|

Back to Blog

Your Financial Philosophy18/8/2020

You financial philosophy is the set of beliefs, values, your identity and relationship with money. It is the way you think about your finances and yourself which controls your actions and in turn determines your financial destiny. I want to help you uncover your financial philosophy, take control of it and develop it to create a brighter financial future. Have you ever taken the time to consciously consider what you believe about money and how it is affecting your life? Why is a financial philosophy important?The set of beliefs you hold about money and your identity around it directly impact your thoughts, habits and your actions each day. Your thoughts, habits and daily actions are what build your financial future. If you have ever tried to stick to a budget and found it difficult, tried to avoid over spending but found it tough, tried to save without success then it is your financial philosophy that is misaligned. Let's take an example. Katie and I have a friend who lost a lot of her family members when she was young. This created the belief that "tomorrow isn't promised" and therefor you should live for today. This is a powerful belief that creates amazing moments, living a full life and real connection. It also has side effects. Our friend didn't save money, she didn't invest and she didn't really care about sorting out her finances. Why would you if tomorrow isn't promised? Live for today right? The problem is that tomorrow is probably going to arrive for most of us and so will the bills for yesterday's excesses! Core beliefs like "tomorrow isn't promised" and "live for the moment" are incredibly powerful beliefs and concepts that drive our day to day behaviour and actions. These behaviours and actions compound over time building into our financial future. If you don't take control of your beliefs, identity and values around money then you could be heading for financial ruin. In 2019 one in 165 households in the UK went bankrupt! They were floating along the river of life until they hit the financial rocks and then sunk. This number is going to be FAR worse in 2021 after the pandemic and associated recession/debt. In 2005 in the USA 1 in every 55 households went bankrupt. Can you believe that??? I was shocked by this number. What kind of financial philosophy do you need to end up bankrupt? I can actually answer that as my my family has been bankrupt many times. I may have some inside knowledge to share. If you don't get to grips with your financial situation, your financial philosophy, then you stand a chance of being one of the many families that are ripped apart by money. Take control of your finances, take control of your financial philosophy and start creating the life of your dreams. Don't just drift down the river of life and shipwreck against the financial rocks. What is a financial philosophy?Everyday you are faced with 100s of interactions with money. Marketeers put thousands of marketing messages in front of you and ask you to buy things. You walk past a coffee shop and think about buying a coffee. You check your bank balance. Your car needs servicing and you decide what type to get. Your kids ask for money. You negotiate over your salary at work. Money is a huge part of our existence and every day you are making micro decisions that shape your financial destiny over the long term. Your financial philosophy is what determines how you behave in these situations. These elements are what determines if you buy that expensive new piece of clothing or invest for the future. The different elements of your financial philosophy are: Identity Your identity is a set of statements that you make about yourself it is your self-image. You can always tell identity statements as they begin with "I am...."

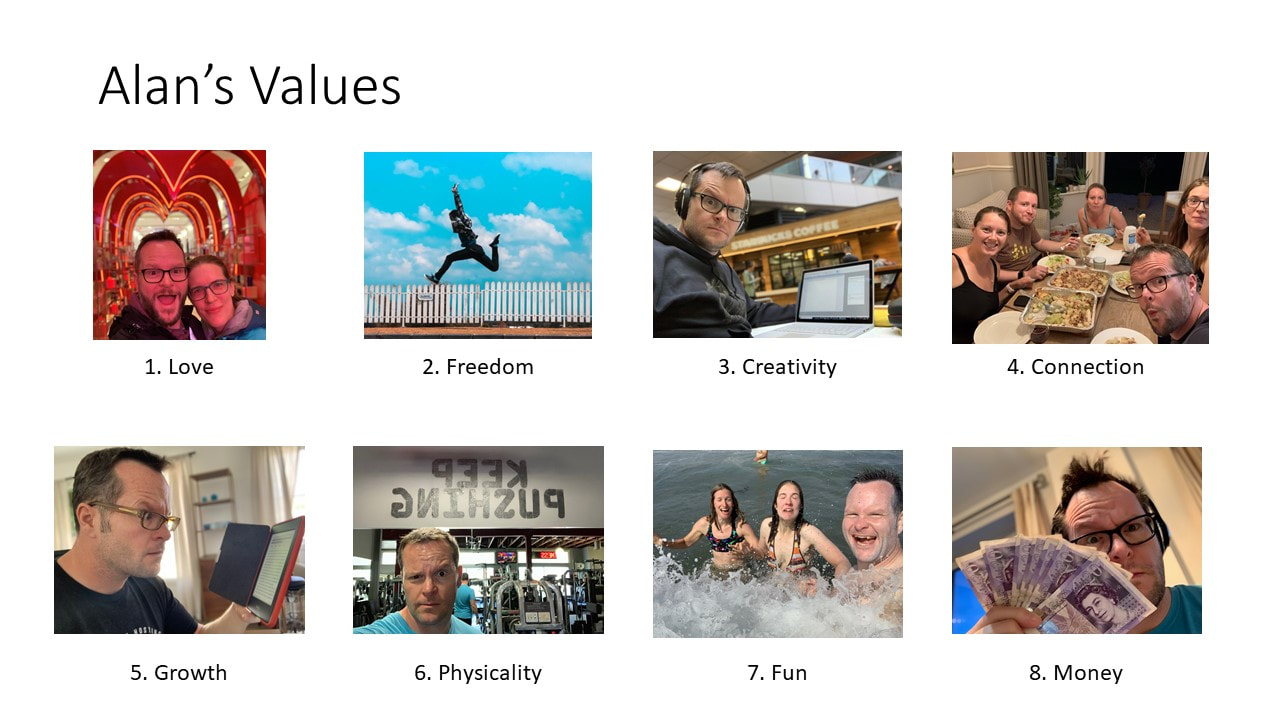

These kind of beliefs are some of the most deeply held and powerful beliefs you can have. They direct and control your interactions on a day to day basis and are rarely, if ever challenged. We have a friend who repeats "I am bad with maths" which stops him from even looking at the numbers. Every time we start to talk numbers in any context he switches off and doesn't engage. If you believed you were bad at maths and numbers why would you engage in the conversation or even try learning? It is impossible for you because you are just bad at numbers! What is a belief like that going to do over a life time? It starts by affecting your moment by moment decisions which compound over time to create a destiny. Values Your values are the things that you place the most importance on in your life. We all have different values that direct how we behave, decisions we make and more on a day to day basis. If we all had the same values life would be very boring and predictable. You uncover your values by answering and journaling about the question "What is important to you?" Write a big long list and then pick out the top 6-10 things that are most important to you. Sounds like a simple exercise but it can take time and thoughts to create the list. These values will be the things that determine your day to day actions and in the long term your results. I remember years ago being on a course and doing this exercise. We wrote, journaled and then reflected on our answers. We pulled together a list and discussed it with the person next to us. The trainer then bought us back and asked a simple question that changed the direction of my life. He asked "is money on your list of values?" I looked down my list and it was not. It felt like the trainer then stared straight at me; his eyes alive and burning, when he said "if you don't think money is important then that is probably why you don't have any!" It hit me like a tonne of bricks and money has been on my list of values ever since. Now don't get me wrong; it isn't as high up as health, it isn't as high up as integrity or friends but it is on the list. If you don't place any value on money then why would it stick around in your life? These values also then end up a very useful list to check against. If I am saying these are the most important things in my life then is that showing up in my actions. If I have a big decision I come back to this list and ask "Does this move me towards my values or away from them?" Beliefs Beliefs are things that we hold as if they were true. We all have a set of beliefs that guide us and help us operate within life. These beliefs might have been developed in childhood, out of painful situations or handed down to us by our parents. They are things that we believe so deeply that we act at all times as if they were true. Here are some examples of money beliefs we have come across through our work:

It takes money to make money is one I have battled against with Rebel Business School for years. There are huge sections of our population that are trapped by this belief. They believe that in order for them to get wealthy they must first get money. They need a loan to start a business. They need thousands to be able to start to invest. They believe that to be able to start you first have to have money. What they don't realise is that in order to get money they must first start. Money is the end result of consistent action and adding value to other people's lives. It is the end result of creating a gap between income and expenditure and investing the difference; no matter how small; over the long term. This belief traps people. They act as if it is 100% true and therefor spend their time trying to borrow or get given money rather than starting and taking action. Your beliefs about money, business, life and more control what actions you take on a daily basis. If you don't believe it is possible why would you every try? These are a little harder to uncover but SO IMPORTANT. You can uncover them through journaling and challenge them by going on courses, reading, learning and taking action. These are so important I am planning a whole series of blog articles on it. More to come I promise!

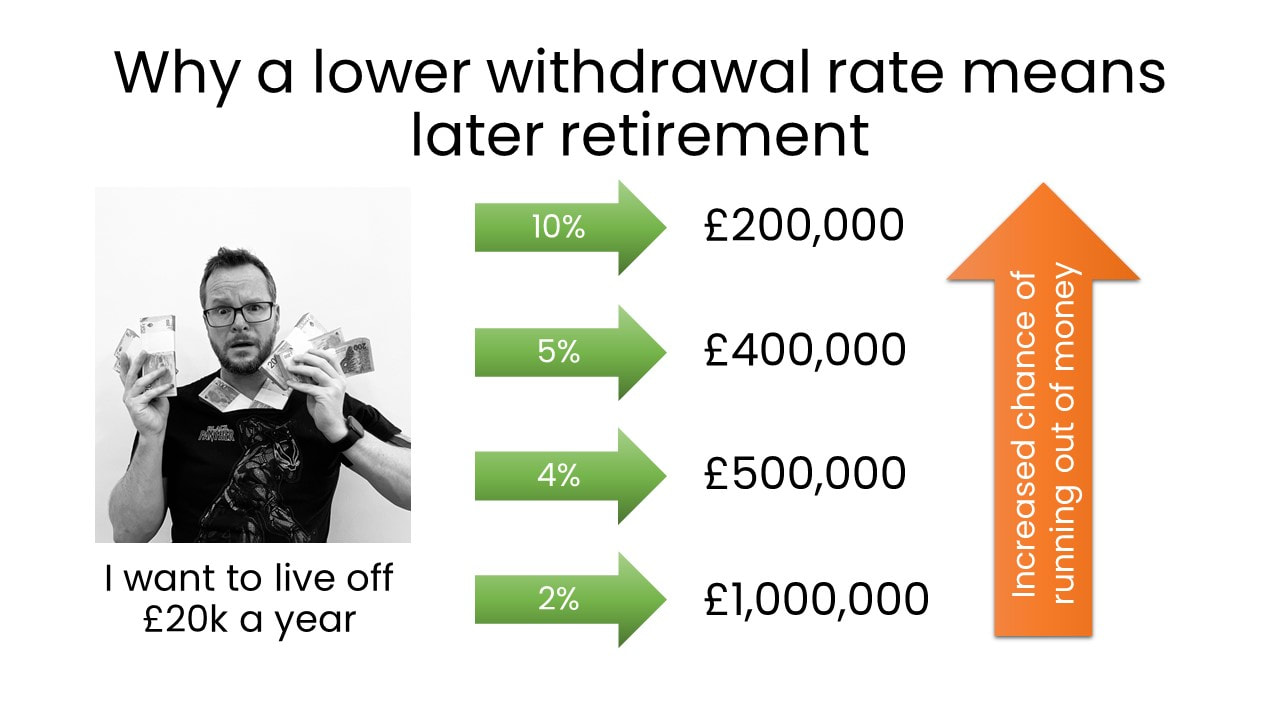

The definitions you hold for money, finance, wealth and other words in this area will directly affect your daily habits, actions and therefor your long term outcomes. Your task if you want to uncover your definitions is to start journaling about them! Write Money is ...... and start writing. Then for bonus points ask a range of people with different financial results what their definitions for money are. Wealth Thermostat Did you know you have a wealth thermostat somewhere inside you? This wealth thermostat or income thermostat regulates your income and wealth just like a thermostat at home regulates the temperature. Let me give you an example: A young person got into sales. The company gave them an area to manage that had traditionally performed badly; there wasn't that many customers and it was not economically thriving. The sales person started, hustled and found customers. They did really well and created a $40,000 income for themselves from the area. The management were super impressed. They promoted them the next year and gave them a better area. More businesses, more clients and more opportunities. By the end of the year the salesperson had roughly create $40,000 worth of income for themselves and the same number of sales that they got in the worse area. The management team where confused and disappointed. Why hadn't they performed better given the better circumstances? The Management team put the sales person back on the old area where there was less opportunity. The sales person hustled, worked and got out there finding new clients. For the third year the sales person again bought in around $40,000 dollars income and a similar number of sales. Now really confused the management team wanted to understand what is going on and how this cycle was repeating itself. No matter the circumstances around them the salesperson seemed to hit $40,000 and a similar number of sales! The management team discovered that the salesperson in the tough area had to work super hard to get the $40,000 and he did it because that was what he needed to earn. When he switched to the better area he didn't need to work as hard. He would get out there and meet a few clients, he would work until he was about to start hitting his number and then he would relax, spend more time with his family, take time off during the day and not work as hard. When he reached the amount of money he was comfortable with he stopped working as hard and stopped earning. His comfort zone was $40,000 a year. That was what he needed and he would work as hard as he needed to to get it. His thermostat was set to $40,000 a year and he would adjust his effort subconsciously to always end up around this number! What is your income or wealth thermostat set to? Taxi drivers do a similar thing. They stay out crazy hours working when there isn't much business available until they hit their daily target. Then when there are lots of customers they work shorter hours and knock of early. They have set the amount of money that they think they need to work and they do what they have to, to create it. Some questions for you to explore and think about:

You can change your thermostat by consciously setting yourself a target. Daily thinking about the target and working out what' the one action you can take towards it. Working on your money philosophy. Where does your financial philosophy come from?You might be thinking "Alan I don't have a money philosophy!" I am here to tell you "You already have a money philosophy." You just aren't conscious of it. We all have one which is built of these different elements we just haven't been conscious of it before and or realised what is actually driving our money decisions. The beliefs, identity and values around money that you already have been installed in different ways, mainly in your childhood. Here are some of the different ways that your financial philosophy has been installed for you:

Since you were very young you have been programmed by all of these different groups to think as they want you to think. You aren't responsible for the bad programming you received as a kid. You are however, 100% responsible for changing it as an adult. Don't let these people and organisation control your mindset around money, your beliefs and in the end your outcomes. Take time to uncover your own financial philosophy and then develop one that better serves you Uncovering your current financial philosophyHow do you uncover your current financial philosophy? It is fairly straight forward but will take time and energy to understand. Here are the tools Katie and I recommend using to uncover this. Journaling Journaling is just a fancy way of saying writing out your thoughts and feelings on a subject. I have found this to be profoundly powerful in examining my beliefs, ideas and identity. It allows you to put your thought on paper and in essence freeze your thoughts at that point in time and allow you to come back and examine them. The first step to working all this out is to put it down on paper and the review it. Here are some journaling prompts that you can use to start the process. If you are a geek like me you will copy these questions and prompts into a blank notebook (I am the biggest fan of OneNote!) and then start to write. I would sit down for a few minutes a day and start journaling out your thoughts and feelings. Getting it all out of your head. Then each day coming back and adding more as it comes to you. Journal prompts for money

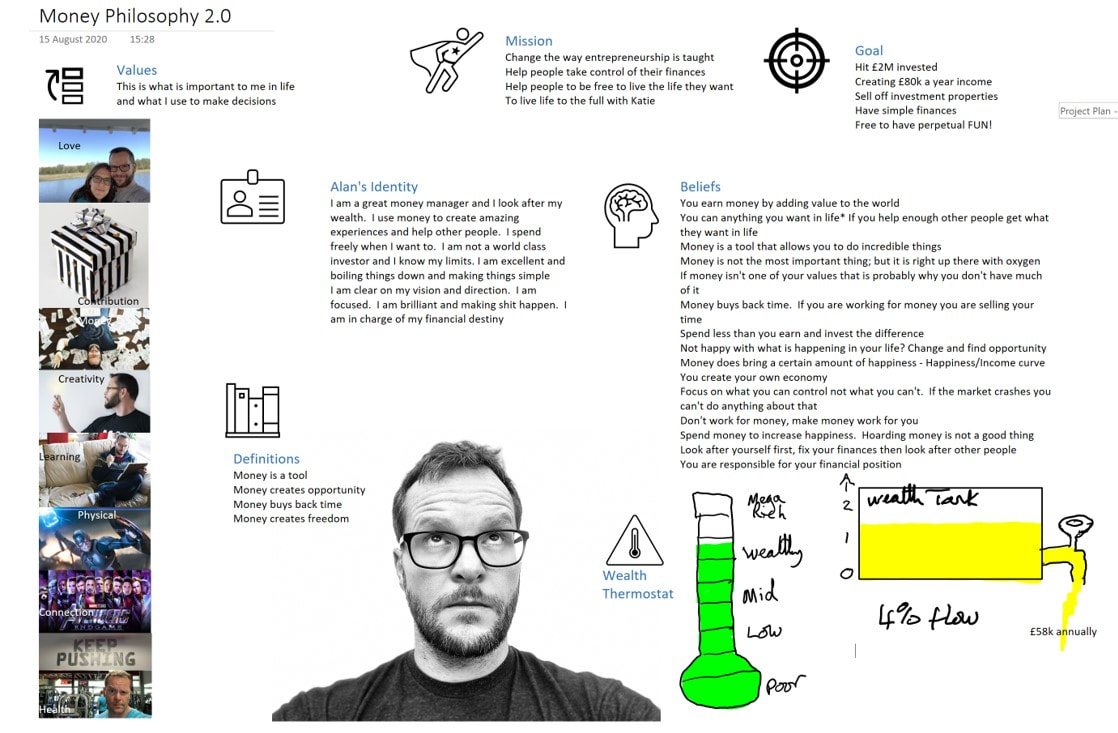

Once you have started to get your ideas out of your head and down on paper or into a computer you can then start to come back and review them. I went spend a little bit of time summarising the key points from the exercise. What have I learnt doing this? What were the key stories that came out as a journaled? Just the act of journaling and reviewing your notes will change your thoughts. Can you change a financial philosophy?Yes. I have done it and so can you. Creating your own financial philosophyThen comes the interesting step of taking what you have learnt from the journaling process and working out what you want to keep and what new beliefs you want to introduce. This for me is the most exciting part of the process. I get to decide what I believe, what I think and who I am. A saying I repeat all the time on the Rebel Entrepreneur Podcast is: The Extraordinary belongs to those that create it What excites me is the idea that I can create. I get to create my life. I get to create my mindset. I get to decide on my beliefs and ideas. I get to build my world. You get to decide too. The question then becomes what mindset do you want to have around money? What do you want to believe and think? Over the past two decades since I learnt about self-development my mindset and money philosophy has been shifting dramatically. I have tried out new beliefs, acted as if they are true for a few weeks and then decided if they are beneficial for me or not. The interesting thing has been that as I have shifted my mindset my actions have shifted and over time my financial results have shifted. The purpose of writing this article is to inspire you to actively look at your current financial philosophy and create your own new one that will help you create the extraordinary life you have always dreamed of (no matter what that means to you! The next strep from here is to write out your new financial philosophy. What do you want to believe? What do you want to value? Who do you want to be in this part of your life? Write it out. Have fun. Add pictures and draw things. Then start to act as if it were true and see how it feels. If you write under identity that you are a great money manager then ask your self the question each day "how would a great money manager act in this situation?" Then take the actions you come up with. After a while of doing this you will just naturally start to think like a great money manager and it will have become part of your identity. Now writing this out sounds easy and in essence it is but it is not something that happens overnight and you will have relapses as you move forward. This is the start of a journey that you can work on monthly over the coming years. This will help you to make incredible change over time. It is the same journey you can take your kids on. Instead of randomly handing them the beliefs that your parents handed to you about money you can break the cycle and help them develop a healthy and positive financial philosophy from early on in life. If you don't want to do this for your self then do it to support the people around you and help the next generation to avoid the financial problems we have been plagued with. It truly is a journey that is worth going on; it leads to increased freedom, happiness and less stress. Alan's financial philosophyAs part of the Rebel Finance School Course that Katie and I have been running I have been inspired to put some more structure around my financial philosophy. So I have been having some fun journaling about it and then taking those thoughts and putting it own on paper. I have taken the philosophy in my head and put it on paper or in true Donegan style in Microsoft OneNote! You can see on the left I have my values. These are the set of things that I hold valuable in life and help me to make those micro-decisions throughout the day. I have some of my financial identity, my definitions of the word money, my mission in life that is driving me and the core beliefs that effect everything. At the bottom I have set out me wealth thermometer and you can see it is set to wealthy; not meg-rich! I am quite happy being wealthy and am not willing to pay the price to be mega-rich! I want to inspire you to have fun with this. Take pictures, get some post it notes and get creative. The more colourful and fun you make it the easier it will stick. Not a one and done; baby!My biggest fear with this stuff is that you go ahead and do this and then you create something, stick it in a draw and don't look at it again till you are moving house! This is not a one and done activity. This is something you should work to create and then at the start of your journey review briefly each month. Take 30 minutes to read through it, ask if you still believe this? Ask if you are living by your values? Ask if it needs updating to reflect how you are changing. After a while it just becomes who you are and how you think. When this happens it is just something I review once a year as part of my annual reflection. Have fun. Create a financial Philosophy. Start to live by what you create. Notice how it impacts your results in life. Thanks for reading and being part of my blogI write for two main reasons. The first is that act of writing enables me to freeze my thoughts, analyse what I think and develop better beliefs, ideas and attitudes. The second is that I want to have a positive impact on people, to help them, to support them and give them the information that has made such HUGE impact on my life.

I know that the two most sustainable ways to happiness for me are growth and contribution. This blog helps me to do both. I learn and grow as I write and I contribute to you. The one thing I ask in return is that you take what you read and try it. Have a go. Take action and see what works for you. I am not asking you to believe me, I am asking you to take the ideas and go out and test them in real life. Then let me know how it goes! Thanks for reading the blog and being part of the gang! If you want to get updated when Katie and I put on courses or do new things then you can join the mailing list below |

DONEGAN |

We built this website to share our stories, the adventures, the amazing people and all the life lessons we've learned along the way!

SIGN UP to our mailing list

|

RSS Feed

RSS Feed