|

Back to Blog

The Self-Employed Pension Crisis14/9/2023

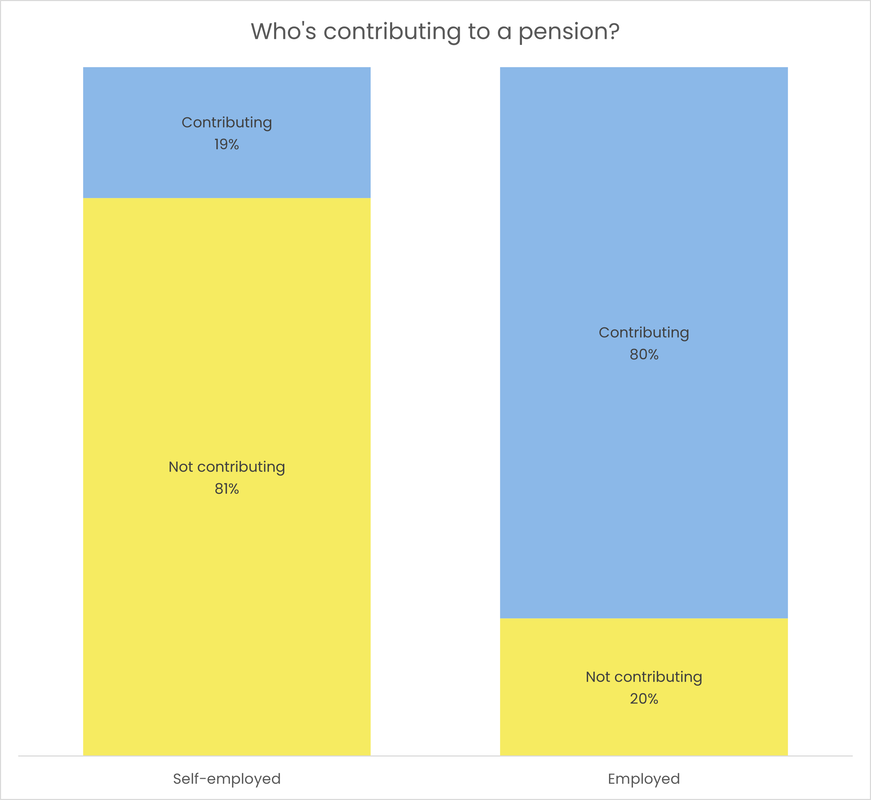

Well, this is a crisis that you won't feel for years until you come to retirement age and find out you don't have enough to live. According to government stats, 81% of self-employed people in the UK are not contributing to a pension. To put this in context, only 20% of employed people are not contributing to a pension. 81% of self-employed people are sleep walking towards a retirement in poverty. What most self-employed people doImagine the scenario. You have just become self-employed. You are so excited building your business, bringing in those first few sales, making money. You work every day to expand the business and make sales. At this stage it is just you so you do the accounts, run marketing campaigns, make sales, deliver products and services and do the customer support. Do you think most people in their first year or two in business have space to think about setting up their own pension? Or are they just trying to bring in the sales and keep their head above water? Your business grows, you start thinking about staff and expanding. You are so excited. You have created a gap between your spending and your sales and you have money to expand. Then you find you have to set up a pension scheme if you hire a few people. A pension scheme? Are the government crazy? You haven't even got a pension you are just trying to build a business. You can sort that out later. And on and on the story goes. Where is your pension, your SIPP (self-invested personal pension) on your list? Is it above making sales this month? Is it above customer service and unhappy customers? Is it above doing the actual work to be able to afford food? SIPP and pension isn't even on the list for most self-employed people. This is clearly shown by the data that shows 81% of them don't have any form of pension. Play this out. You work hard as self-employed, you make money, you look after your family and you work and work and work. You are heading towards retirement age and you start to think it would be nice to stop, look after the grandkids, travel a little. But how are you going to fund this? The state pension is barely enough for the basics. The current state pension is £203 a week. Below an income of £236 a week you are considered to be in poverty. If you're relying solely on the state pension you are going to be in a pickle and not the nice gherkin kind. If you don't save for your pension you will be in poverty by the time you reach retirement. I used the C word at the beginning of the article. Crisis. It gets over used at times but for me this is a Crisis with a massive capital C. A slow moving march towards retirement poverty for the self-employed of the UK. The hard workers, the entrepreneurs, the business people that make up so much of our economy. If nothing is done now millions of self-employed people will be left in poverty in retirement after a hard and long career. What can you do about it?The answer is quite simple and I've set it out below. As you read the points you might be thinking "this is not simple at all Donegans! What are you going on about?!" If you've never looked at your finances this might seem overwhelming. Read on to the end of the article for some resources we've built for you to get you going.

The solution to the crisis is simple. Why don't we do it. We don't make enough in our businesses. We want to spend the money now. We think personal finance is too complex. Pensions seem scary and confusing. There are a million excuses as to why we aren't saving for our retirement. If you don't want to end up in poverty in retirement then you need to look after yourself. There is no knight in shining white armour coming to save you. The government aren't going to bail you out, they are already looking at ways of getting out of the costs of the state pension. You have to do it yourself. You might be asking "how?". Good question. We want to help you! The Rebel School (the business I launched 11 years ago with my business partner Simon) has helped tens of thousands of people to go self-employed, follow their dreams of building a business and making their own money. Now we want to make sure these same people don't end up in poverty in retirement. Actionable steps

2. Learn about investing and SIPPs by watching weeks 6, 7 and 8 of the Rebel Finance School. Then open a SIPP and follow the instruction above

3. If you already have a SIPP, learn to understand it. Watch the "How to read your pension statement" workshop we created for you. There are so many tools available to you.

All you need to do is take the time to understand them and use them to create a bright financial future for yourself. Please help us avert the self-employed pension crisis. Please share this article with every single self-employed person and small business owner you know. Don't do it for us, do it for them. Help them to have a bright financial future. 81% of self-employed people don't have a pension. These people are heading towards poverty in retirement. We need to do something about this. Please share as widely as possible. Let's end the crisis before it becomes a HUGE problem. |

DONEGAN |

We built this website to share our stories, the adventures, the amazing people and all the life lessons we've learned along the way!

SIGN UP to our mailing list

|

RSS Feed

RSS Feed