|

Back to Blog

This photo was taken on the exact spot where, in Spring 2018, and over the course of about 200-300ft or so of run, my life totally changed. The “a-ha” moment came while stumbling across Alan Donegan for the first time on a podcast.

Nine months later, I quit a 100k / year job, never to return. Nowhere near financial independence

I wasn’t at my “FI number” – far from it.

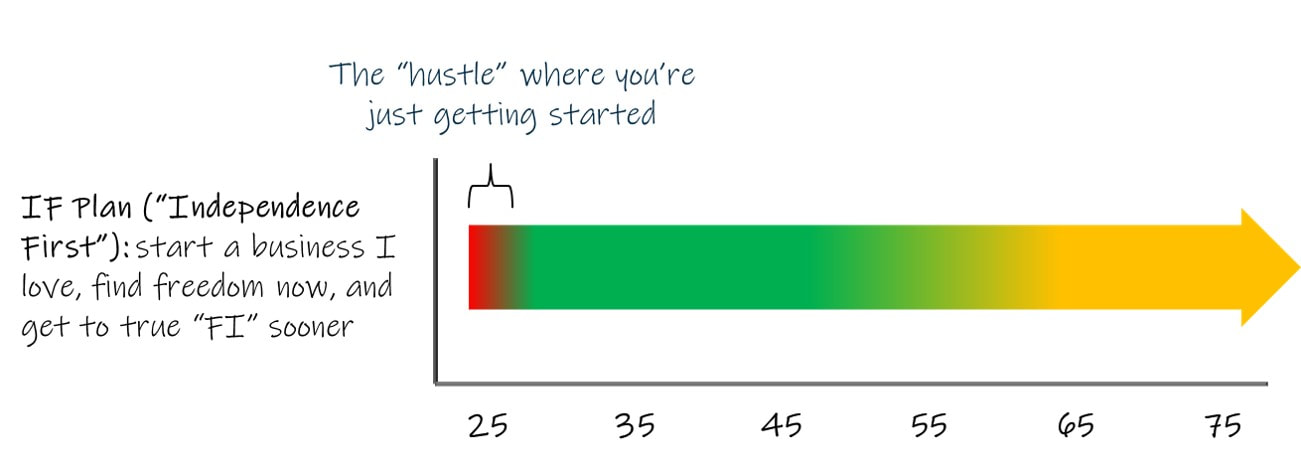

But I’d stumbled across a shortcut that seemed to be promising many of the benefits of full FI – but unlocks them much, much sooner. That shortcut was the magic of entrepreneurship: which at a stroke, can give you considerable (if not total) independence in the short term, let you enjoy your path to FI more, and even get you there sooner. I’m now 14 months into my post-job life as an entrepreneur, and so far, it’s looking like one of my all-time top 3 best life decisions ever. Let me show you how the path worked out for me, and what to do if you want to pursue a similar option. Go to school, get a job, retire when you are old: the Default Option

At the time I went for the aforementioned run, I was working for Sky in London. I enjoyed the work, had some great colleagues, and the work / life balance was reasonable – I was, in short, about as happy as most people in the corporate world could expect to be.

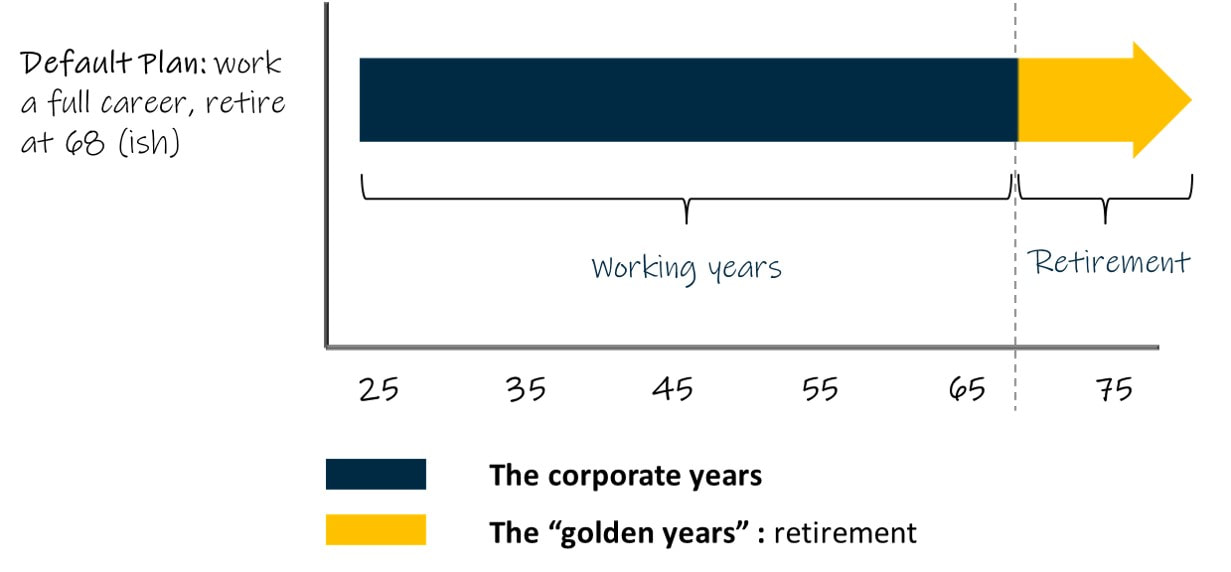

I was following society’s default plan for me, on track to retire sometime in my late sixties:

Nothing wrong with all of that – I certainly wasn’t unhappy. But as is so often the case, I wanted more, in particular, more time to be with the family my wife and I were thinking of starting.

I had seen the lives of those a little higher up the corporate ladder than me. They seemed to perform incredible daily feats balancing a demanding career and making time for their families, often leaving the office by 5.30pm to spend some of the evening with their children, only to then get the laptop out again at 9.00pm for another 2-3 hours work. Huge credit to them. It looked like incredibly hard work to me. Could the principles of FI help?

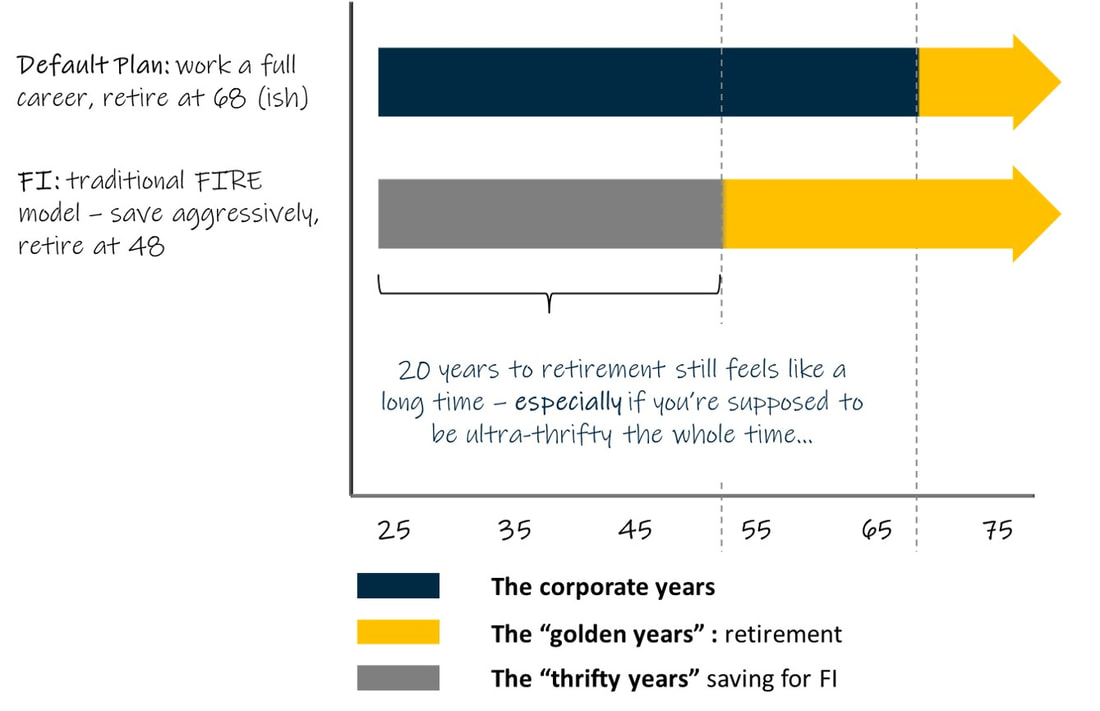

I had recently discovered the FI movement: the powerful and seductive idea that if you make the right lifestyle choices, you can free up decades of your life from having to work for someone else, and retire in your forties or even thirties (although most FI people never truly retire – they find something else exciting to do with their time).

It was an idea that burned through me as soon as I read about it, putting a torch to a whole pile of preconceived ideas about what life should be. I quickly began to wonder: “how can I get myself to the promised land too?” So I sat down with a spreadsheet to figure out when I could retire. My wife and I had a modest though not ultra-thrifty lifestyle, so I was able to reasonably anticipate stashing away about 50% of our earnings. I plugged in the numbers and leaned in to see the answer… Twenty years. Twenty years. Twenty years!!!! Now I don’t know about you, but that’s a long time. And to make matters worse, I had “Mr Money Mustache’s” popular brand of FI ringing in my ears, saying that for all 20 of those years, I had to be insanely careful about how I spent my money. No more morning coffees from the campus café. No more Sunday country pub lunches before a walk with friends or family. No more adventures exploring the cities and mountains of Europe from modest Air BnBs with my wife. It’s not particularly cool to admit as such in many FI circles, but you know what? I like doing those things from time to time. Not living extravagantly or impulsively, just spending from time-to-time in an experience that makes life feel joyful in anticipation, rich with savour in the present, and full of warm memory in the rear-view mirror.

It was looking like a long twenty years.

I began to save anyway, but felt disheartened "What if": Getting to independence first

And it was about this time I went for a run, and came across Alan on the Mad Fientist podcast:

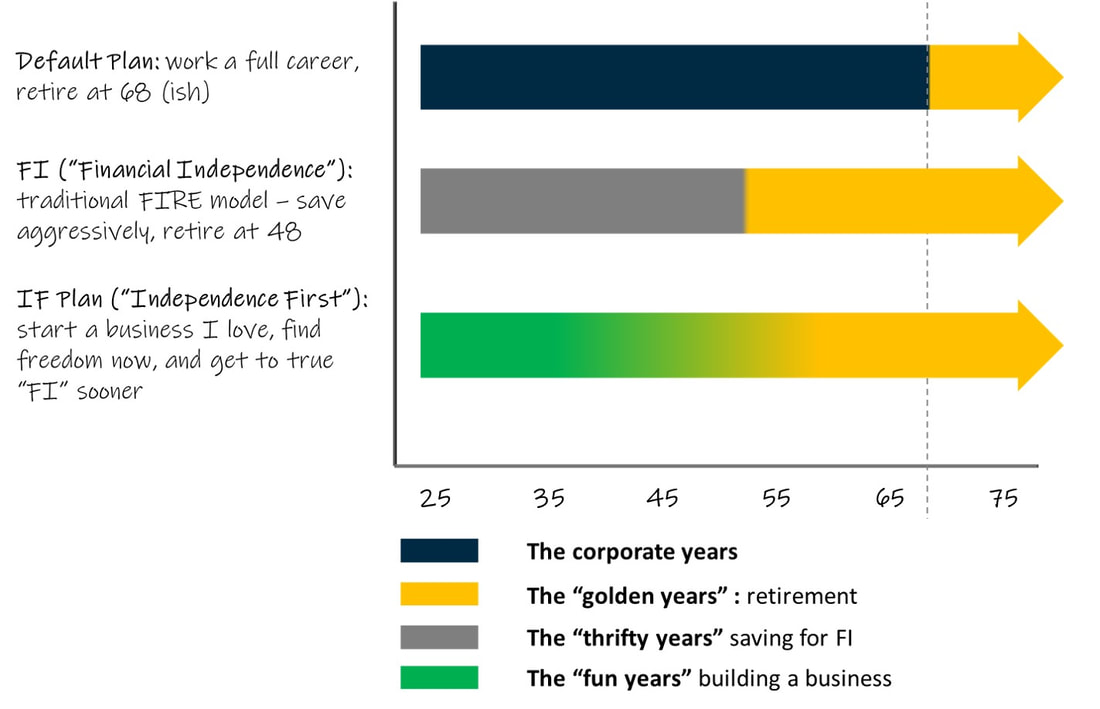

“There’s only so far you can reduce your spending. But there is no ceiling to the amount of money you could earn extra. And I think the thing that’s really exciting for me is that you can earn extra money doing what you love and enjoy the journey. And it gets you to financial independence sooner.” If discovering the FI movement set something smouldering, the idea that I could start my business now was a veritable firestorm of inspiration. Suddenly – and this isn’t really an exaggeration – in the time it takes to jog a few hundred metres, I’d figured out a whole new life plan. And this time, it was one that made total sense to me. I had always intended to start a business when I got to retirement (however early that was), because I loved building businesses, and because I had an itch to scratch (using cognitive psychology to help students to study more effectively for their exams). But why was I planning to wait to retirement to do it? Why not get it started now? Let’s call the new plan “IF”: Independence First. Why do I want to retire if I am having fun - Alan again

Starting a business now rather than waiting until you retire does three things for you, all at once:

The joy of a fulfilling career, which affords sufficient day-to-day time freedoms, is that the business-building years blend seamlessly into the retirement years. Making the switch from Job to Entrepreneur

If all this has intrigued you, you might be wondering how to make it work for you.

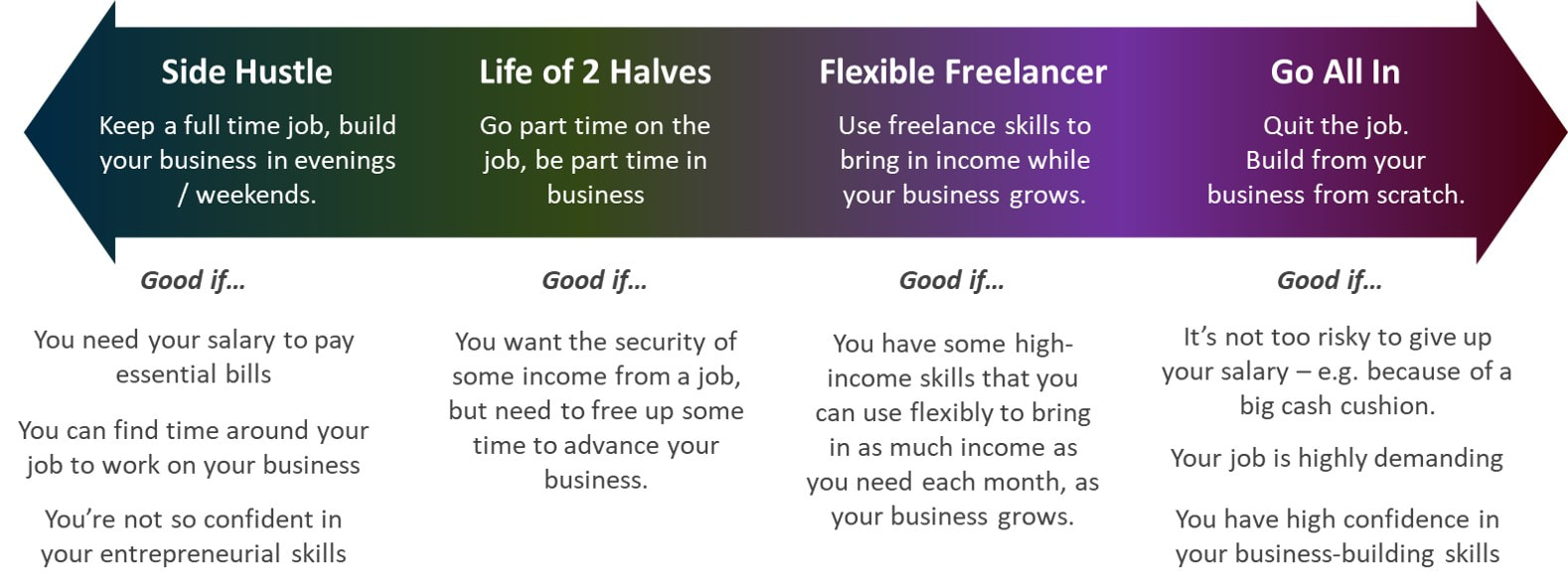

As a first step, I’d suggest taking the time to really figure out what’s going to bring you day-to-day enjoyment and a long-term sense of purpose. The blog Wait But Why has a phenomenal long read (exceptionally insightful, but also a little not safe for work (NSFW) in its language choices in places) which helps you unpack your drivers in life, and understand what you want from your working life, be it through a career or entrepreneurship. With these foundations laid, the Rebel Business School has a great step-by-step guide to starting a business – Step 2 is all about finding an idea, or picking one if you’ve got lots! After that, with your plan for what you want to do in hand, you can think about how to make the transition (assuming you’re currently in a job – if not, dive straight into the business and get going!). There’s a spectrum of options:

At one extreme, there’s the “Side Hustle” route, where you stay in a full-time job, and build up your business in evenings and on weekends. That’s the route I hear advisors most often recommend to new entrepreneurs, because it allows you to grow your skills in business and your income in a totally risk-free way – your job covers your living costs.

But you could also choose to “Go All-In” on your new venture and quit your job immediately – risky, but less so if you have a sizeable cash cushion to live off while your business gets going. Personally, I think the best options are probably somewhere between the two – either going part-time on your job (some financial security) and using the other part of the week to work on your business, or using freelance skills (for me, tutoring science / psychology) to bring in as much money each month as you need while your business matures. Getting started in business: making life easier for yourself

Business often isn’t all plain sailing from Day 1 – the first few months (sometimes the first few years) are filled with doubts, uncertainties, and a lot of hard work with relatively little to show for it.

For me, I had about 10-11 months “in the wilderness”, slogging away and feeling like the world was barely paying any attention to my vast efforts. Then a whole set of things suddenly clicked into place, all at once – I can pretty much pin it down to the week – and the business started to take off.

All entrepreneurs go through a tougher “hustle” phase to a greater or lesser extent, before your business starts to build real momentum.

I’ll leave you with some quick tips for making your “hustle” phase as short and as painless as possible. The first four are straight out of Alan’s “Rebel Business School” playbook (again see their guide for more), and they’ve served me very well. The fifth is mine.

Good luck & have fun!

Whether you take IF (“Independence First”), traditional FI or some other route through life, I wish you well on your journey!

Alan's thoughts & blog update

I am so inspired by William's article and energy and excited to see where his journey takes him.

William also spotted me in the newspaper doing a Rebel photo in a bush and decided to replicate it! See if you can spot the difference in the photos below!

A couple of thoughts about William's post and then some blog announcements for you:

Next on the Alan Donegan Blog

It is not October 2020 as I publish this article and Katie and I are planning a lot for the blog. Coming up we are going to be announcing two new mini-courses on choosing index funds for investing and a second on modelling your financial future in a spreadsheet. Geeky subjects I know!

We are also planning the next dates where we are going to run the Rebel Finance School. We had a huge amount of fun running the first course in August and September and are working on the post course report at the moment. Visit the page and stick your email address in if you want to find out more about the next time we run the course. The Rebel Entrepreneur podcast Season 1 is drawing to a close and we had one of the most spectacular episodes this past week with Keith Hunt who started a restaurant without debt. You can check that out here: Thanks for reading

Katie and I write and create this blog for you. It is nothing without you. So please let us know which articles you love, what has been useful and leave comments blow. If you want to stay up to date then sign up for updates here:

|

DONEGAN |

We built this website to share our stories, the adventures, the amazing people and all the life lessons we've learned along the way!

SIGN UP to our mailing list

|

RSS Feed

RSS Feed