Week 1: How big is your gap?

|

Let's work out where the heck all your money goes and if you are getting bang for your buck or pleasure for your pound!

The main thing we want you to get out of week 1 is the importance of tracking your spending. Do you know where your money goes each month? Are you spending money on things you don't even like or use? Are you getting value from your spending? Let's plug any leaks and have a strong financial ship. WOOT WOOT |

|

Key concepts: week 1

- The route to wealth: creating a consistent gap between income and spending

- The steps to getting wealthy: what to do with the gap

- Weekly / monthly expenses - the true cost

- Tracking your spending

- Tracking your gap

- Homework

The route to wealth - creating a consistent gap between income and spending

|

It is incredible how many people think that the only route to wealth is to win the lottery, inherit money, or build a business. No one thinks that consistently saving an amount each month, investing it over time will lead to wealth.

The true key to creating wealth over the long term is to create a gap between your income and spending. Spending less that you earn and then taking that gap and investing it into assets. |

|

If you are spending more than you earn then you have a negative gap. If you spend everything you earn each month then you have zero gap. If you spend less than you earn and have money left over at the end of the month then you have a positive gap!

The key to creating a consistent gap is working to reduce your spending and then working to increase your income. |

There is so much content online about reducing your expenses. Our first tip is to track your spending and work out what you are getting value from. Look down the list of your spending and see what you could reduce, eliminate, or change.

Read this article for 10 ideas on how to increase your income.

We aren’t saying it is easy to do, but it is possible. You may have already screwed your expenses to the floor and are thinking “I can’t spend less.” Well great, let’s focus on earning more.

It might take time to create the gap but if you consistently focus on it over the coming weeks we believe you can do it.

Read this article for 10 ideas on how to increase your income.

We aren’t saying it is easy to do, but it is possible. You may have already screwed your expenses to the floor and are thinking “I can’t spend less.” Well great, let’s focus on earning more.

It might take time to create the gap but if you consistently focus on it over the coming weeks we believe you can do it.

Am I too old / young to start?

|

It’s not binary! The best time to plant a tree was 20 years ago. The next best time is today! We just need to take small steps from where you are to get in control of your finances. It is amazing how small steps build over time to create something amazing. It isn’t all or nothing!

If you think you’re too old to get started, watch this video. Alan also did an episode of the Rebel Entrepreneur Podcast with Jaymie that felt she was too old to be able to do financial independence. You can listen to the episode here on spotify or on Apple or Google podcasts. The key thought here is that it doesn't matter what age you are. if you are still breathing we can do things to improve your finances. So please check now if you are breathing. Find a pocket mirror, check to see if it mists up. if yes, then you are in luck we can help. Getting on top of your finances at any age is a good thing. |

|

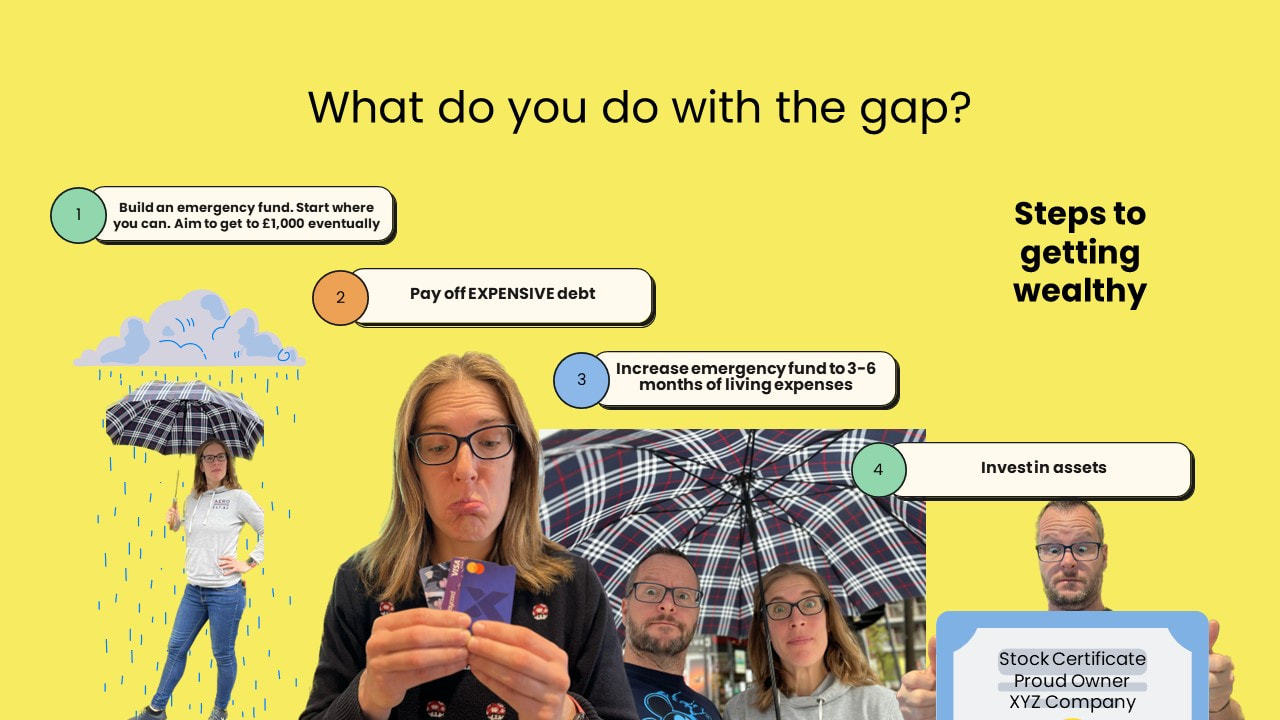

The steps to getting wealthy

What do you do with your gap?

Once you have created a gap between your income and spending, what do you do with it? There are some simple steps that we followed to know what to do that we think will help you as well.

Once you have created a gap between your income and spending, what do you do with it? There are some simple steps that we followed to know what to do that we think will help you as well.

- Step 1: Build an emergency fund of £1000 (or the equivalent in your currency). We will cover emergency funds in detail in week 2. Watch this video to learn more about emergency funds.

- Step 2: Pay off expensive debt (anything over 5% interest). For example credit cards, store cards, loans. We will cover debt comprehensively in week 4.

- Step 3: Expand your emergency fund to 3-6 months living expenses. Read this article for more details about emergency funds.

- Step 4: Invest in assets. After fully funding your emergency fund you take your gap and start to use it to buy assets. The Donegans buy broad-based index funds. We will cover investing and how to do this in weeks 6-8.

Weekly / monthly expenses - true cost

It is amazing how many subscriptions we all end up having. We subscribe to Netflix, Amazon Prime, Spotify, vegetable boxes, insurance and more.

Have you ever checked your banking app or credit card for the recurring regular payments? If not, break out your banking app / credit card app now and check to see what you are subscribing to.

That £10.99 a month on Netflix, £10 on Amazon, £50 on Sky and so on, soon mount up. What would happen to your finances if you cancelled those subscriptions and invested the money instead?

The rules of 194 and 840 show the true cost of monthly and weekly expenses over 10 years, if you had invested the money instead.

Let’s imagine you cancelled Netflix. That is £10.99 a month. If you took that money and invested it in a broad-based index fund how much might you have at the end of 10 years?

For a monthly expense you take the amount and multiply it by 194. £10.99 multiplied by 194 is £2,132. If you took the money you were spending on Netflix and invested it instead you would have £2,132 after 10 years!

If you managed to reduce your car repayment by £100 and invested it instead you would have £19,400 by the end of that 10 year period.

If it is a weekly cost then you multiply the number by 840. Examples of weekly costs might be newspaper subscriptions, magazines, coffee, or other things. Let’s imagine you were spending £50 a week on a vegetable box from a local supplier and you changed to getting it from Lidl instead. You might save £10 a week on vegetables. If you took that £10 saving and invested it you would have £8,400 (£10 * 840)!

This relies on you saving/investing the money you save, not just spending it on something else!

I've written a blog post all about this: what do you spend your money on?

Have you ever checked your banking app or credit card for the recurring regular payments? If not, break out your banking app / credit card app now and check to see what you are subscribing to.

That £10.99 a month on Netflix, £10 on Amazon, £50 on Sky and so on, soon mount up. What would happen to your finances if you cancelled those subscriptions and invested the money instead?

The rules of 194 and 840 show the true cost of monthly and weekly expenses over 10 years, if you had invested the money instead.

Let’s imagine you cancelled Netflix. That is £10.99 a month. If you took that money and invested it in a broad-based index fund how much might you have at the end of 10 years?

For a monthly expense you take the amount and multiply it by 194. £10.99 multiplied by 194 is £2,132. If you took the money you were spending on Netflix and invested it instead you would have £2,132 after 10 years!

If you managed to reduce your car repayment by £100 and invested it instead you would have £19,400 by the end of that 10 year period.

If it is a weekly cost then you multiply the number by 840. Examples of weekly costs might be newspaper subscriptions, magazines, coffee, or other things. Let’s imagine you were spending £50 a week on a vegetable box from a local supplier and you changed to getting it from Lidl instead. You might save £10 a week on vegetables. If you took that £10 saving and invested it you would have £8,400 (£10 * 840)!

- Multiply a MONTHLY cost by 194 to see the true cost over 10 years.

- Multiply a WEEKLY cost by 840 to see the true cost over 10 years.

This relies on you saving/investing the money you save, not just spending it on something else!

I've written a blog post all about this: what do you spend your money on?

Track your spending

|

So many people say to us, “I just don’t know where the money goes!?”

Katie loves to look at them, smile and say, “Shall we find out?” There are many ways to track your spending. Start the habit of tracking your spending each and every month. We think there are 6 main reasons to track your finances:

|

|

- Reason 3: Direction of travel. Measuring your spending allows you to know if it is going in the right direction or not. Is my spending going up? down?

- Reason 4: subscriptions - wasting money. Most people have subscriptions and the companies are cheeky, they get you to sign up on a free trial, you forget to cancel it and the money comes out every month. Get rid of those pesky unused or undervalued subscriptions

- Reason 5: gamifying it. Have fun with it. Have levels for your net-worth, spending and start working out how you can get to the next level. Bring the team together to work on it. Get the kids involved in it

- Reason 6: will you have enough for retirement? Most people have no idea how much they are spending now so how would they tell if they will have enough in retirement? This is critical to understanding your financial needs in the future.

How to track your spending

This might take some detective work to start with. Maybe you'll need to look at multiple bank statements or credit cards. Stick with it! Thankfully there are some tools to help you.

Here are 5 different ideas for how to track your spending

It doesn’t really matter how you do it, just that you do it. Pick the method that you think you can stick to and start to track your spending. We need to know where the money goes!

Here are 5 different ideas for how to track your spending

- Apps specifically designed for the task! If you're in the UK you might like to use Money Dashboard. We are not sponsored by Money Dashboard! It's just the one we use but there are other tools that do exactly the same thing. Money Dashboard is completely free. You link it up to your bank accounts and credit cards and it pulls through all your transactions into one place so you can see what you're spending in total. Katie and I look at our total combined spending so we link all of our accounts into one Money Dashboard account for both of us. It's up to you whether you do this individually or as a household.

Download the app, link up your accounts and categorise your spending. The US versions are mint or personal capital. In New Zealand you can use Pocketsmith. - Use one bank card. Put all your spending through one card so you can use the data on that card to review and categorise your spending

- Banking Apps: Some of the modern banking apps have categorising tools within them so you can track your spending and see where the money is going. Check out your bank account.

- Spreadsheet: just track your spending in a simple spreadsheet!

- Pen and paper: good old fashioned pen and paper and write down everything you spend.

It doesn’t really matter how you do it, just that you do it. Pick the method that you think you can stick to and start to track your spending. We need to know where the money goes!

Tracking your gap

What gets measured gets improved. The act of tracking something gets you to focus on it and the mere act of tracking alters the outcome. The Donegans track their spending each and every month.

We use Money Dashboard and we work out where all our money goes. We know what we are spending. This then enables us to see if there is a gap between our spending and our income!

This is one of the most critical figures in your finances. Do you have a gap each month?

To work out your gap you subtract your spending from your income to see what is left!

Here are some examples:

What we need to look at is your gap over time as some months you might spend a little more than you earn which is ok if the overall trend is that you have a positive gap.

We use Money Dashboard and we work out where all our money goes. We know what we are spending. This then enables us to see if there is a gap between our spending and our income!

This is one of the most critical figures in your finances. Do you have a gap each month?

To work out your gap you subtract your spending from your income to see what is left!

Here are some examples:

- You earn £3000 and you spend £2000. Your gap is £1000! YAY Positive Gap

- You earn £3000 and you spend £3000. No gap. You are spending everything you earn.

- You earn £3000 and you spend £3500 because the car breaks down. Your gap is -£500. DANGER! We are losing money

What we need to look at is your gap over time as some months you might spend a little more than you earn which is ok if the overall trend is that you have a positive gap.

|

To make this easy Katie has created one of her wonderful spreadsheets for you. You can download it here and start to fill it all out. We also created a loom video for you to show you how to use it. Download the spreadsheet now.

Watch the video on the write for a guide on how to use it. |

|

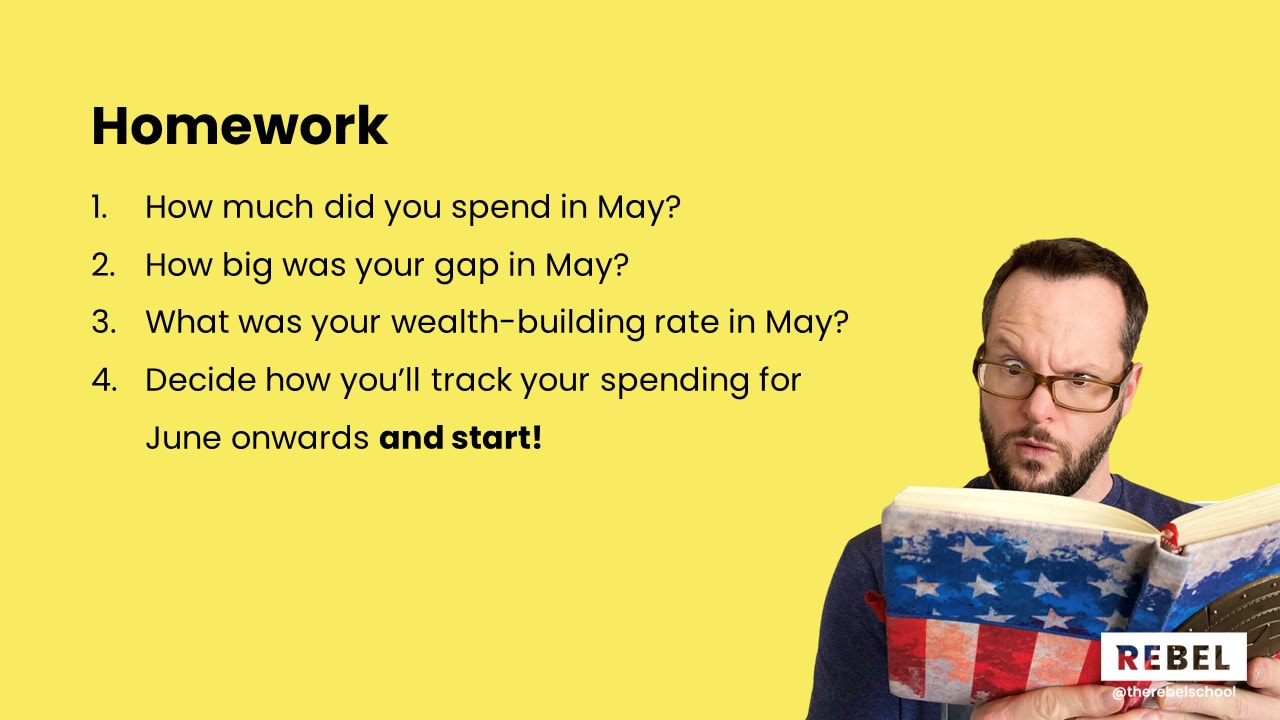

Week 1 homework

To get the most out of this course you must do the homework! The most dangerous words when you're learning something are "I know that". None of this is rocket science. You might know this but are you actually doing it?! Are you implementing?

When you do the homework look at May to start with because it's the most recent month. This is something you should do monthly as part of your monthly finance meeting. More on this in week 5.

So here is the homework for week 1... We’ve summarised it here. Please read on below for more explanation and guidance for each task:

When you do the homework look at May to start with because it's the most recent month. This is something you should do monthly as part of your monthly finance meeting. More on this in week 5.

So here is the homework for week 1... We’ve summarised it here. Please read on below for more explanation and guidance for each task:

- How much did you spend in May?

- How big was your gap in May?

- What was your wealth-building rate in May? Read the explanation for this below and if it’s still a bit overwhelming and confusing, please leave it. We’ll come back to it later in the course when we’ve given you some more information

- Decide how you’ll track your spending for June onwards and start.

- Fill in the “how big is your gap” tracker for the year so far

- Categorise your May spending

- Did you get value from what you bought?

- Did you spend in line with your values?

- What’s the true cost of your habits?

1. How much did you spend in May?

Read the section above “How to track your spending” for help on how to do this. We don't care how you do it. Just do it!

IMPORTANT! We coached someone last year and he was very despondent because he thought his wealth-building rate was zero. He was putting £200 a month to buy investments and counting this as spending. Any money you use to buy assets is NOT spending. Do not include this in your spending figure.

IMPORTANT! We coached someone last year and he was very despondent because he thought his wealth-building rate was zero. He was putting £200 a month to buy investments and counting this as spending. Any money you use to buy assets is NOT spending. Do not include this in your spending figure.

2. How big was your gap in May?

|

This is the part where you can start to use the How Big is your Gap calculator! You can download the calculator here and we’ve also made a video for you to explain how to use the calculator. Part 1 of the calculator works out the size of your gap for you

If you have any problems using the calculator then please put them in the Facebook group or the comments on YouTube and we will monitor and reply |

|

3. What was your wealth building rate in May?

*If this is confusing or overwhelming please leave it. All will become clear as we go through the course together*

This is covered by Part 2 of the How Big is your Gap calculator.

It’s all very well having a gap but what are you actually doing with it? We want to track that to know how much you’re using to look after future you. This is the wealth-building rate.

Read this article to help you understand more about what we mean by the wealth-building rate

You work out your wealth-building rate by comparing how much you are putting towards building wealth with how much you earn.

What does building wealth mean?

For example, you earn 3,000 after tax. You put 300 in your emergency fund.

Your wealth-building rate is 10% (300/3,000)

You don’t need to do any of the maths if you don’t want to. The calculator works this all out for you.

Why are we bothering with any of this?!

Your wealth-building rate is directly linked to how long it will take you to get to retirement. We'll cover this more when we come on to FIRE principles in week 8. If you'd like to read ahead now check out this article by Mr Money Mustache.

This is covered by Part 2 of the How Big is your Gap calculator.

It’s all very well having a gap but what are you actually doing with it? We want to track that to know how much you’re using to look after future you. This is the wealth-building rate.

Read this article to help you understand more about what we mean by the wealth-building rate

You work out your wealth-building rate by comparing how much you are putting towards building wealth with how much you earn.

What does building wealth mean?

- Putting money in your emergency fund

- Buying assets (not sure what this means?! Hang fire for week 6-8 of the course)

For example, you earn 3,000 after tax. You put 300 in your emergency fund.

Your wealth-building rate is 10% (300/3,000)

You don’t need to do any of the maths if you don’t want to. The calculator works this all out for you.

Why are we bothering with any of this?!

Your wealth-building rate is directly linked to how long it will take you to get to retirement. We'll cover this more when we come on to FIRE principles in week 8. If you'd like to read ahead now check out this article by Mr Money Mustache.

4. Decide how you'll track your spending for June and start

Pick a way of tracking your spending and start doing it. Keep it simple. Start with your best guess of what will work well for you and you can always tweak along the way.

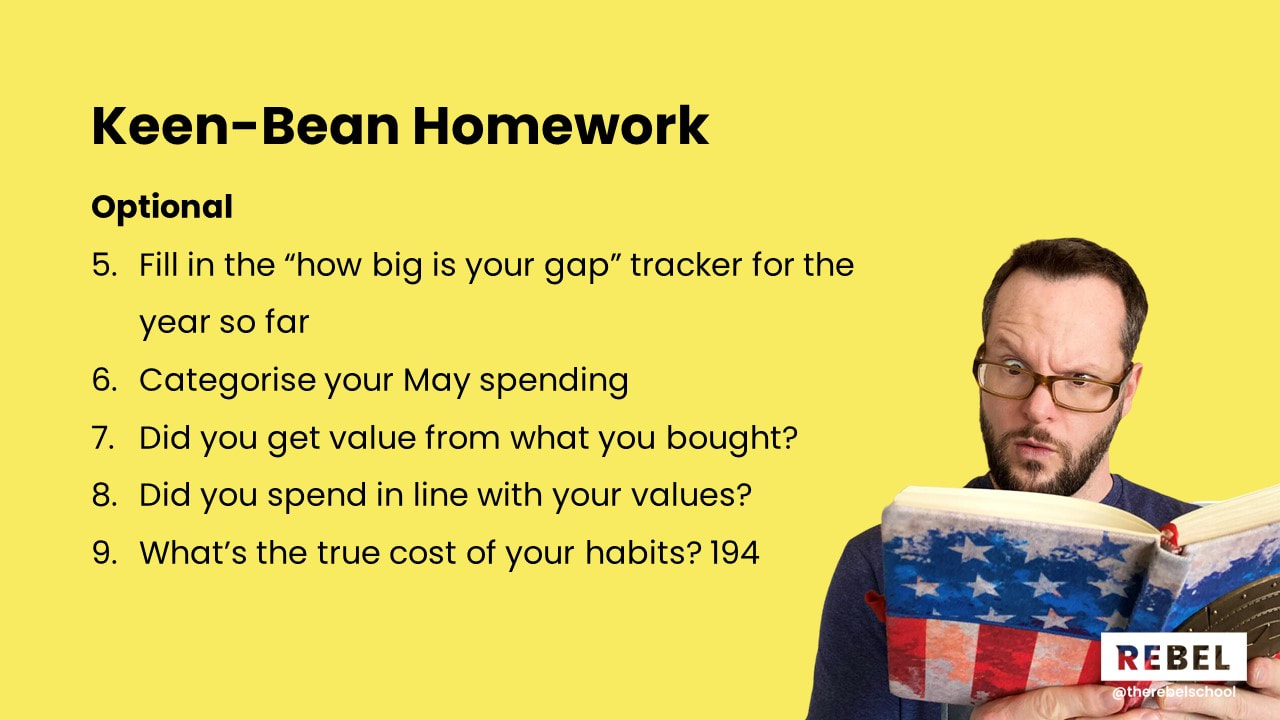

Keen-bean homework

Some of you will just do the homework above and that is perfect. We need to start small and build over time. Some of you will have done that and be wanting more. The keen beans! We love you and honour you with this extra homework! Pick and choose which exercises are most meaningful for you.

5. Fill in the “how big is your gap” tracker for the year so far

The really fun bit comes when you can start to see your trend over the months and the years. Go back and fill in the “how big is your gap” trackers for all the months of the year so far (or as many as you want!).

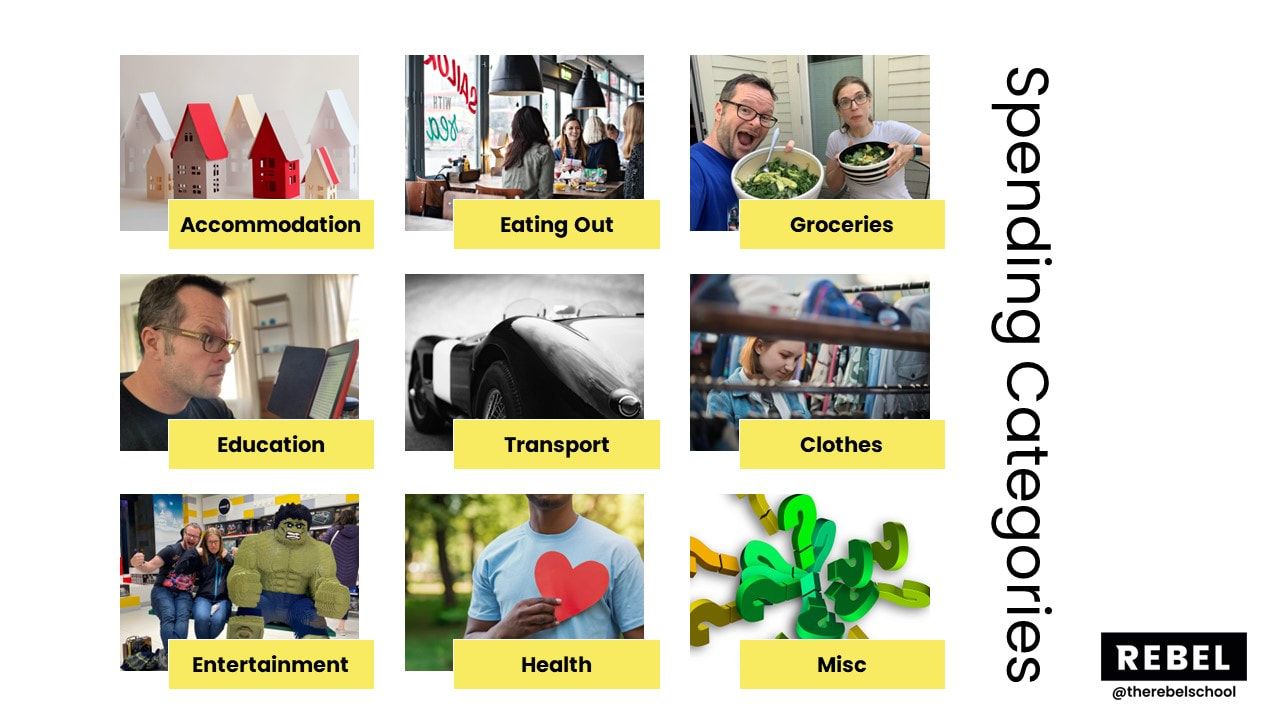

6. Categorise your spending for last month

For each item you bought/spent money on in the last month, categorise it so you can see what areas you're spending your money on. Money Dashboard has its own categories that you can use or you might like to come up with your own.

Choose categories that are meaningful to you. Don’t have more than 10 categories otherwise it becomes too detailed and hard to see what’s going on with your money! We had a friend who had over 30 categories and it was just too much and he spent longer categorising his spending than looking at what he could learn from where his money goes.

I've listed the ones we use below. Our categories are particular to our lifestyle and what we typically spend money on. By all means use ours as a starting point but you'll probably need to adapt them…

Choose categories that are meaningful to you. Don’t have more than 10 categories otherwise it becomes too detailed and hard to see what’s going on with your money! We had a friend who had over 30 categories and it was just too much and he spent longer categorising his spending than looking at what he could learn from where his money goes.

I've listed the ones we use below. Our categories are particular to our lifestyle and what we typically spend money on. By all means use ours as a starting point but you'll probably need to adapt them…

|

7. Did you get value from what you bought last month?

Look down the list of what you bought/spent money on. Did you get value from it? Was it a waste of money? No judgement here, just noticing and this is your chance to change things if you want to.

8. Did you spend in line with your values last month?

What do you value in life? What do you get joy from? Does the money you spend bring you joy? What brings you happiness that you could spend money on if you wanted to?

9. What’s the true cost of your habits?

Do you know how much your monthly and weekly habits are really costing you? Re-read the section “Weekly / monthly expenses - The true cost” above and apply to your own spending. We’re not telling you to cancel all fun, we’re asking you to check whether you’re getting value from what you’re doing. If the answer is yes, please continue to do it!

|

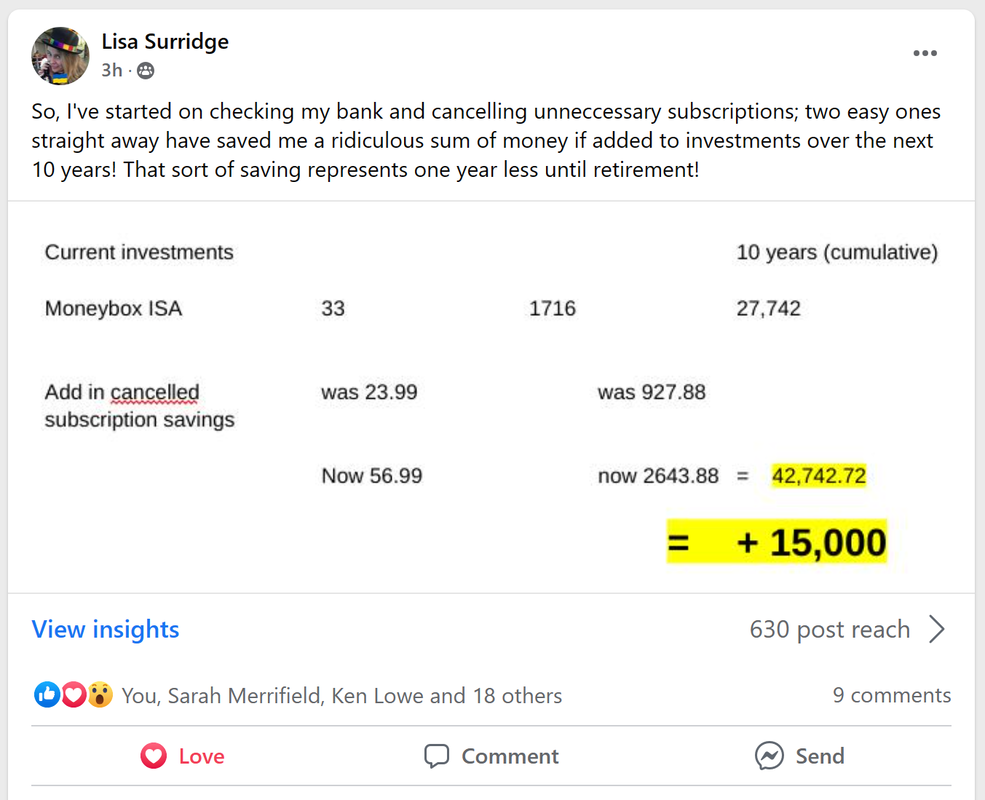

We had a fabulous post of someone doing this in the Facebook group after the course. We were so inspired!

They found little subscriptions that were eating away at their wealth and then used the rule of 194 and 840 to work out what they would have if they invested instead. It is incredible how this stuff adds up! Katie and I got inspired last night and remembered to cancel our FitBit premium membership before the free period ran out! |

Activity and discussion questions

So that you have them all in one place, here are the questions we discussed during week 1's call that will help you to think about your spending further.

Activity

Conscious spending

Monthly spending review questions

These are the questions we ask ourselves when we review our spending each month:

Activity

- Look up direct debits/standing orders in your banking app

- Look up regular payments on your credit cards

- Are they any you had forgotten about?

- Pick one. How much would it be worth after 10 years if you invested that money instead? (multiply by 840 weekly or 194 monthly)

- Are you getting value from your spending?

- Cancel one of your subscriptions now

Conscious spending

- What do you value?

- Are you spending on anything you don’t value?

- What spending brings you the most joy?

Monthly spending review questions

These are the questions we ask ourselves when we review our spending each month:

- Any surprises? Where are you spending more or less than you realised?

- Is your spending in line with your values?

- Where could you spend less if you wanted to?

- Where could you spend more if you wanted to?

- How big is your gap?

- How might you increase it next month?

How do I earn more?

It's not all about decreasing your spending, there are ways to increase your earnings which will increase your gap and make it easier for you to save and invest. Alan wrote a blog article covering 10 ways to increase your income. If you prefer to listen, he also recorded a podcast on the same topic.

Thinking of starting your own business or side-hustle to earn some more money? Check out Rebel Business School which teaches you how to start with NO money.

Thinking of starting your own business or side-hustle to earn some more money? Check out Rebel Business School which teaches you how to start with NO money.

Ask for help

Remember to reach out in the Facebook group with any questions you have or if you get stuck. Don't let confusion be an excuse for not progressing with this stuff. We are here to support you!