|

Back to Blog

How to track your finances15/5/2023

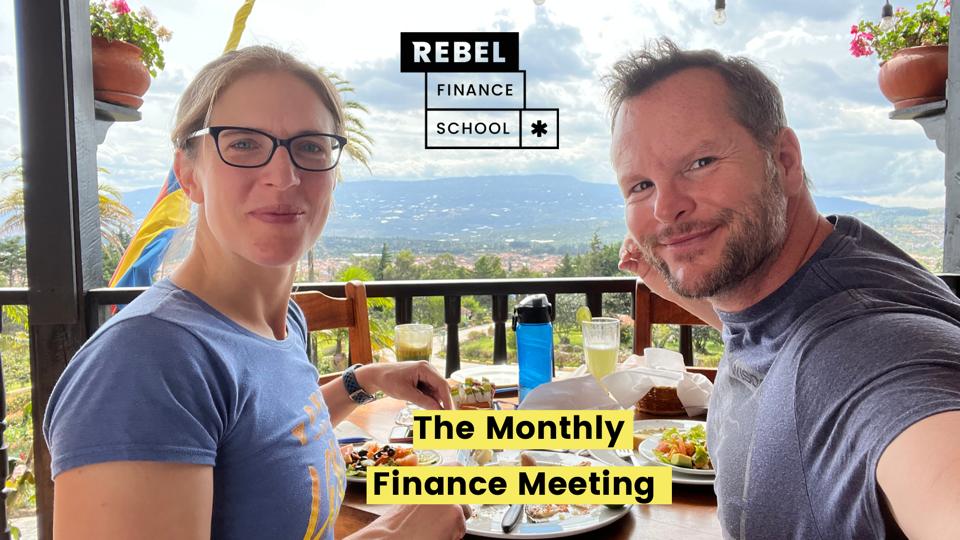

The monthly finance meeting is one of the highlights of our month. We find a cool location for a wonderful breakfast or brunch, open the spreadsheet and input the numbers and work out which direction our finances are going in! This is the exact opposite of most of the population who don't like to look at their finances at all; scared of what they might find. Your average person uses the "bury your head in the sand" strategy to manage their finances; with an occasional peek at the current account to see if they can afford things. If the saying "what gets measured gets improved" is true; then why are so many people so scared of looking at their personal finances?? UPDATE: this article was originally written in 2022, we've now updated it as at May 2023. Hello future! The Monthly Finance ReviewKatie and I have been doing a monthly finance meeting for about 7 years now and it has had an incredible impact on our happiness, finances and collaboration. It is one of these things that if done well is a small investment of time that generates massive results over time. Why bother with a monthly finance meeting or tracking your finances?

The first step to getting on top of your finances is to work out your 'why'. If you and your partner, family member or friends can find a big enough 'why' to get on top of your finances then you will find the energy to make the monthly finance meeting happen and maybe even learn to enjoy it 15% as much as we do! How to Track your FinancesSet a Day & Time Each Month How to track your finance is fairly simple. You pick a day of the month (we choose the end of the month but it doesn't really matter when!) and then set a time that you will sit down, record some numbers and ask yourself some questions each month. That is it! Simple! Record Your Numbers One of the most powerful questions you can ever ask yourself is: "If we keep going like this are we happy with the destination?” You can't answer that question if you don't track your numbers. Most people have NO idea if they are wealthier this month than the last! Most people have no idea if they are wealthier this year than the last. They don't track, they don't know, they just spend what they earn each month. The monthly finance meeting smashes this problem and allows you to know if you are heading in the right direction with your finances or not! Katie and I have created some simple excel templates to help you track your finances (read on below for these!) and there are some cool online free digital tools available as well. You could even be super old school and use pen and paper to do it! It doesn't really matter! What matters is the act of sitting down and recording your numbers each month so that you can keep an eye on what is actually happening and see if you are heading in the right direction or not. Katie and I use simple excel sheets that we log into together each month, input our numbers and it calculates it all for us! It makes it super easy for us and we can instantly see how we did! Prefer to watch a video about this?Check this one out - we talk about how to run the monthly finance meeting! What to track each monthFor each of the things we track I will share with you where you can find our templates and download them for free if you want to! There are four main numbers Katie and I track each month:

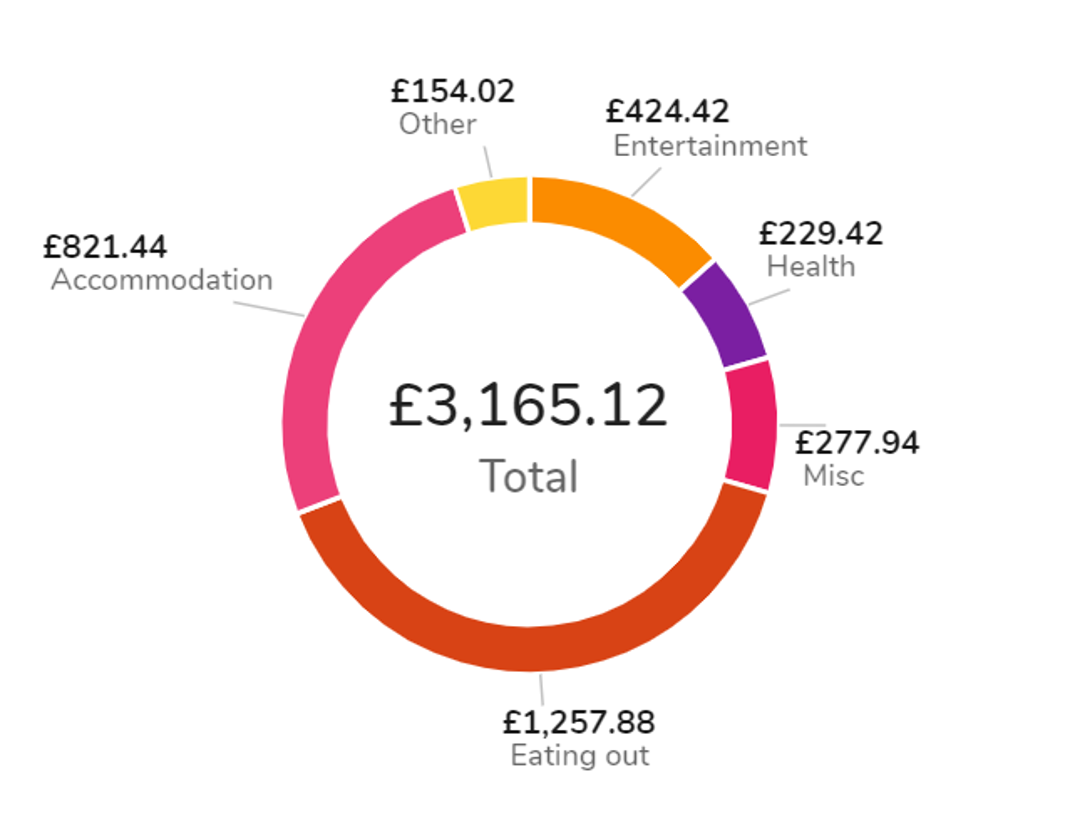

Let's go into a bit of detail on each one... 1. Net-worth is a snapshot of your financial position at that moment in time. We log into our bank accounts and type our balance into the net-worth tracker excel sheet, we enter the values from our pensions and ISAs and how much we have left to pay on our mortgage etc. If you need help doing this then we wrote an article here to help you work out your net-worth, and you can download the net-worth tracker if you would like to use it! (How to measure your net-worth) 2. Spending is how much you have spent and what you spent it on. Where did all the money go?? This is the question we are working to answer for this number. Katie and I use Money Dashboard in the UK that lets you link up your accounts and cards and then categorise them. Then we can see where all the money goes! We can see we spent XX% on accommodation, XX% on food etc. This gives us a simple chart like this one that we can look at and discuss together

What do you spend all your money on? Isn't it time you found out and worked out if you are getting value from all that money? 3. How big is your gap is the size of the gap between your income and spending. This is actually the key to long-term financial success. If there is no gap between your income and spending then you are spending everything you earn and will remain broke. A lot of people have a negative gap! Meaning they spend more than they earn and are heading for financial disaster without actually knowing it. The important thing is then what you do with your gap. How much of your gap are you using to build long-term wealth and look after future you. Which brings me on to... 4. Wealth-building rate. How much are you putting towards looking after future you and getting your finances straight? This is where you put your gap to use! How much are you putting towards building your emergency fund, to paying off debt and to buying assets? The interesting thing about the wealth-building rate is it can tell you your working life span. If you have a 50% wealth-building rate then you will have to work for 17 years until you have enough to retire. So if you start like this at 23 you could be retired at 40. If you have a 6% wealth-building rate you may never be able to retire so knowing this figure and working to improve it is critical to your long-term financial success. Katie and I wrote an article all about how to work it out and a neat little spreadsheet to help you do it on a monthly basis! (What is your wealth-building rate?) Those are the four numbers that we track each month and work out at our monthly finance meeting. The first few times you do this it might take hours but I promise, as you practice this each month, it gets easier and easier. To the point when you will be able to work out your net-worth in about 15 minutes! The questions to ask and discussAfter we have worked out the numbers we sit and chat about them over breakfast. We have a set of questions that we ask each other, each month. These questions help you think about your finances, and work out what is going well and what you want to improve for next month. Here are the questions we ask ourselves:

The questions are meant to inspire discussion and help us tweak our finances and improve them every single month. If we can get 1% better each and every single month, by the end of the year we have made HUGE progress and by the end of the decade, we are in a different financial league altogether! The first time you do this it might feel daunting and you might not make it through all the questions. That is ok. The more often you do this, the more in tune with your finances you will be and you will start to make little tweaks each month that lead to a better result. Doing it with others

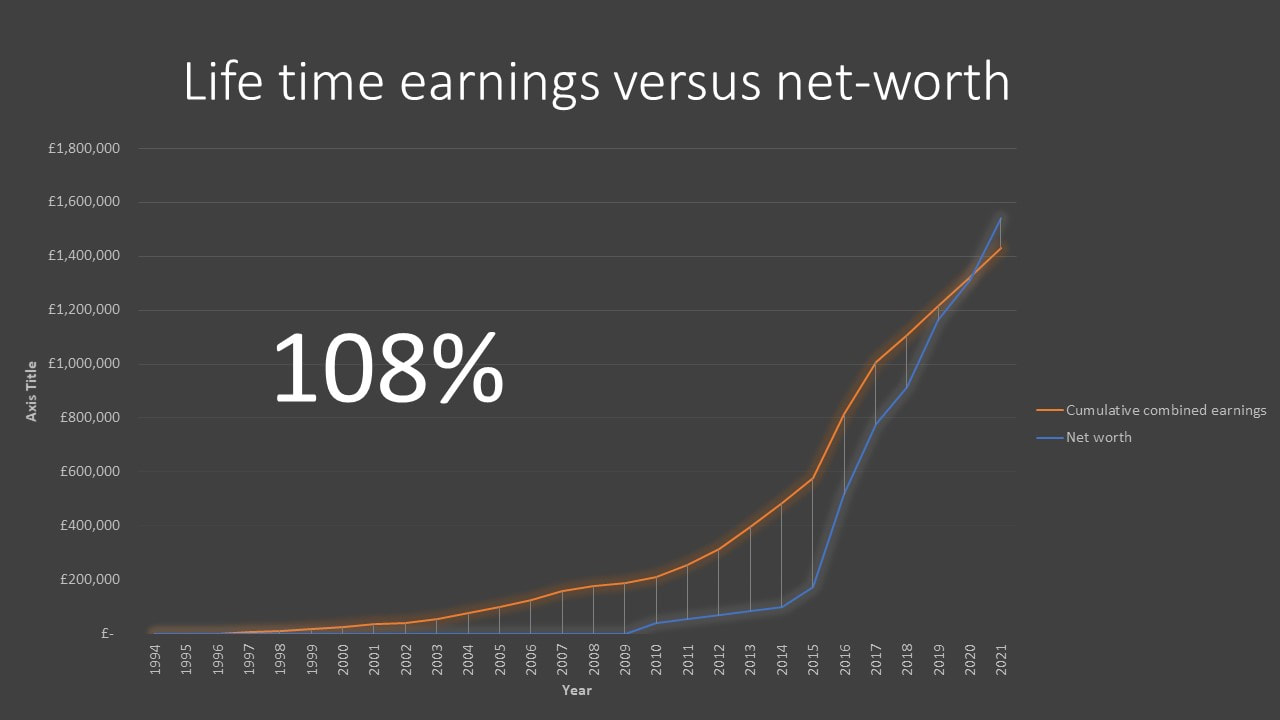

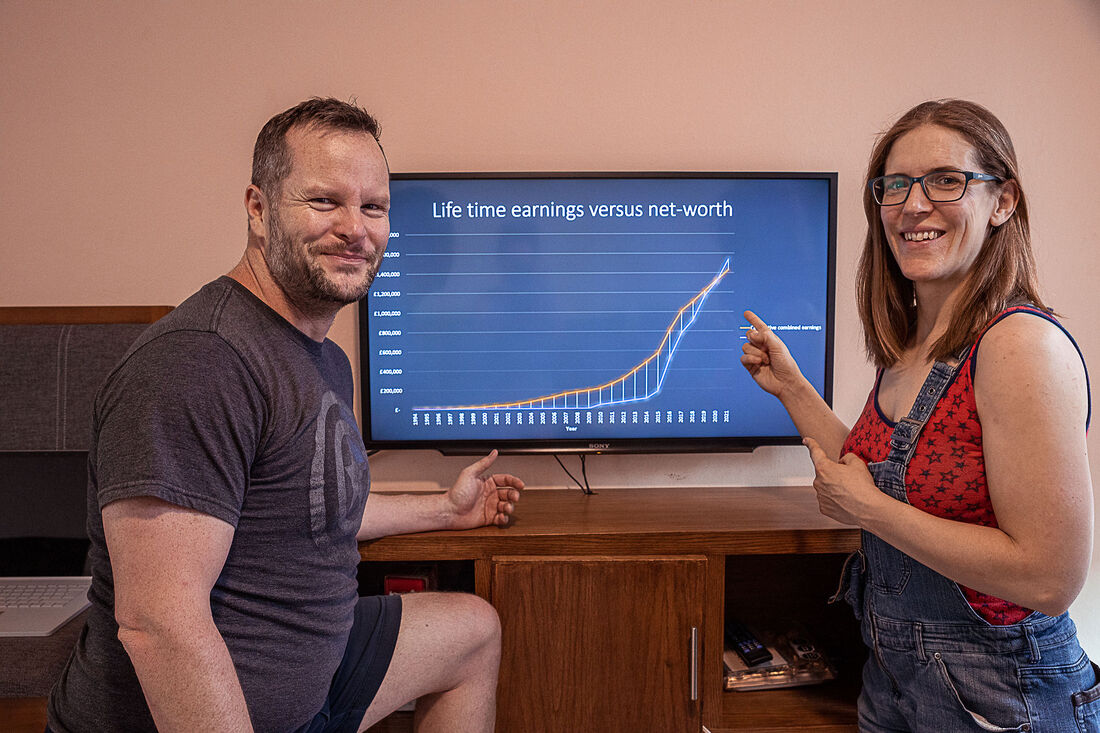

Find a friend, ask your partner, do it with your family. Ask them to help you work on your financial future for both of you. Ask them for their support in working on your future together. If that doesn't work then bribe them with a nice breakfast, glass of wine or home cooked curry and make it as much fun as possible! If you struggle to communicate with your partner about money, check out this article we wrote about how to talk about your finances. What could go wrong and how to avoid it.Our finance meetings have not always been plain sailing! Sometimes we fall out and argue during them, sometimes they bring up strong emotions and sometimes we just get grumpy! Here are some of the most common mistakes we have seen made and made ourselves. We are sharing this to help you understand that it is normal and healthy to have disagreements and that it happens to the best of us! Actively Listen with Patience - Communication is key. It is important that if you are doing this with others that everyone feels that they are being heard. It is about actively listening, collaborating together and removing any sense of hierarchy in these discussions. Even if someone is earning more than the other person, that doesn’t mean that by default they are in charge and what they say is final. Everyone needs to feel like they are being heard so ask the questions and give every person there the chance to answer. Healthy discussions and debates can lead to the best solutions. This might be Alan's biggest challenge as he always wants to jump to the answer. Use your Empathy - It can be very easy, especially at the beginning when addressing finances for there to be a lot of surprise, ugly truths and potential judgement. It is important to acknowledge where your finances are and what led to this point. What we want to avoid is doing so in a judgemental way that can isolate the other person or people involved and make them defensive. If the other people end up feeling defensive they want to withdraw from the discussion and journey. This includes the judgement that you may be directing at yourself. Looking at the number is NOT a chance to beat yourself up for things that happened in the past. We are where we are! Forgive past you for the things that have happened and let's move forward. It is important to remember that it is not a blame game, but rather to see it as an opportunity for positive change and work towards a better financial future. Stay Engaged and Committed - If things are getting off track, stop and reassess your ‘Why’ - is it strong, compelling and motivating enough to keep yourself and everyone on track in taking control and keeping on top of their finances. Katie and I have to do this! If we get lost, if we start to grumble at each other we go back to the "why"! Why are we here? What are we working on together? With a big enough "why", the "how" will become possible. Be patient with yourself and with others that may be on this journey with you, there can/will be bumps in the road and setbacks. It is important to remember that you are in this together. Alan's way of saying this is "shit is going to happen". We just need to breath and then work out what to do next together. Tracking over timeWhat's cool is if you start to do this and track your numbers over time you can start to see the trend and then start to visualise it on a graph. Then you can start to predict where your finances are heading and where you might get to later in life. It is so much fun when you are able to track over time! Katie and I created this chart to show how much money we have earnt in our life time and how much we have kept from our earnings. When you start to create charts and graphs you can see if your finances are heading in the right direction or not! Who knew graphs could be so much fun! (Well Katie did!) How to make this happenTracking your finances is critical for so many reasons and if you have made it this far through the article you are probably ready to get on with it! Here's how to make it happen:

Finance can be fun!If you can find a way to make tracking your finances fun for all and do it regularly the progress you will start to see over the years is unbelievable. Not only that but you will be helping all the people around you to understand finances and be setting them up for a brighter finance future! We would LOVE to know what you think of the article, what your biggest challenges are doing this and what you learn along the way. We are always working to make our financial resources better for you and we can only do this with your feedback! Please leave a message, a like or a share! It means the world to us! The Donegans Rebel Finance School THANK YOU

I would like to thank Haseena from the Rebel Finance School group for contributing to this article. She made what I started so much better and added some great ideas. Thanks for helping me with the article and contributing Haseena! |

DONEGAN |

We built this website to share our stories, the adventures, the amazing people and all the life lessons we've learned along the way!

SIGN UP to our mailing list

|

RSS Feed

RSS Feed