|

Back to Blog

What gets measured gets improved8/5/2023 One of the most interesting questions I have been exploring this year is "If things continue as they are am I happy with the direction?" To be able to answer that question you need to be able to know whether you are going in the right direction or not. The only way to do this is to measure something...…. UPDATE: This article was originally written in November 2020. We've updated it in May 2023. Hello the future! What are you measuring each month?There are quite a few things I measure each and every month that help me to understand if I am on the right path or not. I measure:

What happens if you don't measureIt was a beautiful late summer evening; warm and still light at 8pm. I was in my late twenties and was playing football (soccer). I was having the game of my life, dancing around defenders, shooting with a crispness and accuracy and bounding up and down the pitch. I turned to sprint back after one attack fizzled out and as I turned there was a "pop" behind me. I fell to the floor in agony. It turns out I had ruptured (hospital language for snapped in two!) my Achilles tendon and had 8 weeks on crutches and a long recovery time. I had to stop playing football and exercising but I forgot to stop eating the same volume as previously! In case you didn't know, this is a really good recipe for getting fat fast!

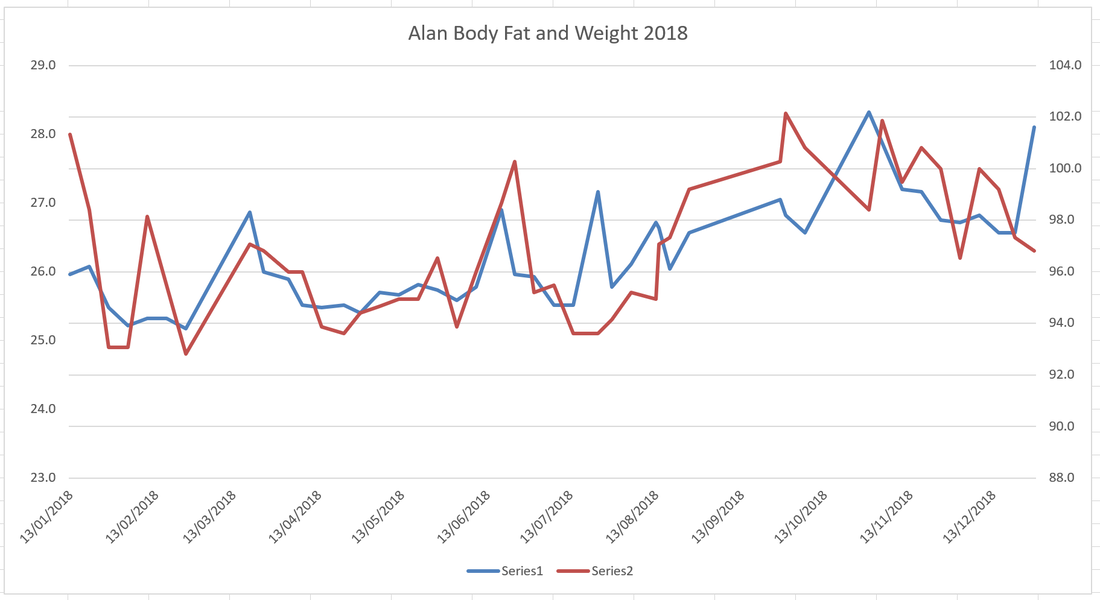

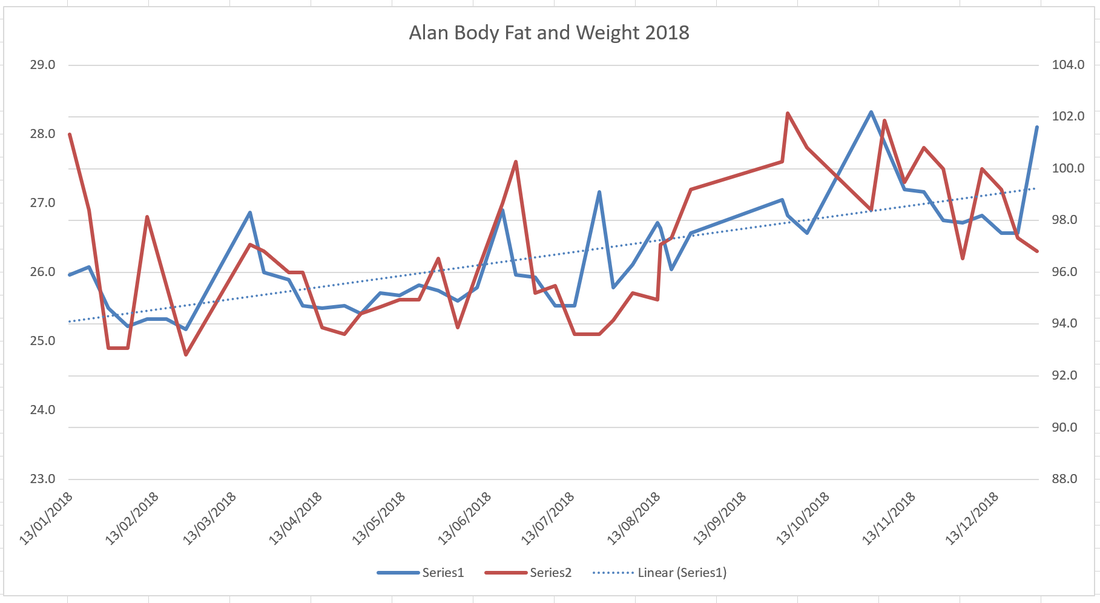

This all happened without me really noticing. I had been sliding in the wrong direction for some time but I didn't really realise and then I woke up one morning and I was fat! I had not been measuring and didn't know if I was going in the right direction or not. Sure there were signs, my clothes got tighter and tighter but these were easy to explain away and ignore. I sleep-walked into fatness. I think quite often people sleep walk into disasters without really knowing it is happening. They don't really notice that things are changing slowly, an extra pound of weight on your belly every month, over spending by a few hundred pounds a month, a relationship getting slightly worse each month and then all of a sudden they wake up on the edge of a disaster without knowing how they got there. If you aren't measuring something then how do you know if you are going the right direction and how do you realise quick enough to do something about it before it becomes a complete disaster?! My weight ballooned and ballooned without me noticing until I was a fat 30-something. If I had been measuring as I went along I might have noticed the decline earlier and done something about it! If you don't know which direction you are moving in, how can you do anything about it? Noticing trends earlyNow I measure my weight daily to know whether I am going in the right direction or not. I measure it at the same time every day and I can see the results in the app that links to the scales. Back in January 2019 in Tallinn, Estonia, I was doing my annual reflection and noticed the trend of my weight and body fat percentage was going in the wrong direction! This is the graph: Several things stand out. Firstly, after Christmas 2018 I recovered quickly from the overeating! Although, it always amazes me how much my weight balloons over Christmas! In the middle of the year we had several trips and then went to a two week financial retreat called FI Chautauqua in October and the food was too good! Towards the end of the year my weight quickly went up! At the low in the year I was 14.8 Stone (94 kilos or 206 pounds) and at the high I was 16.1 stone (102 kilos or 224 pounds) which is way to heavy for me! My clothes didn't fit properly and I felt uncomfortable! If we add a trend line to the graph it really creates an impact! Then I started to ask myself the questions "If I continue in the current direction, am I happy with where I am going.?" If you look at that trend line I am headed right back to extremely overweight and fat. This is not where I want to go. Noticing this at Christmas allowed me to take action before it got really, really bad. I took action. In the first 5 weeks of the following year, 2019, I lost 4 kilos (9 pounds) and I started to move in the right direction. If I had not been measuring to see this graph I might have slipped the wrong way for another year before truly noticing what was happening. If you are not tracking and measuring how can you do something about it? What gets measured gets improved! Check out this video we made of WHY you should track your money every month What can you measure?The question you should ask yourself to uncover what you should measure is "what's important to me?" What do I value in life? My list of things that are important to me include; health; creativity; relationships & love; finances; creativity; fun and more. Some things like "fun" don't need measuring with a number but it is worth having a monthly check in to ask the question "are we having enough fun in our lives?" Other things like finance, business and health are easy to measure, track and work out if you are going in the right direction or not. Here's the list of what Katie and I measure to make sure we are staying on track:

There are so many thing you could measure which is why I suggest starting with the question "what is important to you?" One sure fire way to fail at this stuff is to try and start tracking everything at once, make it an onerous task and give up after a few days.

Start tracking one thingPick one thing that is important to you and start tracking it over the next few months, get into the habit of tracking and reviewing and make it something easy and pleasurable to do! Katie and I have our monthly finance meetings each month where we track our net-worth and expenses. We make it fun by doing it with a nice breakfast out! MMMM, eggs, bacon and an Americano and talking about finances! It is so much fun. Pick one area and start to measure and track. Review the numbers once every fortnight (British for 2 weeks) or once a month and ask the question "do I like the direction I am heading?"

What gets measured gets improvedGet geeky about it and create an easy way to track the numbers in the area you have decided upon. and then review them fortnightly or monthly and you will be amazed at the results. Where your focus goes energy flows. If you focus on your health and improving it then results will follow. If you focus on your sales numbers and start doing something every day to improve them then it is only a matter of time before results follow. Use the numbers to focus your energy and improve the results you are getting in the most important areas of your life. Take actionit is all very well knowing this but nothing changes unless you take action. Get the metaphorical tape measure out and start to measure the numbers that are important to you and review the direction you are going in!

I would love to know what you track, if you have found it helps or not, if you used to measure things and stopped? Let us know in the comments. Thanks for reading our blog and being part of the gang! If you want updates on Rebel Finance School and to get alerts when we publish articles etc. then sign up to the mailing list below. Have a wonderful week and I am excited to work with you on improving our health, wealth and happiness! Alan |

DONEGAN |

We built this website to share our stories, the adventures, the amazing people and all the life lessons we've learned along the way!

SIGN UP to our mailing list

|

RSS Feed

RSS Feed