Week 8: Practical investing and Retirement Principles

|

This week we carried on talking about the "sexy" stuff.... investing!

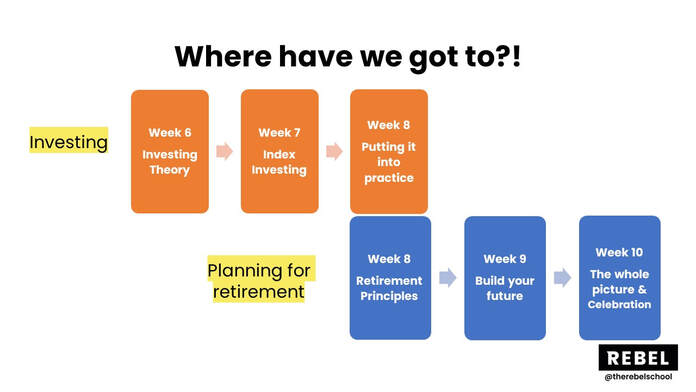

In week 6 we covered the theory behind investing, then last week (week 7) we dived into detail on index fund investing and how to build wealth for the long term. This week we rounded off investing with how to actually implement this and buy your first assets. Then we started the retirement planning part of the course and we talked about how to know when you can retire. Thank you for taking the time in the previous weeks of the course to patiently lay the foundations for a strong stable base before you come onto investing. It's so important to have that base and it takes time for us to share all this information with you. We didn't just want to give you the "answer" of how to invest without a full and thorough understanding of whether you're ready to invest and why we are such big index investing fans! Remember you are only ready to invest if you have no expensive debt (interest rate more than 5%) and you have an emergency fund of 3 to 6 months of living expenses. |

You can watch on catchup here... and rewatch to your heart's content!

|

Disclaimer

We are NOT financial advisers. The content of this course, the articles on our blog and these summaries are NOT financial advice. This is our opinion and we are just sharing what we are doing. DO YOUR OWN HOMEWORK

We are NOT financial advisers. The content of this course, the articles on our blog and these summaries are NOT financial advice. This is our opinion and we are just sharing what we are doing. DO YOUR OWN HOMEWORK

Investing part 3: Implementation!

Remember! Learning about investing is like learning a whole new language. There are going to be terms and phrases you don't understand. Stay calm, look up what it means, or ask us!

These specifics are for people in the UK, but the principles are the same wherever you are in the world.

We've been banging on about Vanguard index funds. How do you actually buy them?

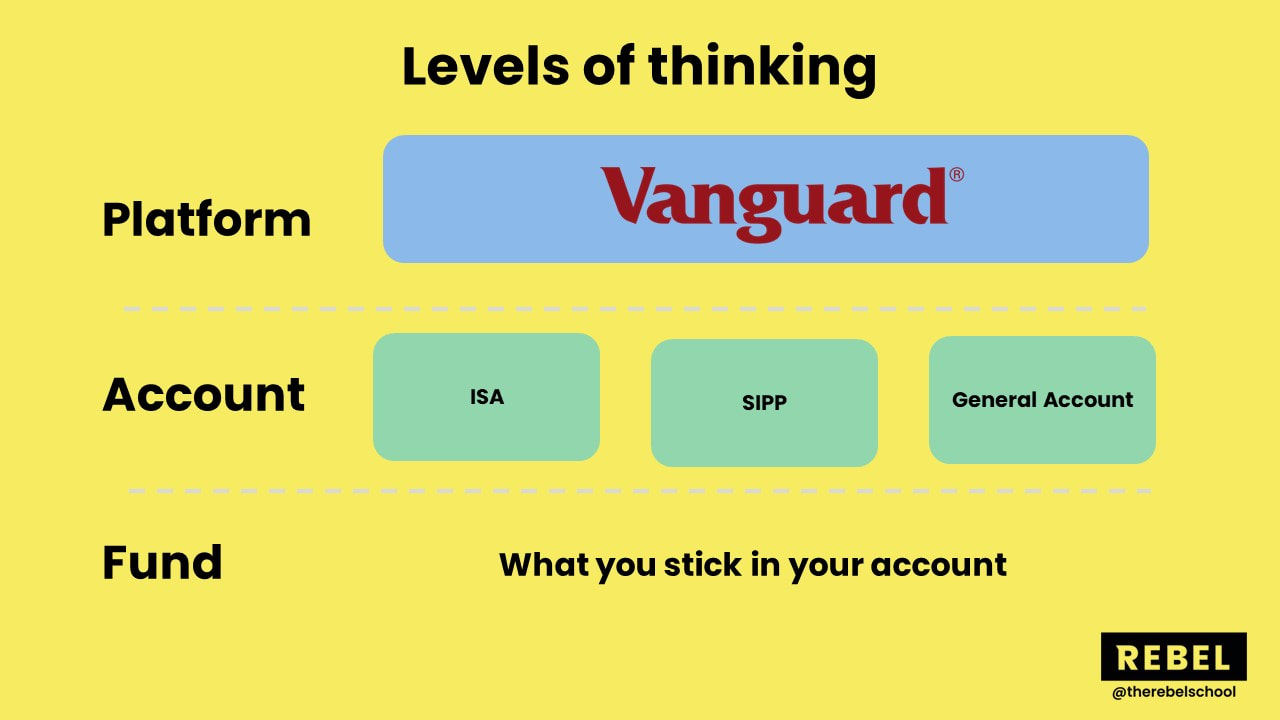

Well first you need to understand the different levels of thinking when buying index funds.

These specifics are for people in the UK, but the principles are the same wherever you are in the world.

- There is a TON of information out there for those of you in the USA... we suggest the Mad Fientist's blog, Mr Money Mustache and JL Collins' blog and book The Simple Path to Wealth as a good place to start.

- For Canada check out Kristy and Bryce at Millennial Revolution.

- For New Zealand there's a NZ specific Rebel Finance School Facebook group and have a read of Ruth's Happy Saver blog.

- For other countries, there's bound to be someone in your country that's thought about this before. Look for the Financial Independence groups in your country and if they don't exist yet maybe you can start one and figure it out together.

We've been banging on about Vanguard index funds. How do you actually buy them?

Well first you need to understand the different levels of thinking when buying index funds.

- Platform or provider This is the company through which you buy the index funds. Vanguard has its own platform. There's lots of different providers/platform and they all charge different fees!

AVOID Wealthify, St James Place, PensionBee and any high fee platforms. Avoid at all costs. You can read my open letter to Wealthify here to find out why we say this. Use Katie's Fees Tool to analyse the fees you have got already compared to Vanguard.

Your mission at platform level is to minimise fees.

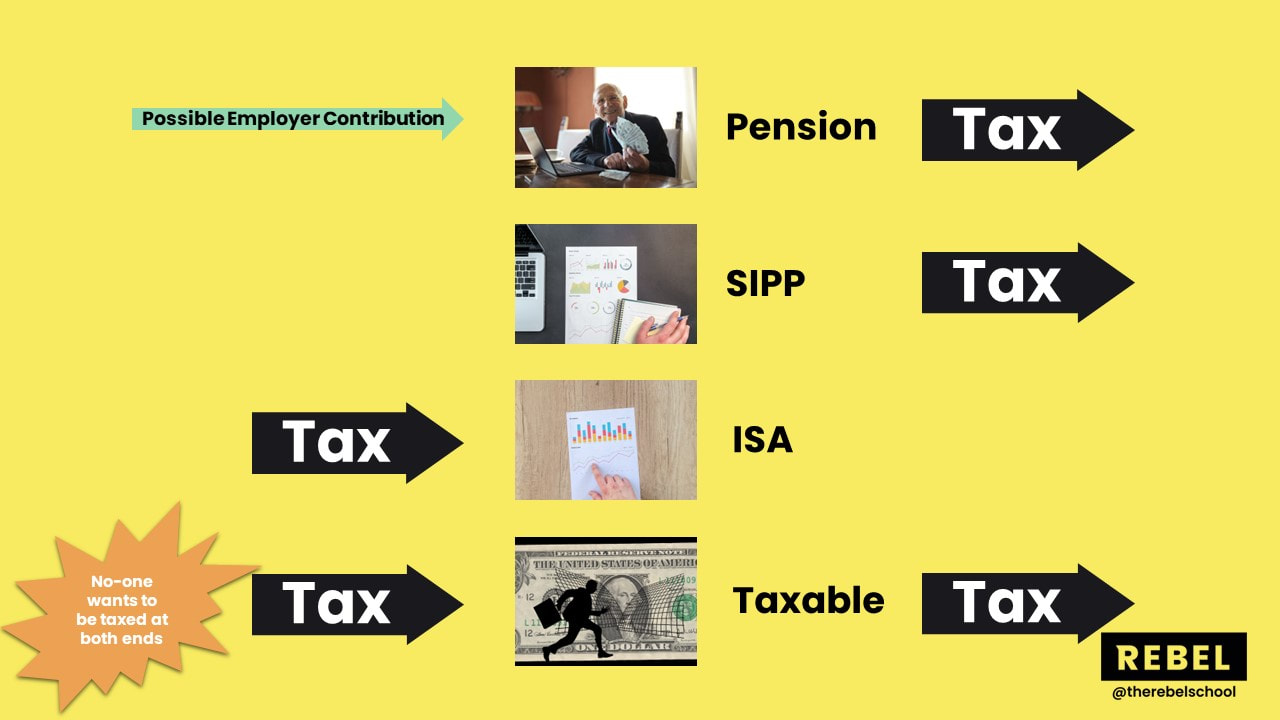

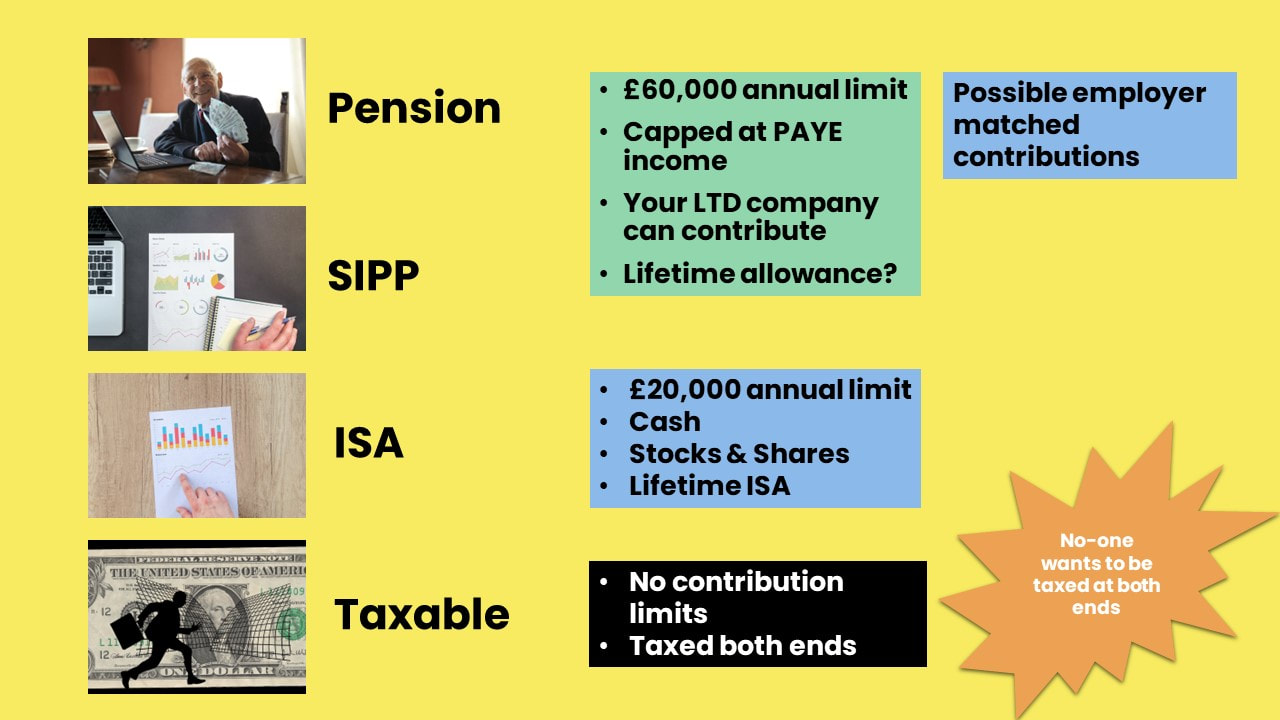

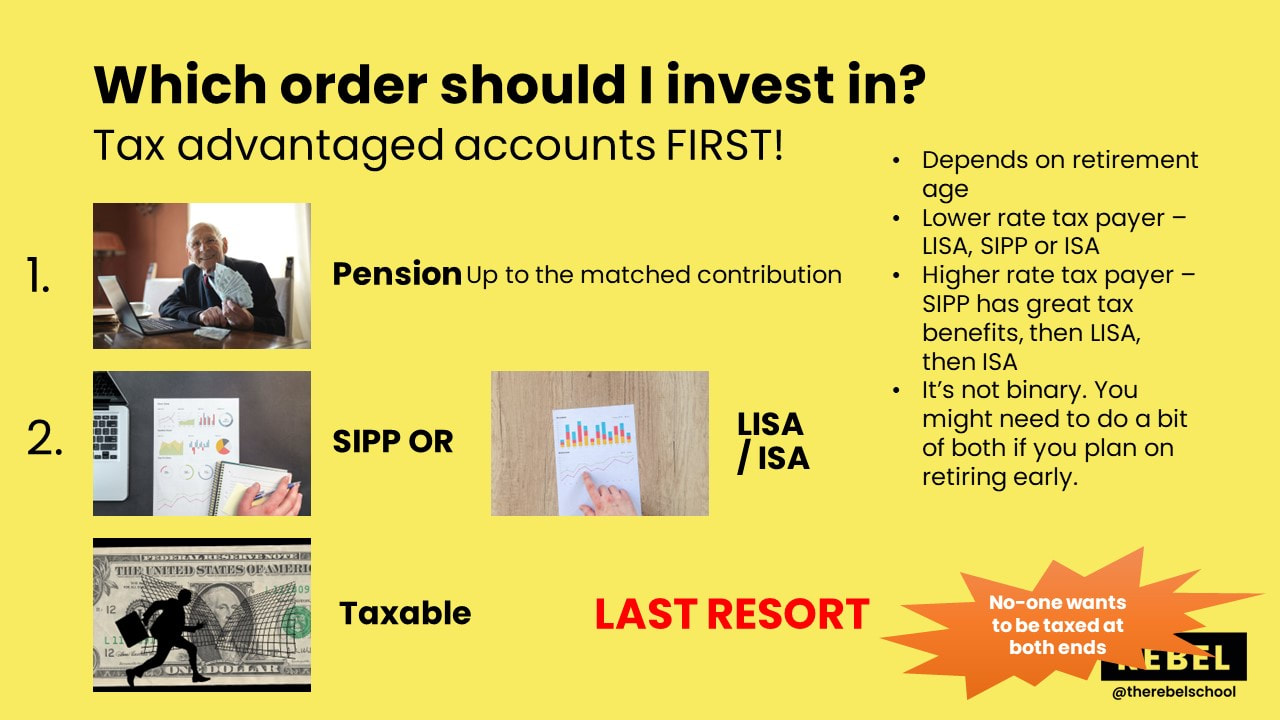

- Account type The government incentivises us to save by allowing us to open these things called tax-advantaged accounts. In the UK we have ISAs (Individual Savings Account) and pensions/SIPPs (self-invested personal pensions).

- ISAs. You invest money that you've already paid income tax on and then the investments grow tax free and you can withdraw money from your account without paying any tax. There is no age restriction on when you can access these.

- Lifetime ISAs (LISAs). A special type of ISA. If you're aged 18-39 you can open a LISA and invest up to £4k a year until age 50. The government matches 25% of what you put in. You can access the money either when you're age 60 OR to use as a house deposit IF you're a first time buyer . You also don't pay tax on money you withdraw, so you don't pay tax at either end!

- Pensions or SIPPs. You buy assets in these accounts with money that hasn't been taxed. The investments grow tax free, but when you come to withdraw from the account in retirement you have to pay tax on the money you withdraw. These are age-restricted. You cannot get to these until you are 10 years younger than your state retirement age!

- General accounts. (also referred to as trading accounts or taxable accounts). These have NO tax advantages. You invest in them with money you've already paid income tax on and you have to pay tax on the money you withdraw. In the UK we have very generous annual allowances for ISAs and pensions/SIPPs so these should be used as a last resort! No-one likes being taxed at both ends!

The main difference between the accounts is when and how you get taxed. Your mission at the account level is to minimise tax through use of tax-advantaged accounts.

- Fund This is what you stick in your account, the index fund itself. Vanguard has its own low cost broad based index funds. You can have more than one fund in the same account but you don't need to! Just buy one passive global index fund.

Your job at this point is to pick the simplest broad based index fund like the Vanguard FTSE Global All Cap Index Fund or the Vanguard FTSE Developed World ex UK fund.

Understanding fund fact sheets

We are talking a lot about setting up new investments. Remember that it is also important to optimise your current investments as well. Part of the home work for the last few weeks has been to get out all of the paperwork for your existing pensions and investments.

|

Now you understand the levels. Platforms, Account and finally Fund, it is really time to dive in an analyse your existing investments .

Check out the Platform and see if you are happy with them. Understand the fees and more. Then start to understand the funds inside your SIPPS, Pensions and more. To help you truly understand the funds Katie and I did a workshop called deciphering a fund fact sheet for you. If you want support understanding your existing investments this is the workshop to watch with your paperwork in hand! |

|

IMPORTANT! Vanguard is both a platform/provider and it is also a fund manager. So when you're talking about Vanguard are you talking about the provider (the website through which you buy the funds) or are you talking about the funds themselves?

You can buy Vanguard funds with lots of different providers. For example we have an ISA account with Halifax in which we have Vanguard funds. We also have a SIPP account with Halifax in which we have Vanguard funds. You can also have an ISA account with Vanguard (provider) and have Vanguard funds.

The only reason we use Halifax is that Vanguard wasn't a platform provider when we started and we couldn't invest directly.

You can buy Vanguard funds with lots of different providers. For example we have an ISA account with Halifax in which we have Vanguard funds. We also have a SIPP account with Halifax in which we have Vanguard funds. You can also have an ISA account with Vanguard (provider) and have Vanguard funds.

The only reason we use Halifax is that Vanguard wasn't a platform provider when we started and we couldn't invest directly.

Tax on SIPPs

When you make personal contributions to a SIPP it'll be with money that you've already paid income tax on.

Hang on! I thought you invested in SIPPs with before tax money?!

Yes you do! Your SIPP provider (Vanguard or whoever) goes to the government on your behalf and asks them for the tax that you've already paid on that money and they'll put it into your SIPP account for you. Thank you provider and government! They will do this up to the basic tax rate.

So if you invest £800 as a personal contribution in your SIPP, the provider says "oh our customer shouldn't have paid income tax on that money, let me go and ask the government for that tax back". They'll get £200 back from the government and that £200 will show up in your account a short while later and you can invest it.

The provider only does this up to the basic rate. If you're a higher rate tax payer you need to either claim the tax on a self assessment tax return OR if this would be the only reason that you're filling in a tax return, you can just write to them! Shout out to Rebel Ninja Kate who has helped you by making you a template for the letter to write to HMRC!

When you make personal contributions to a SIPP it'll be with money that you've already paid income tax on.

Hang on! I thought you invested in SIPPs with before tax money?!

Yes you do! Your SIPP provider (Vanguard or whoever) goes to the government on your behalf and asks them for the tax that you've already paid on that money and they'll put it into your SIPP account for you. Thank you provider and government! They will do this up to the basic tax rate.

So if you invest £800 as a personal contribution in your SIPP, the provider says "oh our customer shouldn't have paid income tax on that money, let me go and ask the government for that tax back". They'll get £200 back from the government and that £200 will show up in your account a short while later and you can invest it.

The provider only does this up to the basic rate. If you're a higher rate tax payer you need to either claim the tax on a self assessment tax return OR if this would be the only reason that you're filling in a tax return, you can just write to them! Shout out to Rebel Ninja Kate who has helped you by making you a template for the letter to write to HMRC!

| pension_tax_relief_claim_letter_template_v2.docx | |

| File Size: | 21 kb |

| File Type: | docx |

We are so lucky to have such an incredible community of people, Rebels and Ninjas that help us do all this stuff and the best thing about finance is that we can all work together to get better at it!

|

What if I'm planning on retiring early?!

If you're planning on retiring early and want to work out what split you need between your SIPP and ISA, we covered this question and more in a workshop we did last year all about planning out your financial future. Check out the video here... We had a lot of fun creating this video for you and it will help you to build your own spreadsheet to be able to see what happens to your finances over the coming decades. Let us know what you think! |

|

What's this about fees? What do I have to pay? How does it work?

There are various different fees involved as well as the cost of buying the index fund itself.

There are various different fees involved as well as the cost of buying the index fund itself.

- Platform fees - The provider/platform charges you for the privilege of having the account. This is either charged as a percentage of the money that you have in your accounts (Vanguard is 0.15% a year, capped at £375) or as a fixed monetary amount.

- Dealing fee to buy the index fund - Some providers charge you to buy the fund. (Vanguard doesn't charge)

- Entry or initial fees - Some platforms cream off up to 5% of everything you put in. FIVE PERCENT! This is before you've even invested anything! Vanguard doesn't have any entry fees.

- Ongoing charges figure (OCF) - each fund has a fee that you pay for them to manage it for you. For the Vanguard FTSE Global All Cap fund this is 0.23%.

- Exit fees - some providers charge you to transfer your investment or to withdraw. Vanguard doesn't!

|

Curious how much impact the fees have on your investments over the long term? Check out this impact of fees tool Katie made

Your job is to minimise fees as much as you can. Fees are one of the biggest predictors of long term success in investing.

|

Vanguard site

When people get to the stage of actually investing and log onto the website it can get confusing. There are so many accounts and funds to choose from. So many people have got to this stage, stopped and turned into never bothered Ned. Don't let this happen to you! We made a YouTube series to help you navigate the Vanguard UK website and get going!

The videos below will help you by actually showing you the buttons to press on the website and answering any question you have as you go along! Open a SIPP or an ISA alongside Alan and Katie!

The videos below will help you by actually showing you the buttons to press on the website and answering any question you have as you go along! Open a SIPP or an ISA alongside Alan and Katie!

|

|

|

|

ISA and SIPP how-to videos

|

|

Retirement principles

The second part of week 8 was the start of the retirement planning section of the course. This is the final section of the course which we'll continue in weeks 9 and 10 . This week we talked about how to know how much you need to be able to retire.

Remember back to week 1?! We showed you how to calculate your wealth-building rate. Check out the notes for week 1 if you need to refresh your memory. You can find the how big is your gap tracker template in this blog article. Why is this relevant for planning for retirement?!

The key here is that WEALTH-BUILDING RATE is the determining factor of how long it will take you to get to retirement NOT how much you earn although clearly earning more will mean you can save more! We wrote a article covering 10 ways to increase your income here.

It all comes back to the size of your gap baby!

To work out how much you need to retire, multiply how much you want to live on a year in retirement by 25. The inverse of this is 4% (1/25 = 4%). Alan has written a blog article all about the 4% rule and a follow up article answering questions about the 4% rule

You might feel overwhelmed by this target. You work out you need £40,000 a year to live on, you multiply that by 25 and you get the HUGE number of £1,000,000! Looking at that number you might think you will never get there, but you haven't allowed for the power of compounding! Alan wrote a blog article to reassure you! The insurmountable mountain

It's not F&*£ing binary! Don't use "I'll never get there" as an excuse for not starting. Check out this article Alan wrote about an Italian bin man we met in Ecuador who spends 6 months of the year surfing in Ecuador. It is amazing what you can achieve.

The secret mission behind Rebel Finance School is to help you get your finances in order so you can live the life you actually want to live! It all starts with working through this stuff, getting your finances in order and buying the freedom to live life as you want to!

The last article to read is one of the best from the entire FIRE (Financial Independence Retire Early) community about the subject. It is from Mr Money Mustache and it is called the Shockingly Simple Maths behind Early Retirement.

Remember back to week 1?! We showed you how to calculate your wealth-building rate. Check out the notes for week 1 if you need to refresh your memory. You can find the how big is your gap tracker template in this blog article. Why is this relevant for planning for retirement?!

The key here is that WEALTH-BUILDING RATE is the determining factor of how long it will take you to get to retirement NOT how much you earn although clearly earning more will mean you can save more! We wrote a article covering 10 ways to increase your income here.

It all comes back to the size of your gap baby!

To work out how much you need to retire, multiply how much you want to live on a year in retirement by 25. The inverse of this is 4% (1/25 = 4%). Alan has written a blog article all about the 4% rule and a follow up article answering questions about the 4% rule

You might feel overwhelmed by this target. You work out you need £40,000 a year to live on, you multiply that by 25 and you get the HUGE number of £1,000,000! Looking at that number you might think you will never get there, but you haven't allowed for the power of compounding! Alan wrote a blog article to reassure you! The insurmountable mountain

It's not F&*£ing binary! Don't use "I'll never get there" as an excuse for not starting. Check out this article Alan wrote about an Italian bin man we met in Ecuador who spends 6 months of the year surfing in Ecuador. It is amazing what you can achieve.

The secret mission behind Rebel Finance School is to help you get your finances in order so you can live the life you actually want to live! It all starts with working through this stuff, getting your finances in order and buying the freedom to live life as you want to!

The last article to read is one of the best from the entire FIRE (Financial Independence Retire Early) community about the subject. It is from Mr Money Mustache and it is called the Shockingly Simple Maths behind Early Retirement.

Week 8 homework

This week's homework comes in two parts since we covered two topics. Investing implementation and retirement principles.

This week's homework comes in two parts since we covered two topics. Investing implementation and retirement principles.

Investing implementation homework

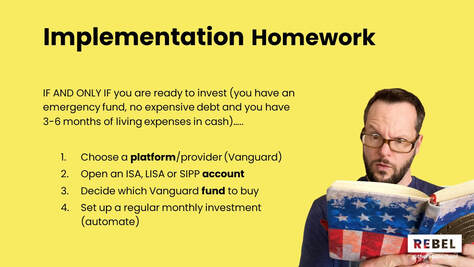

IF AND ONLY IF you are ready to invest (you have an emergency fund of 3-6 months living expenses and no expensive debt)...

1. Choose a platform/provider. Vanguard is great! We suggest using them. We are NOT sponsored by Vanguard or receive any benefit from recommending them. We just believe in their philosophy and mission and love how low their fees are!

2. Open a stocks and shares ISA, a Lifetime ISA or a SIPP account with the platform/provider you have decided on.

3. Buy a Vanguard global index fund. The two we own are the Vanguard FTSE Global Index fund and the Vanguard FTSE Developed World ex UK.

We covered this in detail in a set of blog articles we wrote for you about how to invest in index funds. Also check out the videos above.

4. Set up a regular monthly investment to buy the fund you've chosen

And if you can automate it so much the better! Have it come out automatically so you don't have to think about it and it is all done for you! GENIUS!

And here's the homework for the retirement principles we talked about...

1. Choose a platform/provider. Vanguard is great! We suggest using them. We are NOT sponsored by Vanguard or receive any benefit from recommending them. We just believe in their philosophy and mission and love how low their fees are!

2. Open a stocks and shares ISA, a Lifetime ISA or a SIPP account with the platform/provider you have decided on.

3. Buy a Vanguard global index fund. The two we own are the Vanguard FTSE Global Index fund and the Vanguard FTSE Developed World ex UK.

We covered this in detail in a set of blog articles we wrote for you about how to invest in index funds. Also check out the videos above.

4. Set up a regular monthly investment to buy the fund you've chosen

And if you can automate it so much the better! Have it come out automatically so you don't have to think about it and it is all done for you! GENIUS!

And here's the homework for the retirement principles we talked about...

Retirement principles homework

1. How much do you want to live off in retirement? You might need to go back to what we discussed in week 1 to have an idea of what you're currently spending. Of course your plans for retirement might cost more or less than your current lifestyle. Your current spending gives you a good idea what you might need later on, plus or minus mortgages and childcare etc.

2. How much do you need invested in order to reach your target? (25x your annual expenses). The idea is to set a target for the amount you want to get invested and then in the next few weeks we will lay out a road map to get there.

Keen-bean homework:

3. Watch the Playing with FIRE documentary

Coming up in week 9

Week 9 is Planning for your future! You've nearly made it to the end of the course! Two more weeks to go. We're going to cover how to plan for the future and how to figure out how long it will take to get to the target that you've set. Katie's going to crack out the spreadsheets. She is SUPER excited!

Ask for help

Remember to reach out in the Facebook group with any questions you have or if you get stuck. Don't let confusion be an excuse for not progressing with this stuff. We are here to support you!

Alan and Katie

2. How much do you need invested in order to reach your target? (25x your annual expenses). The idea is to set a target for the amount you want to get invested and then in the next few weeks we will lay out a road map to get there.

Keen-bean homework:

3. Watch the Playing with FIRE documentary

Coming up in week 9

Week 9 is Planning for your future! You've nearly made it to the end of the course! Two more weeks to go. We're going to cover how to plan for the future and how to figure out how long it will take to get to the target that you've set. Katie's going to crack out the spreadsheets. She is SUPER excited!

Ask for help

Remember to reach out in the Facebook group with any questions you have or if you get stuck. Don't let confusion be an excuse for not progressing with this stuff. We are here to support you!

Alan and Katie