|

Back to Blog

The system is out to get you....4/7/2021

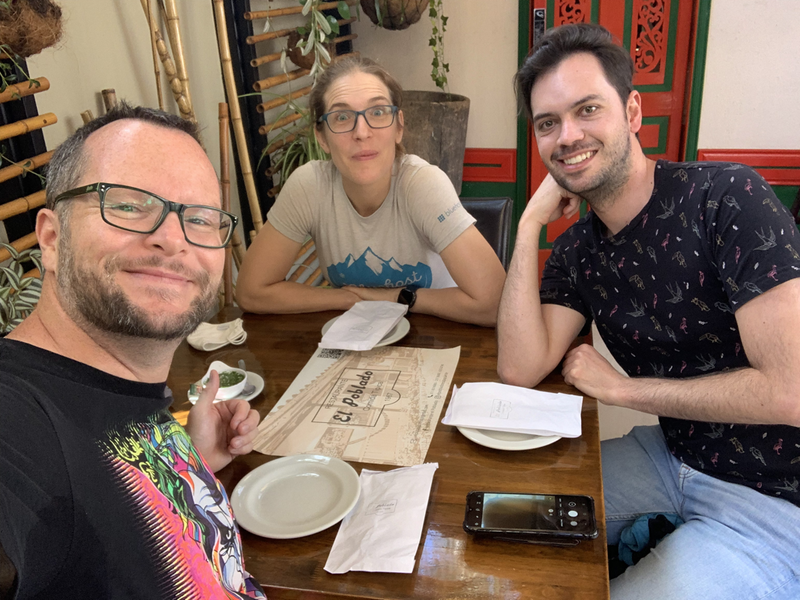

For years I have felt as though companies are working against me. They try and sell me insurances I don't need, give me credit when I can afford to buy it without it and try every trick under the sun to squeeze a few more £££s out of me at every single turn. But who can blame them? They are just trying to turn a profit aren't they? Or are there teams of the smartest people in the world working for multinational companies scheming how to increase profits, make products addictive and get more money out of you? The Colombian financial systemKatie and I are in Colombia at the moment helping to build Rebel Business School Colombia and eating all the Colombian food possible. We LOVE it here, Bogota is high in the Andes mountain range and the weather is an eternal spring, the sun shines and the prices are incredible. This past week we were out picking bits up from the local pharmacy. I was buying deodorant, soap and some other bits. We got to the check out to pay and this is how the conversation went. Please bear in mind my Spanish is actually pretty good. "Hola" (hello) "Hola" "Como quiere pagar?" (how would you like to pay) "Tarjeta por favor" (Card please) We put the card into the machine and the lady asked "Cuantas cuotas" I had no idea what this meant at all. So I asked. She tried to explain and I was still left blank and confused. Eventually she decided for me and said "1 cuota". I agreed as I needed the deodorant. This happened a few times over the next few days (even when we were having breakfast out!) until we met our Colombian friends and asked them what this means. "Cuantas cuotas?" means "How many instalments?" You can choose to spread anything you purchase out over instalments. You can choose as many as you like. So if you go out for a fancy breakfast you can chose to spread the payment over 36 cuotas/instalments or months. My head immediately said if you can't afford to buy breakfast out you should probably not be paying for it over 36 months or three years. I asked my friends if the companies charge interest or not. They looked at me as if I was an idiot and said "of course; 28% interest!" WOW. Imagine if you went to a breakfast place and they offered to spread the payments over 3 years at 28% interest. I would tell them where to go! If you spent £40 on a fancy breakfast out somewhere you would end up paying £60 back at that rate of interest! They have just managed to get 50% more out of you as a customer just by allowing you to spread the payments. This is crazy! This is all dressed up to make it look as though they are helping you, making it easy for you and in reality they are squeezing you for every single penny they can get out of you! If you can't afford breakfast out you shouldn't really be splitting it into 36 monthly instalments and paying interest! Cook in and save money! And do you know what makes this even worse. Our friends in Colombia say that some place you shop at don't even offer you the option they automatically set it to 36 months or 3 years of instalments. To me that sounds down right illegal! All credit cards do this.............I don't know why I am so angry at the Colombian system. At least they make the offer and it has a final deadline on it. Actually this is clearer than our system in the UK and the USA. In our countries when you buy something on a credit card they don't define how long or ask you cuantas cuotas? They allow you to put it on your credit card and then set it to minimum payments and continue to pay for decades! If you racked up a credit card bill of £10,000 on a credit card with an interest rate of 28%, it would take you 361 months to pay it off at minimum payments. That is 30 YEARS! And you would end up paying back £22,616 in total. Over double what you spend! I find this outrageous. The system is set up to put you into debtCompanies thrive and make huge profits through putting you into debt. They don't call it debt, they call it credit or financing. They make it sound sexy and as if they are helping you. The car industry makes more money out of the loans than they do selling you the car! The slower you pay off the money you spend and the higher the interest rate, the more money they make and the longer they keep you in servitude. The entire system is set up to put you into debt and then keep you there. The longer they keep you in debt the more they make out of you in the long term. This might sound shocking but it is just good business. Businesses want to make it as easy as possible for you to borrow, to purchase and to spend. The more you spend; the better. The system is literally designed to work against you because the people that designed the system are the companies, the banks and the financial institutions. They designed the system to work in their favour not yours. Wouldn't you if you were them?? How to stack the system in your favour.....It is not all doom and gloom there are plenty of ways you can stack the deck in your favour. Here are some of my favourite:

Most people's strategy for managing their finances is to stick their head in the sand and hope that it will all turn out ok by retirement. This is CRAZY. Don't just hope for the best, don't just wait to see how it is going to turn out, take control of your finances and learn to play the system that is set up to try and place you in debt. The system is set up to work against you but you can learn to play the system and come out on top. Katie and I reached financial independence 26 years before the normal retirement age in the UK. If we can figure this out, with a little help you can too. Thank you for reading and being part of the gang. Katie and I want to you to take charge of your finances and start to build an incredible future for yourself. We will be running another Rebel Finance School again and if you want to find out the date join the mailing list at the bottom of this page and we will tell you once we figure it out. The purpose of this article is top help you work to being in the half of the population that is actually good with their money. Just knowing of these tactics and how to protect yourself against them is going to have a tremendous impact on your financial future. Just start by avoiding debt, interest and sales and start to invest instead. Love Katie and Alan |

DONEGAN |

We built this website to share our stories, the adventures, the amazing people and all the life lessons we've learned along the way!

SIGN UP to our mailing list

|

RSS Feed

RSS Feed