|

Back to Blog

Your relationship with money8/5/2020

Read on to work through your money relationship issues! If this scares you then remember changing your relationship with money will change your results with it...……..

Updated: 11th May 2021 What do you think about money?

Let's play the word association game right now. If I say the word money to you what words or phrases come to mind?

I am serious! Let's do this now. Before you read on, write down the top three things that come to mind when you think of the word money. ​ What comes to mind when you think about money?

This is going to show us a lot about your relationship to money and what you believe about it. I am always amazed when I do this exercise with people. They say words like:

​

What you associate to money is so important because if you think it is bad, evil or scuzzy then how are you going to react when it tries to come into your life? I went onto Facebook and asked my friends what words they associated with money and I got 106 responses! I have taken these words and turned them into a word cloud to illustrate their responses. One thing you need to know is that my friends are not indicative of the general population. Most of the people on my Facebook are old friends, friends from Rebel Business School events and then financial independence friends. So this is a VERY biased survey, but that doesn't mean it isn't interesting and informative. Here is the word cloud:

The words that came up the most were:

These are incredibly empowering and positive words and a lot of my friends have good associations with money. So when they think about money they think positive things. Some, however, do not! One friend wrote: Greed, Chains & Worry Wow, if that is what you think of when you think about money, then it is going to colour your decision-making and direction! Are you going to look after money when it shows up if you believe it shows greed? Or are you going to get rid of it as quickly as possible? Are you going to do the work needed to earn the money you need if you think it produces worry? The words you wrote down about money show a part of your relationship with it and what you associate to it. If you have bad associations and a bad relationship, this is going to affect your decisions over money, your actions, and ultimately your results with it! Stress, Worry, Greed, Panic, Shortage, Illusion, Envy, Fear, Evil, Regret, Sad, Never Enough, Dislike, The root of all EVIL!

These are some of the words that my friends associate with money. Do you think that believing money is the root of all evil will affect how you work with it, deal with it, and discuss it?

You had better believe it! If you want to improve your financial situation then the first step is to improve your relationship and associations with money. Freedom or Evil?

The words and phrases I associated with money have changed dramatically over the years. My youth is littered with painful experiences of lack and family fighting over money.

I was 18 years old. I had a job working for my dad in his warehouse and was earning around £450 a month. One night we went out for Chinese food at the local village restaurant with my mum. I always loved it there; the prawn toast was sensational. However, the conversation at the meal didn't go well. My dad and I argued over things, and I had this horrible feeling in my belly. He was struggling with money and his businesses were failing. I don't even remember what we argued about but there was a hideous atmosphere that fell over the table. I just wanted to leave, to run away, to escape. I felt trapped there and didn't want him to pay for the meal because it made me feel like I owed him something. I took out my wallet and a £20 note to pay for my share of the meal and gave it to my dad. He saw this as a huge insult, grabbed the money, and threw it in my face shouting at me. I ran out of the restaurant tears, streaming down my face. This memory is vivid even today and was one of the strongest memories I have about money and its impact on family. At that point in my life, it made me want to run away from money. I saw it as something that caused huge pain. My dad's businesses kept going bankrupt. Some days we would have money, some days we would be out doing a car boot sale (garage sale) to get money to be able to afford to buy food. I associated pain with money deep in my psyche. This was one of many bad experiences with money and how people behave around it that I used to create bad associations with money. Over the years different family members have stolen or tried to steal from our family, tried to rip us off, or worse. I am sure they did it out of lack, fear, or scarcity but they still did it and it changed my associations with money very quickly. It has taken me many years to get over this. How has your history coloured your relationship with money? Do you have negative associations with money because of your past? Because of family issues? Because of incidents with money?​ What is your current relationship with money?

The first step to healing is to understand where your current relationship has come from and then to make a conscious decision, as an adult, whether you accept these associations or beliefs. First you need to understand.

I have an exercise for you that really helped me to figure out a lot of my money beliefs. I want you to write a letter to money. Break out a pad and paper or your laptop and write to money. You might be thinking, "Alan, have you gone mad? Money isn't alive? Where do I send it?" Maybe I am mad, but try it, start writing, and see what comes out. You don't have to actually put a stamp on it and send it to money. This is a tool to help you uncover your beliefs and associations with money. Some examples I have seen and written myself are: "Dear Money, you always seem to leave me at the end of the month. I am not sure why you decide to flee the house and leave me high and dry every single month! How am I meant to rely on you being there?" "Dear Money, you have ripped my family apart. They are jealous and greedy and they try and fight to take you from me. They lie and steal and take you away. It seems as though there is NEVER enough to go around and we are fighting over you all the time." "Dear Money, there are so many things I want to do with you. To buy a new car together, to go on holiday and have fun, but you never seem to want to hang out with me for very long. Is it something I did? My parents told me you didn't grow on trees." What do you want to say to money? What would you write? ​The first stepping to changing the programming and associations you have with money is to understand them. I would love for you to write a letter to money and explore your relationship with it. Take out a piece of paper or your laptop and start writing now. You aren't responsible for the bad programming that came from your childhood, but you are 100% responsible for changing it as an adult

The first step to taking control of your relationship with money is to explore it as it currently exists. After you have done that you can start to think how you want it to change, how it could be healthier, and how you want to move forward.

If you never take the time to explore your existing relationship then how can you move forward and improve. it This is one of the first steps towards creating a positive and healthy financial philosophy. Blog Update

A lot has been happening on the blog, at Rebel Business School, and in my life too! I have a lot to share with you and an offer if you are interested.

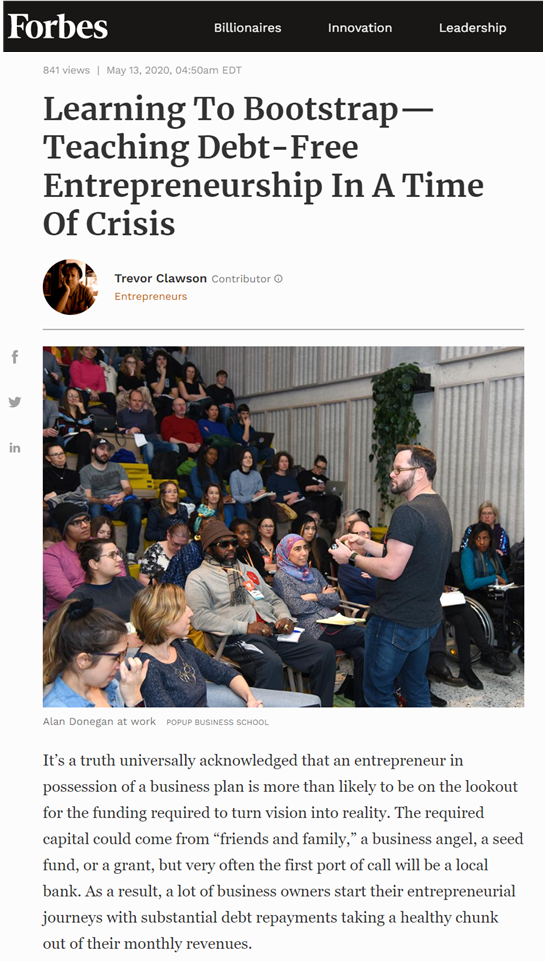

The third episode of Rebel Entrepreneur was released on Monday (18th May 2020) and I am so excited to share this episode with you. I get the opportunity to interview Katie and Andrew from Time Trap escape rooms who joined us at the Rebel​ in Reading 4 plus years ago! Their story is an incredible example of bootstrapping and starting without debt.

Katie and I have been building and launching the Rebel Finance School over the last few months. The first version was called Take Control of your Finances and we helped 150 people to take control of their money.

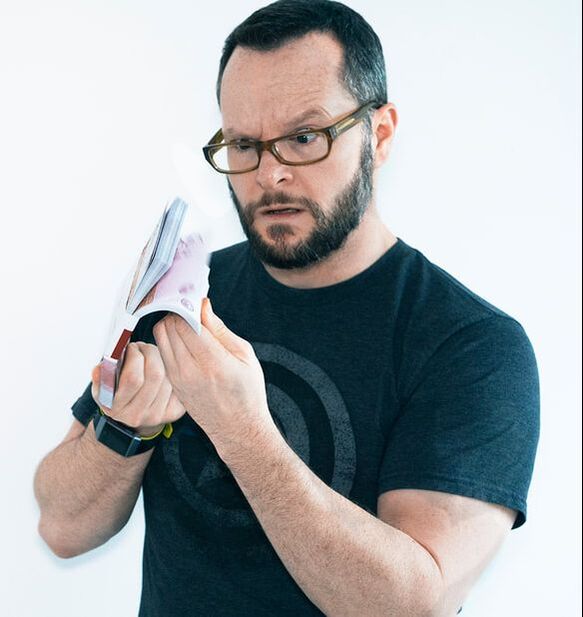

The second version of this, The Rebel Finance School, is running right now and we have 400 people joining us weekly to work through their finances, make progress, and to start investing for the future. If you want to join them then it is not too late (as of 11/05/2021) so visit the page for Rebel Finance School and sign up. The workshops are each Monday at 8pm UK time. Good luck with writing your letter to money. Be real, be raw, and let out your real emotions. No one is ever going to read this, you can burn it afterwards! Let out your real emotions. The first step to progress is acknowledging where you are right now. Please share the blog with people you think would find it valuable. Love ​Katie and Alan |

DONEGAN |

We built this website to share our stories, the adventures, the amazing people and all the life lessons we've learned along the way!

SIGN UP to our mailing list

|

RSS Feed

RSS Feed