Week 5: Communicating about money

|

Week 5 is all about communicating about money with the people around you and working as a team

One of the biggest reason for divorce is money. 41% of people say money is a HUGE source of stress in their lives. If we can operate better, communicate better and work together it is amazing the progress we can make together with our finances. The YouTube live of the course is to the right. Thanks for being part of the Rebel Finance School and full resources for this week's course are below! |

|

Resources

There are a lot of resources that we have created to help you with this week. Here is a list of them all and then scroll on to find the course notes!.

|

How to talk to your partner about money blog post.

Why bother tracking your finances - YouTube video

|

How to talk about money YouTube video - 6 minutes long

How to track your finances - full article about monthly finance meetings

|

What get's measured gets improved blog article explaining the key concepts

How to run a monthly finance meeting youtube video.

|

Course notes

This week' course had two main elements. Firstly how to communicate about money and secondly how to stay on track when you get into this finance stuff.

Katie and I created a short 6 minute YouTube video that highlights the key points and is easy to share if you want to. One way to recap the main content of part 1 is to watch that video or to read the article we wrote about How to talk to your partner about money.

Katie and I created a short 6 minute YouTube video that highlights the key points and is easy to share if you want to. One way to recap the main content of part 1 is to watch that video or to read the article we wrote about How to talk to your partner about money.

|

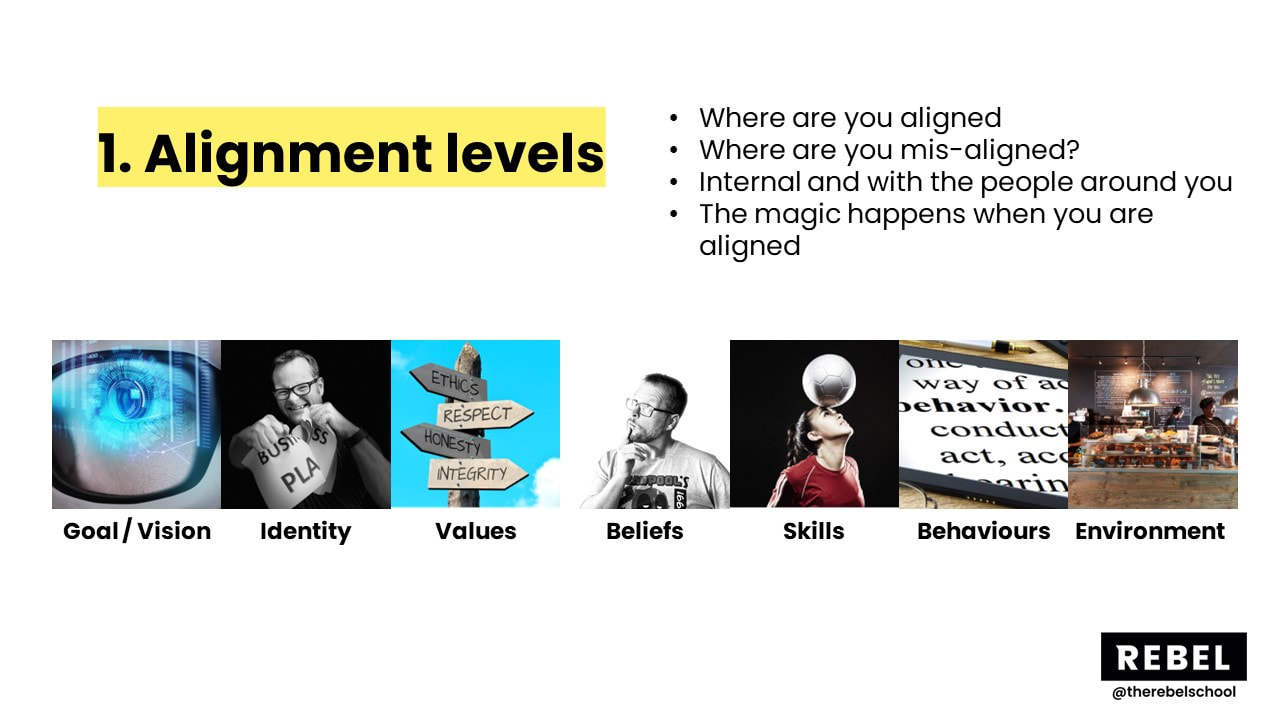

In week 3 we spoke a lot about internal alignment. Does your goal align with your identity, beliefs and more. Internal alignment is only step 1. The second is the external alignment.

If you and your family, partner or other have a joint goal to get your finances sorted but one of you doesn't believe it is possible or isn't really interested it is going to cause huge friction for you both. Being able to communicate about money, work with the people around you is critical to your success. |

|

The problem

Money ripped Alan's family apart. it has caused huge damage in both our lives and the thing we have come to realise over the years that it is not money's fault. it is the people and their lack of ability to communicate and work together that is the problem. Don't blame money for your lack of communication skills or ability to work together.

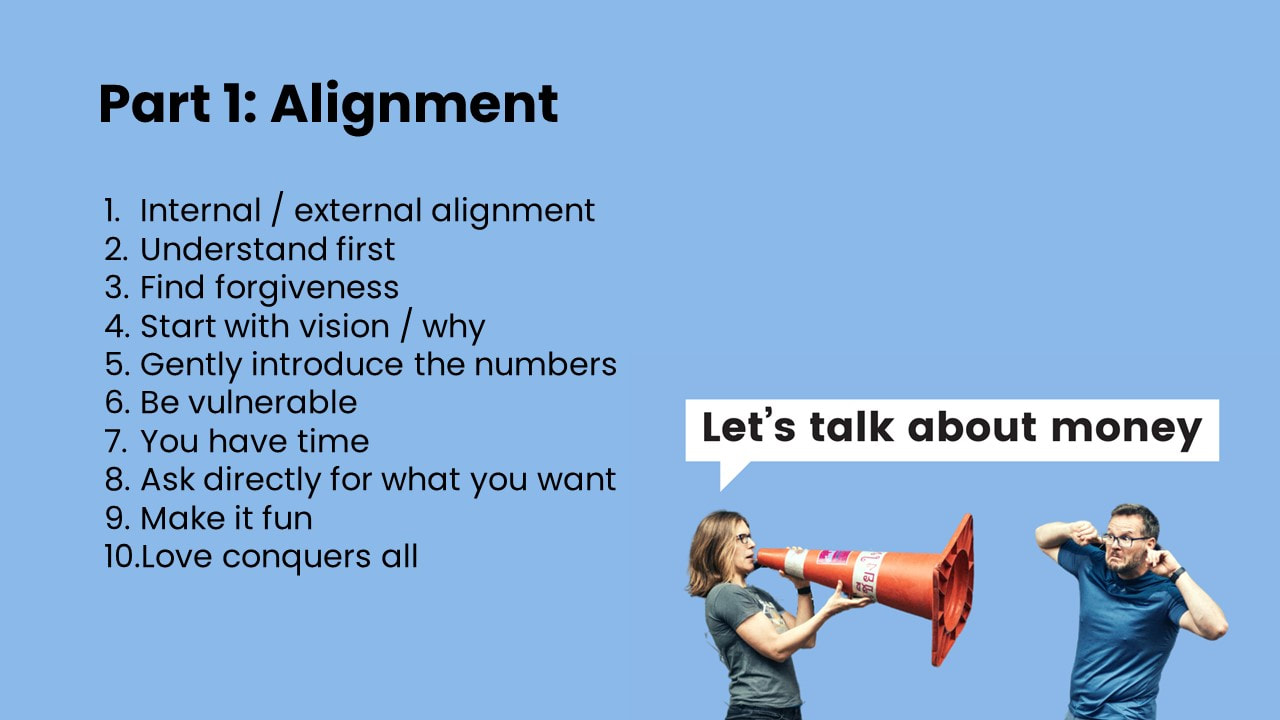

1. How to communicate with the people around you about money

We covered 10 key principles in communication on the course last night. These 10 things will give you ideas and cluse about where you might be stuck as a team/family. The key for us is to use the alignment model to work through together to find out where you have alignment and where you don't.

Maybe you could use the alignment model on the right to go through as a family / team and to work to see if you have alignment. Ask them what their goal is and compare to yours. Ask them what they believe about money / finances and compare to your beliefs. See if you can uncover the differences and possible friction points!

Maybe you could use the alignment model on the right to go through as a family / team and to work to see if you have alignment. Ask them what their goal is and compare to yours. Ask them what they believe about money / finances and compare to your beliefs. See if you can uncover the differences and possible friction points!

As a reminder here are the 10 points and a brief description of each.

- Internal / external alignment - use the alignment level model to understand where you are aligned and then where you and the people around you have alignment or not.

- Understand first - most people like to tell first. They tell you what they think, they explain their point of view without understanding. Stop telling people what you think and ask questions with curiosity. Understand the people in your life BEFORE you try and be understood.

- Find forgiveness - if shit has gone wrong with your finances in the past, if your partner, family have made mistakes with their finances then you need to find forgiveness. If you can't find forgiveness then you owe it to yourself and the other people around you to admit that. Don't just live in pain, find forgiveness and a way forward.

- Start with vision / why - no-one cares about categorising spending until they know why they are doing. Find a huge vision for your life, a compelling reason and then use that to motivate and drive you and the people around you. Remember to start by understanding the other person and don't just sell them your vision. People support what they co-create.

- Gently introduce the numbers - after you have a vision you can start to understand the numbers. What would we need to live our dream life? How much would it cost? How much do we need to invest a year to be able to live as we want to in the future. Use the vision to drive the numbers and the conversation will be far easier!

- Be vulnerable - sometimes the best way to get someone else to open up is to open up yourself. Share your fears, your letter to money, your thoughts and talk openly about what is going on with you. Leave space for the other person, this is not your opportunity to download everything. This is your opportunity to be vulnerable to allow the other person space to do the same. Talk to your family about your fears of not being able to provide for them, talk to them about your fears of investing and open up to those around you.

- You have time - finding alignment, working together and making this happen takes time. This is not a one chat and done kind of thing. Be patient and take your time. Work on this slowly together.

- Ask directly for what you want - what more can I say other than stop being British, stop indirectly asking for what you want, stop the passive aggressive crap about them not categorising the spending properly. Directly ask for support building your dream life together. Directly ask the other person for what you need with kindness and compassion. Direct communication is critical to working on the future together.

- Make it fun - finance can be fun. Do the monthly finance meeting with a curry and a glass of wine, or like we do with a nice breakfast! Create fun charts, joke and have fun. Finances don't have to be tough, they can be fun. Use your imagination to make things fun and watch how the people around you open up and start getting excited. Watch your kids, your family as they start to realise money doesn't have to be a source of stress but can be a source of joy and opportunity!

- Love conquers all - love for the people around you and love for yourself. Self-care is not bubble baths and chocolate and all that crap. True self-care is building a life you don't have to run away from. Love yourself and your family by working on your finances and your life to truly build a life that you want to live.

Everything you want in life is done with and through other people. With this in mind one of the most important things you can do is to work to understand your friends, your family and your partner if you have one. The better your communication around money the easier your progress will be.

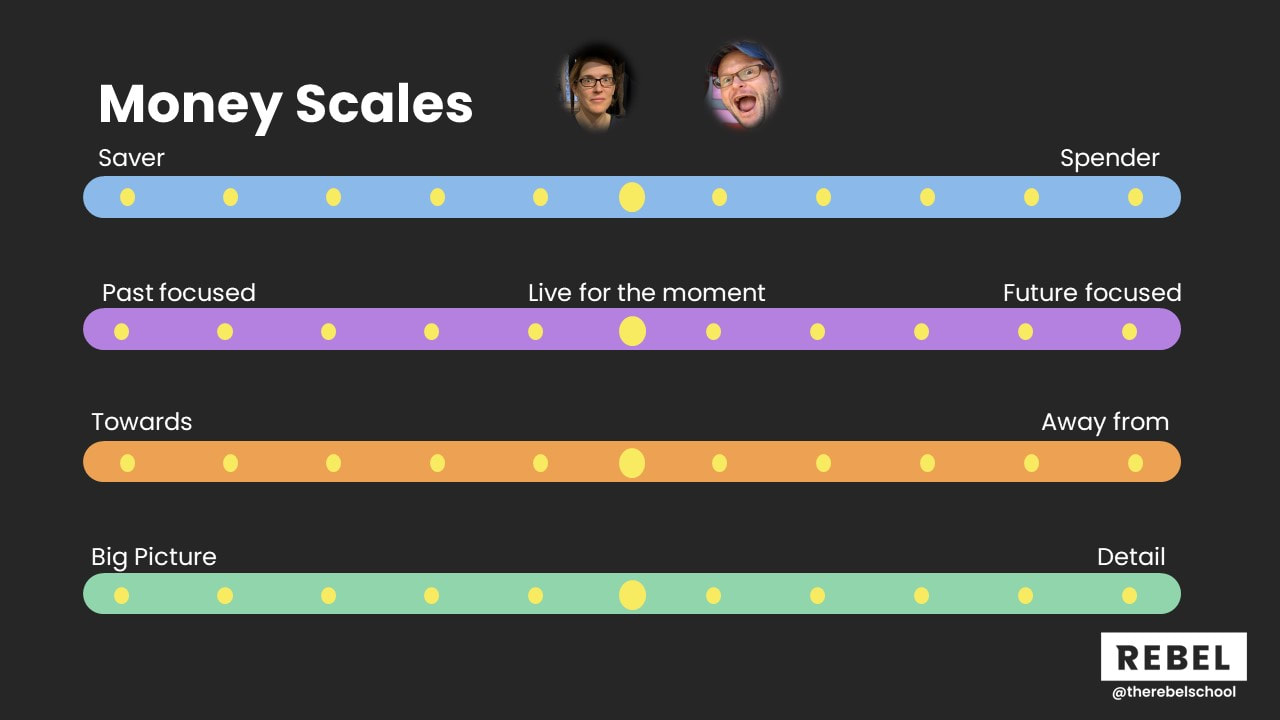

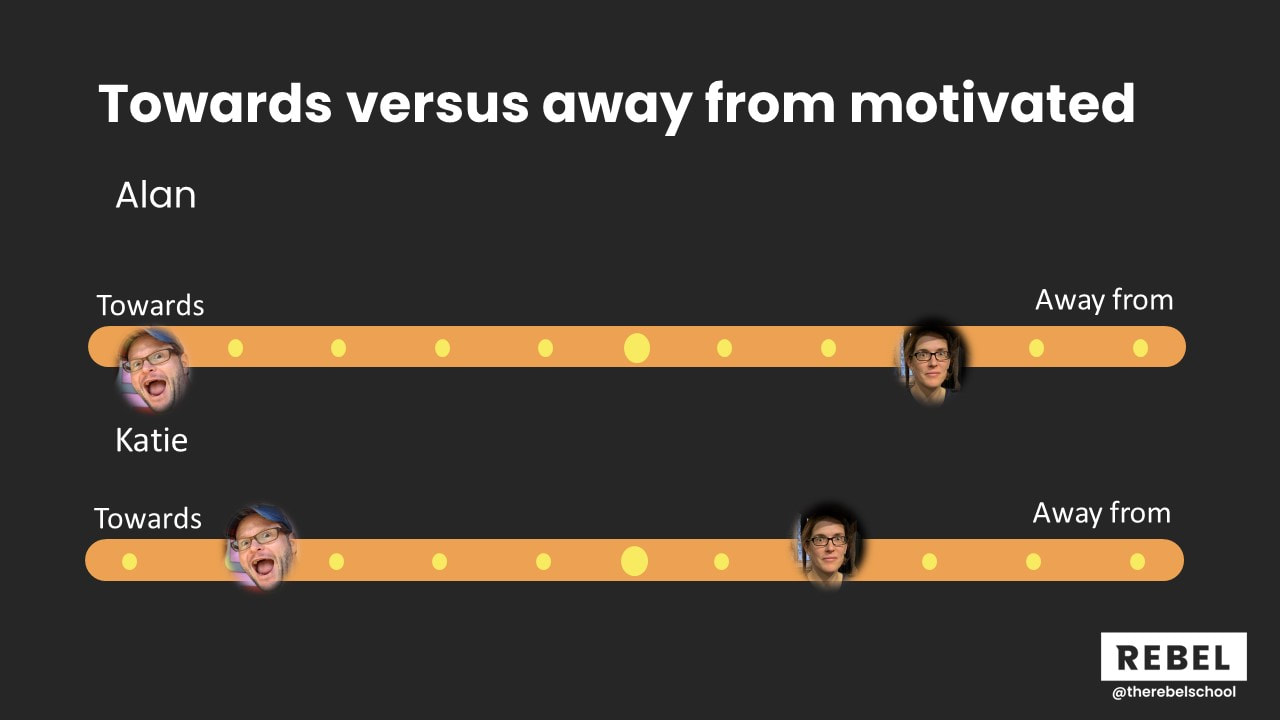

One of the first elements we looked at was the differences in how we operate around money. We introduced four scales to highlight some of those differences. Homework alert.... team up with another human, mark where you are on these scales and discuss the answers:

Katie and I found it eye opening working through these and started to understand why we argue sometimes. Katie and I are at opposite ends of the spectrum on motivation and big picture versus detail.

Understanding this helps us both to flex our styles so we work better together

One of the first elements we looked at was the differences in how we operate around money. We introduced four scales to highlight some of those differences. Homework alert.... team up with another human, mark where you are on these scales and discuss the answers:

- spender vs saver

- past focused/present focused/future focused

- towards motivated vs away motivated (the carrot and the stick)

- big picture vs detail

Katie and I found it eye opening working through these and started to understand why we argue sometimes. Katie and I are at opposite ends of the spectrum on motivation and big picture versus detail.

Understanding this helps us both to flex our styles so we work better together

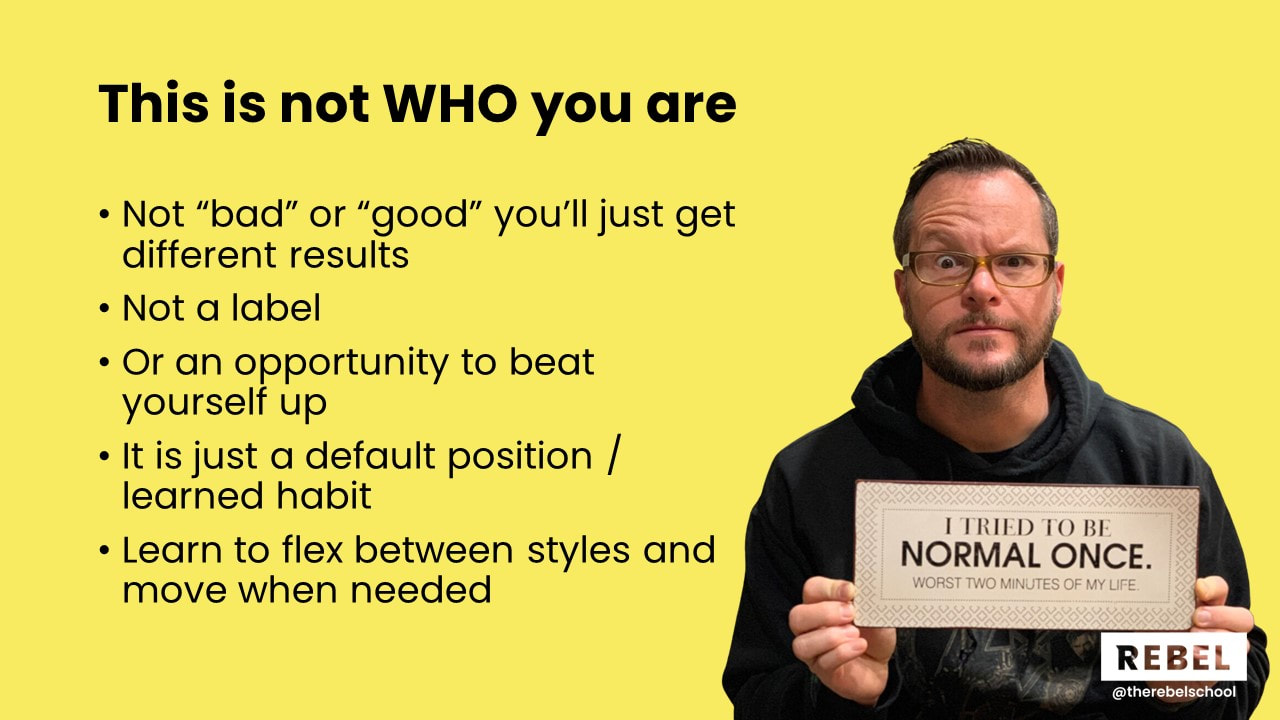

Identity warning: This is not an excuse for you to "label" yourself a spender so you don't have to change. Non of these things are labels they are just ways of thinking about our behaviour. We all have default positions that we get stuck in that we can work on and change. Just because you focus on the detail first doesn't mean you can't look at the big picture or even train yourself to start with the picture.

The second thing I really want you to get is that none of these things are either good or bad. Being a spender is not good and being a saver is not bad. They are just habitual ways of behaving that lead to different results. If you have fallen into a spender habit then you will find spending easy and saving difficult and vice versa. Both patterns have different outcomes and side-effects. This exercise is about noticing you and your families default ways of operating and then working together to be more flexible!

Your success in life is related to how flexible you can be on these scales. Sometimes you need to think about the future and focus on your plans and then you need to come back into the moment and live for now when you are with the people you care about. Sometimes you need to focus on the vision and big picture and then you need to focus and flex to look at the details that make the possible. Become flexible!

The second thing I really want you to get is that none of these things are either good or bad. Being a spender is not good and being a saver is not bad. They are just habitual ways of behaving that lead to different results. If you have fallen into a spender habit then you will find spending easy and saving difficult and vice versa. Both patterns have different outcomes and side-effects. This exercise is about noticing you and your families default ways of operating and then working together to be more flexible!

Your success in life is related to how flexible you can be on these scales. Sometimes you need to think about the future and focus on your plans and then you need to come back into the moment and live for now when you are with the people you care about. Sometimes you need to focus on the vision and big picture and then you need to focus and flex to look at the details that make the possible. Become flexible!

Alignment Levels

The alignment levels give us a tool to be able to look at our own world or that of our family/partner and to discuss different issues we have. Most people try and solve issues they are having at the behaviour level (i.e. you are spending too much money, not tracking) and don't realise that the issue is at a different level such as identity (I am not good with money)

Here are the levels and a description of them.

The real power of this piece of work is to help us get alignment internally and then with other people. If you are working to get to financial independence (mission) and you believe that are wealthy people are crooks (belief) then you are going to be torn as you work on this. You are going end up finding it difficult to follow through or having self-sabotaging behaviours. if you can work on alignment together and internally you will find making progress on your goals and vision SO MUCH EASIER!

Practical things you can do in this area are:

This Mad Fientist interview shares Jill and Brandon's story of how they found alignment.

The pre-work money belief survey is an interesting exercise to do with your partner or family. Fill it in independently and compare your answers.

The alignment levels give us a tool to be able to look at our own world or that of our family/partner and to discuss different issues we have. Most people try and solve issues they are having at the behaviour level (i.e. you are spending too much money, not tracking) and don't realise that the issue is at a different level such as identity (I am not good with money)

Here are the levels and a description of them.

- Mission / Vision - Where are you heading as a couple, family or individual? Do you have a vision for life in the future?

- Identity - who are you? Are you good with money? Do you enjoy maths and spreadsheets?

- Values/beliefs - what is important to you? What do you believe to be true?

- Capabilities - what skills do you have? Have you developed spreadsheet, investing or communication skills?

- Behaviours - what are your daily habits?

- Environment - where do you have your monthly finance meeting? Is the environment conducive to good conversation and focus? What type of people are you surrounding yourself with?

The real power of this piece of work is to help us get alignment internally and then with other people. If you are working to get to financial independence (mission) and you believe that are wealthy people are crooks (belief) then you are going to be torn as you work on this. You are going end up finding it difficult to follow through or having self-sabotaging behaviours. if you can work on alignment together and internally you will find making progress on your goals and vision SO MUCH EASIER!

Practical things you can do in this area are:

- Develop a vision for your future. Share and discuss. The Donegan way of doing this is to each create a PowerPoint answering a question like "What do we want life to be like in retirement?" and then discuss the answers!

- Work through the scales above and discuss - the first step to making progress is understanding. building trust starts with understanding your family and the people around you. Only then can you work on getting alignment.

- Start conversations about money by asking questions. Your mission is to understand the other person first

This Mad Fientist interview shares Jill and Brandon's story of how they found alignment.

The pre-work money belief survey is an interesting exercise to do with your partner or family. Fill it in independently and compare your answers.

2. Staying on track

|

This week Alan (with the help of the fabulous Haseena from the group) finished an article on how to run your monthly finance meetings. Click the button to the right to find the full article.

|

In the second part of the week we shared 6 ways to stay on track if you find yourself in the valley of despair at any stage.

After you leave the course your are bound to lose motivation at some stage. This is not an excuse to give up but rather a sign that you need to set up systems to help you keep going and to go about living your life in the time it takes for this stuff to work.

After you leave the course your are bound to lose motivation at some stage. This is not an excuse to give up but rather a sign that you need to set up systems to help you keep going and to go about living your life in the time it takes for this stuff to work.

- Automate investments payments - don't rely on will power. Automate your payments to pay off your credit card in full each month, automate your contributions to your SIPP and ISA and take advantage of automated systems to make things easier.

- Reconnect with your why - if you lose motivation reconnect with the reason why you are doing this! What is your vision of the future, are you doing this for your family? What is your motivation. It is not the Donegans' job to inspire you it is YOUR job. Inspire yourself by thinking about your dream life and then get going on making it happen

- Monthly Finance Meetings - this is a critical element that we use to stay on track with out finances. Find the article about how to run your monthly finance meeting here.

- Continuous Learning - there is always more to learn. Find a podcast that inspires you, find content that lifts you, find a book that ignites curiosity and continue to develop your skills over time.

- Find other Rebels - Two of the people that came on the course last year have been meeting every week on Monday ever since. Monday night is finance night after all! They work together on their finances, they chat and make progress. Use the Facebook group to find people in your area, or set up a virtual meeting with people you like and work together on your finances.

- Live your life - we had a question from an incredible participant last year who had done all the homework and he looked at us deep in the eyes and said "What do I do now? I have set up all the direct debits, and the investments and I don't know what to do now!? Katie and I in unison replied "LIVE YOUR LIFE" The reason we work on our finances is to enable us to live our life. Why else are we doing it. money, finances and investing are tools to allow you to live how you want to live. Nothing more. So once you have set it up get on with living your life, spend time with the people you live, cook, travel, create or anything than brings you JOY!

Choose someone to do the monthly meetings with so that you can hold each other accountable. Schedule it in each month and make it fun! We like to do ours over a leisurely breakfast. How might you make it fun and exciting for everyone?! Post in the Facebook group if you want to find a Rebel Finance School buddy to do your monthly finance meetings with...

People always do more for other people than they will for themselves. To take advantage of this commit to doing it with someone else, commit to helping someone else, commit to making it happen and that will hold you accountable.

Week 5 homework

To get the most out of this course you must do the homework (plus homework is fun!)

So here is the homework for week 5...

Ask for help

Remember to reach out in the Facebook group with any questions you have or if you get stuck. Don't let confusion be an excuse for not progressing with this stuff. We are here to support you!

So here is the homework for week 5...

- Set up your monthly finance meeting

- Who

- Where

- When

- Set up recurring calendar invite

- Have a conversation about the future with your partner/family/friend

- Do the four scales exercise with a friend and discuss your answers

Ask for help

Remember to reach out in the Facebook group with any questions you have or if you get stuck. Don't let confusion be an excuse for not progressing with this stuff. We are here to support you!

Katie's millionaire tool

Have a go with Katie's millionaire tool and let us know what you think. All you need to do is go to it, type in your net-worth and it will tell you how many countries around the world you are a millionaire in!

You need just £200 to be a millionaire in Colombian Pesos! We haven't defeated the game yet and we aren't milionaires in every country around the world! are you?

You need just £200 to be a millionaire in Colombian Pesos! We haven't defeated the game yet and we aren't milionaires in every country around the world! are you?