Week 2: Net-worth

|

How do you know if you are heading in the right direction or not if you don't know where you are? Most people can not answer with any degree of accuracy what their net-worth is or even what should be included or not!

This week join Katie and Alan as they explore tracking your finances, what to measure, assets and liabilities and other core personal finance principles that are going to set us up for a bright financial future. Welcome to week 2 of Rebel Finance School. You can catch up on Week 2 by watching the YouTube video to the right (appears below on webpage). The whole session was recorded for you. |

|

Climbing a mountain

Whenever you start a new project it can feel daunting as there is so much to do. If you are feeling overwhelmed by the course, the materials or the Donegans then we would love you to start by reading this article: The insurmountable mountain. I wrote it to help you get started on this journey.

If you are feeling good about the course and the task ahead then it is time to get right into this and take your first financial snapshot! Let's measure your net-worth!

If you are feeling good about the course and the task ahead then it is time to get right into this and take your first financial snapshot! Let's measure your net-worth!

Time to measure your net-worth

The main thing we want you to get out of week 2 is the importance of tracking your net worth. Check out my how much are you worth blog post. The blog post includes a spreadsheet template that you can download and fill in.

Katie updated the net-worth tracker for this year. She has made it clearer, it has a separate section for your home and she has added a graph to show the change over time.

We don’t really care if you use our net-worth tracker template, you create your own or you just do it on paper. It doesn’t matter how you do it, just that you DO IT. The act of tracking the numbers makes you focus on them. Where focus goes energy flows.

To get the most out of this course you must do the homework! The most dangerous words when you're learning something are "I know that". None of this is rocket science. You might know this but are you actually doing it?! Are you implementing? So many people who come to the Rebel Business School tell me they know all the content and then when I dive in and ask questions they just aren't doing it and that is why their business is failing. It is the same in finances.

Getting wealthy is not a get rich quick scheme kinda thing. This will take time! Each step might take you months or years. We are in this for the long haul and we will help you through it. Stick with the course over the coming weeks, we've designed it to build as we go. Trust in the process! We can climb this mountain together and we'll be with you every step of the way.

Katie updated the net-worth tracker for this year. She has made it clearer, it has a separate section for your home and she has added a graph to show the change over time.

We don’t really care if you use our net-worth tracker template, you create your own or you just do it on paper. It doesn’t matter how you do it, just that you DO IT. The act of tracking the numbers makes you focus on them. Where focus goes energy flows.

To get the most out of this course you must do the homework! The most dangerous words when you're learning something are "I know that". None of this is rocket science. You might know this but are you actually doing it?! Are you implementing? So many people who come to the Rebel Business School tell me they know all the content and then when I dive in and ask questions they just aren't doing it and that is why their business is failing. It is the same in finances.

Getting wealthy is not a get rich quick scheme kinda thing. This will take time! Each step might take you months or years. We are in this for the long haul and we will help you through it. Stick with the course over the coming weeks, we've designed it to build as we go. Trust in the process! We can climb this mountain together and we'll be with you every step of the way.

What are you willing to give up?

What are you willing to give up to get control of your finances? It is going to take time and energy to fill out the spreadsheet, find old pension details and more. You are going to have to work for this. This is a refrigerator course. You only get out what you put in?

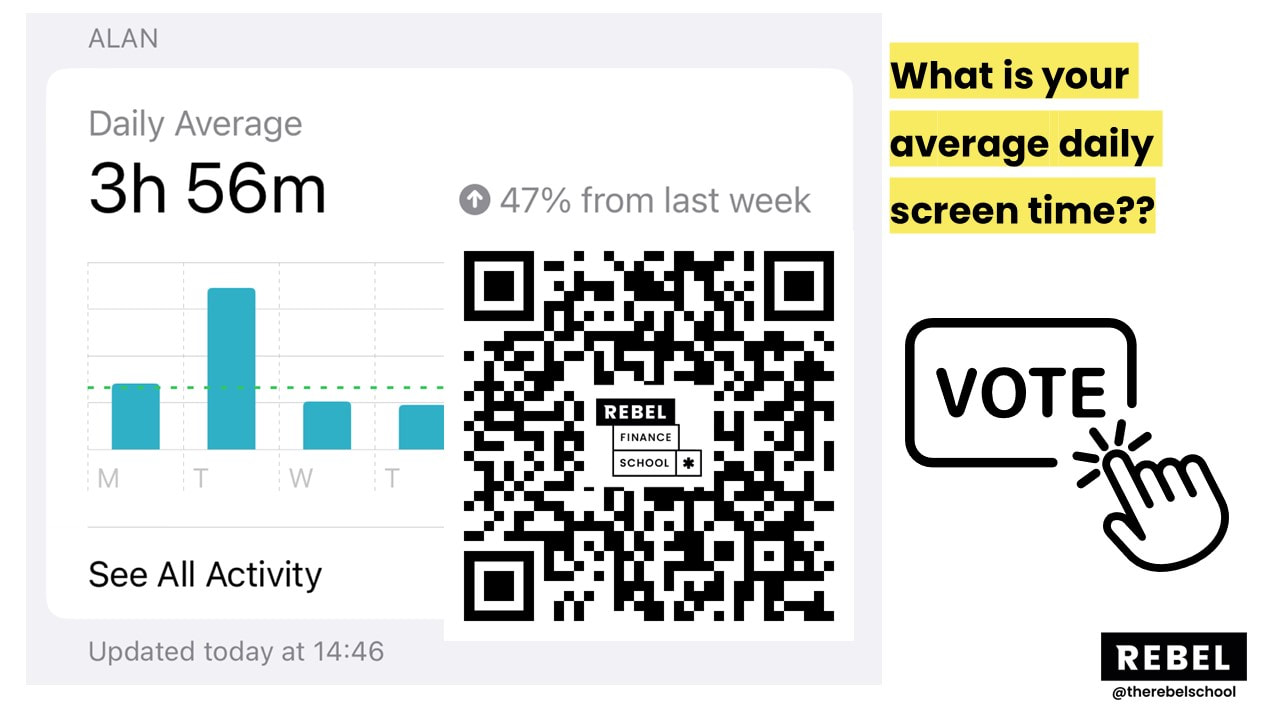

On the course this week we asked you to look up your average screen time on your phone. How many hours a day are you looking at that screen? I think the results shocked a lot of people on the call. The answers ranged from an hour a day all the way up to 8 hours a day. The average was four.

Imagine if you took one of those hours that you were spending on your phone and applied them to your finances. To reduce your spending, increase your income and create a gap. If you spend an hour getting on top of your paperwork. If you spend that hour filling out the net-worth tracker?

Imagine how much progress you would make if you committed some of your Netflix, phone screen or other time to finances! We genuinely believe you can take control of your finances and make huge progress, but it takes focus.

What are you willing to give up to take control of your finances? You can have anything you want in life if you are willing to pay the cost up front and in full. The cost for having good finances is time, focus, energy.

On the course this week we asked you to look up your average screen time on your phone. How many hours a day are you looking at that screen? I think the results shocked a lot of people on the call. The answers ranged from an hour a day all the way up to 8 hours a day. The average was four.

Imagine if you took one of those hours that you were spending on your phone and applied them to your finances. To reduce your spending, increase your income and create a gap. If you spend an hour getting on top of your paperwork. If you spend that hour filling out the net-worth tracker?

Imagine how much progress you would make if you committed some of your Netflix, phone screen or other time to finances! We genuinely believe you can take control of your finances and make huge progress, but it takes focus.

What are you willing to give up to take control of your finances? You can have anything you want in life if you are willing to pay the cost up front and in full. The cost for having good finances is time, focus, energy.

Week 2: Homework

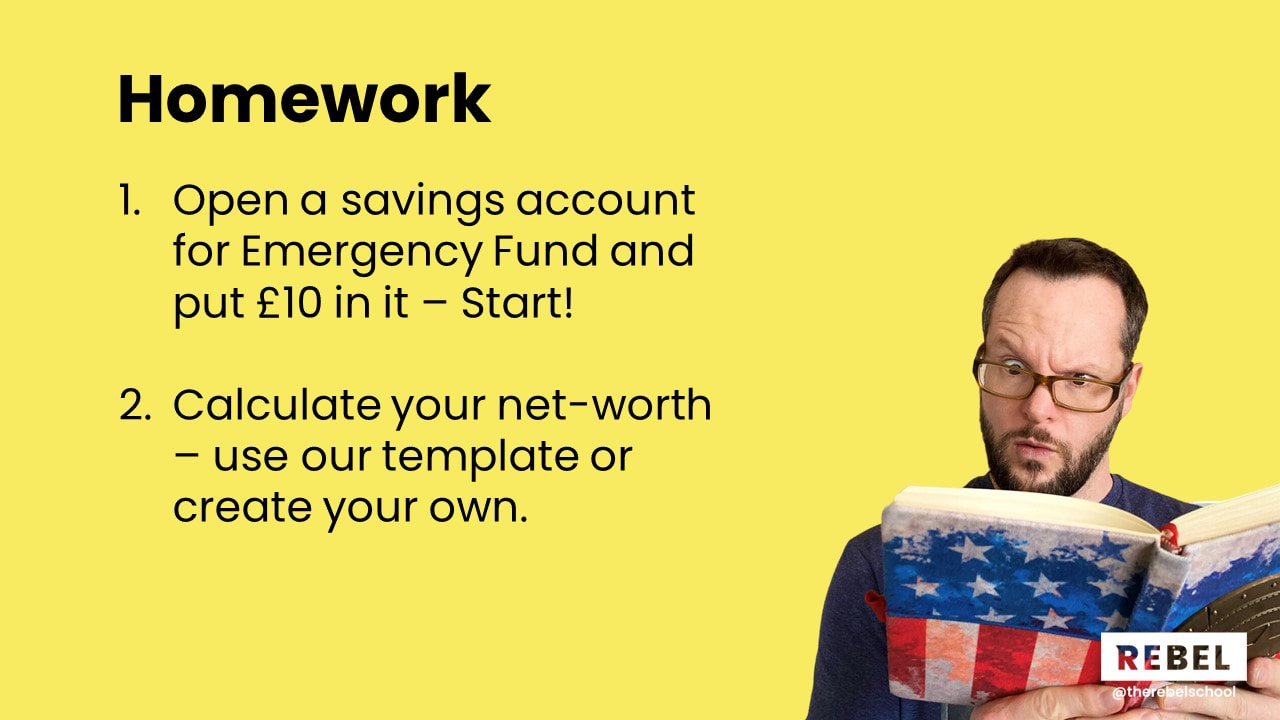

- Open a savings account for your emergency fund if you don't already have one. Start putting money into it! Initial aim is to put £1,000 in (or whatever the equivalent of this in your currency). Start where you are, this might be £5 or $5 a month to begin with.

- Calculate your net-worth using the net-worth tracker template. If you already have your own template you don't have to use ours. The important thing is doing it! Alan's how much are you worth blog post has the template in it and gives you a guide to what to do put in or not

Optional keenbean homework

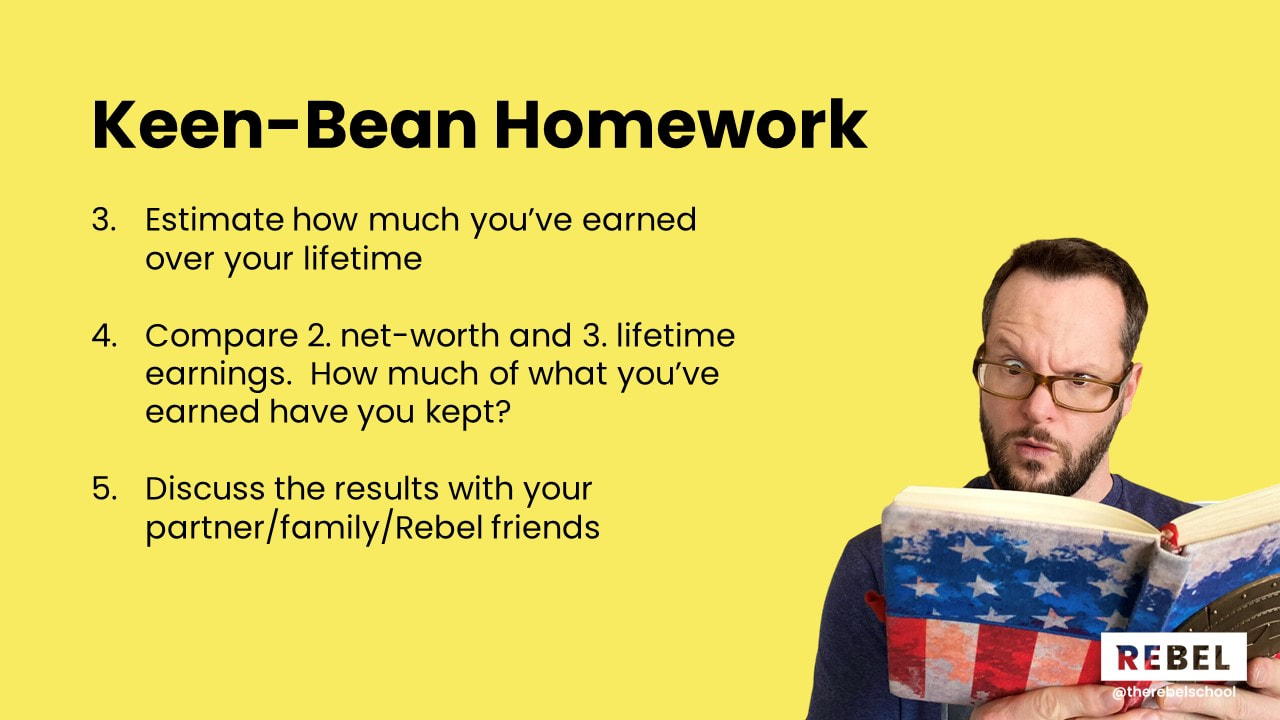

3. Work out how much you've earned over your lifetime. We've created a template to help you do this. Click here for the template. If you're in the US you can get this info really easily at the social security website.

4. Compare 2. (your net-worth) and 3. (your lifetime earnings). How much of what you've earned have you kept? Warning: this may bring up some emotion! The purpose of this exercise is to inspire change so that you can keep more of what you earn and get it working for you.

5. Discuss what you've discovered with your partner/family/friends or tell us in the Facebook group. We LOVE reading your comments during the week and replying. Please leave us some comments, ideas or more in the Facebook group or on YouTube.

4. Compare 2. (your net-worth) and 3. (your lifetime earnings). How much of what you've earned have you kept? Warning: this may bring up some emotion! The purpose of this exercise is to inspire change so that you can keep more of what you earn and get it working for you.

5. Discuss what you've discovered with your partner/family/friends or tell us in the Facebook group. We LOVE reading your comments during the week and replying. Please leave us some comments, ideas or more in the Facebook group or on YouTube.

Course questions / discussion

It's important to reflect during the course on what you're currently doing and what you'd like to change. Nothing changes unless you change! These are the discussion questions we had during week 2. Discuss these with your friends, partner, family, randoms in the street!

Direction and tracking net-worth

Gap between earning and spending

The fundamentals of good personal finance

There are three main elements to good personal finance habits. The first is reducing your spending, working out where your money goes and making sure you get good value from the money you are spending. This is week 1 of the course. The second is increasing your income to create a gap between that and your spending. Most people spend just about everything they earn each month and there is no gap between income and expenditure.

It is not always about earning more but let's be honest a few extra pounds/dollars a month won't hurt! I created a blog article and podcast episode on increasing your income to help with this. Listen or read these two.

Direction and tracking net-worth

- What direction are your finances heading? Do you know with certainty if they are improving or not?

- How do you feel about your financial direction? Are you positive and happy? Are you feeling apprehensive? How do you feel about the direction of your finances?

- Where will this direction leave you at retirement age?

- What do you think the main benefit of tracking net-worth is for you?

Gap between earning and spending

- Do you have an emergency fund?

- Have you had times where the car/washing machine broke down and you were scrambling for money?

- Do you have a gap between your income and expenditure?

- Is there money left over at the end of the month? If so, what do you do with it?

The fundamentals of good personal finance

There are three main elements to good personal finance habits. The first is reducing your spending, working out where your money goes and making sure you get good value from the money you are spending. This is week 1 of the course. The second is increasing your income to create a gap between that and your spending. Most people spend just about everything they earn each month and there is no gap between income and expenditure.

It is not always about earning more but let's be honest a few extra pounds/dollars a month won't hurt! I created a blog article and podcast episode on increasing your income to help with this. Listen or read these two.

Then the final part of the fundamentals is what you do with the new found gap between income and expenditure. We will be covering this in later weeks but for now the basic steps are:

- Build an initial emergency fund of £1000

- Pay of Expensive Debt (greater than 5% interest)

- Increase your emergency fund to 3-6 months

- Start to invest

|

This is the start of the journey! Nice work for making it this far! Fill out that net-worth tracker and we will see you for week 3 Money Beliefs shortly!

The course builds week on week and just the act of turning up every Monday night and thinking about your finances will change the trajectory of them. Thanks for coming. Thank you for focusing your energy on your own finances. We are so excited to see your progress. |

Where in the world are you?

We are a truly international bunch for Rebel Finance School 2023. This map shows where everyone is! Welcome friends from all around the world. Click on the map for the interactive version. We all live in different countries, under different tax codes but good personal finance habits are the same the world over. Let's work together to get on top of our finances.

Ask for help

Remember to reach out in the Facebook group with any questions you have or if you get stuck. Don't let confusion be an excuse for not progressing with this stuff. We are here to support you!

Update by Katie, Alan and the Rebel Ninjas 20/06/23

Remember to reach out in the Facebook group with any questions you have or if you get stuck. Don't let confusion be an excuse for not progressing with this stuff. We are here to support you!

Update by Katie, Alan and the Rebel Ninjas 20/06/23