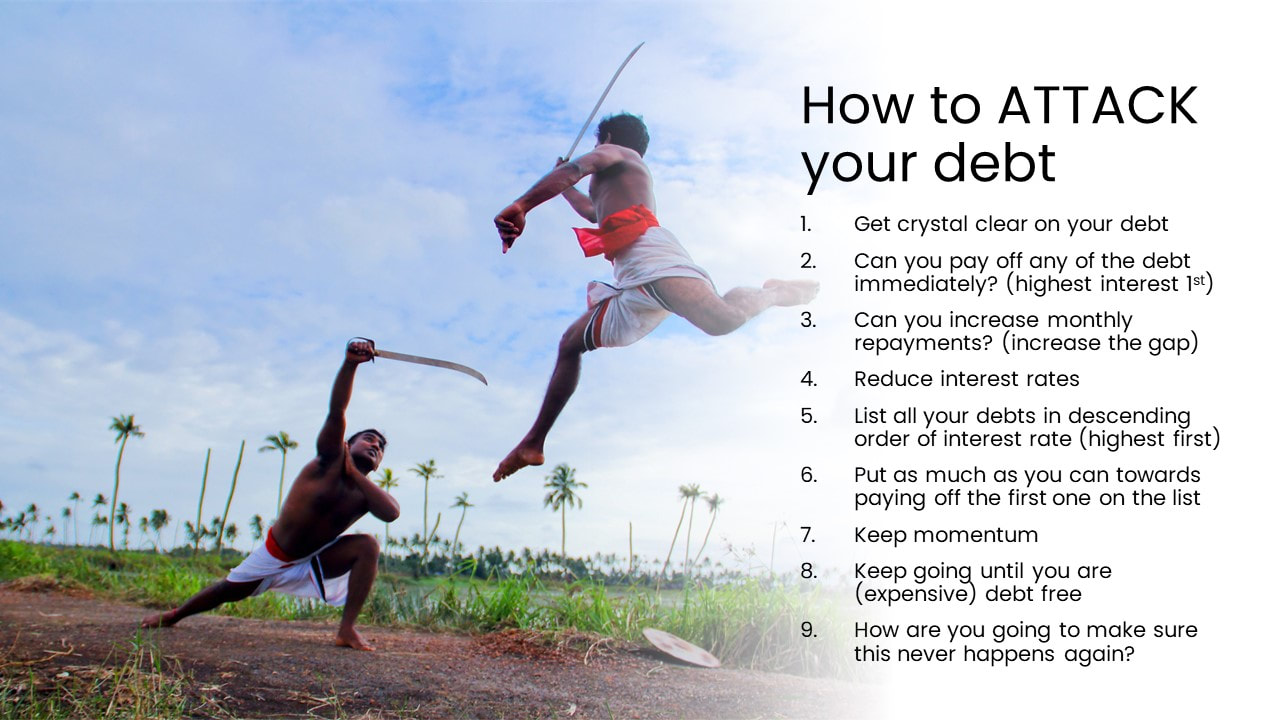

How to get out of debt:

The debt attack strategy

This is how we think about debt. As always, don't take our word for it! Do your own homework and research and think about whether this is right for your circumstances. That being said, here's the strategy! We've put some ideas under each step - do all of the steps but you don't have to do ALL of the additional ideas. Don't get overwhelmed, just pick a couple to start with and get some momentum.

|

The debt attack strategy has 9 steps. Designed to take you from where you are all the way through to getting out of debt.

As part of our second series of YouTube videos we created a video taking you through all the steps. It is 9 minutes long. If you don't like to read then watch the video here. The whole purpose of our content is to help you get out of debt and stay out of debt. If we can help you do that then we are ready to get onto the sexy stuff, investing. We want compounding to work for you not against you! |

|

1. Get crystal clear on what all your debts are

For each of your debts (car loans, store cards, credit cards, personal loans...), find the paperwork and get clear on:

Put all the debts in a table like this one: https://www.vertex42.com/Calculators/debt-reduction-calculator.html

Include 0% cards, this is a temporary situation. It won't always be 0%. You have to pay these off too. You can't just keep shifting it to 0% cards forever. Your calendar is your friend. Set a reminder a month or so before the deal ends so you can work out what you want to do with that debt and so you won't be surprised when they start charging you interest!

When we first work with people they come to us with a story about how they got into debt and they mostly don't understand the different debts they have. Clarity is power. We need to get super clear on exactly where you are financially so we can tackle it and start to make progress.

- Balance (how much you owe)

- Interest rate

- Minimum payment

- If the deal changes after a certain time (e.g. pay nothing for a year), find out what the payments will be, what the interest rate will be and when it changes. Put a reminder in your calendar of when the deal is going to end so you can reassess

Put all the debts in a table like this one: https://www.vertex42.com/Calculators/debt-reduction-calculator.html

Include 0% cards, this is a temporary situation. It won't always be 0%. You have to pay these off too. You can't just keep shifting it to 0% cards forever. Your calendar is your friend. Set a reminder a month or so before the deal ends so you can work out what you want to do with that debt and so you won't be surprised when they start charging you interest!

When we first work with people they come to us with a story about how they got into debt and they mostly don't understand the different debts they have. Clarity is power. We need to get super clear on exactly where you are financially so we can tackle it and start to make progress.

1. Can you pay off any of the debt immediately?

There are some ways you might be able to raise some cash straight away...

We’re not telling you that you have to give it up forever. Store it on gumtree/craigslist until you can afford it. What we mean by this is sell it on these platforms (or something else like Facebook Marketplace). You can always buy it back (or one very similar) when you're in a better financial position.

This has a double whammy because you'll get the money from selling the liabilities AND you'll stop paying for them each month.

Thinking clearly about interest rates, investments and savings became a huge thing this year. We met three people in very different situations. Have a look at the three slides below and tell us which one of the options on each slide you would chose?

- Can you sell any liabilities?

- Holiday home

- Car that’s barely used

- Motorbike

- Pleasure boat

We’re not telling you that you have to give it up forever. Store it on gumtree/craigslist until you can afford it. What we mean by this is sell it on these platforms (or something else like Facebook Marketplace). You can always buy it back (or one very similar) when you're in a better financial position.

This has a double whammy because you'll get the money from selling the liabilities AND you'll stop paying for them each month.

- Can you sell any belongings you don’t use? Are you using that treadmill you bought as a very expensive clothes horse? Sell the stuff you have in the house and the garage. In the UK you can use Ziffit or Amazon to sell second hand books and DVDs.

- Do you have a storage unit full of forgotten belongings? Sell that stuff AND stop paying the storage fees. Do you have an old bike?

- What savings do you have? Banks make money by lending at a higher rate than they'll give you on your savings. KEEP EMERGENCY FUND of £1,000. Use any other savings to pay off your debt.

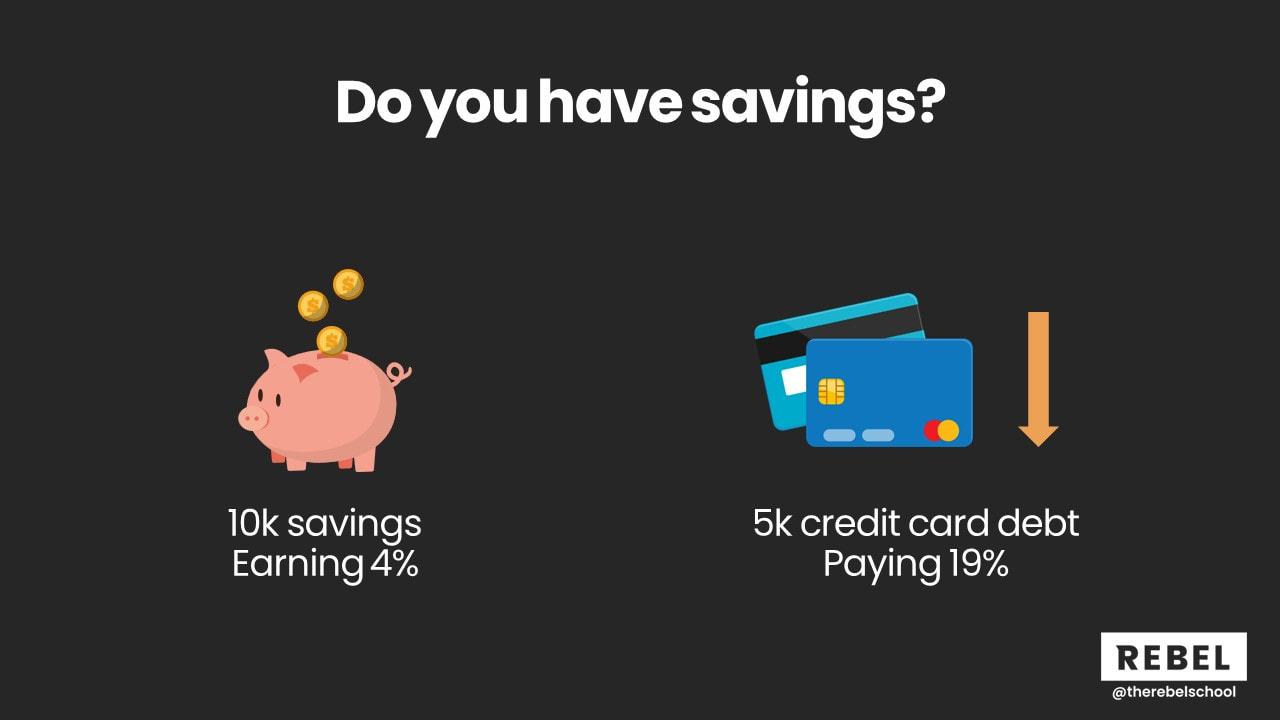

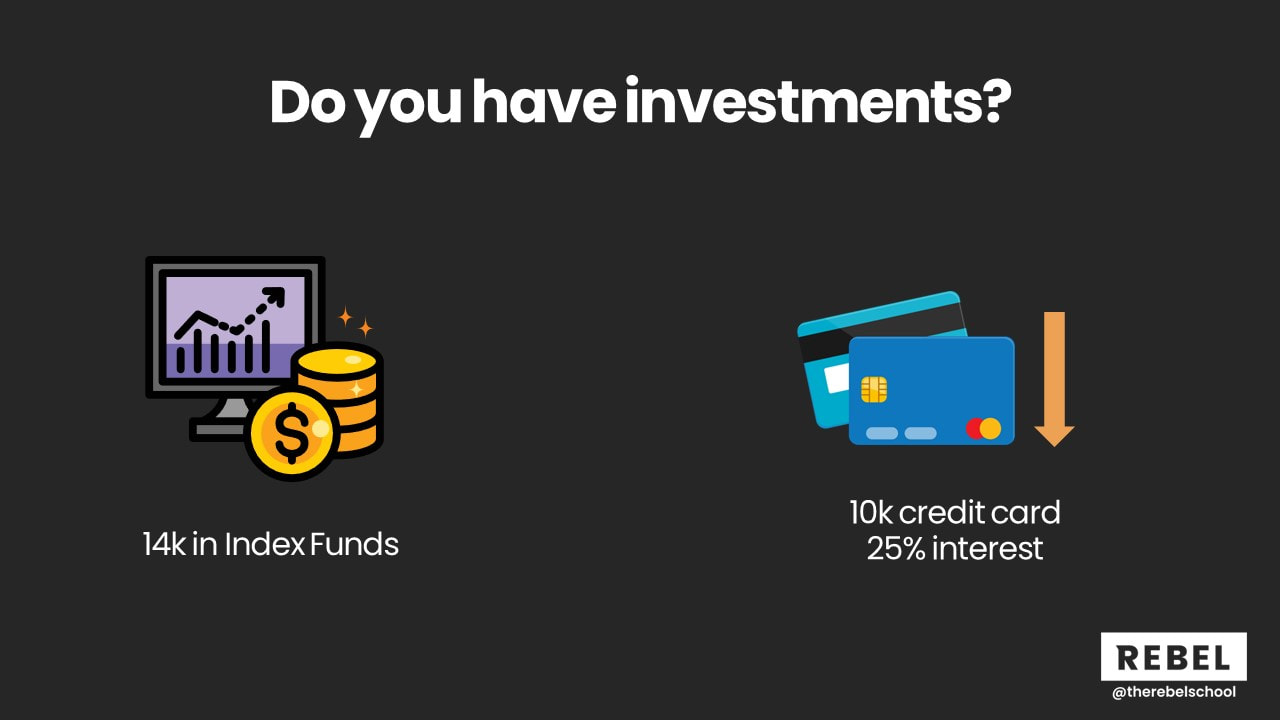

Thinking clearly about interest rates, investments and savings became a huge thing this year. We met three people in very different situations. Have a look at the three slides below and tell us which one of the options on each slide you would chose?

Example 1: If you had £10k in savings earning 4% interest and you had £5k in credit card debt at 19% interest what would you do? Some of you might be thinking is this even a choice Donegans? Well this is a real life situation from this year's debt case studies! If it was us we would cash in some of our savings and pay off the credit card debt straight away getting a guaranteed 15% better return!

Example 2: You have build up £14k in index fund investments. These generally return somewhere around 10% a year but there is a risk that they won't do that every year. Then you also have £10k credit card debt at 25% interest. What would you do? Seems crazy to us. In this situation you are borrowing at 25% interest on a credit card to get a possible 10% return in the market! Sell the index funds and pay off the debt!

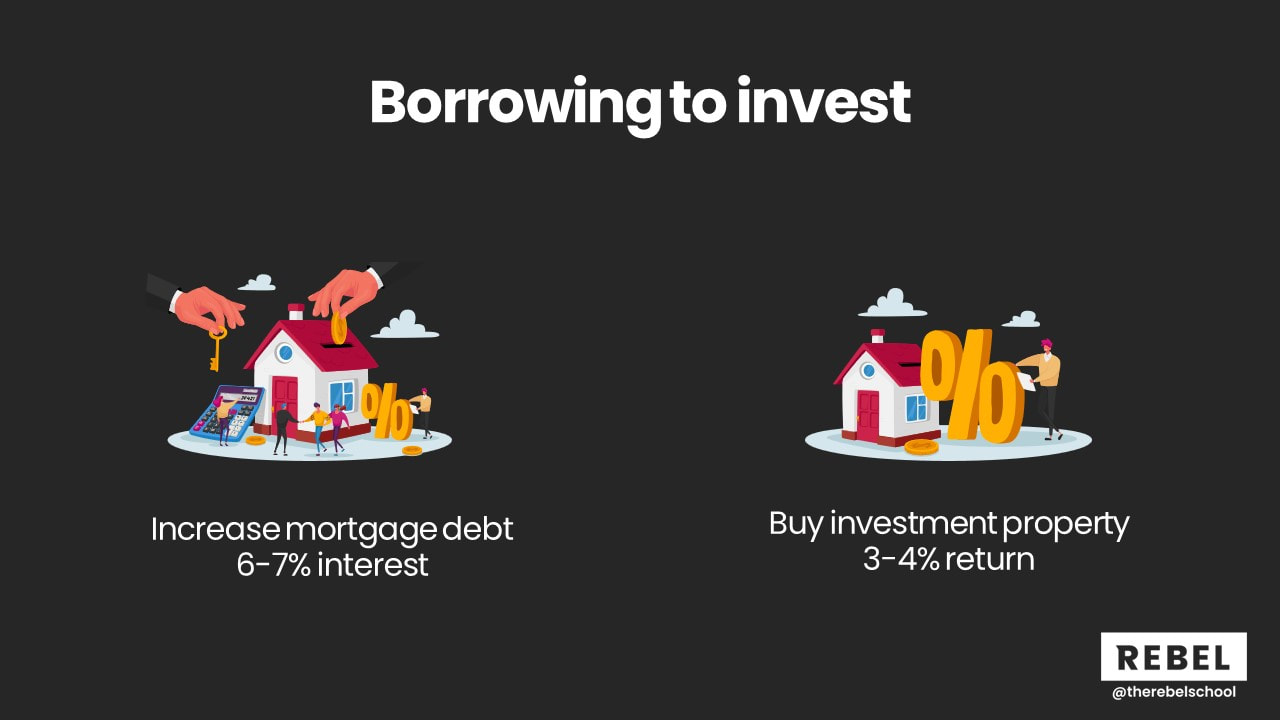

Example 3: Comes from a question we were asked the first week. The lady asked should I refinance my primary residence to get the money to buy an investment property. Alan's first question was "what's the potential returns on the investment property?" The lady said "3-4%". We were shocked. So you are going to refinance your house, borrow money, go into more debt at 5-7% interest rates to buy an "asset" that is returning 3-4%? Would you do that?

The Donegans would NEVER borrow money at an expensive interest rate to buy a fake asset that returns less than that. This is crazy financially.

We need to think more carefully about how we use our money and if you have savings or investments it might be better off paying off your debt by selling those!

Example 2: You have build up £14k in index fund investments. These generally return somewhere around 10% a year but there is a risk that they won't do that every year. Then you also have £10k credit card debt at 25% interest. What would you do? Seems crazy to us. In this situation you are borrowing at 25% interest on a credit card to get a possible 10% return in the market! Sell the index funds and pay off the debt!

Example 3: Comes from a question we were asked the first week. The lady asked should I refinance my primary residence to get the money to buy an investment property. Alan's first question was "what's the potential returns on the investment property?" The lady said "3-4%". We were shocked. So you are going to refinance your house, borrow money, go into more debt at 5-7% interest rates to buy an "asset" that is returning 3-4%? Would you do that?

The Donegans would NEVER borrow money at an expensive interest rate to buy a fake asset that returns less than that. This is crazy financially.

We need to think more carefully about how we use our money and if you have savings or investments it might be better off paying off your debt by selling those!

3.Can you increase monthly repayments?

You need to prioritise paying off your debt and stop going on holidays, stop eating out, stop getting takeaways, stop buying the latest iPhone. Stop investing in the stock market (for now), until you've paid off your expensive debt. If you're doing this, you are essentially borrowing money to invest in the stock market and this is NEVER a good idea.

How much a month can you put towards paying off the debt? How might you reduce your spending elsewhere or increase your income? Widen the gap between income and expenses as much as you can! Trim the fat like we showed you in week 2!

How to increase income

How to reduce spending

These are some ideas to reduce spending.... some are more extreme than others! Pick the one(s) that work for you

How much a month can you put towards paying off the debt? How might you reduce your spending elsewhere or increase your income? Widen the gap between income and expenses as much as you can! Trim the fat like we showed you in week 2!

How to increase income

- Read Alan's 10 ways to increase your income article and pick one idea to implement

- How might you change your living situation to increase your gap? e.g. Get a room mate/lodger. In the UK the rent a room scheme allows you to earn £7,500 a year (£625 a month) TAX FREE by renting out part of the home you live in

- Start a side hustle. Check out Alan's Rebel Entrepreneur podcast which is all about how to start a business without going into debt. Start with the episode 5 ways to start a business with no debt

- Use the gig economy (Deliveroo, Uber, Flex etc.)

- If you have a partner, first of all tell them about the debt. Secondly they might be willing to help and put some of their income towards the debt

How to reduce spending

These are some ideas to reduce spending.... some are more extreme than others! Pick the one(s) that work for you

- Go through your spending category by category. Where can you reduce spending? We use Money Dashboard to track our spending (see week 2 for more details)

- Streaming platforms. You can only watch one at once! Cycle through them rather than having them all at the same time. e.g. have Netflix for a month or two to watch the shows on there, then switch to Amazon Prime and so on.

- Transport. Could you downsize your car? Have you optimised your car to spend less? Do you even need a car? Multiple cars?

- Utilities. Compare to the average in your area. Use comparison sites to check you have the best deal.

- Insulate your home. In some areas/countries there are government schemes to help you do this. Check if there's one in your area

- Don't have any kids or dependents? Ready to go extreme with your living situation? Check out Property Guardians in the UK

- Food shopping.

- You *think* you're an Aldi shopper and just get a few bits and bobs in Waitrose but are you really? Track it for a month and find out.

- Make a list before you go to the supermarket and only buy what's on the list

- Other spending

- What subscriptions could you cancel and put towards the debt instead. We coached someone who had an £18.99 gym subscription they weren't using. When they put that towards their credit card debt it saved them £514 in interest and they paid if off 10 months quicker.

- Stop expensive hobbies (at least for now). Be creative with ways to have fun for free or for much cheaper

4.Reduce interest rates

Can you negotiate lower interest rates with your credit card company or get a 0% balance transfer? Could you get a cheap(er) personal loan? BEWARE commercial debt management companies. They are there to make money out of you.

The best way to do this is to call them on the phone and talk to them. Tell them you can't afford the repayments. Tell them the debt is crippling you. Tell them you are doing to need to move else where to get on top of it. Ask for a reduction in interest rates and then go silent. SILENCE is so powerful when negotiating.

The best way to do this is to call them on the phone and talk to them. Tell them you can't afford the repayments. Tell them the debt is crippling you. Tell them you are doing to need to move else where to get on top of it. Ask for a reduction in interest rates and then go silent. SILENCE is so powerful when negotiating.

5.List all your debts in descending order of interest rate (highest first)

NOT in order of balance. This way you will pay the least amount of interest. If you have multiple 0% cards, put the deal that ends soonest first. Some of the debt strategies out there tell you to do this in order of balance and pay off the smallest first but this can be the least efficient way to pay it off.

Put all the cards in order of interest rates. You will have heard the Donegans asking on the course in their questions "What's the interest rate?" when people are talking about debt. This is one of the most critical pieces of information we have and one that a lot of people don't know!

Put all the cards in order of interest rates. You will have heard the Donegans asking on the course in their questions "What's the interest rate?" when people are talking about debt. This is one of the most critical pieces of information we have and one that a lot of people don't know!

6.Put as much as you can towards paying off the first one on the list

Pay the minimum payments on all debts AND put any and all additional cash towards paying off the first debt on the list. The key is to attack the debt with the highest interest rate with all your resources. Tackle that sucker! Focus on the highest interest rate debt first!

7.Keep momentum

When you pay off a loan or card, roll that payment into the next one on the list. Never lower overall repayment amounts. Keep rolling each one you pay off into the next one. This builds momentum and helps you tackle the debts quicker and quicker.

If you are paying £800 a month towards your debt and you pay off the first one which would reduce that by £200 don't celebrate and go on holiday yet! Keep your repayments at £800 a month, or more if you can and roll that extra £200 into the next debt. Keep that momentum and you will find it gets quicker and quicker as you get nearer the end of the debt repayments.

If you are paying £800 a month towards your debt and you pay off the first one which would reduce that by £200 don't celebrate and go on holiday yet! Keep your repayments at £800 a month, or more if you can and roll that extra £200 into the next debt. Keep that momentum and you will find it gets quicker and quicker as you get nearer the end of the debt repayments.

8.Keep going until you are (expensive) debt free

Celebrate your freedom! Maybe have a picnic or do a little jig in the kitchen. Celebrate, cheer, write to the Donegans or email and tell us. We want to know about your successes!

9. How are you going to make sure this never happens again?

Do you trust yourself with credit cards... if not, cut them up! Make sure you have an emergency fund. Sell any big liabilities if you can. Change your spending strategy. Have a monthly finance meeting.

Use the 8 ways we described earlier in the article to avoid this ever happening again. We don't want this to be a yo-yo financial diet. You know the thing when you diet strictly with food, lose a lot of weight, celebrate success and then bounce back to your old weight in a year.

Avoid this and use these tools to avoid this ever happening again!

This is the tool Katie used to work out what order each debt case study should pay off their debts and how long it will take: https://www.vertex42.com/Calculators/debt-reduction-calculator.html

When it asks you to choose which strategy you want go with "Avalanche". This puts the debts in descending order of interest rate.

Use the 8 ways we described earlier in the article to avoid this ever happening again. We don't want this to be a yo-yo financial diet. You know the thing when you diet strictly with food, lose a lot of weight, celebrate success and then bounce back to your old weight in a year.

Avoid this and use these tools to avoid this ever happening again!

This is the tool Katie used to work out what order each debt case study should pay off their debts and how long it will take: https://www.vertex42.com/Calculators/debt-reduction-calculator.html

When it asks you to choose which strategy you want go with "Avalanche". This puts the debts in descending order of interest rate.

Student loans

|

Student loans became a huge topic of conversation in Rebel Finance School this year. We had a participant in the first week who rightly bought up her loan and asked the question "Should I pay off my student loan quickly?"

This sent Katie off into research mode for about a day and a half. She came back with some amazing learnings about the student loan scheme in England. All of the home countries have different loan schemes so if you are in Scotland you will need to do your own research. The video to the right is the Donegans coaching Al, The Rebel HQ Building manager, through the thought process of whether he should pay off his student loans or not. |

|

If you know someone that has a student loan then get them to watch this video and think through their personal situation. it has become very nuanced with the increase in interest rates recently. Watch the video and then think through your earning potential.

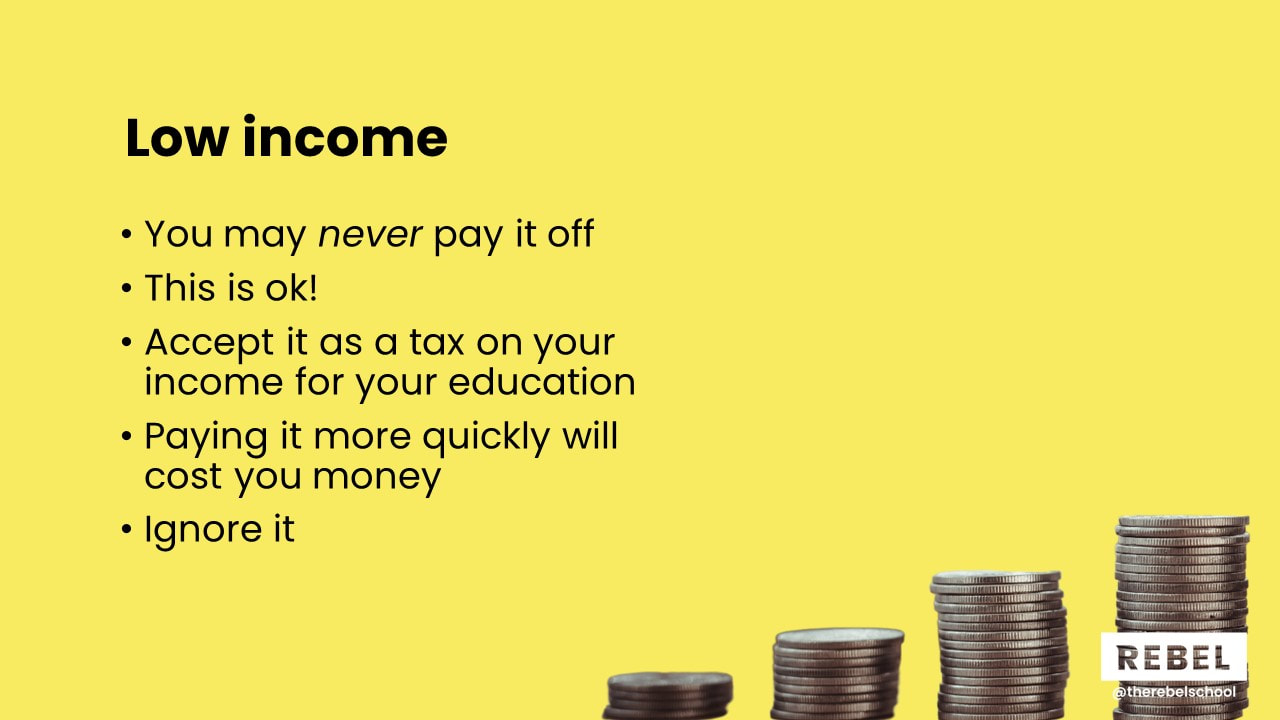

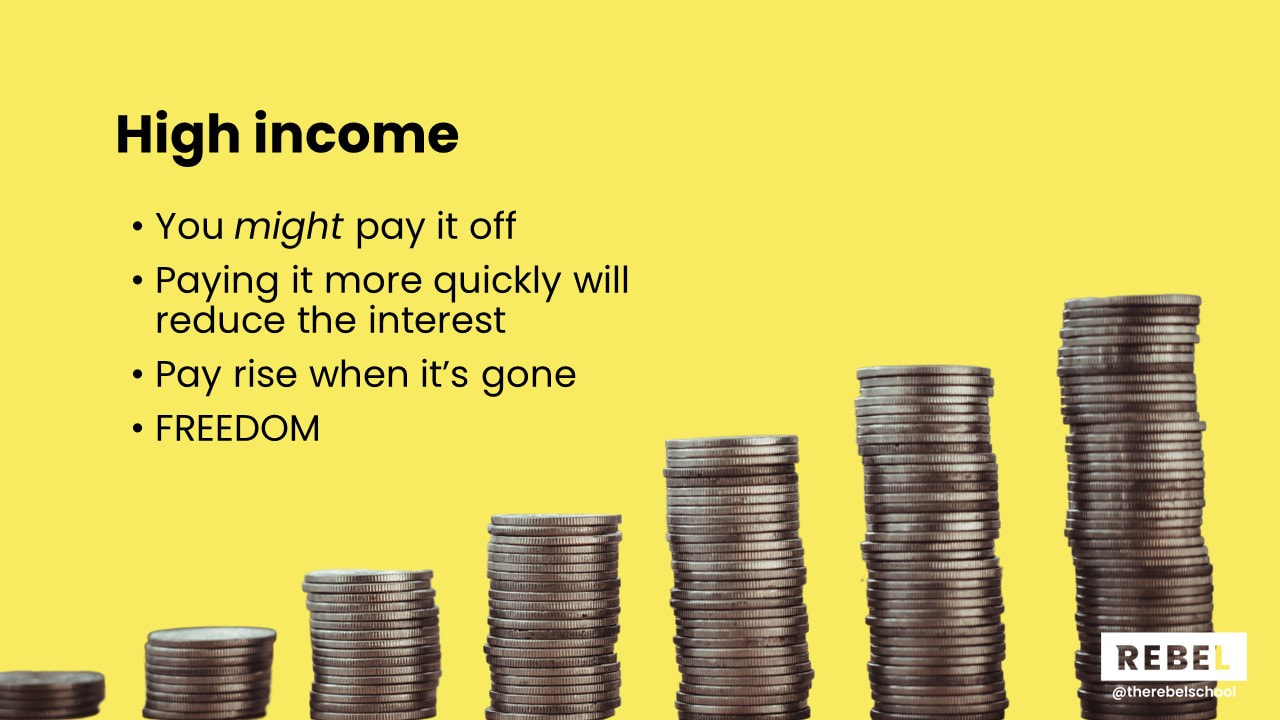

One of the biggest questions we have for you is about your earnings potential. Are you high earner? Has your degree led you to a job at Deloitte and you might make £60k+? Or have you chosen a career with lower earnings potential? This hugely affects whether you should look at your student loan as a debt to get rid of, or a life long tax on your earnings for education.

Student loans - UK

Money Saving Expert has some excellent articles on this: https://www.moneysavingexpert.com/students/student-loans-repay/

And here's the official government website: https://www.gov.uk/repaying-your-student-loan/what-you-pay

Money Saving Expert has some excellent articles on this: https://www.moneysavingexpert.com/students/student-loans-repay/

And here's the official government website: https://www.gov.uk/repaying-your-student-loan/what-you-pay

Should I supress my earnings to avoid paying back my student loan?

People often ask us about ways to make their earnings look lower so that they don't have to pay off their student debts. (In the UK, repayments are based on how much you earn and are wiped out after 30 years.) To me, this feels like cutting your nose off to spite your face. Playing a game to try and minimise your earnings is the wrong thing to focus on if you're aiming to get to Financial Independence (FI) or Partial FI. Focus on maximising your earnings and paying your debts off so that once those are gone you can quickly accumulate wealth.

You are NEVER worse off earning more. The more you earn the quicker you can get onto more exciting things after getting rid of the debts.

As ever, this is NOT binary. If you have some savings that are earning less than the interest that's building up on the student loan, consider paying off at least some of the loan. For example, if you are not yet earning enough to have to pay anything back but you are earning some money and have a reasonable gap between your earnings and expenses, consider paying down the interest that's building up so at least it's not compounding against you.

CAVEAT: This depends on your earnings potential. WATCH the video above where we guide you through our thinking and then use this flow chart below to work out if you should aggressively pay it off or just accept it as a tax and forget about it!

Don't take our word for it, read the Money Saving Expert articles and watch his videos and see what you think.

People often ask us about ways to make their earnings look lower so that they don't have to pay off their student debts. (In the UK, repayments are based on how much you earn and are wiped out after 30 years.) To me, this feels like cutting your nose off to spite your face. Playing a game to try and minimise your earnings is the wrong thing to focus on if you're aiming to get to Financial Independence (FI) or Partial FI. Focus on maximising your earnings and paying your debts off so that once those are gone you can quickly accumulate wealth.

You are NEVER worse off earning more. The more you earn the quicker you can get onto more exciting things after getting rid of the debts.

As ever, this is NOT binary. If you have some savings that are earning less than the interest that's building up on the student loan, consider paying off at least some of the loan. For example, if you are not yet earning enough to have to pay anything back but you are earning some money and have a reasonable gap between your earnings and expenses, consider paying down the interest that's building up so at least it's not compounding against you.

CAVEAT: This depends on your earnings potential. WATCH the video above where we guide you through our thinking and then use this flow chart below to work out if you should aggressively pay it off or just accept it as a tax and forget about it!

Don't take our word for it, read the Money Saving Expert articles and watch his videos and see what you think.

Student loans - USA

Choose FI is a financial independence podcast whose co-host Jonathan had a LOT of student loan from studying to become a pharmacist. This article talks you through the things to think about when you're considering paying off your student loan: https://www.choosefi.com/paying-off-student-loans-vs-investing/

Choose FI is a financial independence podcast whose co-host Jonathan had a LOT of student loan from studying to become a pharmacist. This article talks you through the things to think about when you're considering paying off your student loan: https://www.choosefi.com/paying-off-student-loans-vs-investing/

Further help on debt

This article from Money Saving Expert has some additional tips and ideas for how to pay off debt as quickly as possible: https://www.moneysavingexpert.com/loans/debt-help-plan/

Compounding

Albert Einstein is reputed to have said "Compound interest is the eighth wonder of the world. Katie Donegan says:

"He who understands it, earns it; he who doesn't, pays it." MIKE DROP

"He who understands it, earns it; he who doesn't, pays it." MIKE DROP

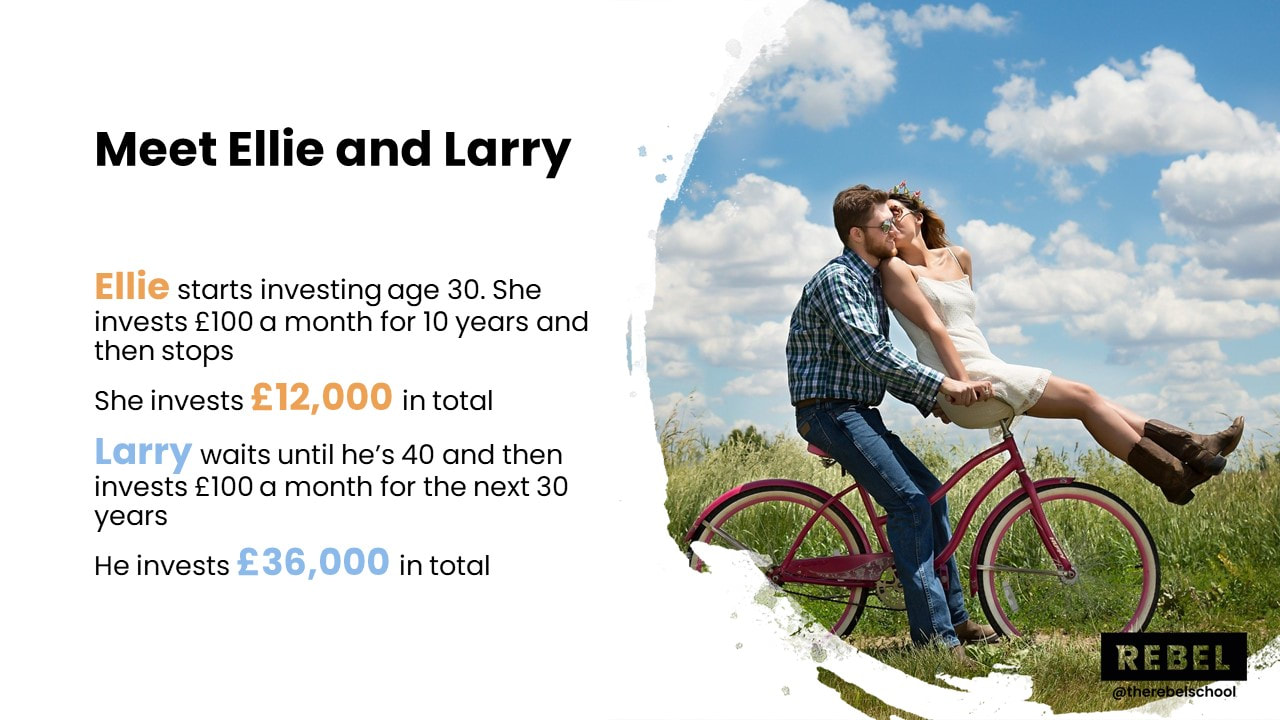

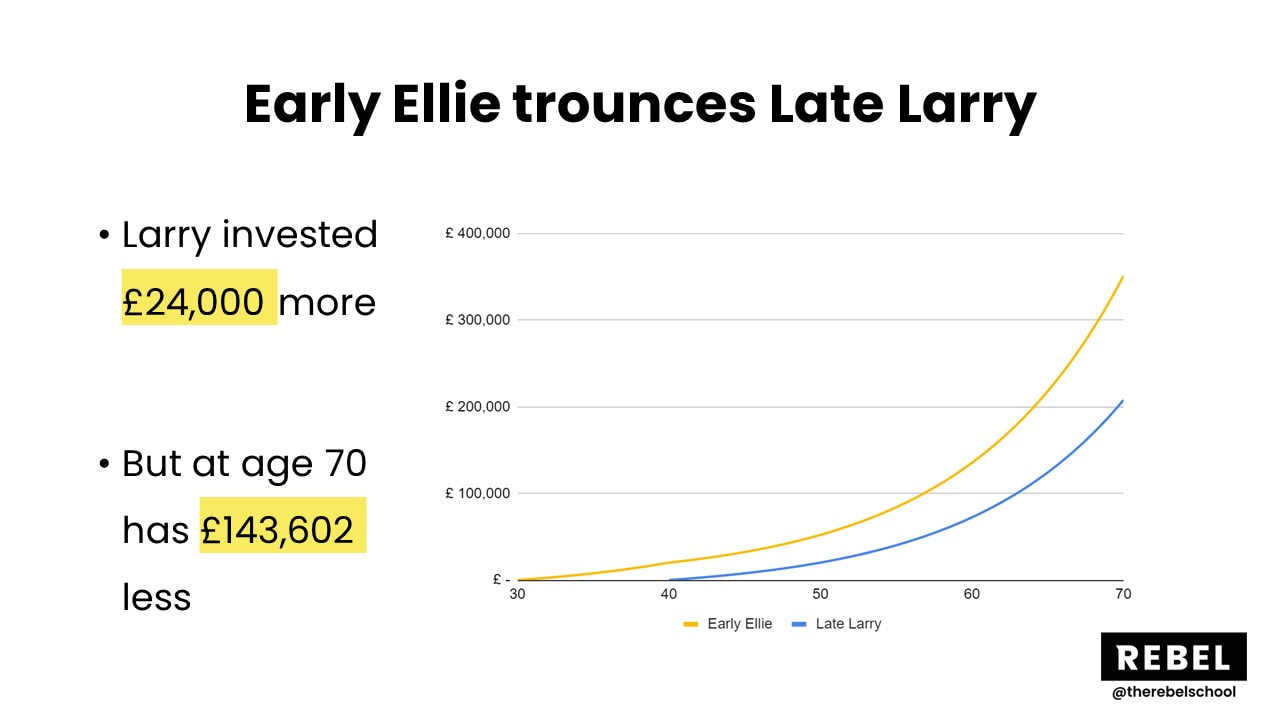

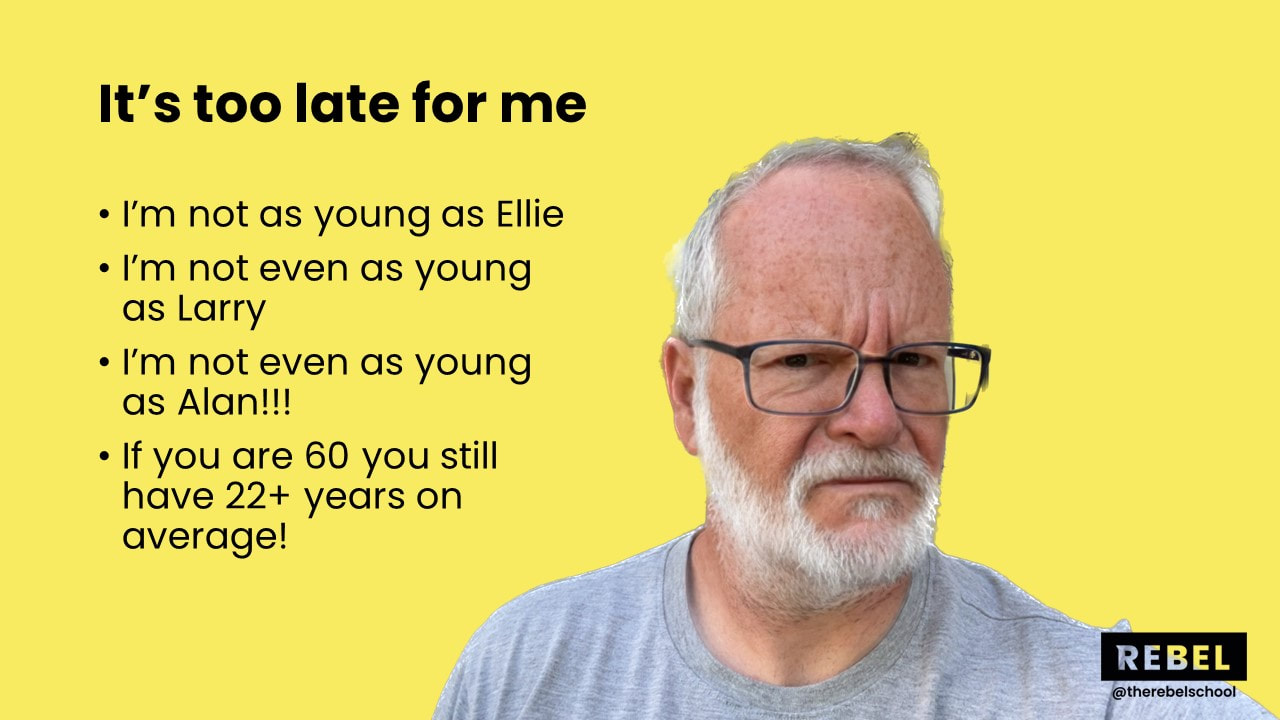

We met Early Ellie and Late Larry and saw the power of compounding over time. The earlier in your life that you start investing the better. The lesson here is NOT "I'm too old I've missed the boat", it's "GET ON WITH IT"! You're on this course so you're in the right place and you're sorting out your finances so stick with it. You'll be way better off than Never Bothered Ned who never got his finances in order and ended up with no savings whatsoever for retirement.

Compounding is incredibly powerful and is so important in helping you get to your financial goals. If you debt compounding is working against you and the debt companies know this. The average credit card debt take nearly 30 years to pay off and that is because you are paying interest on interest with the money you owe. We need to stop this!

Then we need to start making compounding work for you. If you invested £10k for a baby into an index fund that baby would be worth more than £6m at retirement age! CRAZY how compounding can work for you.

Start as soon as you can to get going with this stuff and remember than no matter when you start you are better off than never bothered Ned!

Then we need to start making compounding work for you. If you invested £10k for a baby into an index fund that baby would be worth more than £6m at retirement age! CRAZY how compounding can work for you.

Start as soon as you can to get going with this stuff and remember than no matter when you start you are better off than never bothered Ned!

Debt warning

For a recap of the key concepts about debt and a warning about avoiding it please read this blog post and share with your friends

Homework

To get the most out of this course you must do the homework! Here is the homework for week 4...

1. Make a plan of ATTACK for your debt. Read the debt attack strategy, watch our YouTube video on the debt attack strategy. Understand it from different angles then create a plan to get out of debt as quickly as possible.

2. If you have student loan, please work through the content and videos above and work out if you are going to pay it down quickly or treat it as a tax on your income.

2. If you have kids or any other younger people in your lives, think about how to help them avoid debt.

3. Have you done the homework from the first 3 weeks?

If not go back now and do it! Consider doing some of the optional exercises you might not have got round to yet. Continue journalling about money and notice if any thoughts, beliefs or values have shifted. You can find all homework for previous weeks here:

Week 1. Week 2. Week 3.

4. Come up with ways to increase the gap between your income and your expenses. On the expenses side, one way of doing this is to go through each of your spending categories and see if there's anything you could cut. Remember, this is not about deprivation this is about conscious expenditure.

1. Make a plan of ATTACK for your debt. Read the debt attack strategy, watch our YouTube video on the debt attack strategy. Understand it from different angles then create a plan to get out of debt as quickly as possible.

2. If you have student loan, please work through the content and videos above and work out if you are going to pay it down quickly or treat it as a tax on your income.

2. If you have kids or any other younger people in your lives, think about how to help them avoid debt.

3. Have you done the homework from the first 3 weeks?

If not go back now and do it! Consider doing some of the optional exercises you might not have got round to yet. Continue journalling about money and notice if any thoughts, beliefs or values have shifted. You can find all homework for previous weeks here:

Week 1. Week 2. Week 3.

4. Come up with ways to increase the gap between your income and your expenses. On the expenses side, one way of doing this is to go through each of your spending categories and see if there's anything you could cut. Remember, this is not about deprivation this is about conscious expenditure.

Discussion questions

So that you have them all in one place, here are the questions we discussed during week 4.

Company strategies for putting you in debt

Our strategies for putting ourselves into debt

Debt recap

Ask for help

Remember to reach out in the Facebook group with any questions you have or if you get stuck. Don't let confusion be an excuse for not progressing with this stuff. We are here to support you!

Company strategies for putting you in debt

- How have you fallen for these in the past?

- What have you learned?

- How aware are you of these tactics?

- How aware are your family of these tactics?

Our strategies for putting ourselves into debt

- What are your spending strategies?

- What do you say to yourself before or as you are spending money?

- How do you use credit cards? Or are they using you?

- How are you going to change your spending strategies starting today?

Debt recap

- What have you learnt about debt?

- How will you share this with the next generation?

- What’s your biggest take away from the debt attack strategy?

Ask for help

Remember to reach out in the Facebook group with any questions you have or if you get stuck. Don't let confusion be an excuse for not progressing with this stuff. We are here to support you!