|

Back to Blog

For an overview of which Index Fund to choose start here. This article is to help you decide whether to invest in the Vanguard Developed World Ex. UK Fund or the Vanguard FTSE Global All-Cap Index Fund and what the differences are!

​We are going to break down the differences between the two funds and, given that nearly all of our money in invested in the Developed world fund, whether we are going to change that going forwards. We do not receive sponsorship from Vanguard or anything in return for promoting their products. I kind of wish we did; lol. Where are you investing?

We have spoken a lot about diversification (Read: What is diversification); and how important this is when creating your investment portfolio. Between the Vanguard Developed World Fund ex UK and the Vanguard FTSE Global All Cap Index fund where will you invest your hard earned savings??!!

Katie has been having too much fun (we should cut back) visualising the funds for you so we can truly understand where our money is going when we invest. We are partly doing this work for us to work out if we have our money in the right place or if we should change our strategy going forwards. We actually didn't really know what we were buying when we started to invest in this fun. On that note this article is "probably" analysis overkill. You could pick either one and be pretty damn happy you have made a good decision. That is what we did when we were first getting into index investing. JL Collins said buy a broad based index fund and we did without knowing all the ins and outs that you are about to discover What we found though was that the people on our Rebel Finance Course really struggled when choosing funds and it normally came down to these two. We have also written a second guide to ESG (ethical, sustainable and governance funds) to help you decide if you want one of these funds or an ESG flavour. The purpose of this article is to break down the two funds and help you make a choice between them so you can get started on your journey towards financial independence. You might get a deeper understanding of investments and index funds along the way too! Where's your money going?

Let's start with geography. This map shows you which countries you are investing in by weighting. What that means is what percentage of your money is invested in each country!

The first map shows the FTSE Developed World ex. UK. You can see that as of 30th June 2023, 70% of money that you invested in the Developed world fund would go into US stocks or companies. 7.3% of your money is invested in Japanese stocks and shares and 0.2% in Israel. The different colours are different regions. Orange is North America, blue is Europe and green is Pacific.

Katie has created an interactive map so you can scroll around the above map and zoom in and out to see the different countries! These work best on a large screen so you can see them and move about. As you roll over each element it will give you more details. Get out the big screen!

The second map here shows you the FTSE Global All Cap Index fund. These fund names are a bit of a mouthful so from now on, I will refer to the two funds as Dev World and Global.

The main difference between the two charts is that the Global fund has investments in South America, parts of Africa, India, China and other Asian countries; the Dev World fund doesn't hold any of these. The Dev World's holdings are more concentrated in the USA with 10% more of your investments going into the USA.

​Katie has put the two world maps next to each other so you can compare where you money is invested around the world:

Region Comparison

There are so many different ways you can analyse the two funds. We are going to take you through them step by step. ​ In the bar chart below, Katie has pulled this data together in a different way so you can see the difference between the two funds in terms of region. You will notice the only real difference is the addition of the Emerging Markets in the Global fund. You get a slightly lower percentage of North America if you buy the Global fund and get Emerging Markets (China, India etc.) instead. Sector Comparison Next let's have a look at the industry sector comparison. An industry sector is a way of grouping a set of companies together that are in a similar line of business, such as finance, technology or consumer products. The first thing I noticed when I looked at this chart was there was hardly any difference at all between the two funds. The Dev World is on the left and the Global on the right. The addition of emerging markets into the global fund doesn't really change the industry sector split at all.

There are slightly more technology firms in the Developed world fund due to the concentration of that type of firms in that area of the world.

Number of Companies

One of the BIGGEST differences between the two funds is the number of companies that you are invested in. Katie and I have spoken a lot about the power of diversification (What is Diversification?) and how useful it is. In the Dev World fund you are invested in 2,047 companies around the world but in the Global fund you are invested in 7,194 companies! That is a huge difference of 5,147 companies! On first glance that means you should go for the most diversified fund doesn't it? Just buy the one with more companies in it? We were curious how much overlap there was between the two funds. How many of the 2,047 Dev World companies are also in the Global fund? And what percentage of the Global fund do these companies account for? The question is not just about the number of the companies but the weighting. I can hear you saying "What the hell is weighting Alan?" When Vanguard get your money they don't take your money and invest it evenly over all the companies in the fund. They put a higher percentage of your money into the bigger companies to match the size they are in the market. What this means is that more of your money gets invested into the bigger companies like Microsoft, Apple and Google etc. They represent more of the market because they are the bigger more valuable companies. This is an important feature of the index and how your money is invested because the more valuable companies tend to be more profitable. You want more of your money in the bigger companies. Katie woke up about a month ago with the question in her head "How much of our money is invested in Apple stock?" This led to her exploring all this data and creating all these charts. Turns out quite a high percentage is invested in Apple. As at 30th June 2023, Apple accounted for 5.2% of the Dev World fund (the fund we own). 4.1% of the Global fund is made up of Apple shares. The biggest companies in the fund are very dominant. The top 100 companies in the Global fund make up 40% of the fund by weighting. That is a huge percentage given that if all companies had an equal weighting, 100 out of 7,194 companies is just 1.4%. 1.4% of companies in the Global Fund make up 40% of the value! I particularly love these next two charts Katie created. They are interactive so make sure you open them full screen and you can roll over each of the bubbles to see what they actually are. The blue represents the companies in both the Dev World fund and the Global fund and then orange represents companies just in the Global fund. These charts are a way of seeing the difference in the number of companies and then the weighting of those companies. The chart on the left shows the difference in the number of companies between the two funds. This means that every bubble on the chart is the same size and each company has equal weighting. In this view you can see that the Dev World fund is a relatively small portion of the Global fund. What is really interesting to note is that pretty much all of the Dev World fund is included in the Global fund. When you buy the Global fund you get everything in the Dev World fund plus a load more companies from the Emerging Markets. Then look at the chart on the right. It shows exactly the same company data but this time adjusted for weighting so we can see how much of the Global fund is actually made up by the Dev World fund! The only change between the two charts is that in the chart on the right the size of the bubble represents how much of that stock you own in the index.

What we realised is that it sounds like you get a HUGE amount more when you buy the global fund as you are getting nearly 5,000 more companies. But actually the percentage of your money that gets invested in these "extra" companies is quite small.

As you can see from the chart on the right the blue (Dev World) makes up nearly all of the chart and the orange (additional shares you get with Global) is a small amount extra even though it is a large number of companies. The Dev World makes up 78% of the Global fund! We would not have realised this if we had just read the top line stats on the website. To make this easier to see, Katie has also created a Venn diagram to visualise the point. This first Venn diagram shows the cross over between the two funds by number of companies. You will see that nearly all of the Dev World fund is included in the Global fund.

Global and developed world fund by number of companies Global Developed world excl UK

This second Venn diagram shows the same thing by company weighting. It shows you just how much of the Global fund is actually made up of the Dev World fund.

Global and dev world funds by company weighting Global Developed world excl UK

Katie then went onto analyse a few other different funds and the cross over between them. I think this is a fascinating way to be able to see what you are actually buying when you get one of these funds. The next Venn diagram shows number of companies and then the second shows company weighting.

Overlapping funds by number of companies Global USA Dev world Emerging markets UK

Overlapping funds by company weighting Dev world USA Emerging markets UK Global

The five Vanguard funds we are visualising here are

There are a few things to point out when looking at these Venn Diagrams. Firstly, when you buy the individual funds such as the USA, UK and Emerging Market you get exposure to some extra companies that aren't in the Global or Dev World funds. Secondly, the USA market is a HUGE percentage of the world economy. You can see how large the USA circle is and how much of the Global and Dev fund it makes up. Finally the Global Index gives you such a broad exposure to all of the different funds. So far we have looked at geography (where your money is going to be invested), Industry sectors and the difference between the funds in number of companies and then by weighting. Let's discuss performance, profit, the good stuff! Fund performance

Let's get down to the nitty gritty. Profit. We are buying these index funds as an investment to make us wealthy over time so that we eventually no longer have to work and are financially free.

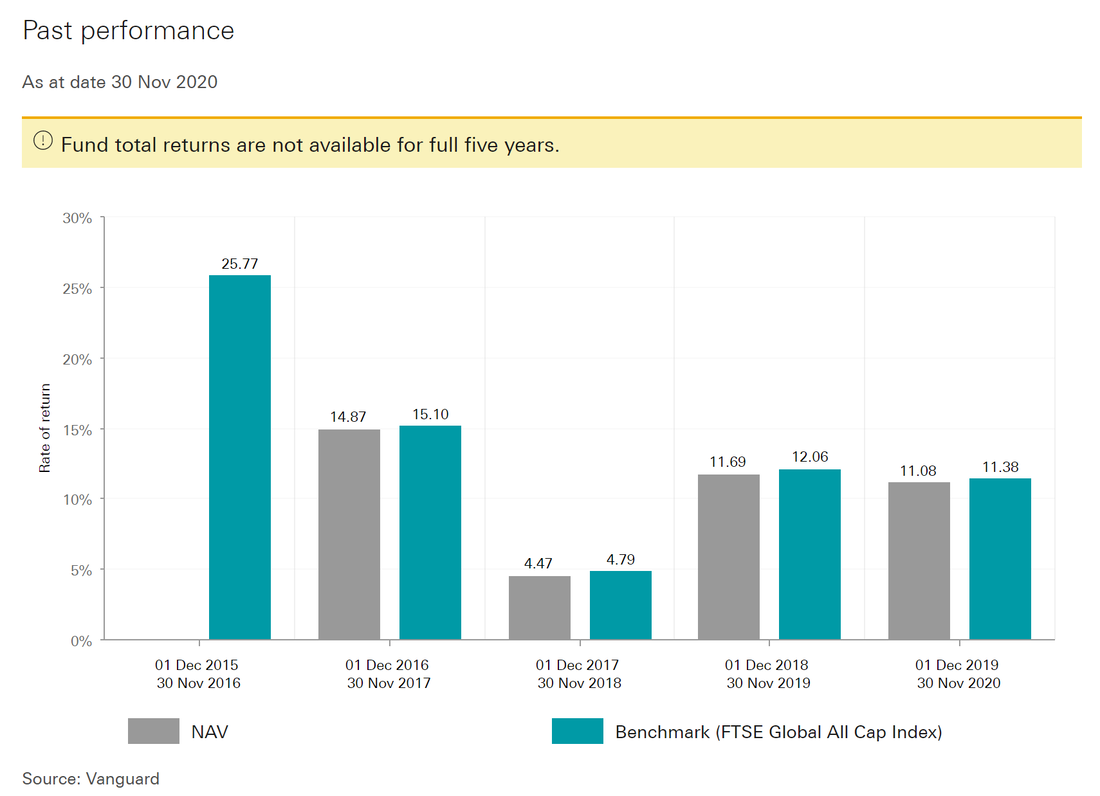

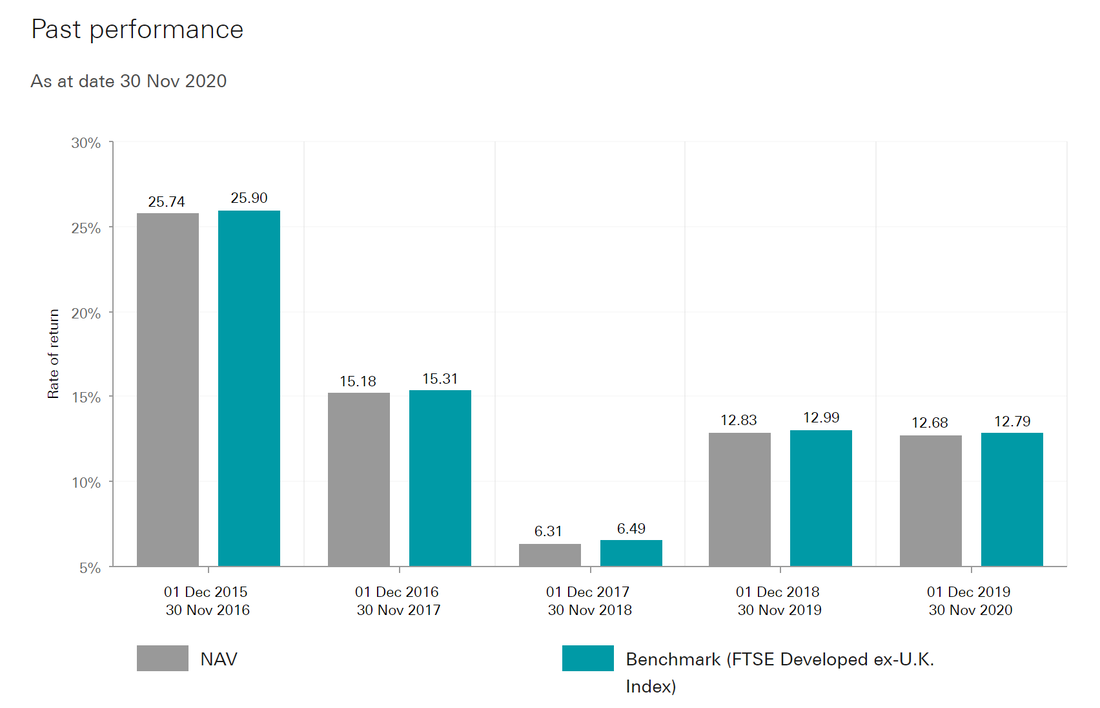

Which one is going to get us there faster? Which will perform better? The simple answer is no one knows! NO ONE. Not ever Warren Buffet the world's greatest investor knows and he will happily tell you that! We can look at past performance for a clue but as every single investment advert will tell you: "Past performance is not an indicator of future performance". What they mean is that just because a fund did well this year doesn't mean it will do well again next year. It was at this point that Katie and I had discussed doing an evaluation of our investments to see if we would have been better off if we had invested in the Global Fund instead of the Developed world fund. We decided against doing these calculations because we would not have done anything different knowing this and it will not change our actions going forwards. Even if we work out that the Global fund was better over the last five years that doesn't mean it will be over the next five! Doing this calculation would not have impacted our decision about what to do in the future. It should also not impact your decision about which one to buy. Looking at the past performance in order to work out which fund we should invest in is irrelevant. Just to put your heart at ease, let's take a little look at the past performance of these two funds over the last five years and you'll see that there is very little difference between the two funds. Firstly the Global Fund. It hasn't quite been around for the full five years so there isn't data for the first year but you'll get the picture

Secondly the Developed World fund

What you will notice is that they are very closely correlated. You can probably already guess why?? Because they are broadly made up of the same things. The Global fund is the Developed world plus a bit of emerging markets. So of course they are going to be closely correlated.

Overall the Developed World Fund has performed marginally (and I do mean a small margin) better. Does that mean it will continue to do so? No! Do we have any idea which one will do best over the next decade? Three decades? No. We just have to pick one and go for it. My only inkling is that as the world grows and changes over the coming years and decades, other countries will start to expand their economies and grow. I expect to see the rest of the world becoming a bigger piece of the global economy. This is an argument for investing in the Global fund. Impact of fees

We know what you are thinking: "Alan and Katie you told us in the last article to reduce fees at all costs. Shouldn't I just be gong for the cheaper fund?"

Is it worth paying extra for the Global fund? The costs of these two funds are 0.14% (+0.01% transaction fees) for the Dev World versus 0.23% (+0.05% transaction fees) for the Global fund. This is a difference of 0.13% overall. Is that significant? Will it impact me over the long term? Should I just be going for the cheaper fund? These are questions that Katie and I have been asking ourselves this week working out if our strategy is good and what the impact is over time. Obviously Katie got VERY excited and went off and created a spreadsheet to model the impact over our lifetime to see what difference it would make! After an hour engrossed in a spreadsheet she took her hoodie down and shouted at me "I have the answer!" To put into perspective the impact of the difference in fees between the two funds we decided to include an actively managed fund in the analysis. Assumptions

The results Over 65 years you are 5.2% worse off if you choose the Global fund over the Dev World fund. We have assumed the same growth between the two funds so the Global fund will always come off worse because it has higher fees. In practice the growth will be different between the two funds but we can not know which one will be higher. There is a chance that the Global fund will outperform and make up this difference. There is also a chance the Dev World will perform better. We have no idea. No one does! To put this into context let's look at the difference between the Dev World and the actively managed fund. We would be 58% WORSE OFF in the actively managed fund! HOLY MOLY! The 0.09% difference in fees between the 2 funds we are comparing makes a difference of 5% but when you compare this to the actively managed fund fees of 1.61% it makes a MASSIVE DIFFERENCE over time. What are Katie and I trying to say here? When you get down to the smaller fee numbers it doesn't make that much difference. It is the massive fees that we need to avoid at all costs. For more about the impact of fees read this! Market capitalisation

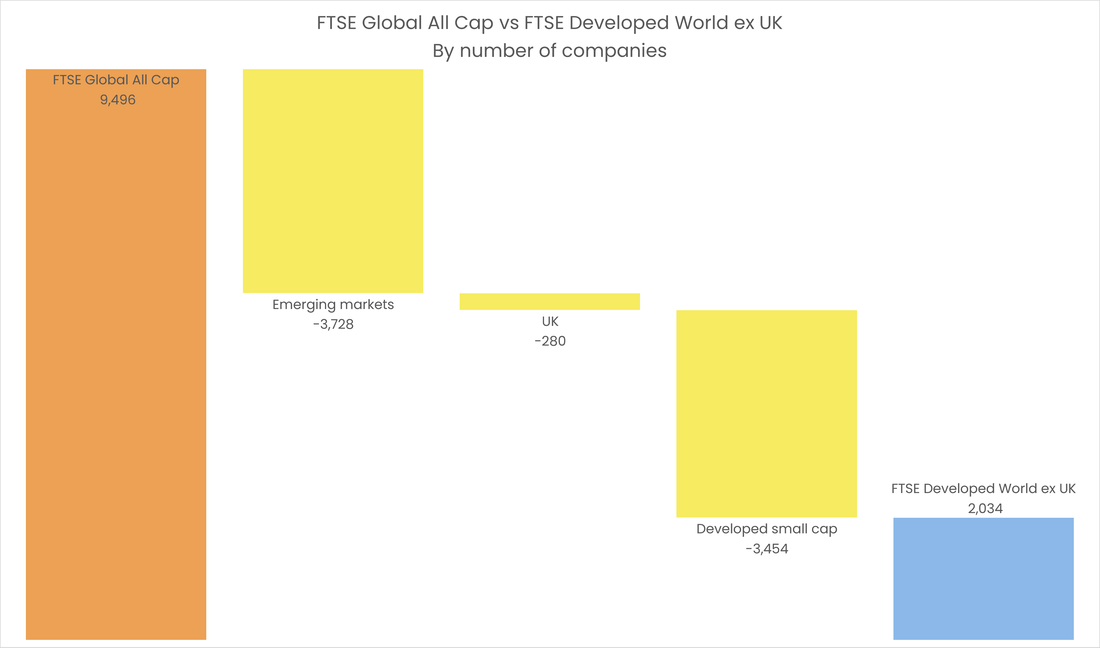

When Katie and I bought the developed world excluding the UK index fund the Global All Cap Index fund wasn't available for us. One thing we didn't understand is that the developed world fund is not an all cap fund!

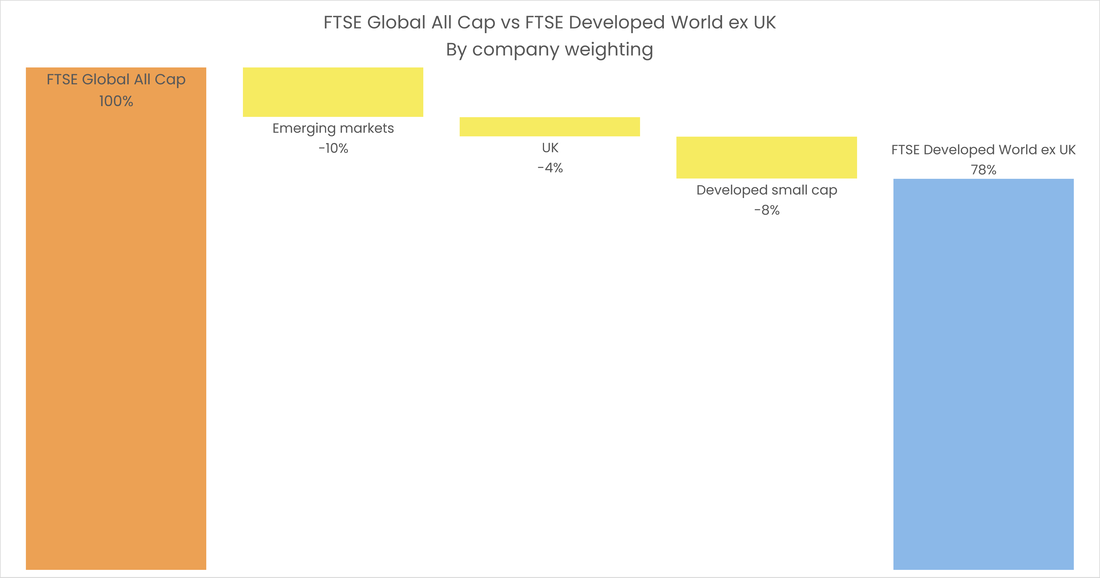

What the hell does that mean? Market capitalisation is the size in monetary terms of a business. You take the total number of shares in a company and then multiply it by cost of each share. This gives you the total value of the company. For example there are 1,034,000,000 shares in Tesla that exist. Each one is worth $869.83 (Feb'22). So if you multiply the number of shares in Tesla and the share price you get the overall market capitalisation of value of Tesla which is $8639.86 Billion (Feb'22) Some funds like the Global fund are all cap index funds which means they include all sizes of companies. What Katie and I didn't realise when we bought the Developed world fund was that it is only medium and large cap companies. So they have removed all the small cap companies from the fund. Katie has gone and got super geeky again and has produced a series of waterfall graphs to help you see how you can go between the global and developed world fund. There are two charts. The first shows the data by number of companies and the second by weighting. The first chart makes the difference between the two funds look huge! Which by number of companies it is but by weighting it isn't You start at the left of the chart showing the FTSE Global all cap benchmark then as you move to the right you can see what is removed from the index to get to the FTSE developed world.

This second chart shows the data by weighting (size of the company in $) rather than numbers and you can see in this view the difference between the funds is only 22%

To help make this a little bit clearer the orange bar on the left is the benchmark for the FTSE global all cap. You then remove 10% which is the emerging markets. Then you remove 4% for the UK and finally developed small cap companies (this is the bit Katie and I didn't know when we first invested in this fund) which leaves you with the developed world fund.

We have spent a huge amount of time working to make the comparison between these two funds as simple as possible for you. I would love to know your thoughts, questions and comments. Was there anything that confused you? Please help us to make the article stronger by leaving us a comment. Global vs Dev world: the conclusion

The short answer to which fund to invest in is "it doesn't really matter". As long as you are investing and putting your money into a broad based index fund you will be making progress. Just get started

It's not binary As Katie often randomly outbursts "it's not binary!". Normally she would add a swear word as well. What this means is that you don't have to pick one. You could go 50/50 or 70/30 or another split. You could get the developed world and add an emerging market fund to it. This is not a binary decision. Costs There is a cost difference between the two funds (0.09%) but it is very small. We have looked in depth at the difference between the funds and you are going to have to convince yourself whether or not you are willing to pay that small amount extra for the global fund. The global fund costs more because of the increased administration of owning all those extra companies around the world. The difference The companies in the Developed World fund make up 78% of the Global fund anyway! The real difference is you get a bit more diversification and the inclusion of Emerging Markets in your fund. That is it. Diversification is important. Donegan plan What are we going to do based on this? We are going to hold our Developed World e.x. UK fund for now. We are not going to sell and swap to the Global fund. This exercise has shown me that the only real difference for me is the inclusion of the Emerging Markets in the Global fund. So if I want to increase my exposure to Emerging Markets then I will invest some additional money in this fund in the future. We have just added £20k into the emerging markets fund and as of Feb'22 Alan has also started to buy some of the global fund into our mix as well. Just start In our opinion (and remember this is not financial advise, just our opinion!), both of these funds represent a fabulous way to invest. Both give you an incredibly diversified portfolio of companies around the globe at a low cost. It doesn't really matter which you pick as long as you get in the game and pick. The way you truly miss out is by not investing in your future and financial freedom. Pick a fund. Make peace with your decision. Keep on working towards your financial freedom.

Disclaimer: This is not financial advice. Katie and I are not trained financial advisors, nor to we pretend to be one online. Read our full disclaimer here. ​

PS can't believe that no one has left me a comment on this article! Come on; tell me what you think! Alan

|

DONEGAN |

We built this website to share our stories, the adventures, the amazing people and all the life lessons we've learned along the way!

SIGN UP to our mailing list

|

RSS Feed

RSS Feed