|

Back to Blog

This article was first published on 4th February 2019. It was updated on 8th September 2020 and then again on 1st June 2021.

What can you actually invest in?

There are so many different things you can "invest in". Some of them are actual investments that provide a solid return on investment and some of them are just gambling. How do you know the difference and where should you put your money?

After reading Rich Dad, Poor Dad I knew that I wanted to buy assets that produced a return and I knew I wanted to buy my time back. Kiyosaki talks at length in the book about property investment. When I was 20 years old my dad persuaded me to invest in the stock market and I lost my life savings! This put me off investing in stocks and shares for the next 14 years. My strategy after reading Rich Dad, Poor Dad was to buy entirely investment properties. Oh how things have changed! Let's look at the options and discuss each one a little bit (read the disclaimer at the bottom of the article as well please as I am NOT an investment advisor! I am just sharing my experiences!) Property

Illiquid versus liquid

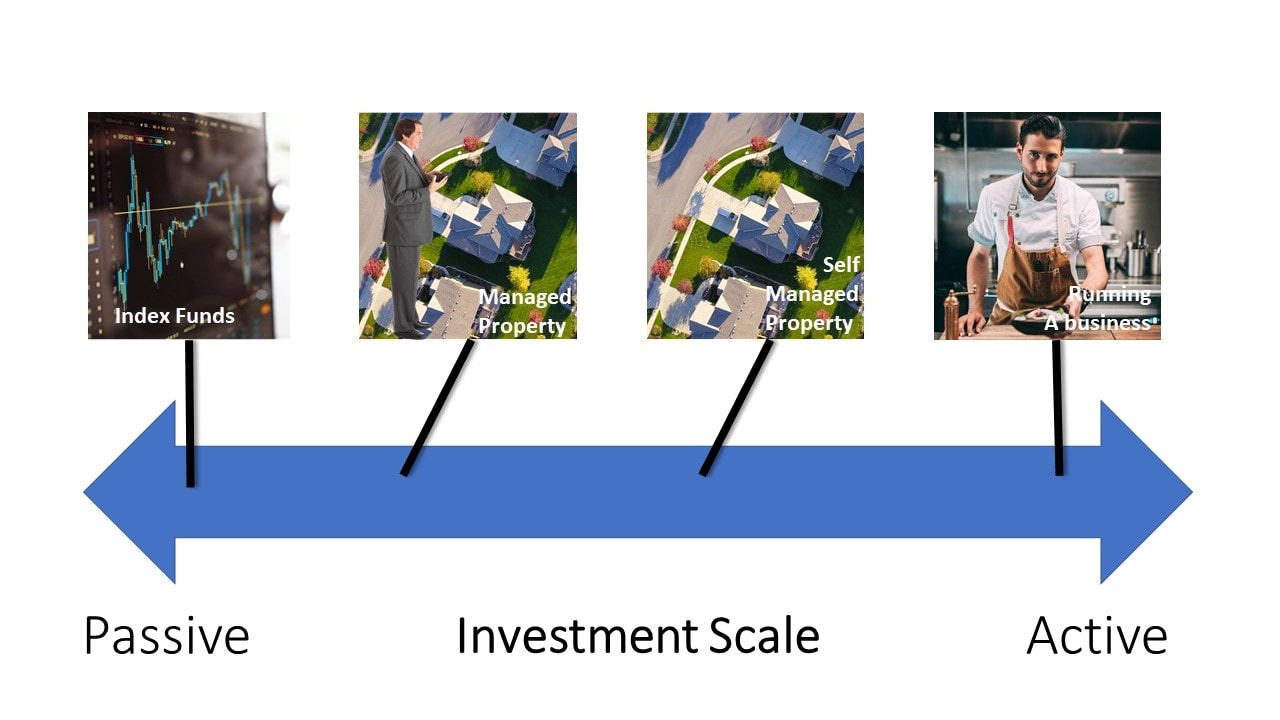

Property is an illiquid asset. What I mean by that is when you buy an investment property you have a lot of money tied up in it and if you want to sell it then it is going to take a while to get that money out. The money is not very liquid and easily accessed. ​Katie and I are experiencing this with a depressed property market at the moment (June 2021) and trying to sell our investment properties. We have had them on the market for some time with no viable offers. We can't get our equity out of the investments easily. Units of 1 Property is binary if you are individually investing. You have to save and buy in units of one. You can't really buy £10 or £20 of a house. When you buy an investment property you are going all in and buying an entire property for £100,000+. This is why it took Katie and me so long to buy our first investment properties. We saved up a deposit of £50,000 and spent so long scouring the market for a bargain! Easy to understand Property is a lot easier to understand than a lot of the other asset classes because we have all lived in or rented one. This makes it easier to understand the economics of capital appreciation (how much the house goes up by) and rent each month. I think a lot of investors (Katie and me included) start here because we don't understand stocks and shares! Leverage When you buy a property, most people do it with a mortgage. This means you are leveraging your money with the bank's/building society's finance. Our first investment property cost £104,000 in total and we put down a £25,000 deposit. So we had leveraged for £79,000. Leverage is a double-edged sword. If the property price goes up you see all the profit and if it goes down you see all that downside! We can explore the ins and outs of leverage in another article. Other ways to invest in property Real Estate Investment Trusts (REITs) are another way to invest in property without buying an entire property. You buy a share of the REIT with other investors and then you own a small percentage of the properties that the REIT holds, and get a return on that percentage. This is a way to invest without having to build up an entire house deposit to do it yourself. Your own home In my opinion the home you live in is NOT an investment or asset because it costs you money every month. I do not see the flat I live in as an investment because it has a lot of my money tied up in it and it is costing me money every single month (mortgage, maintenance, heat, light, power etc). You can turn the home you live in into an asset by renting out a room, converting the outhouse into an Airbnb and generating an income from it. Then it is generating an income for you, not just costing you money! Passive versus active A lot of people talk about property as a passive income source. In my opinion, property is not a completely passive investment. It is more of a business. Imagine a scale from passive (doing nothing and collecting the money!) to full time activity working 8 hours a day. On the full time activity end of the scale is starting a business, which takes a massive amount of energy, and on the other end of the scale is index investing (see below). Property is somewhere in the middle. We didn't want to pay the estate agent management fees and lose 10% of our rental income so we manage our 3 properties ourselves, which means we do a bit more of the work and collect a bit more of the profit. Last night, our tenant messaged us to say that they are having a problem with their tap and I need to go and fix it (this is not completely passive!) You can make your property investments more passive by having managers but you have to pay them and this reduces your profitability or return.

Alan & Katie's strategy

We currently own 3 flats in Basingstoke that are rented out. We manage them ourselves and rent them out ourselves. They provide a rent return each month and have been a good investment. We are currently working to sell our investment properties as they are more difficult to manage whilst we are globetrotting! We bought both these flats before I understood stocks and shares. When we sell the properties we are going to take the equity out and invest it into low-cost Vanguard index funds That was a lot about property! Next up, stocks and shares! Stocks and Shares

Way back when I was 20 years old, my dad was investing some of his money. He got his financial advisor to come around. He showed up at our house in his flashy convertible car and slick suit and persuaded my dad and me to put our savings into a high-tech, high-growth managed fund that had been performing with good returns for several years. I had £7,000, which was my entire life savings at that point. It was enough for a house deposit so I was choosing between buying a house and investing in stocks and shares.

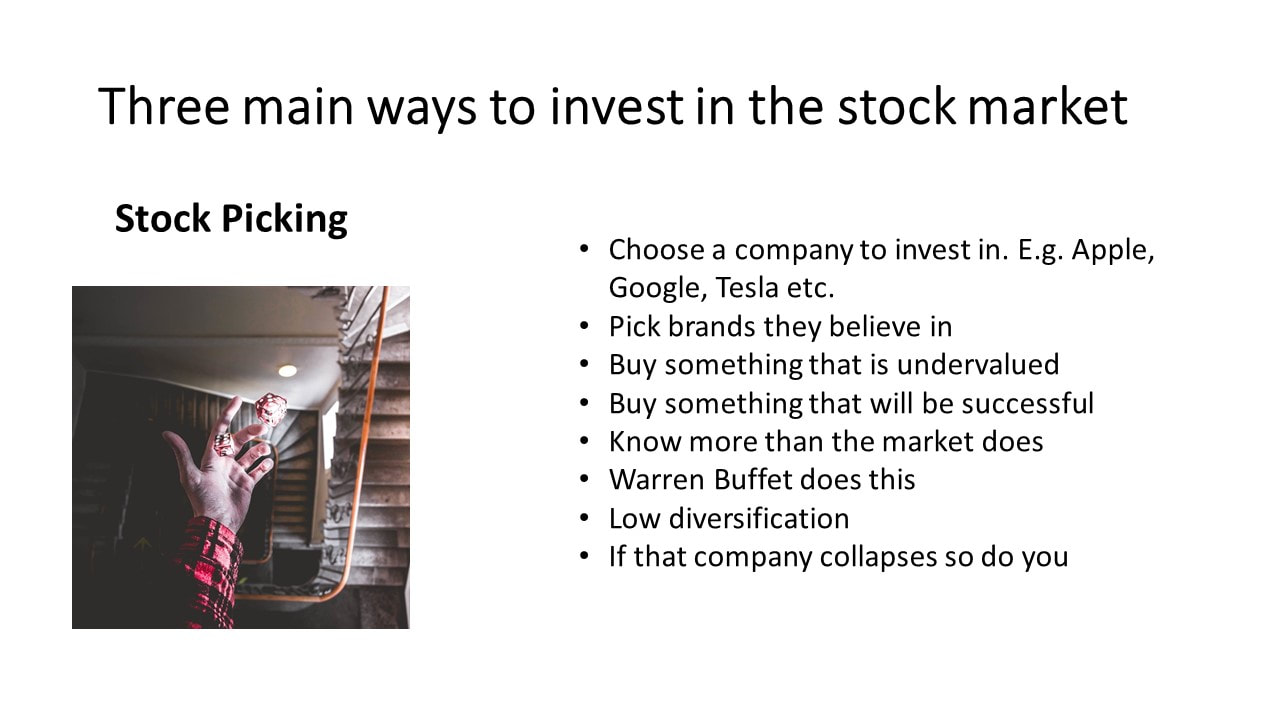

I invested in the stocks and then a few months later the 2001 stock market crash dot com bubble hit and my fund went from being worth £7,000 all the way down to £1,200. I lost nearly all my life savings. I want to swear about it now just thinking about it. I eventually sold the fund five years later for £1,400. It never recovered. This experience put me off investing in stocks and shares ever again. I was firmly in the camp of DON'T DO IT! My mum was also afraid of investing in the stock market as my dad had lost huge amounts of money doing it. This all changed when I started to invest in my education. I read many books, blogs, and listened to podcasts on investing. There are three ways you can invest in stocks and shares: 1. Pick individual stocks and shares This is where you pick a company you like the look of and invest your money in that business. So you might say that you think Apple or Google is going to do well in the future and you invest your money in that business. This is risky as any business might fail and you could lose all your money. ​Many people pick stocks that they believe in (because they own the product and believe in the cause) or that they think are going to perform well. They are taking a risk that the stock will continue to do well and grow in value. I have realised I am not well enough read and not willing to invest the time to learn which stocks and shares to pick so I don't do this. In my opinion this is a very risky investment strategy.

2. Actively managed funds.

This is where you might say, "I am not clever enough to pick stocks and shares so I am going to hire someone to do it for me". You pick a fund that has a fund manager with a good track record and then they invest your money for you into different stocks and shares. In return for this the fund manager gets a percentage of your money, normally between 1-3%, and they get paid this no matter whether the fund goes up or down. So they get paid even if you lose money. Sounding good? This is the option that the financial advisor and my dad persuaded me to pick. According to the book Money: Master the Game by Tony Robbins, 96% of these funds fail to out perform the market. They sell you the dream that they will get you better results than everyone else but in 96% of instances they fail to do so! Side note: Don't read Money Master the Game, it is way too long and overcomplicated. If you want a concise book that explains how to invest, I recommend JL Collins' Simple Path to Wealth (this is an affiliate link; I will get a small commission if you buy this book at no extra cost to you!). Also, you don't need to buy his book! All of the information is available for free on JL's website. Check out his stock series of articles. Active fund managers sell you on the fact that they can pick the best stocks and outperform the market. The reality is that there is hardly anyone in the world that can actually outperform the market!

3. Index funds

Index funds were created by Jack Bogle as a way of investing your money across the whole market. Jack was on a mission to allow the average investor to participate in a fair share of market returns. When you buy an index fund they don't pick stocks, they buy a small percentage of everything in that index or market. So you get a small percentage of Apple, Google, Nike and all 3600 companies floated on the American market or whichever market you choose. Because no one is actively picking stocks or moving money around, Vanguard index funds have very low fees associated with them. For example, the Vanguard Index funds can have fees as low as 0.05% in the UK to invest with them. This is certainly cheaper than the 1-3% actively managed funds charge you! Katie and Alan's strategy Our strategy is to invest in Vanguard index funds. Nearly all our money is invested in the global developed world index fund with Vanguard. I have realised that I am not smart enough to pick stocks and shares and neither are most fund managers so I don't bother and I just track the market. ​ It turns out that average returns aren't average! Katie and I wrote a series of articles to explain index investing. The first article covers diversification and builds from there.

Learn more before investing

Investing is a complex subject and you need to do your homework and research before jumping in. Start to learn and expand your financial vocabulary. Most of what I have learned about investing in the stock market has come from two main books.

You can start investing from £100 a month with Vanguard and even lower with other companies. You don't need to save a fortune to invest, you can start small and build. I am going to write more about how to save and invest later but for now you can get going with very little.

Please AVOID investing if you have debt, haven't saved an emergency fund, or taken control of your finances first. As JL Collins likes to say, "The market does the optimum thing to embarrass the largest number of people at any point!" If you don't know what you are doing, investing can be very painful. Investments can AND DO go up and down and you have a chance that you will lose your money as well as gain. ​This next bit is not a recommendation, it is just a statement of fact about my strategy for investing and what I do. All I am reporting is what I do with my savings. I buy one index fund mainly and it is: Vanguard FTSE Developed World (ex UK) equity index fund - accumulation This is a global fund of stocks and shares from all the developed countries around the world. I buy the accumulation fund so the dividends it pays are rolled back in because I want it to keep growing. Check out the series of articles Katie and I wrote together about index investing. Business

You can invest your time and energy in starting your own business. This is the least passive investment of all and creates you a second full-time job, especially when you first start.

You could also invest in a start-up company that you find. I think this is highly risky as the national average survival rate for start-ups in the UK is 53.7%. This means the business you pick has a 50/50 chance of surviving 3 years. ​Not a risk I am willing to take at the moment. Gold and other stuff like that

You could invest in gold or other natural resources. This is an option but I don't know enough about it to talk coherently. So I am going to leave it there and say it is an area that we do not invest in and makes me feel particularly nervous.

Cryptocurrency and other things.....

A lot of people are very excited about this at the moment and it has the promise of huge returns. Every time I hear about it at the moment it makes me feel like it is a scam, especially the people plugging it as an investment.

In addition to my own blog post, one of the best articles I have seen on investing in cryptocurrency and why you should avoid it at the moment is by Mr Money Mustache. Cash in the Bank

Cash in the bank is a devaluing asset. Inflation is higher than the interest you get in most bank accounts. So every year you leave your money in the bank it has less buying power than it did before.

By leaving your money in the bank it is devaluing every year. This is a safe place to put your money but it is not an investment that will provide good returns. Summary

There are so many different ways to get started investing and that makes it overwhelming for most people (including me for many, many, many years!)

These investments are also covered in warnings (as they should be) saying that you might lose all your money! If that doesn't put a few people off then I don't know what will! It took many years for Katie and me to come up with our investing strategy, which is currently buying and holding Vanguard index funds. We take what money we can save and we put it in ISAs, SIPPs and taxable accounts to buy Vanguard index funds. Our strategy comes from JL Collins and his book The Simple Path to Wealth. JL, thank you for your amazing teachings and information; you changed our lives. We have written some articles on how to actually choose which place to invest your money in and the practical steps. Sign up below to my mailing list to be informed of new articles, courses and opportunities. I think the key to getting started in investing is to keep it simple and take the small steps you can each month. When I started I was overwhelmed by trying to learning everything. It wasn't until I read JL's book The Simple Path to Wealth that is really clicked and I started to make massive progress. Keep it simple, keep it low risk, keep it diversified, and GET ON WITH IT! Please write me a comment below as I would LOVE your questions and thoughts. I will add to this article and edit it based on what you think and your questions. Please do let me know what you think...……... Disclaimer: Shit happens

I am sharing with you what I have learned about investing over the last 10 years I have been actively involved in the game. It is important to remember that investments might go up as well as down and your money is at risk with nearly all of these. You can lose all your money investing, and it has happened to me and my family. This is not something you get involved in lightly without doing your own research. I don't want you to trust me, I want you to go out and do your own homework. This article is meant to inspire conversation and get you started on the journey to investing wisely.

When choosing which of these investments to go with, there is a lot to consider including the timeframe you are investing for. Please think through all these different things before diving in. I am going to develop more guides over the coming months. Next Steps

Where do we go from here?​

My aim is to help you get to financial independence and create your own passive income. I want to help you buy back your time so you can do whatever you want with your life. This is a big mission and we will get there one step at a time. Let me know your thoughts below. ​Alan |

DONEGAN |

We built this website to share our stories, the adventures, the amazing people and all the life lessons we've learned along the way!

SIGN UP to our mailing list

|

RSS Feed

RSS Feed