Week 3: Money Beliefs

|

Here is this week's YouTube Live covering Money Beliefs. Enjoy the course this week and you can find all the notes and resources below.

This week is all about the way we think about money, finances and resources. It is our thinking that creates our behaviours, actions and results. If we can change our thinking around money we can change our financial destiny. Enjoy the course and let us know what you think! We love hearing from you. |

|

The main thing we want you to get out of week 3 is the importance of uncovering what you believe about money, finances and wealth. You then need to examine these beliefs. Are they true? How might the opposite be true? Is believing this giving you the results you want in your life? What might be a more empowering belief be about yourself or money?

Our relationship with money is a critical element of our finances. Having a healthy relationship with money leads to good financial practices and better financial results. Start by reading: Your relationship to money

Our relationship with money is a critical element of our finances. Having a healthy relationship with money leads to good financial practices and better financial results. Start by reading: Your relationship to money

It's not just about the numbers

Katie here.... you know me, I LOVE spreadsheets and numbers and the geeky tactics for how to get to financial independence. But these won't get you anywhere if you have disempowering beliefs around money.

For example, if you believe you don't deserve to be wealthy (this was one of mine), you never will be because you won't try or if you do accumulate some wealth you will subconsciously do what you can to get rid of it! Looking at your beliefs and identity around money and wealth is SO important. It was the main obstacle I had to overcome to get to financial independence. We would have got there quicker if I'd dealt with this earlier.

For example, if you believe you don't deserve to be wealthy (this was one of mine), you never will be because you won't try or if you do accumulate some wealth you will subconsciously do what you can to get rid of it! Looking at your beliefs and identity around money and wealth is SO important. It was the main obstacle I had to overcome to get to financial independence. We would have got there quicker if I'd dealt with this earlier.

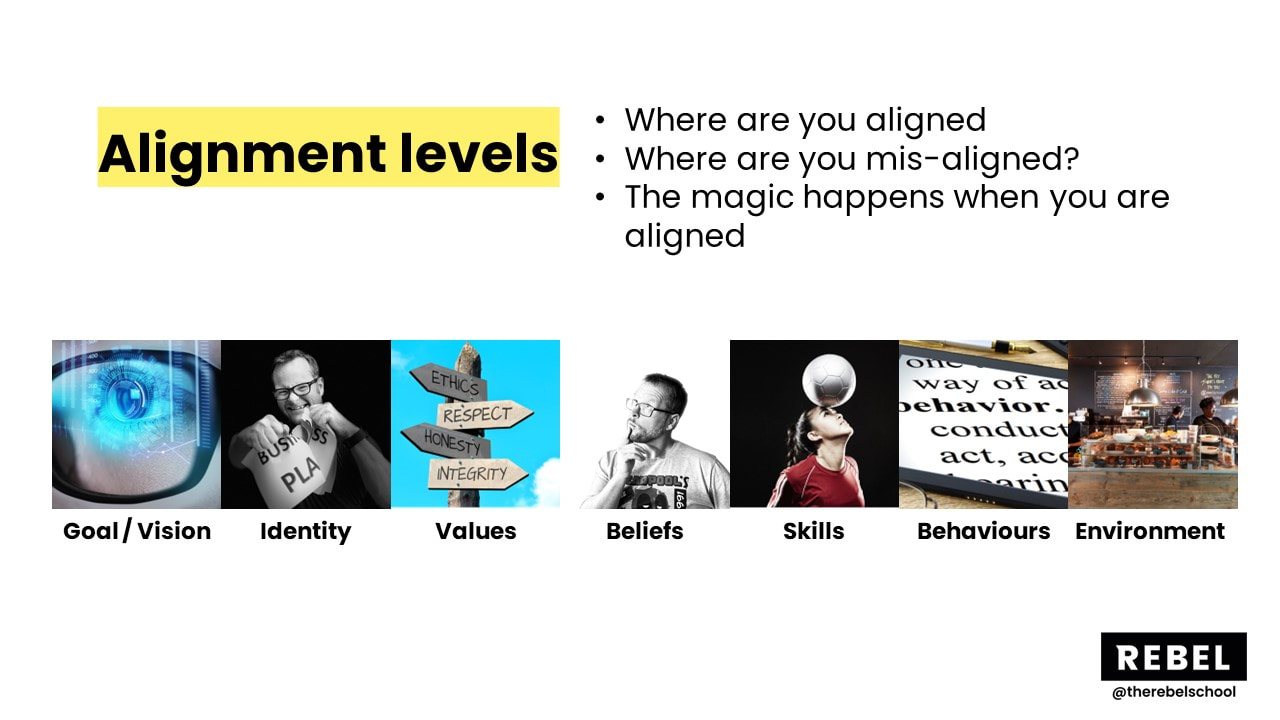

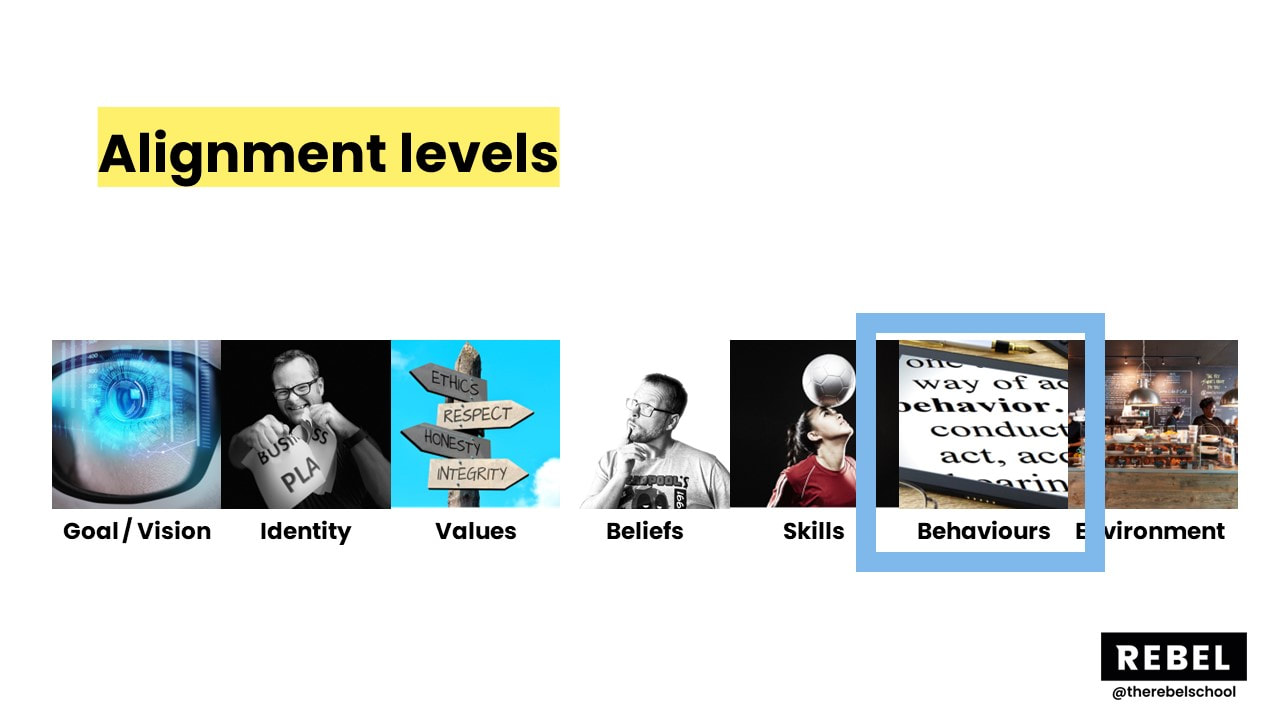

Alignment levels

|

Alignment levels are our way of exploring what makes us tick. It shows us where there is potential conflict between your goals and other areas. The purpose of this model is to allow you to think about where you are stuck and get unstuck. The levels are:

|

Mis-alignment / incongruence

Mis-alignment or incongruence is where some of these different levels don't match and cause internal conflict. The simple way to look at this is to see someone's goal and then see if they believe it is possible for them. This is classic mis-alignment. The person wants to sort out their finances but doesn't believe it is possible for them, they want to build a business but don't believe they have a chance.

This kind of misalignment causes huge pain because you want the goal but self-sabotage, procrastinate because you don't believe it is possible. We either need to shift the belief or the goal.

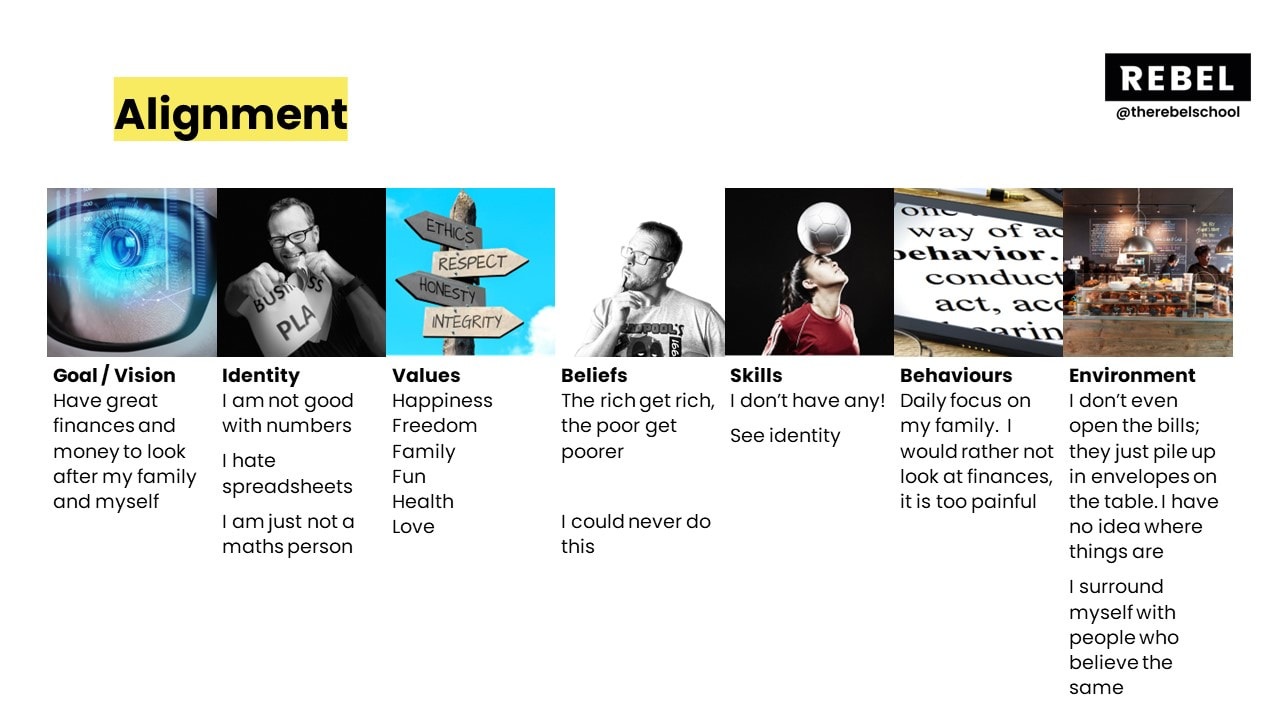

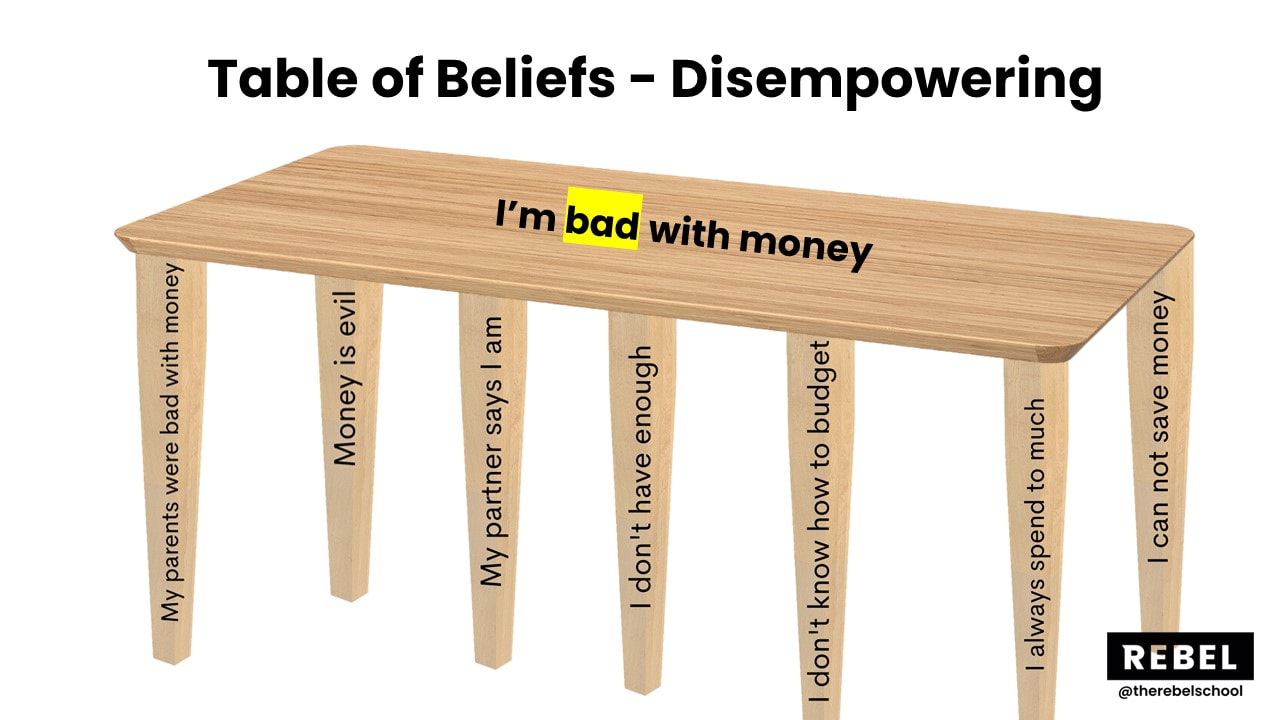

This week we started with an example of mis-alignment in the personal finance world. Imagine you knew the person described in the image below. What do you think their chances are of sorting out their finances?

This kind of misalignment causes huge pain because you want the goal but self-sabotage, procrastinate because you don't believe it is possible. We either need to shift the belief or the goal.

This week we started with an example of mis-alignment in the personal finance world. Imagine you knew the person described in the image below. What do you think their chances are of sorting out their finances?

If you have a goal of having great finances but believe you aren't good with numbers we have some challenges coming up! If you believe that the rich get rich and the poor get poorer, you don't believe you have the skills to do it and you would rather not look at your finances because it is too painful you are screwed.

We actually need to find alignment between your goals, identity, values etc. for you to be able to make progress. Let's look at each of these areas individually

We actually need to find alignment between your goals, identity, values etc. for you to be able to make progress. Let's look at each of these areas individually

Identity - who are you?

Your identity is a set of beliefs you hold about yourself. Those beliefs normally start with "I am.........". It is the story you tell yourself and others about who you are.

Try asking yourself the question "Who am I?" and see what comes out.

I (Alan) say things like "I am a geek, I am strong, I can learn anything, I am a Marvel fan". I used to have a lot of negative identities when I was younger thinking things like "I am shy, I am fat, I have no chance to be succesful" and more. These really stopped me from making progress.

Identity is what you believe about yourself. Beliefs are about other things/people/concepts.

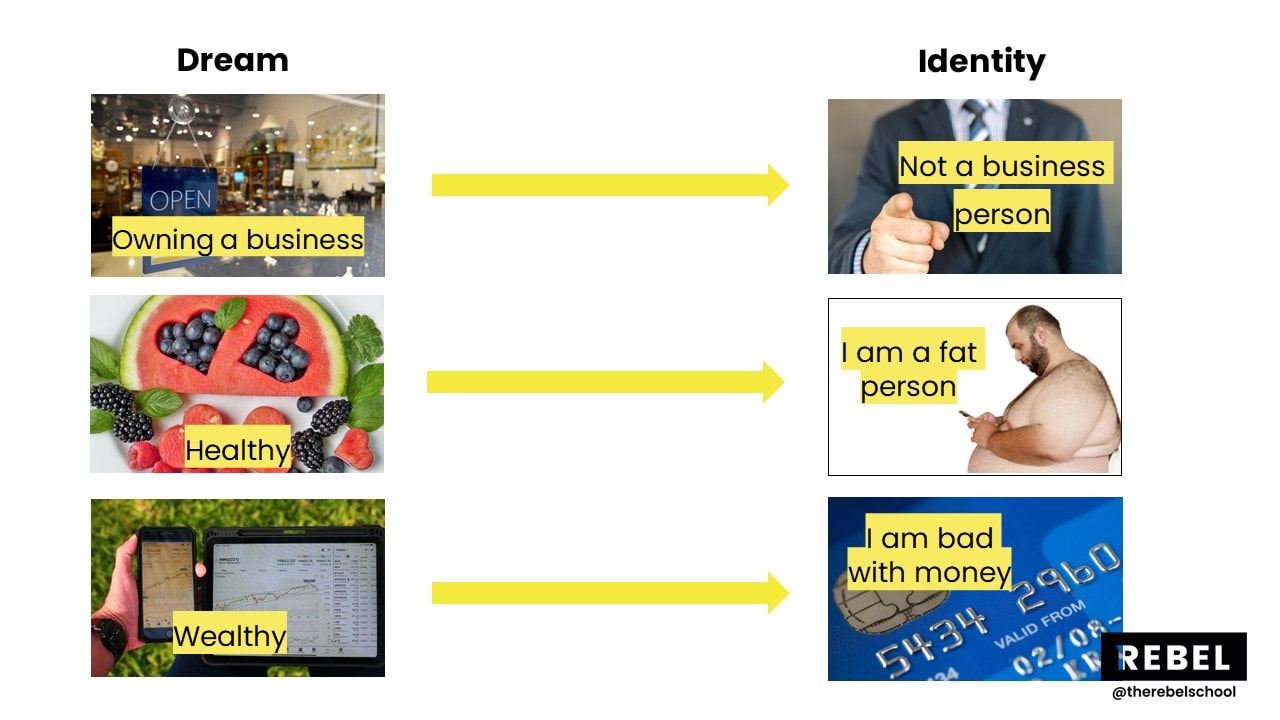

Is your identity in alignment with your dream? On the course we gave three examples of when identity conflicts with a dream but there are so many more:

If you have conflicting identity and goals, then it makes doing the activities to fulfil your goals really difficult. You are going to find it difficult to manage your money if you believe you are bad with it and not matter how hard you try to change your behaviour you are going to fall back to your identity. This is what keeps us stuck and stops us from making progress on our goals.

People believe identity is fixed; they think it is set in stone. People say things like "I am bad at money, I am bad at maths, I am bad with technology" and this then gives them the excuse to not try as that is "just who they are".

Your identity is not fixed. You can change it, you can develop it, you can craft it. The Alan Donegan you see in the videos is VERY different to the one that got bullied at school, struggled through his youth to find his place in the world and fought to even get a job. I developed this new version of myself over years.

You can choose your identity. You can choose who you are and how you want to show up in the world. Why not make up a version you actually like and start to develop it.

Try asking yourself the question "Who am I?" and see what comes out.

I (Alan) say things like "I am a geek, I am strong, I can learn anything, I am a Marvel fan". I used to have a lot of negative identities when I was younger thinking things like "I am shy, I am fat, I have no chance to be succesful" and more. These really stopped me from making progress.

Identity is what you believe about yourself. Beliefs are about other things/people/concepts.

Is your identity in alignment with your dream? On the course we gave three examples of when identity conflicts with a dream but there are so many more:

- I want to run a business, but I am the furthest thing possible from a businessperson.

- I want to be healthy, but I am a fat person.

- I want to financially independent, but I am bad with money

If you have conflicting identity and goals, then it makes doing the activities to fulfil your goals really difficult. You are going to find it difficult to manage your money if you believe you are bad with it and not matter how hard you try to change your behaviour you are going to fall back to your identity. This is what keeps us stuck and stops us from making progress on our goals.

People believe identity is fixed; they think it is set in stone. People say things like "I am bad at money, I am bad at maths, I am bad with technology" and this then gives them the excuse to not try as that is "just who they are".

Your identity is not fixed. You can change it, you can develop it, you can craft it. The Alan Donegan you see in the videos is VERY different to the one that got bullied at school, struggled through his youth to find his place in the world and fought to even get a job. I developed this new version of myself over years.

You can choose your identity. You can choose who you are and how you want to show up in the world. Why not make up a version you actually like and start to develop it.

How; you might ask? We will come onto this in the beliefs section but there are simple steps. For example, you choose the identity "I am a healthy person".

The first action is to decide what this means to you. Does a healthy person exercise every day, choose vegetables over cake 80% of the time, take vitamins in the morning? Choose and then start to do those things that show yourself you are a healthy person and create your new identity. After a while of doing it you have the proof you need to start believing it! More to come on this in the beliefs section

If you want to believe that you are "good with money" start voting for that identity with actions. Start categorising your spending, working out where the money goes and come on Rebel Finance School every week. if you do that you might actually start to believe you are good with money shifting your identity.

The first action is to decide what this means to you. Does a healthy person exercise every day, choose vegetables over cake 80% of the time, take vitamins in the morning? Choose and then start to do those things that show yourself you are a healthy person and create your new identity. After a while of doing it you have the proof you need to start believing it! More to come on this in the beliefs section

If you want to believe that you are "good with money" start voting for that identity with actions. Start categorising your spending, working out where the money goes and come on Rebel Finance School every week. if you do that you might actually start to believe you are good with money shifting your identity.

Values

Values are an internal list of what is most important to us. For example, some people think that family is the most important thing, some think health is the most important thing and some think freedom is more important than anything. What your values are directly impacts how you behave and act in day-to-day life.

If you think family is more important than your health, you will look after other people at the expense of your own health. If you think money is more important than family you will choose to stay at work more often than not rather than going home to be with your kids. Your values direct your behaviour on a daily basis.

When reading the barriers to creating an extraordinary life in the pre-course survey we read this answer: "I want to be healthier, but convenience food is so convenient"

We agree whole heartedly but the Donegan's don't give into convenience food as we value health over convenience every day. We are optimising for health not speed and ease.

What are you optimising for - convenience or health?

It doesn't really matter which one you choose; you will just get different results. Where the problems start are when are goal is health and we value convenience so at the behaviour level we eat fast food and wonder why we can't fix health. We beat ourselves up for not getting healthy but never change our choices in the moment because we value or place more importance on convenience than health

Whatever you are optimising for, own it, and be happy with it. We promise not to judge. Maybe convenience is the top value for you and that is ok, just expect your physical form or body to reflect your daily behaviours. Your behaviours are a reflection of your values.

If you think family is more important than your health, you will look after other people at the expense of your own health. If you think money is more important than family you will choose to stay at work more often than not rather than going home to be with your kids. Your values direct your behaviour on a daily basis.

When reading the barriers to creating an extraordinary life in the pre-course survey we read this answer: "I want to be healthier, but convenience food is so convenient"

We agree whole heartedly but the Donegan's don't give into convenience food as we value health over convenience every day. We are optimising for health not speed and ease.

What are you optimising for - convenience or health?

It doesn't really matter which one you choose; you will just get different results. Where the problems start are when are goal is health and we value convenience so at the behaviour level we eat fast food and wonder why we can't fix health. We beat ourselves up for not getting healthy but never change our choices in the moment because we value or place more importance on convenience than health

Whatever you are optimising for, own it, and be happy with it. We promise not to judge. Maybe convenience is the top value for you and that is ok, just expect your physical form or body to reflect your daily behaviours. Your behaviours are a reflection of your values.

I (Alan) had a HUGE shock on a course in my twenties. The trainer asked us to do an exercise to uncover our values. I spend an hour or so journaling, drawing up a list and ordering it. Afterwards the trainer came to me and asked where was money on my list?

I looked up and down the list and it was no where to be seen. He looked at me and said "Well if money isn't important to you then that is probably why you don't have any!"

It struck me like a tonne of bricks. If I don't value you money then it isn't going to stick around in my life!

We are not saying that it should be the top of your list. We value health, happiness and family above money but it is on our list. it is important to us as it allows us freedom, time together, travel and adventures. It allows us to put on this course and run it for free for you.

Where is money on your list?

I looked up and down the list and it was no where to be seen. He looked at me and said "Well if money isn't important to you then that is probably why you don't have any!"

It struck me like a tonne of bricks. If I don't value you money then it isn't going to stick around in my life!

We are not saying that it should be the top of your list. We value health, happiness and family above money but it is on our list. it is important to us as it allows us freedom, time together, travel and adventures. It allows us to put on this course and run it for free for you.

Where is money on your list?

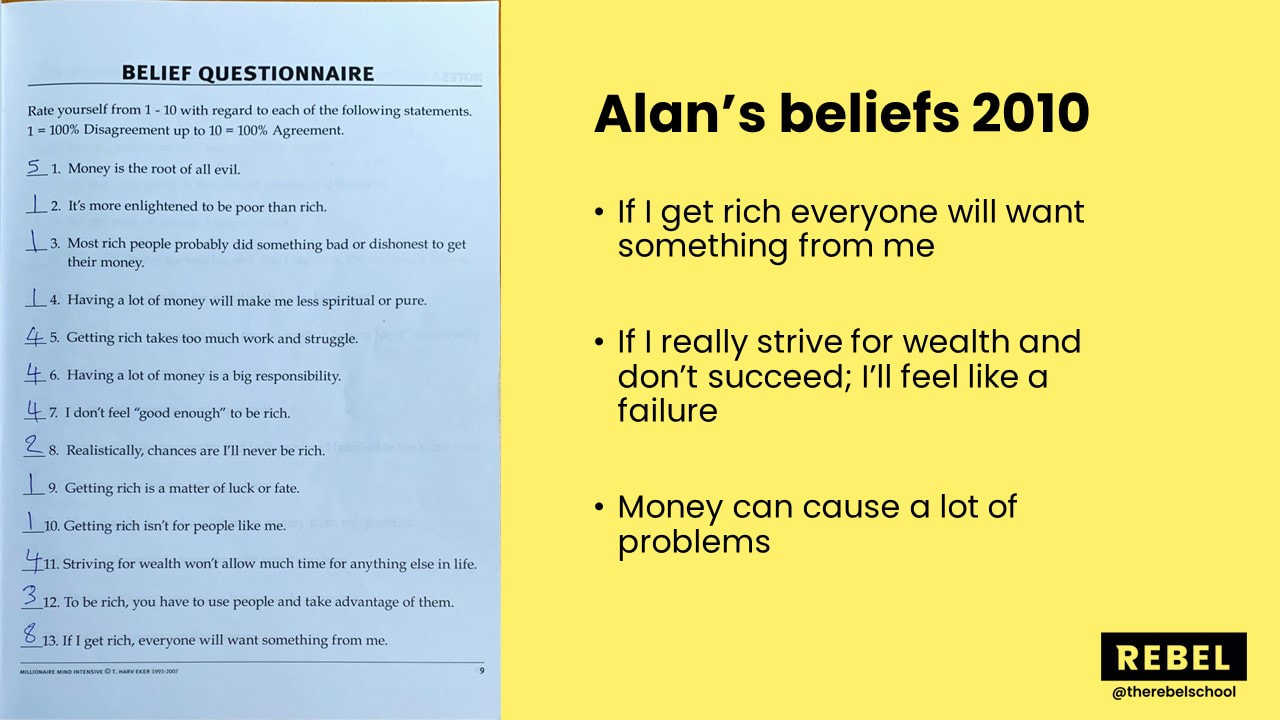

Beliefs

A belief is an idea or thought that we hold as if it was "true" or a "fact of life". One of the best examples of this came in the Q&A this week where we had a wonderfully brave course participant come forward and share his belief that "no-one had ever become successful without at least one supportive parent. "

This is a deeply held belief and this participant had gone through some tough times and lost his adopted parents at a young age. He now believed that this was the thing that was holding him back, and the worse part about it is we can't go back and change it!

A belief can be as simple as "I believe the sun will come up tomorrow" or as complex as "I believe the only way to get rich is to win the lottery or inherit money". They are the things we say to ourselves and hold as true.

Some of these beliefs are positive. "I (Alan) believe that you can learn anything given time." This belief helps me to make progress because I when I get stuck I work out what I need to learn to get past this problem and start to take action. Some people have the opposite beliefs and I have heard family members say "You can't teach an old dog new tricks!" They believe it is too late to learn new things and as such there is no point trying.

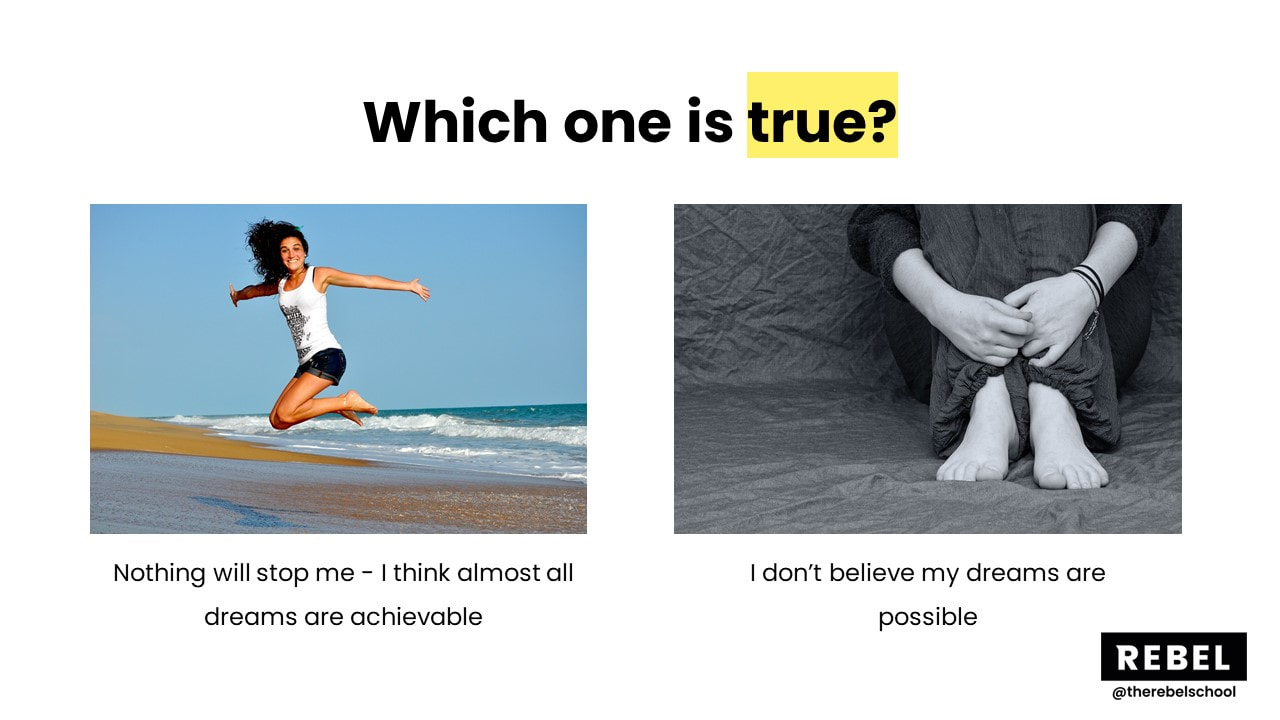

Which one of these believes is true?

Neither? Both? Actually I don't care at all. I care which one helps me to lead a positive and happy life. I choose the empowering belief not the disempowering belief.

Have you ever taken the time to examine your beliefs and then to choose which ones you want to hold onto? Most people don't think you can choose what they believe they just believe it because their parents told them so, or all their friends believe it, or because someone in a position of authority told them so.

You get to choose your beliefs so choose wisely as some beliefs will trap you and some will free you and help you to make progress and none of them are true anyway!

This is a deeply held belief and this participant had gone through some tough times and lost his adopted parents at a young age. He now believed that this was the thing that was holding him back, and the worse part about it is we can't go back and change it!

A belief can be as simple as "I believe the sun will come up tomorrow" or as complex as "I believe the only way to get rich is to win the lottery or inherit money". They are the things we say to ourselves and hold as true.

Some of these beliefs are positive. "I (Alan) believe that you can learn anything given time." This belief helps me to make progress because I when I get stuck I work out what I need to learn to get past this problem and start to take action. Some people have the opposite beliefs and I have heard family members say "You can't teach an old dog new tricks!" They believe it is too late to learn new things and as such there is no point trying.

Which one of these believes is true?

Neither? Both? Actually I don't care at all. I care which one helps me to lead a positive and happy life. I choose the empowering belief not the disempowering belief.

Have you ever taken the time to examine your beliefs and then to choose which ones you want to hold onto? Most people don't think you can choose what they believe they just believe it because their parents told them so, or all their friends believe it, or because someone in a position of authority told them so.

You get to choose your beliefs so choose wisely as some beliefs will trap you and some will free you and help you to make progress and none of them are true anyway!

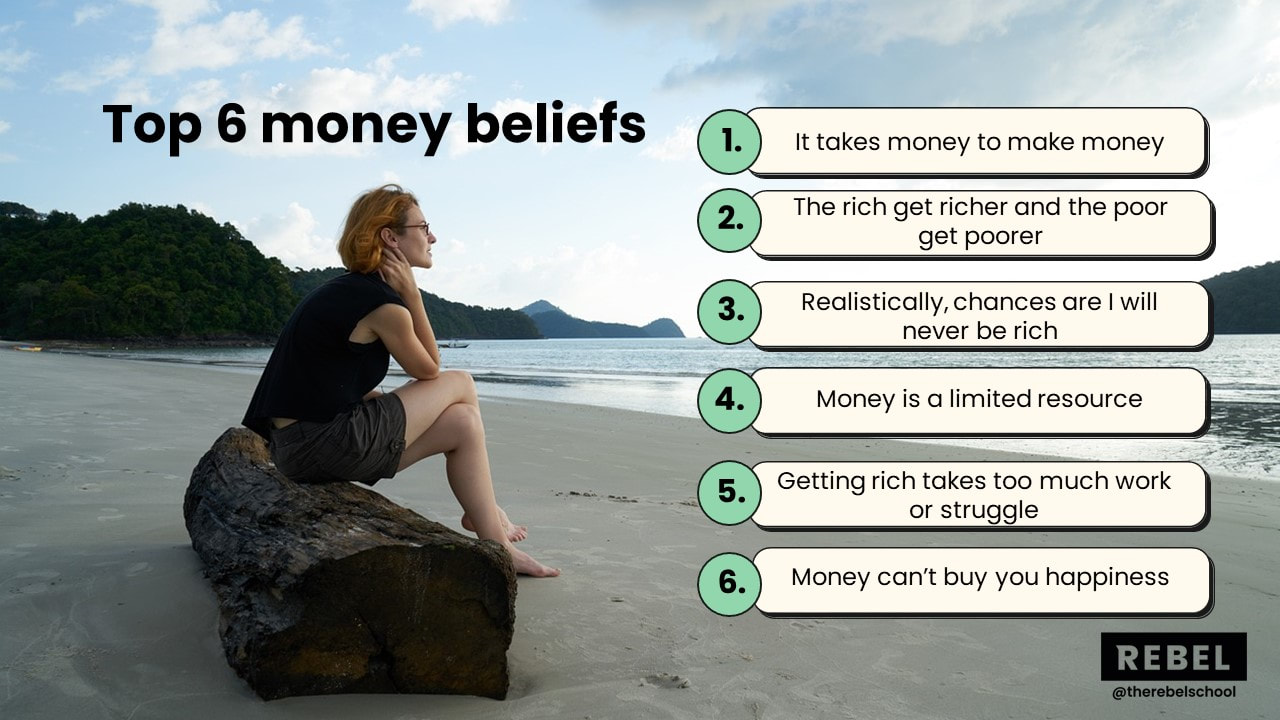

Top 6 money beliefs 2023

|

Before the course we asked you to do a belief survey. Over 1400 of you filled it in and these are the top 6 held beliefs within our group.

I want you to imagine for a second you help all 6 of these beliefs. How likely are you to succeed with money? How likely are you to get your finances in order and make progress? Your beliefs directly affect what is possible for you or not in life. |

- It takes money to make money

- The rich get rich, the poor get poorer

- Realistically, chance are I will never be wealthy

- Money is a limited resources

- Getting rich takes too much work or struggle

- Money can't buy you happiness

To these beliefs lead to a happy and healthy relationship to money? Or are they a barrier to your success? These are the kind of things our parents repeat to us, we hear on television and we say to our kids perpetuating the myths.

The fascinating this is that the sub-context to nearly all of these is "well it's not worth trying. For example, if it takes money to make money, and I don't have any money then it is impossible for me and I might as well not try. If chance are I will never be wealthy then why should I try? Let's accept life as it is rather than working to change it.

So many people come to Katie and I and argue for their beliefs. They argue that they are right, the rich get rich, the poor get poorer. We don't really care if they are right, we care what that belief does to our chances, our mojo, our motivation.

When people come to us and say these things are they looking for us to agree and give them permission to give up? People come to us and say "it's is too late for me to get on top of my finances!" Are they looking for us to agree and let them off the hook so they can stop trying?

If we challenge that belief they end up defending and fighting back against us. What we have realised is that you get to keep the limitations you fight for. If you want to persuade us it is too late for you then you are welcome to try, we don't believe it. We believe that no matter what age you are there are things we can do to improve your financial situation.

If we challenge that belief they end up defending and fighting back against us. What we have realised is that you get to keep the limitations you fight for. If you want to persuade us it is too late for you then you are welcome to try, we don't believe it. We believe that no matter what age you are there are things we can do to improve your financial situation.

You get to chose your beliefs! Why not chose empowering ones? Our mission for you based on this section is to uncover the beliefs you have about money and then work to change them to more positive beliefs.

Take some time to uncover your beliefs, look at them, discuss them with people you love and start to understand how they have effected your decision making over the years.

Below in the home work we have different ways for you to uncover your beliefs and start to examine them.

Take some time to uncover your beliefs, look at them, discuss them with people you love and start to understand how they have effected your decision making over the years.

Below in the home work we have different ways for you to uncover your beliefs and start to examine them.

Skills and capabilities

None of us are born with all the skills we need. We need to learn how to negotiate, present, sell, look after ourselves and more. The question is do you have the skills to back up your goal? Have you learnt to manage your money, invest and organise your finances?

None of us are born with all the skills we need we have to develop them over the years. I believe you can learn anything given time and space. So give yourself the gift of a little bit of time and space and expand the skills you have that tie into your goal or vision.

Question

One question that I find SUPER helpful here is "Who do I have to become to achieve this goal?" This question helps me think of the type of person that I have to become and then I can get to work on developing that identity, those skills and more to support my journey to the vision!

- If you want to launch a business are you learning sales so that get that business started?

- If you are working on your health are you studying longevity and developing your cooking skills to make healthy food?

- If you want to get in control of your finances are learning how to manage your gap, increase your earnings and invest the difference?

None of us are born with all the skills we need we have to develop them over the years. I believe you can learn anything given time and space. So give yourself the gift of a little bit of time and space and expand the skills you have that tie into your goal or vision.

Question

One question that I find SUPER helpful here is "Who do I have to become to achieve this goal?" This question helps me think of the type of person that I have to become and then I can get to work on developing that identity, those skills and more to support my journey to the vision!

Behaviours

This is the area that everyone tries to create change. They say they want to get fit so they start a challenge, they say they want to write a book so they try to write for 20 minutes at 6am, they say they want to get on top of their finances so they try and stop spending any money.

They are creating change at the behaviour level through willpower alone and willpower is finite. If it isn't back up by a supporting identity, values and beliefs using willpower to change behaviours is doomed to failure.

If you create change at the other levels and then back it up with action at the behaviour level it will be easier to follow through. STOP trying to change your behaviour and start working on your beliefs, identity and values first.

If you truly value convenience food over finances then trying to make a salad each day (cheaper and healthier) to eat is doomed to failure over the long term. You need to change your identity, values and beliefs and then getting the actions to follow is so much easier.

Never start at this level. Start working through the other levels and then choose the behaviour that flows from your identity, values and beliefs. You still need to take massive action but first let's find alignment otherwise we are just torturing ourselves trying to force ourselves to do something that we truly don't want to or believe is possible.

Step out of purgatory, stop torturing yourself through willpower alone and find alignment at all levels. This will make doing the behaviour SO MUCH EASIER!

They are creating change at the behaviour level through willpower alone and willpower is finite. If it isn't back up by a supporting identity, values and beliefs using willpower to change behaviours is doomed to failure.

If you create change at the other levels and then back it up with action at the behaviour level it will be easier to follow through. STOP trying to change your behaviour and start working on your beliefs, identity and values first.

If you truly value convenience food over finances then trying to make a salad each day (cheaper and healthier) to eat is doomed to failure over the long term. You need to change your identity, values and beliefs and then getting the actions to follow is so much easier.

Never start at this level. Start working through the other levels and then choose the behaviour that flows from your identity, values and beliefs. You still need to take massive action but first let's find alignment otherwise we are just torturing ourselves trying to force ourselves to do something that we truly don't want to or believe is possible.

Step out of purgatory, stop torturing yourself through willpower alone and find alignment at all levels. This will make doing the behaviour SO MUCH EASIER!

Environment

This might sound like a basic level but it has incredible power to affect your ability to follow through. Let me give you a few examples of how mis-alignment here can cause problems:

Environment is INCREDBILY powerful and can make or break an endeavour. It is so important to think through this level. How can you create an environment that backs up your goal and identity rather than makes it harder?

Can you set up your house so you have a good filling system for all your documents? Can you organise your filling on your computer so everything is neat for you? Can you remove easy access to shopping apps and one click purchasing? Can you have the net-worth tracker easily available to fill in each month with your family / partner?

How can you set up your environment so that it supports your goals? Could you have sayings and expressions on the walls? Could you have "Buy your Freedom FIRST!" written on your home screen of your phone so when you go shopping you see it!?

Take a moment to go through your goals and ask is my environment supporting me or hindering me? Then notice how you might be able to change your environment to better support the life you actually want to live!

- You want to start a business, you believe it is possible, you are pumped to get going but you have bad Wi-Fi at home, your kids don't respect your working hours and interrupt continuously and your partner doesn't believe in your project and keeps telling you to go back to work.

- You want to get healthy, you believe it is possible and you are excited. You partner does the weekly shop and only buys un-healthy food saying it is all he likes, the gym is a half n hour drive away, you live on a street without street lights and can't go running at night when you have time.

- You want to improve your finances but your paperwork is in a mess, you can't find the password for your investment accounts and the home screen on your computer loads up amazon with one click purchases turned on! You are in trouble baby. No matter how much will power you have

Environment is INCREDBILY powerful and can make or break an endeavour. It is so important to think through this level. How can you create an environment that backs up your goal and identity rather than makes it harder?

Can you set up your house so you have a good filling system for all your documents? Can you organise your filling on your computer so everything is neat for you? Can you remove easy access to shopping apps and one click purchasing? Can you have the net-worth tracker easily available to fill in each month with your family / partner?

How can you set up your environment so that it supports your goals? Could you have sayings and expressions on the walls? Could you have "Buy your Freedom FIRST!" written on your home screen of your phone so when you go shopping you see it!?

Take a moment to go through your goals and ask is my environment supporting me or hindering me? Then notice how you might be able to change your environment to better support the life you actually want to live!

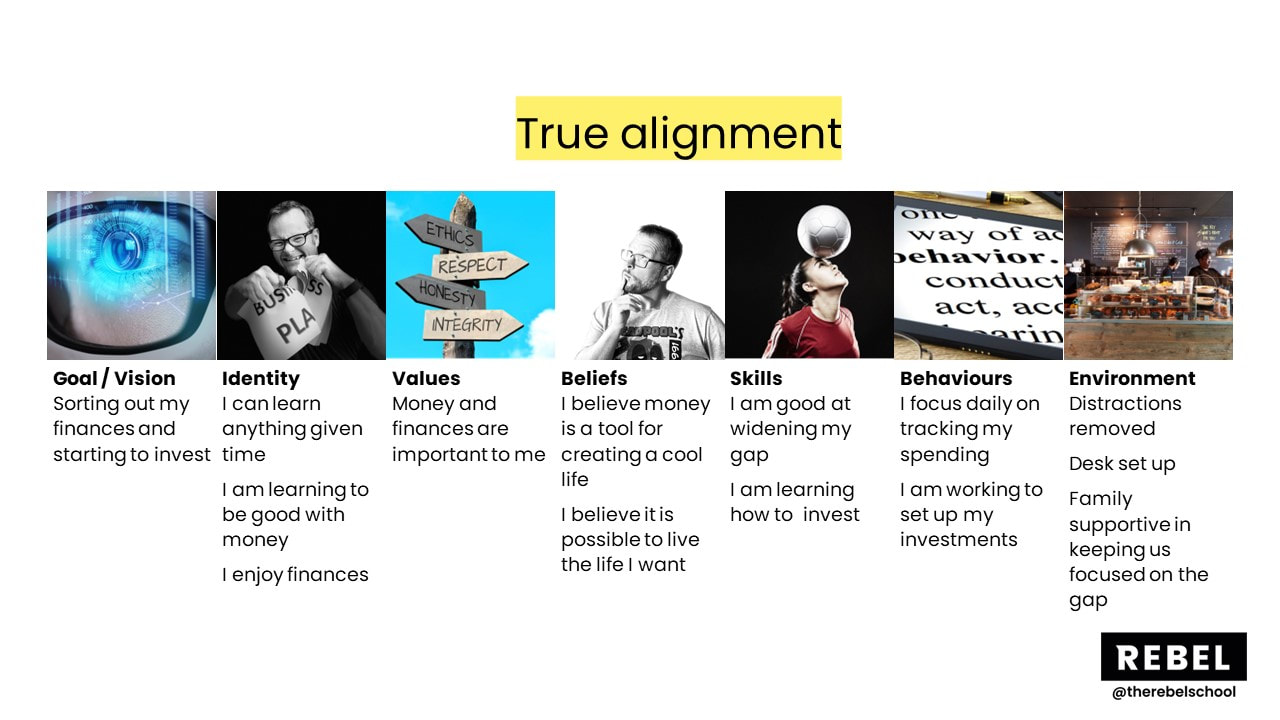

True alignment

If you can find true alignment you will find taking action so much easier in your life.

if you want to sort out your finances, believe it is possible, value good finances, have the skills to back it up and and environment that supports you then taking action and making progress is SO MUCH EASIER!

Our mission in this weeks' course was to challenge your beliefs around money and help you to find alignment, a healthy relationship with money so you find it easy to make progress.

On to the home work!

if you want to sort out your finances, believe it is possible, value good finances, have the skills to back it up and and environment that supports you then taking action and making progress is SO MUCH EASIER!

Our mission in this weeks' course was to challenge your beliefs around money and help you to find alignment, a healthy relationship with money so you find it easy to make progress.

On to the home work!

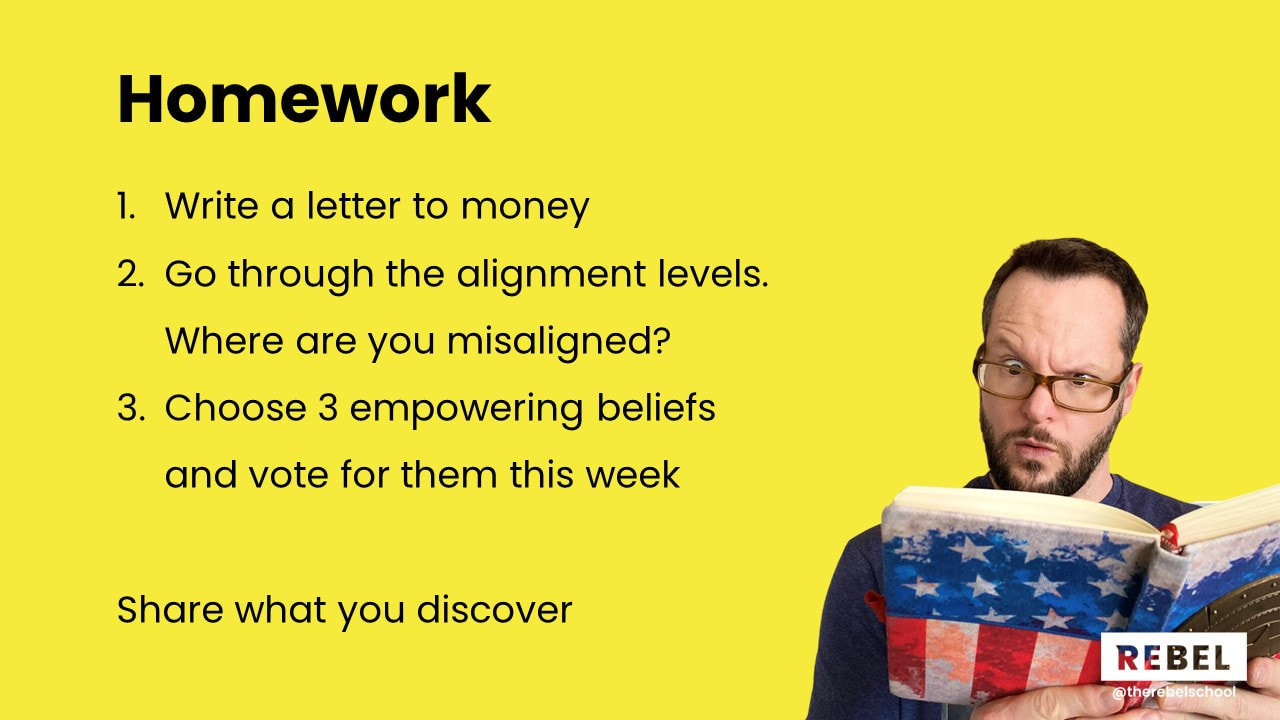

Week 3 home-fun

To get the most out of this course you must do the homework! Remember that this course is a refrigerator course... you only get out what you put in....

So here is the homework for week 3... This is a process. It is not a one and done. It will take time to uncover, reprogramme and develop your money beliefs, identity and philosophy. Sit down for an hour and think about it. Then come back in a few days and add to it. Keep coming back and different things will come to you at different times. It takes time for this stuff to percolate

So here is the homework for week 3... This is a process. It is not a one and done. It will take time to uncover, reprogramme and develop your money beliefs, identity and philosophy. Sit down for an hour and think about it. Then come back in a few days and add to it. Keep coming back and different things will come to you at different times. It takes time for this stuff to percolate

1. Write a letter to money

What is your relationship with money? Write a letter to money telling it how you feel about it. What do you want to say to it? Are you angry with it for the way it's shown up (or not!) in your life? Do you feel grateful towards it? What has it taught you? What joy has it brought you? What anguish has it brought you?

For example

Dear Money

I have always hated you a little bit. You are never there when I need you. The car breaks down and you seem to vanish. The end of the month comes and I want to go out with my friends and where are you to be seen? I love you when you are here, we have such good times together.........

Let it all out and write out your thoughts and feelings to money. Take our time and really write what you want to say to money.

2. Go through the alignment levels

Take the different alignment levels above and work through each one of them. Explore your identity, your beliefs and your values and start to see where you are in alignment and where you aren't. List them out, make some notes, talk about them with friends and uncover.

Beliefs and Identity are two of the most powerful areas so spend time uncovering your beliefs and beliefs about yourself. We recommended three ways to do this on the course.

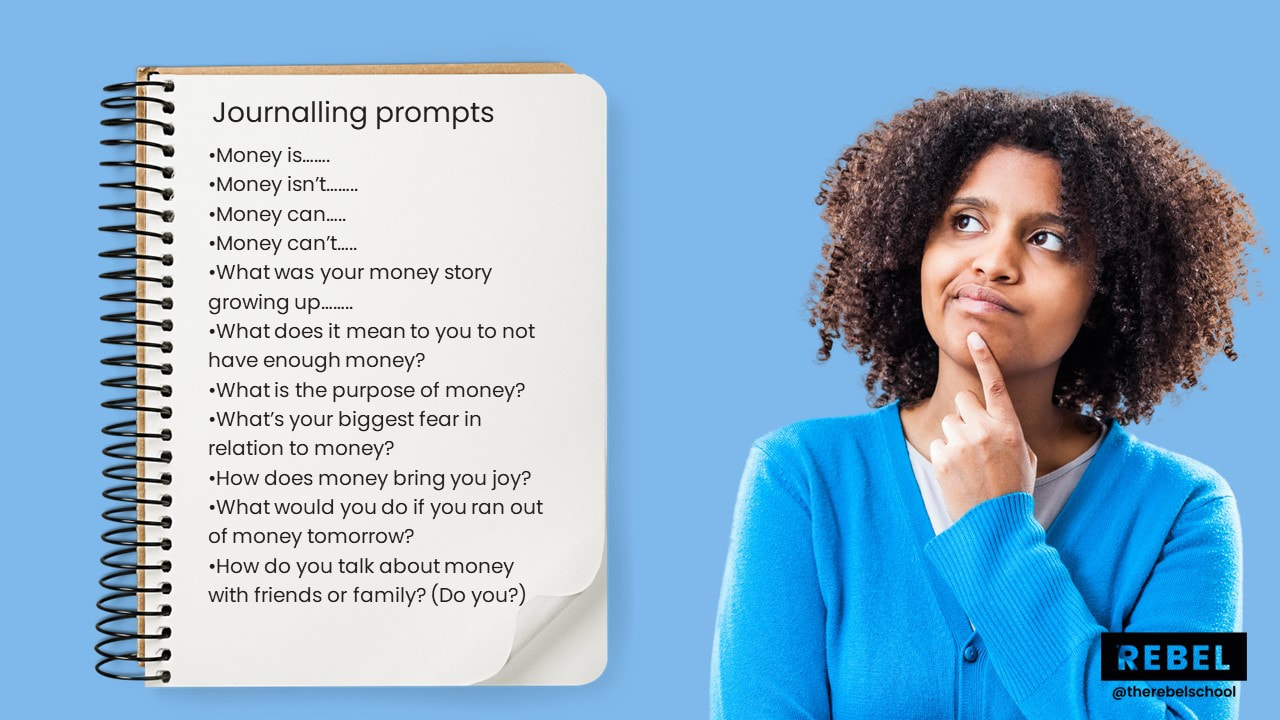

Journaling

This is an exercise where you will be journaling about money. By "journal" we mean use the prompts below, start writing and see what comes out. This is stream of consciousness kind of stuff, don't censor yourself, just keep writing. If you dry up start with the prompt again or move onto the next one.

WARNING: some emotions might come up during this exercise! You might uncover things you didn't realise you thought or believed. You might remember incidents you haven't thought about in years. This is to be expected and is part of the process. Let's flush out all the old crap to make room for new empowering beliefs that will help get your finances where you want them to be. Once you've done the journaling and got it out on paper, you'll be able to decide these beliefs are serving you or you can choose new ones!

You don't have to answer all of these. These are prompts to get the juices going!

Journalling prompts

What is your relationship with money? Write a letter to money telling it how you feel about it. What do you want to say to it? Are you angry with it for the way it's shown up (or not!) in your life? Do you feel grateful towards it? What has it taught you? What joy has it brought you? What anguish has it brought you?

For example

Dear Money

I have always hated you a little bit. You are never there when I need you. The car breaks down and you seem to vanish. The end of the month comes and I want to go out with my friends and where are you to be seen? I love you when you are here, we have such good times together.........

Let it all out and write out your thoughts and feelings to money. Take our time and really write what you want to say to money.

2. Go through the alignment levels

Take the different alignment levels above and work through each one of them. Explore your identity, your beliefs and your values and start to see where you are in alignment and where you aren't. List them out, make some notes, talk about them with friends and uncover.

Beliefs and Identity are two of the most powerful areas so spend time uncovering your beliefs and beliefs about yourself. We recommended three ways to do this on the course.

- Journaling - use the journaling prompts below to write out your thoughts, beliefs and ideas about money. This will help you to find, uncover your beliefs and understand them

- Conversation - talk to someone about money and where your beliefs came from. One of our favourite questions to start with is "What did your parents teach you about money?"

- Reviewing the money beliefs - below you will find the entire list of beliefs from the money belief survey at the start of the course. Go through them, find the ones that you believe and start to work out new and more empowering beliefs.

Journaling

This is an exercise where you will be journaling about money. By "journal" we mean use the prompts below, start writing and see what comes out. This is stream of consciousness kind of stuff, don't censor yourself, just keep writing. If you dry up start with the prompt again or move onto the next one.

WARNING: some emotions might come up during this exercise! You might uncover things you didn't realise you thought or believed. You might remember incidents you haven't thought about in years. This is to be expected and is part of the process. Let's flush out all the old crap to make room for new empowering beliefs that will help get your finances where you want them to be. Once you've done the journaling and got it out on paper, you'll be able to decide these beliefs are serving you or you can choose new ones!

You don't have to answer all of these. These are prompts to get the juices going!

Journalling prompts

- Money is…….

- Money isn’t……..

- Money can…..

- Money can’t…..

- I can…….

- I can’t………..

- What was your money story growing up?

- What does it mean to you to not have enough money?

- What does it mean to have too much money?

- What is the purpose of money?

- How do you feel about money?

- What’s your biggest fear in relation to money?

- How does money bring you joy?

- What is a good amount of money to earn?

- What would you do if you ran out of money tomorrow?

- What’s the best or most helpful piece of advice you have heard about money?

- What’s the worst or least helpful advice you have learnt about money?

- How do you talk about money with friends or family? (Do you?)

Share what you've discovered with the people closest to you

What have you learned about yourself? Have you had any a-ha moments? Start a discussion with your partner, children or friends about what you've discovered and ask them what they believe about money. Go gently! Maybe start by asking them what their parents taught them about money and see where the conversation goes from there.

What have you learned about yourself? Have you had any a-ha moments? Start a discussion with your partner, children or friends about what you've discovered and ask them what they believe about money. Go gently! Maybe start by asking them what their parents taught them about money and see where the conversation goes from there.

Keen-bean homework

We know some of you love homework nearly as much as Katie does! Your keen bean home work for this week is to really delve into the journaling around money, explore your beliefs and really get to the root of your thoughts.

Then secondly to do a values exercise to uncover your values. Journal about What is important to you and then turn that into a top list of values that you will use to direct your life!

Then secondly to do a values exercise to uncover your values. Journal about What is important to you and then turn that into a top list of values that you will use to direct your life!

Discussion questions

So that you have them all in one place, here are the questions we discussed during week 3's call. You can journal about the answers, you can take them to dinner with a friend or partner or just think peacefully on a park bench in the sunshine!

What beliefs did your parents (or whoever raised you) give you?

What beliefs did your parents (or whoever raised you) give you?

- What expressions did they repeat?

- What lessons did they give you about money?

- Did they give you pocket money/allowance?

- Did you have to work for your money?

- Did they argue about money?

- Helpful or unhelpful beliefs, doesn’t matter. Just what programming did you receive?

- Have you ever taken the time to examine and discuss your beliefs?

- What are some of your strongest money beliefs?

- If there was one belief you could change, what would it be?

- What beliefs are strongest for you? Which do you want to tackle? See below for a list of common money beliefs

- What is the impact of believing this? What are the long term consequences? How might the opposite be true?

- What are the alternative beliefs you want to foster and try out?

Ask for help

Remember to reach out in the Facebook group with any questions you have or if you get stuck. Don't let confusion be an excuse for not progressing with this stuff. We are here to support you!

Common money beliefs

If you're struggling to uncover beliefs that might be holding you back, here's some common money beliefs that you might want to tackle! These were all in the pre-course survey that you took. We are going to ask you to rate them again in a post course survey to see if they have shifted at all! (data exciting!)

- Money is the root of all evil

- Money is a limited resource

- Getting rich takes too much work or struggle

- I don't know where the money goes each month

- More money means more problems

- It is too late for me to get rich

- Having a lot of money is a big responsibility

- Realistically, chances are I will never be rich

- Getting rich is a matter of luck or fate

- Striving for wealth won't allow me much time for anything else in my life

- To get rich you have to use people or take advantage of them

- If I get rich everyone will want something from me

- If I get rich there will be certain people in my life who won't like it or me

- If I have a lot of money; it means someone else is going to have less

- Having excess money means you are greedy

- I'm terrible with money

- I am just bad with numbers

- If I strive for wealth and don't succeed then I will feel like a failure

- This just isn't the right time for me to start going for it financially

- Money isn't really that important

- Money can't buy you happiness

- You can't have money, do good and be happy at the same time

- Money can cause a huge amount of pain

- It takes money to make money

- People should only have enough money to live "comfortably"

- Given my past it is difficult for me to get rich

- I am not smart or intelligent enough to be wealthy

- I am too young to get rich

- I am too old to get rich

- As a woman it's much more difficult to get rich

- I wish I didn't have to deal with money

- I don't enjoy managing money

- I don't have time to manage money

- I don't need to manage my money because I hardly have any

- Money corrupts artistic and creative endeavours

- It's not right to be rich when other people are so poor

- The rich get richer the poor get poorer

- Rich people aren’t happy

- I can just pay someone else to manage my money

- If I earn more money I will have to pay more taxes; it is pointless

- Getting rich is not really a skill you can learn

- I am just not meant to be rich

- Investing is too difficult and complex for me to ever learn

- Investing is for people with a lot of money

- Most investments other than the bank are too risky

Week 4: Debt, Compounding and more

We will see you next week for Debt Week. Even if you don't have debt this one is important as you can learn how we get into debt, help other people avoid it and learn about some of the scams that are out there that leave us in real trouble.

Plus we have the 8th wonder of the world to talk about with you. Can't wait to see you next week and thank you so much for coming on the course.

Love Katie and Alan

Plus we have the 8th wonder of the world to talk about with you. Can't wait to see you next week and thank you so much for coming on the course.

Love Katie and Alan