|

This is the week you have all been waiting for. The "sexy" week where we talk all about investing. We hope it lives up to the hype! Did Alan manage to stay fully clothed?! Tune in to find out!

There's a lot to cover! There is soooooo much to talk about when it comes to investing. When we first ran the course we thought we'd be able to cover it in one 90 minute session. How wrong we were! Since then we have split the investing content of the course into 3 parts.

|

|

Hang tight

A little knowledge can be a dangerous thing! We have two more weeks of content to cover this investing stuff. Hang tight. You don't need to implement anything yet! We have more to tell you. Just stick with it! What I am trying to say is learn as much as you can through the investing weeks and THEN implement.

Disclaimer

We are NOT financial advisers. The content of this course, the articles on our blog and these resources are NOT financial advice. This is our opinion and we are just sharing what we are doing. DO YOUR OWN HOMEWORK

That being said, onto the Week 6 recap!

Week 6 recap

Learning about investing is like learning a whole new language. There are going to be terms and phrases you don't understand. Stay calm, look up what it means, ask us! If you forget what it means then we can go through it again. Please remember there is no such thing as a stupid question. If you are thinking it so are other people probably so ASK AWAY!

One subtle distinction to point out on the language that can be confusing. There's a difference between "index linked" and "index funds". Index linked is a term in the UK that usually means that something is going to go up in line with inflation. For example, many pension schemes are linked to the RETAIL PRICE INDEX so that as retail prices increase year by year, pensions increase by the same proportion so that they keep their value in real terms.

An index fund is what we have been talking about investing in. More on this shortly..........

A little knowledge can be a dangerous thing! We have two more weeks of content to cover this investing stuff. Hang tight. You don't need to implement anything yet! We have more to tell you. Just stick with it! What I am trying to say is learn as much as you can through the investing weeks and THEN implement.

Disclaimer

We are NOT financial advisers. The content of this course, the articles on our blog and these resources are NOT financial advice. This is our opinion and we are just sharing what we are doing. DO YOUR OWN HOMEWORK

That being said, onto the Week 6 recap!

Week 6 recap

Learning about investing is like learning a whole new language. There are going to be terms and phrases you don't understand. Stay calm, look up what it means, ask us! If you forget what it means then we can go through it again. Please remember there is no such thing as a stupid question. If you are thinking it so are other people probably so ASK AWAY!

One subtle distinction to point out on the language that can be confusing. There's a difference between "index linked" and "index funds". Index linked is a term in the UK that usually means that something is going to go up in line with inflation. For example, many pension schemes are linked to the RETAIL PRICE INDEX so that as retail prices increase year by year, pensions increase by the same proportion so that they keep their value in real terms.

An index fund is what we have been talking about investing in. More on this shortly..........

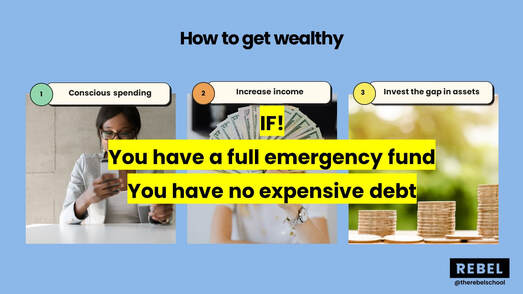

Are you ready to invest?

Remember the steps to getting wealthy? Well you're only ready to invest in assets if you've done the first few steps to getting wealthy. You need to have a full emergency fund of 3-6 months living expenses and no expensive debt. Then, and only then, are you ready to invest in assets.

Remember the steps to getting wealthy? Well you're only ready to invest in assets if you've done the first few steps to getting wealthy. You need to have a full emergency fund of 3-6 months living expenses and no expensive debt. Then, and only then, are you ready to invest in assets.

Are you already an investor?

If you have a company pension scheme you are already an investor. Your money is being invested for you. Do you know what it's invested in? Are you blindly accepting the default option without understanding it? Will you have enough for retirement?! Read our article for more on this!

If you have a company pension scheme you are already an investor. Your money is being invested for you. Do you know what it's invested in? Are you blindly accepting the default option without understanding it? Will you have enough for retirement?! Read our article for more on this!

What are assets?

We've been jabbering on about buying your freedom for weeks now. We've been telling you to buy assets not liabilities. But what does that actually mean? What are assets? What are stocks and shares? How do you even buy them?

Well Alan wrote a blog post all about this.

We've been jabbering on about buying your freedom for weeks now. We've been telling you to buy assets not liabilities. But what does that actually mean? What are assets? What are stocks and shares? How do you even buy them?

Well Alan wrote a blog post all about this.

If you ask someone that works in the finance world what an asset is they will probably give you a very traditional view and tell you assets are things like:

- Equities also called stocks & shares

- Bonds

- Money Market - things that pay interest

- Real Estate/Property

- Commodities

If you ask friends and family what an asset is they will probably tell you things like:

What do we, the Donegans, think an asset is?

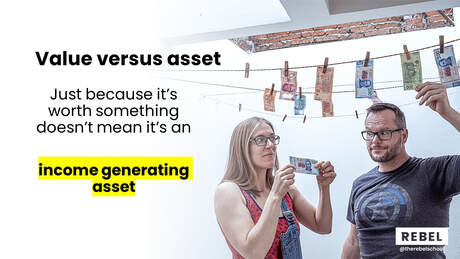

An asset is something that produces an income for you such as a property that brings rent or an index fund that produces dividends from company profit.

So to us things like gold, crypto, wine and whiskey are not assets. Does gold put money in your pocket? Does owning Bitcoin put money in your pocket? We're not saying that these other things don't have value, we're saying that you won't be able to live off them in retirement because they don't give you an income. They also tend to be speculative meaning that you are relying on the value of the item to go up rather than holding it for the long term and living off the income that it produces.

An asset is something that produces an income for you such as a property that brings rent or an index fund that produces dividends from company profit.

So to us things like gold, crypto, wine and whiskey are not assets. Does gold put money in your pocket? Does owning Bitcoin put money in your pocket? We're not saying that these other things don't have value, we're saying that you won't be able to live off them in retirement because they don't give you an income. They also tend to be speculative meaning that you are relying on the value of the item to go up rather than holding it for the long term and living off the income that it produces.

|

How do you invest in the stock market?

People ask us this all the time! So we made a video to answer the question. Spoiler alert. There are 3 ways to invest 1. Picking individual companies to invest in (aka gambling) 2. Paying expensive fees to get someone else to choose which companies to invest in (this is super expensive and they generally do a bad job) 3. Buying every single company you can in a low cost index fund (this is what we do!) |

|

|

Donegan investment strategy

Our strategy is to buy Vanguard index funds. They're easy to buy, it's a simple strategy and the fees are very low. We'd rather be living our lives than spending all day every day thinking about our money and managing our investments. We are NOT sponsored by Vanguard, we just believe in what they do! Next week Brad Barrett is going to help us dive into the detail on index funds and the following week we'll cover practically how to buy them. We own the Vanguard FTSE Developed World ex UK index fund in tax advantaged accounts (ISAs and SIPPs). This might be confusing and not mean anything to you! Never fear, all will be explained over the coming weeks! We also made a video for you explaining what an index fund is that you can check out here... |

|

I'm a visual learner, is there a way I can see what an index fund is?!

I'm glad you asked! Katie has made you a beautiful chart so you can see what an index fund is at a glance. Each box represents a different company in the index. Each colour is a different country. We're not choosing an individual company, country or industry. We're choosing every investable company in the world. We're "betting" on the world economy continuing to do well.

I'm glad you asked! Katie has made you a beautiful chart so you can see what an index fund is at a glance. Each box represents a different company in the index. Each colour is a different country. We're not choosing an individual company, country or industry. We're choosing every investable company in the world. We're "betting" on the world economy continuing to do well.

Feeling keen?!

If you are SUPER keen then we created a page going through all our investing content on the blog that you can read if you like. Or you can just come to week 7 and keep working through it with us!

We wrote a whole investor series of articles starting with what is diversification and moving to what is an index fund that you can get into that will explain more.

If you are SUPER keen then we created a page going through all our investing content on the blog that you can read if you like. Or you can just come to week 7 and keep working through it with us!

We wrote a whole investor series of articles starting with what is diversification and moving to what is an index fund that you can get into that will explain more.

But WAIT Donegans; Isn't investing in the stock market risky?

The financial industry has confused the terms "risk" (risk of losing money) and "volatile" (how much the value of your investment changes over time). Click on the photo below to read an article Alan wrote that explains all about this!

The financial industry has confused the terms "risk" (risk of losing money) and "volatile" (how much the value of your investment changes over time). Click on the photo below to read an article Alan wrote that explains all about this!

In it for the long term

For our strategy to work you have to be in this for the long term. This is not a short term get rich quick scheme. This is slow and steady wins the race. Buy and hold and NEVER sell. Never kill the golden goose! You have to be prepared psychologically for WHEN the stock market crashes. If you know that you won't hold on WHEN the stock market drops this strategy WILL NOT work for you.

For our strategy to work you have to be in this for the long term. This is not a short term get rich quick scheme. This is slow and steady wins the race. Buy and hold and NEVER sell. Never kill the golden goose! You have to be prepared psychologically for WHEN the stock market crashes. If you know that you won't hold on WHEN the stock market drops this strategy WILL NOT work for you.

Coming up in the next two weeks

You might be thinking...

"This is all very well Donegans but I'm now sat at my laptop ready to invest, how do I actually do it? What are the different accounts I can get? What are the different fees you have to pay and how can you minimise these?"

Well this week we covered some of the theory of investing. Next week we'll have Brad Barrett with us from Choose FI to dive deep into index investing in more detail and we'll explain how fees can eat into your investments. The week after that we're going to talk about how to implement all of this! Stick with it, we're building week on week.

You might be thinking...

"This is all very well Donegans but I'm now sat at my laptop ready to invest, how do I actually do it? What are the different accounts I can get? What are the different fees you have to pay and how can you minimise these?"

Well this week we covered some of the theory of investing. Next week we'll have Brad Barrett with us from Choose FI to dive deep into index investing in more detail and we'll explain how fees can eat into your investments. The week after that we're going to talk about how to implement all of this! Stick with it, we're building week on week.

Week 6 homework

To get the most out of this course you must do the homework (plus homework is fun! Or that's what Katie tells me....)

So here is the homework for week 6...

1. When we ran the course the first time we didn't give enough information on how to choose an index fund and how to actually get going. During lockdown in 2020 we wrote a whole series of articles covering this and they go into way more detail than we have time to cover on our calls. Your homework is to read the articles about index investing which starts with "What is diversification?"

2. For existing investments (in the UK these might be Stocks and shares ISAs, pensions with your employer, Self Invested Personal Pensions (SIPPs)) find out:

Side note on DB pensions

For Defined Benefit pensions (also referred to as DB pensions or final salary pensions), what the fund it is invested in is less important. That's because you are promised a certain amount each month/year when you get to retirement age and the employer is taking on the risk that what they've invested in isn't enough to support that.

A few of you asked whether you should transfer your DB pension out from your former employer. BE VERY CAREFUL with this! A DB pension promises to pay you a certain amount in retirement which is a pretty sweet deal! There is a lot to think about with this, sit tight and we'll talk about this in the next couple of weeks.

To get the most out of this course you must do the homework (plus homework is fun! Or that's what Katie tells me....)

So here is the homework for week 6...

1. When we ran the course the first time we didn't give enough information on how to choose an index fund and how to actually get going. During lockdown in 2020 we wrote a whole series of articles covering this and they go into way more detail than we have time to cover on our calls. Your homework is to read the articles about index investing which starts with "What is diversification?"

2. For existing investments (in the UK these might be Stocks and shares ISAs, pensions with your employer, Self Invested Personal Pensions (SIPPs)) find out:

- What funds they are invested in - exact names and the most detail you can find. See if you can get the fund factsheet as that should tell you everything you need to know about the fund. If you're feeling super keen you can check out the bonus workshop we did on how to decipher a fund factsheet.

- How much the fees are - and there might be a few! There are usually platform fees, annual management charges (AMCs), entry and exit fees. You might have to call them and ask or get super geeky on the paperwork. They don't make it easy to actually find out, it isn't in their best interest. There will be some detective work involved so take a deep breath and keep digging!

- Are they active or passively managed - it should say on the fund fact sheet or you might have to ask them.

- What funds are available to invest in (can you choose?) For example if you have a pension that is already invested into a certain fund what other funds can you choose within that pension?

Side note on DB pensions

For Defined Benefit pensions (also referred to as DB pensions or final salary pensions), what the fund it is invested in is less important. That's because you are promised a certain amount each month/year when you get to retirement age and the employer is taking on the risk that what they've invested in isn't enough to support that.

A few of you asked whether you should transfer your DB pension out from your former employer. BE VERY CAREFUL with this! A DB pension promises to pay you a certain amount in retirement which is a pretty sweet deal! There is a lot to think about with this, sit tight and we'll talk about this in the next couple of weeks.

Ask for help

Remember to reach out in the Facebook group with any questions you have or if you get stuck. Don't let confusion be an excuse for not progressing with this stuff. We are here to support you!

Alan and Katie

Remember to reach out in the Facebook group with any questions you have or if you get stuck. Don't let confusion be an excuse for not progressing with this stuff. We are here to support you!

Alan and Katie