|

Back to Blog

Guide to ESG Index funds29/5/2023

Sounds like a good idea but my biggest concern is that this leads to stock picking and therefore worse performance (profit for us) over time. Katie and I wanted to dig into my preconceived notions and ideas to find out the truth behind ESG funds and all the hype that surrounds them!

Do the Donegans invest in ESG funds?

The simple answer is, no. At the time of writing this article we don't invest in ESG funds, we invest in the straight forwards global index fund (Vanguard FTSE Developed World EX UK Index Fund)

The reason for this is that when we were learning about investing we learnt from two main sources, Tony Robbins and JL Collins. Both recommend straight forward index funds and JL Collins says that ESG funds are stock picking and that is why he doesn't invest in them. So we copied and just picked the "regular" fund. Yes the Donegans are very good at finding a strategy and following it! Since then we have been running the Rebel Finance School courses and have done a deep dive into the research on index funds to better understand them. YouTube video accompaniment

Stock picking versus index investing

I am fundamentally against stock picking. My family has done it with disastrous results, I have watched people lose fortunes and screw up their financial futures. Every time I have tried to pick stocks or time the market I have failed miserably.

I was put off investing in the stock market for nearly 15 years because my father persuaded me to invest my life savings in an actively managed, high tech, high growth fund which lost nearly all its value after the dotcom crash and never recovered! An actively managed fund is someone else stock picking for you. It is an expensive type of stock picking. As you can tell I am pretty against stock picking and actively managed funds. Instead we learnt to Index invest after reading JL Collin's book the Simple Path to Wealth. Index investing is where you don't pick shares but buy a tiny slice of every company in the market. Want to know "what is an index fund?" Start Here. We have written a whole series of articles explaining index investing and I suggest reading those articles first because this article builds on them! The idea behind this article is to explore what an ESG fund is, whether they are a good place to invest your money and to see if my biases against them are unfounded or not! My hope is that after reading this article you will have enough information for you to make up your own mind on ESG funds and be able to decide if you want to choose a standard index fund or an ESG variant. Here are my assumptions about ESG index funds before writing this article:

As you can probably tell I am not the biggest fan of these funds currently. A biased start to the article. However I am open to changing my mind based on data and information. Show me the data baby! Katie my gorgeous wife, sat opposite me now, is a true data geek. She got super excited about this article and is researching ESG funds as we speak. So let's get geeky on the data and see what we find! What actually is an ESG fund?

My assumption is that it is one of the broad based index funds like the FTSE Global All Cap Index Fund but with a whole bunch of companies stripped out.

When you log onto the Vanguard website to have a look for index funds you see a whole bunch of different funds.

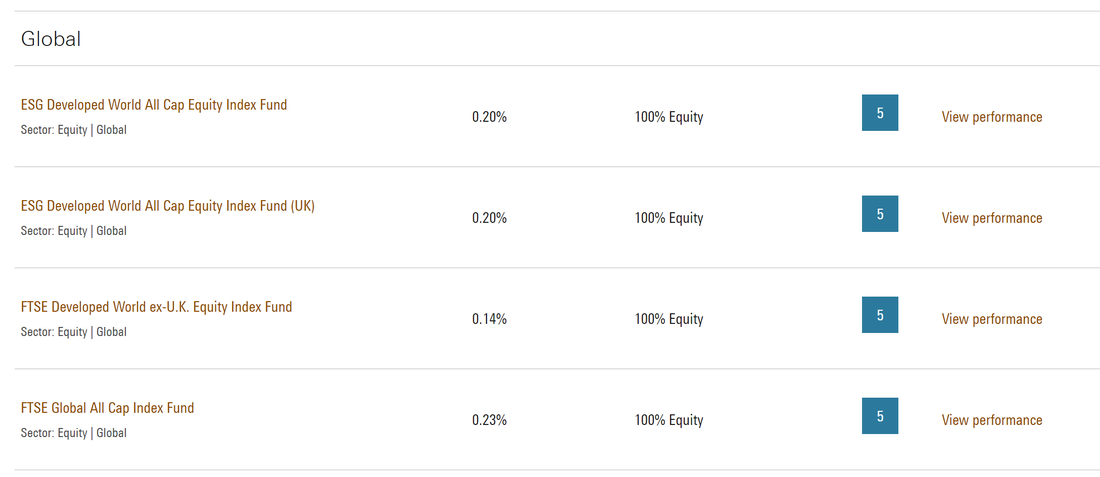

There are five different global funds on the Vanguard website. Here are the top four. There are two ESG funds and two standard index funds.

For the sake of simplicity we will call non-ESG funds "standard" funds. Annoyingly the top two appear to be exactly the same. Vanguard "why do you have to make this complex for us?" So annoying! We're thinking of writing an article about these two funds at some point! Watch this space Then there are two other funds, the FTSE Developed World ex.UK and the FTSE Global All Cap Index fund. Katie and I did a comparison of these two funds here. There isn't an ESG Global fund on the Vanguard site. You would have to build that yourself by picking one of the ESG funds above and then adding in ESG emerging markets. The first thing I noticed is the expense ratio is slightly higher for the ESG funds. The ESG fund has an expense ratio (the percentage you pay each year for the management of the fund) of 0.2% whereas the standard index fund has an expense ratio of 0.14%. This is a slight black mark against the ESG fund although when you are talking this level of fees, 0.06% is not going to make a huge difference over time. If you truly believe that the ESG fund is doing good in the world then this is a cost you might be glad to pay. Read this article if you want to understand the impact of fees on your portfolio over time. In total on the Vanguard website there are three ESG funds. The two you see above which appear at an initial glance to be the same and an Emerging Market ESG fund. Back to the question what actually is an ESG fund? This is how Vanguard describes it "The Fund promotes environmental and social characteristics by excluding companies from its portfolio based on the impact of their conduct or products on society and/or the environment."

Sounds like my assumption is correct so far. They take the original index, look through and remove a bunch of companies based on certain criteria.

How do they choose what to remove from the index?

What actually is an ESG company? How do the creators of the indexes actually chose which companies live up to the standards that they set or not? What are the criteria for choosing?

Katie here! Hi! Turns out it isn't Vanguard that chooses which companies to exclude from the ESG funds. All Vanguard funds (both standard funds and ESG funds) are constructed based on an underlying benchmark index. The Vanguard funds aim to track these benchmarks as closely as possible. There are companies that provide the benchmark indexes to Vanguard. These benchmark providers work out which companies to include in the standard and ESG benchmark indexes. The two main benchmark index providers are FTSE (Financial Time Stock Exchange) and MSCI (Morgan Stanley Capital International). More on this further down. Keep reading! Let's stick with FTSE for now. So FTSE are the ones that tell Vanguard which companies to include in their funds. And they are the ones that have excluded some companies from the ESG benchmark funds. FTSE exclude companies based on the products/services they provide and the conduct of the company. Companies that provide the following products/services are removed from the index:

Companies that don't conduct themselves well in the following areas are removed from the index:

Of course this second list could be considered quite subjective so FTSE has a detailed document you can download if you're interested in more detail as to how they choose which companies to exclude. A further twist in the story is that not all of the ESG benchmarks exclude all of the categories. The ESG benchmark funds that are available in the UK do not have companies removed based on board diversity and equal opportunities practices. FTSE apply the above criteria to create a list of companies that fit this profile. This is the list or index that then Vanguard base their fund on and then Vanguard try to mirror this as closely as possible. This is how you end up with the index funds that we buy! What is the difference between the standard index and the ESG index?

The challenge we have at this point is you can't directly compare the Vanguard standard funds with the Vanguard ESG funds on the Vanguard site because they are all built on slightly different underlying benchmark funds. This is SUPER frustrating and annoying and is one of these "Why can't you make this simple, financial industry?" moments.

For example there is no ESG Global All Cap Index fund. You can buy the standard version but you can't buy a ESG version of this. There are all different funds from Developed world, Global to Emerging Markets. Developed world funds We wanted to be able to compare an ESG developed world fund with a standard developed world fund. But this isn't possible! The ESG developed world fund (ESG Developed World All Cap Equity Index Fund) includes small companies and companies in the UK whereas the standard developed world fund (FTSE Developed world ex UK) doesn't include either of these. Oh and to further complicate things, and as already mentioned, there's two versions of the ESG Developed World All Cap Equity Index Fund. One has (UK) written after it in the fund name and one doesn't. Confusing! We might write an article about this at some point in the future. Watch this space! Global funds There is a standard fund called FTSE Global All Cap Index fund but there's no ESG global fund available. (Side note: there is an ETF ESG global fund available but we're just looking at index funds here) Emerging funds We got excited when we looked at the standard and ESG emerging markets funds! Looks like Vanguard has a standard and ESG version so we can compare those and understand the differences! YAY! Hang on a minute! When we started to compare the two emerging markets funds we realised that the emerging markets ESG fund has MORE companies. WTAF

This is the exact opposite of what we both assumed about ESG and standard funds. How can the ESG fund have more companies within it? We thought an ESG fund was a standard index fund with a bunch of companies removed!

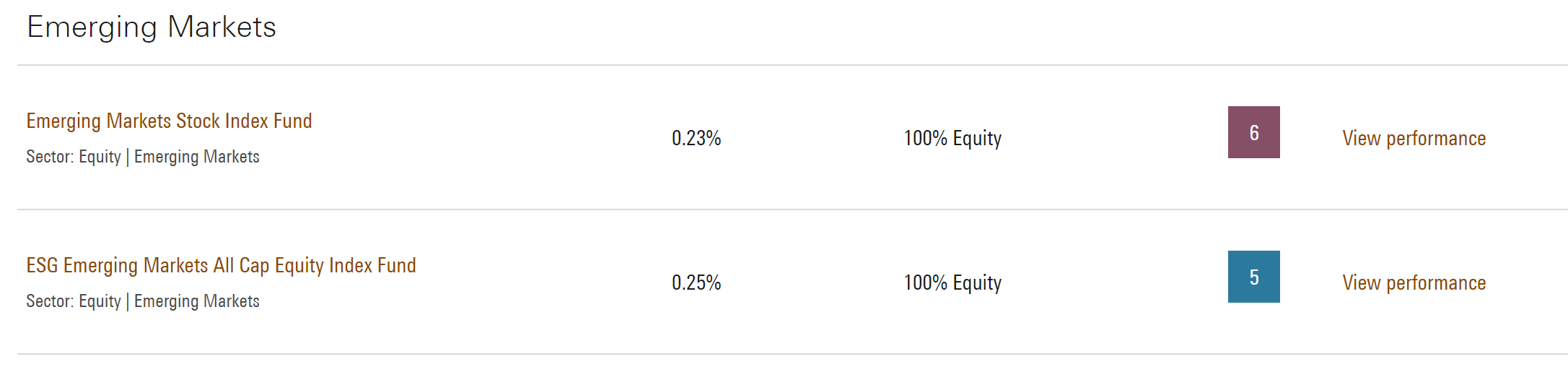

Here are the two emerging market index funds available from Vanguard. As at 30th June 2021, the standard index had 1,437 stocks included in it and the ESG version had 2,974 stocks in it. How can this be? What happened?

After two days of wandering round Mexico in a daze Katie had a thought "I wonder if they are based on different benchmark funds!?"

Alan didn't see Katie for two days afterwards as she went down a rabbit hole of working out how Vanguard decides what goes in the indexes and what are they all based on! Whilst Katie was off doing that I sat here pondering why this stuff has to be so complex. My answer is that if it is this complex then you probably need to pay for an advisor. The financial industry does not benefit from transparency and simplicity. How does Vanguard decide what goes in the indexes?

Vanguard actually uses two different benchmark index providers to work out what they are going to put into their index funds! Why; oh why Vanguard could you not have picked one to make it simpler?

The two they use are FTSE and MSCI. FTSE International Limited trading as FTSE Russell (/ˈfʊtsi/) is a British provider of stock market indices and associated data services, wholly owned by the London Stock Exchange (LSE) and operating from premises in Canary Wharf, London. and MSCI Inc. (formerly Morgan Stanley Capital International and MSCI Barra), is an American finance company headquartered in New York City and serving as a global provider of equity, fixed income, hedge fund stock market indexes, multi-asset portfolio analysis tools and ESG products. It publishes the MSCI BRIC, MSCI World and MSCI EAFE Indexes. This is why there are different numbers of companies in the two Emerging Market funds. The standard fund is based on the MSCI benchmark and the ESG fund is based on the FTSE benchmark. I don't know about you but this is the point where I start to wonder why this can't be simpler and easier. Actually I was already at the point of "Why can't this be simpler just looking at the fund pages!" lol. To get to this point in our understanding has taken months or research and effort. Anyway let's keep going.......... FTSE versus MSCI differences Are Poland and Korea emerging countries? In Katie's research she discovered that even at a country level the two different benchmark indexes treat countries differently. FTSE says that Poland and South Korea are developed countries and MSCI says they are emerging markets. They can't even agree on what a developed country versus an emerging market country is! For more on the difference between developed countries and emerging markets, Katie and I have written and researched an article for you entitled "How Global is your Global Index Fund?" Who decides all this stuff? There are so many decisions made at different levels before you even get to decide which index fund you are going to buy. The index fund benchmark (FTSE or MSCI) have decided which countries and which companies go into their bench mark in the first place. Then Vanguard or your index fund provider takes those lists and makes some decisions on how to mirror the benchmark and what to take out and then which of these indexes they are going to offer to you and then right at the end you have to decide which one you are going to buy! Is this stock picking at a super high level? It feels like it to me. Right at the very top, FTSE and MSCI, are making decisions about what countries, companies and indexes should be included in the indexes. How are indexes created?

This sent Katie down a further rabbit hole of researching how benchmark indexes are created. It gets super technical very quickly! I lost for her for another week as she was buried in technical documents explaining how they're constructed and trying to decipher it and make it easy to explain to other people. Imagine a movie montage scene where the genius is researching and there is paper, laptops and more everywhere! We have put some effort into this article!

At a high level this is how the FTSE benchmark indexes are constructed:

Phew that was intense. Well done for reading this far! I hear you asking about market cap now! Well we have written another article for you! What is small cap, mid cap, large cap? Now that we have all the companies included in the benchmark they are listed in order of size and the top 70% are "large cap", the next 20% are "mid cap" and the final 10% are "small cap". It was only when Katie started looking in detail at the funds and the benchmarks that we realised that our FTSE Developed World ex UK only includes mid cap and large cap companies. It doesn't include small cap. This got us thinking how do they decide what goes in and what doesn't? It is super complex to actually understand what you are investing in! We didn't actually completely know what our fund was when we invested; but this didn't stop us doing it anyway and making a lot of money on the way. What is the difference between an ESG fund and a Standard fund?

I know you've been waiting to see some charts! Here they come...

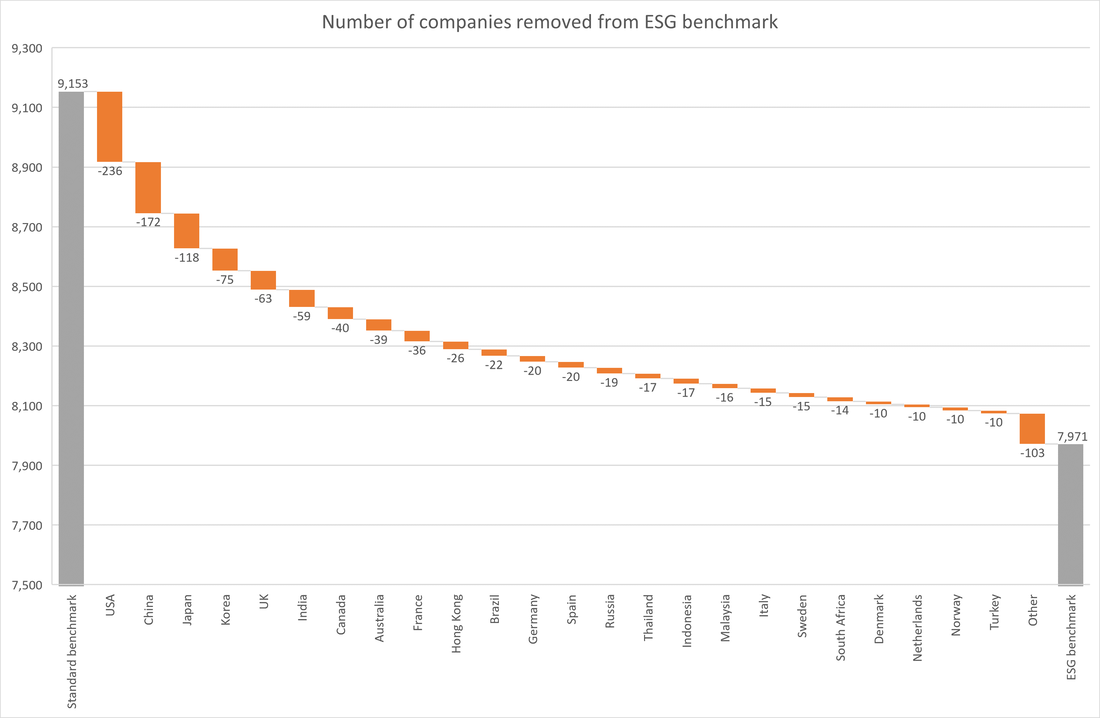

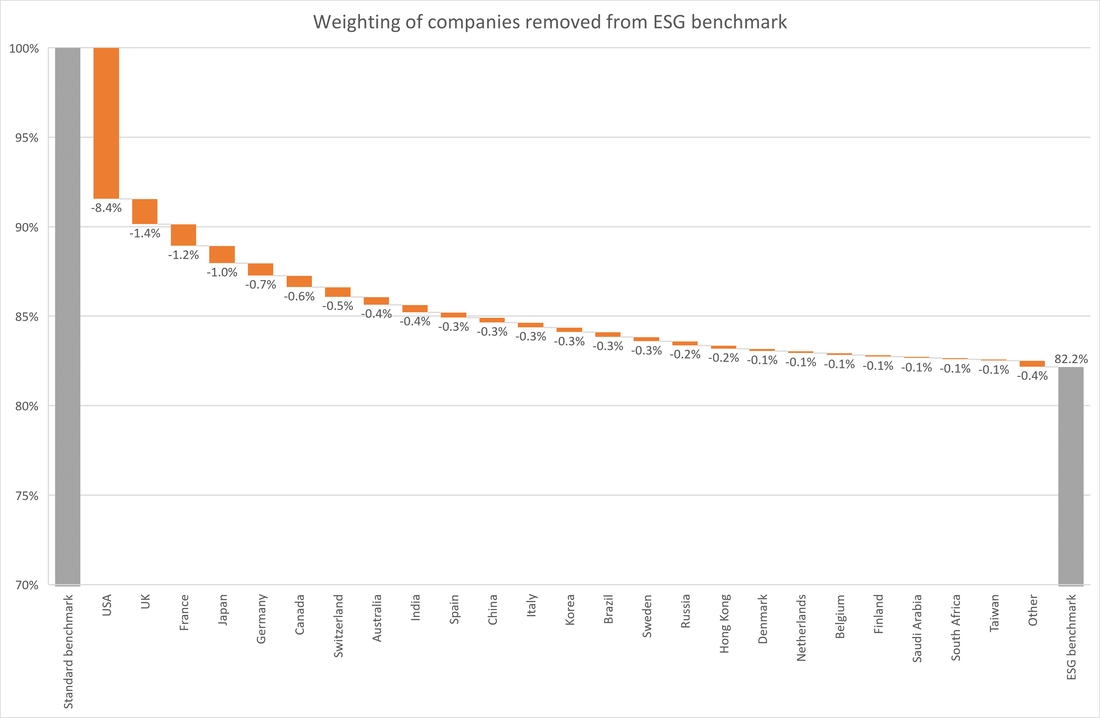

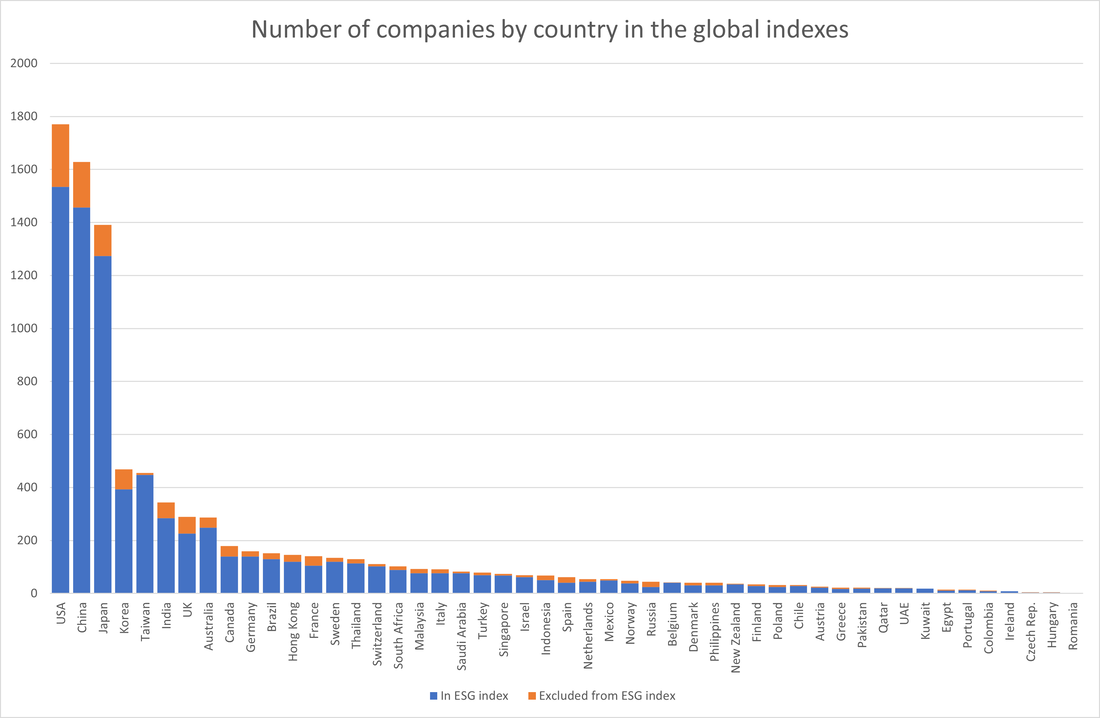

To understand the differences between the standard fund and the ESG fund Katie has analysed the global benchmark funds as provided to Vanguard by FTSE. She found that in the standard global benchmark there are 9,153 companies. Then 1,182 companies are removed to arrive at the ESG global benchmark. That's 13% of companies being removed. Sounds like a lot! The graph below shows the number of companies removed by country. You start at the left with the total number in the standard benchmark and then each orange bar is taken away until you get to the ESG benchmark in grey on the right.

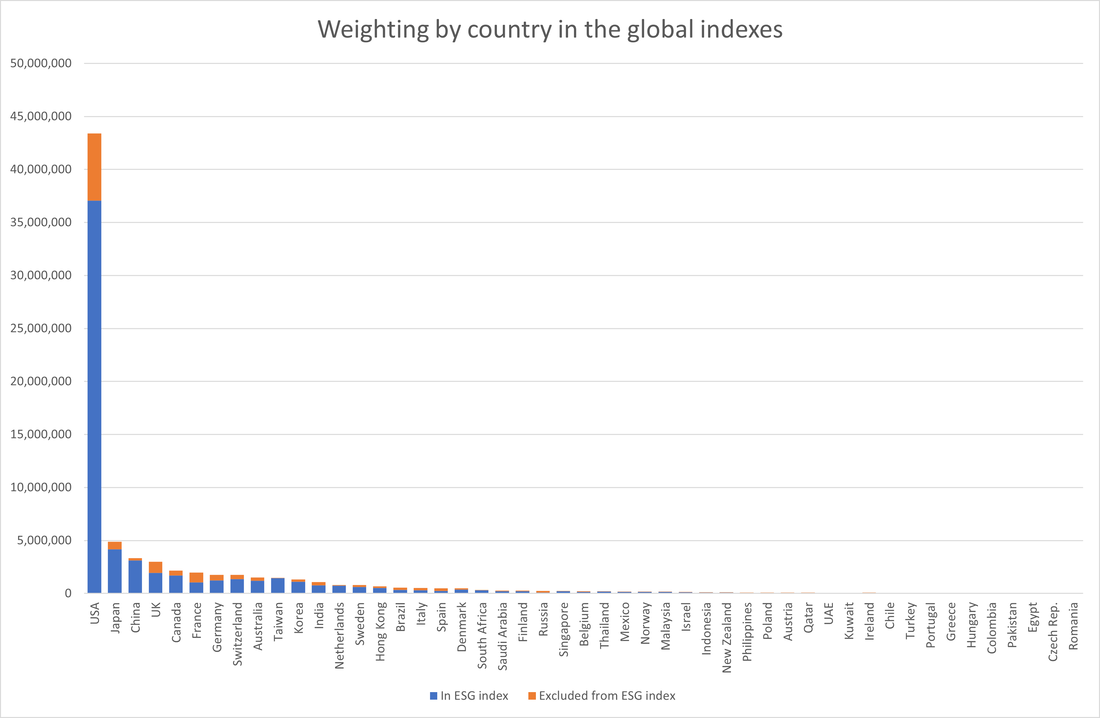

Looking at the number of companies doesn't tell the whole story because not all companies are weighted equally in the index. Overall nearly 18% of companies are removed based on their weighting. 18% feels a lot of companies to be removing! This means that FTSE thinks that 18% of the companies we can invest in through the standard benchmark are not ethical, sustainable or well governed. Let's look at a similar chart but based on the company's weighting in the index rather than just the number of companies to illustrate this.

You can see that 8.4% of the companies in the USA by weight are removed from the index; then 1.4% from the UK and on.

Who are the naughty boys and girls?

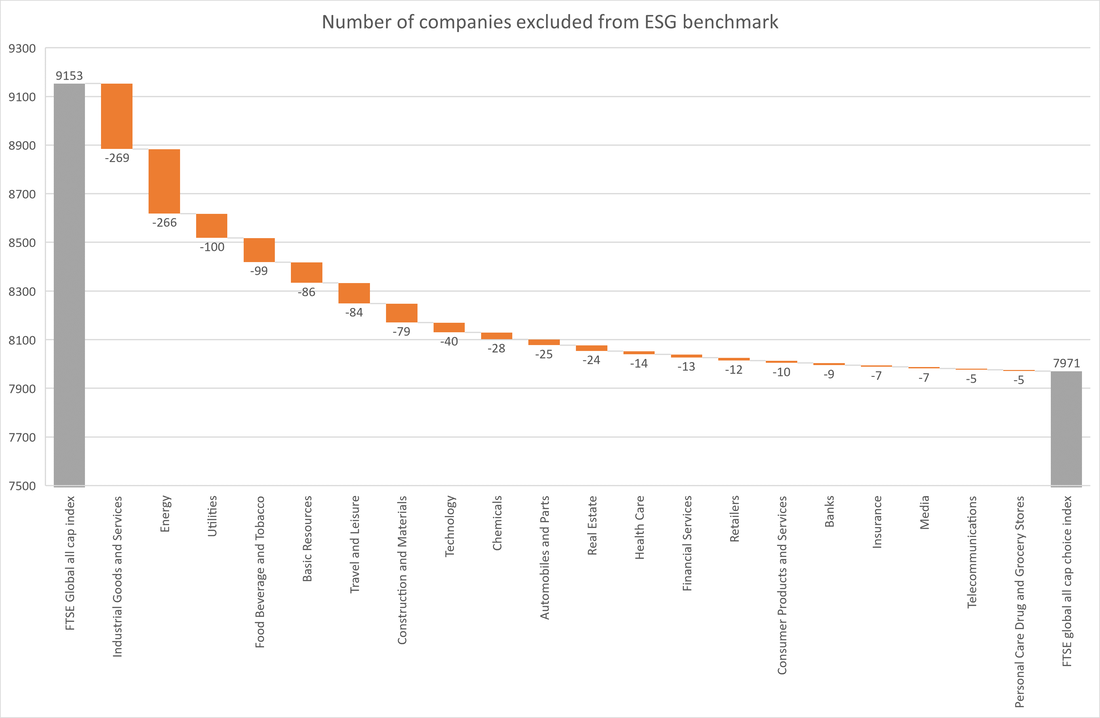

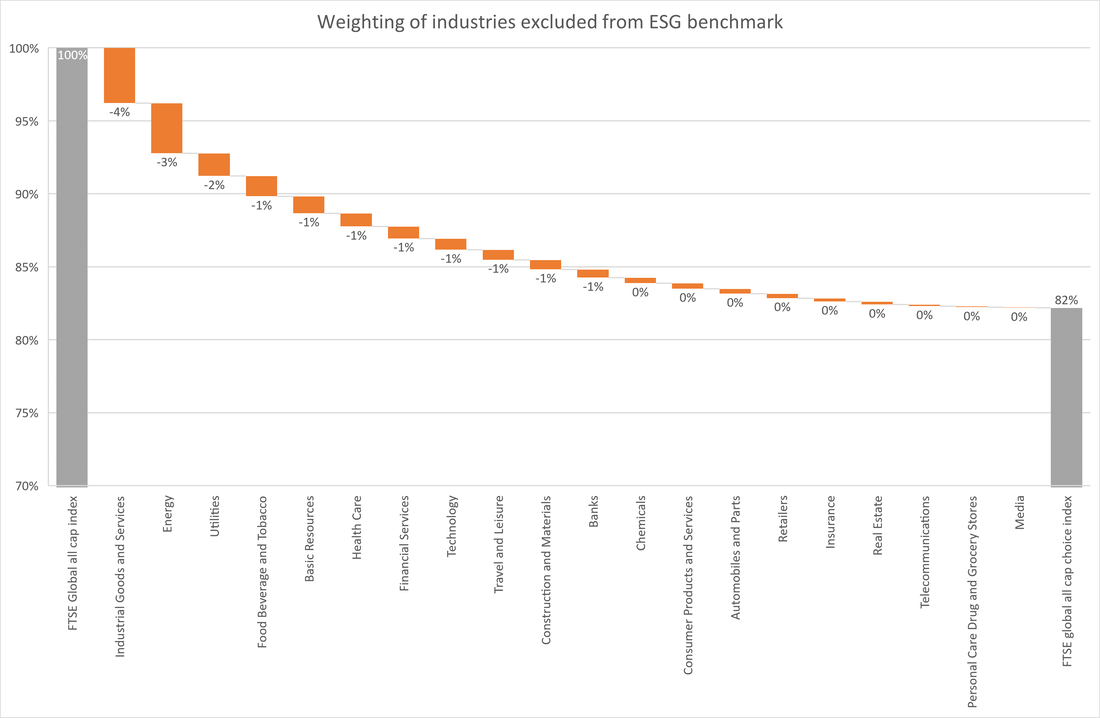

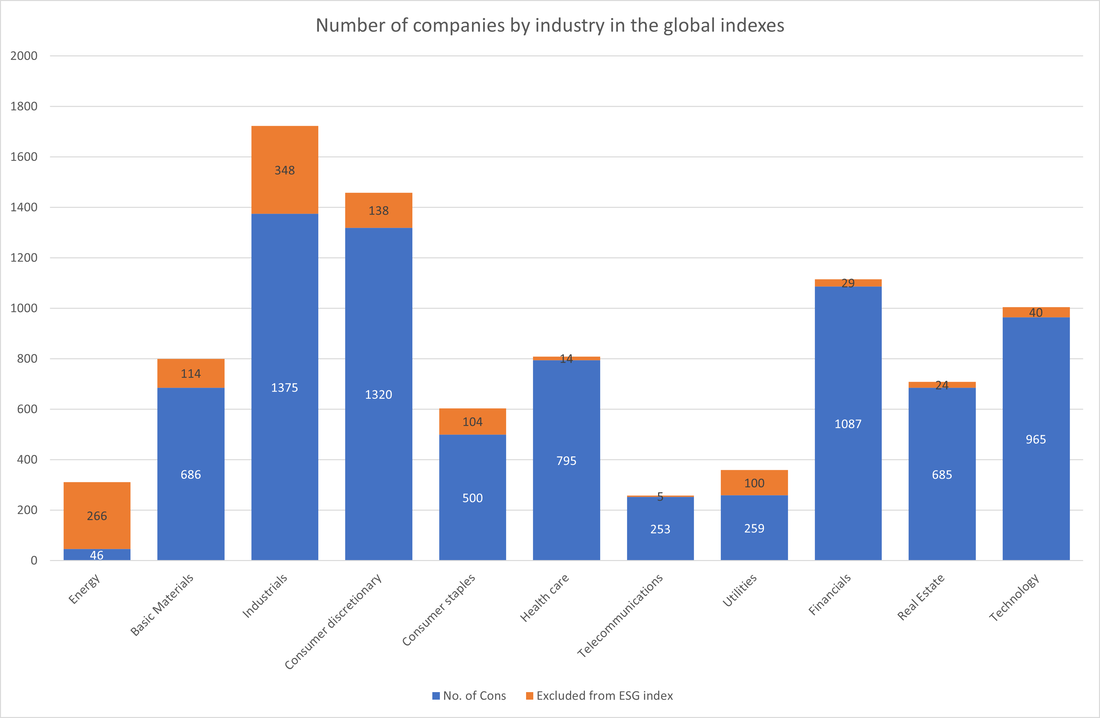

The two graphs tell slightly different stories in terms of which companies are excluded from the ESG index. In the first graph it looks like USA, China and Japan are the biggest culprits with 236, 172 and 118 companies removed from the standard benchmark respectively. Now looking at the second graph... USA, UK and France are top of the naughty list since they account for the biggest chunks of the pie being removed (8.4%, 1.4% and 1.2% respectively). But this doesn't tell the whole story! A more meaningful thing to look at is how much each country contributes to the companies excluded and how that compares to how much that country is in the original benchmark. For example, of the companies removed from the index, the USA accounts for 47% of them by weighting. Wow, you're saying that nearly half of the companies on the naughty list are from the USA?! Sounds like they're super naughty doesn't it. But in the standard benchmark, 57% of the companies are from the USA so you could argue that actually they're less naughty on average! What about the industries that are excluded from the benchmark? The following graphs show the companies that have been excluded from the ESG benchmark index based on what sector they're in. First by number of companies and secondly by the weighting of the companies in the index. So you can see the standard benchmark index on the left and then the first orange bar to the right shows 269 companies in the industrial good and services sector have been removed; then a further 266 companies from the energy sector (this is going to be a lot of oil, fossil fuels and non-renewable energy companies).

This time the top 4 "naughty" industries are the same whichever way you look at it as summarised in the table. The final column shows you how much those companies account for, of the excluded companies. For example, the industrial goods and services companies that have been removed are 21% of the excluded companies by weighting.

Visualising the ESG funds and what gets excluded

Katie and I really wanted to get geeky and visualise what actually gets removed from the standard indexes to arrive at the ESG indexes. Katie downloaded the data for the Emerging Markets benchmarks and the Global benchmarks and analysed each of these in turn.

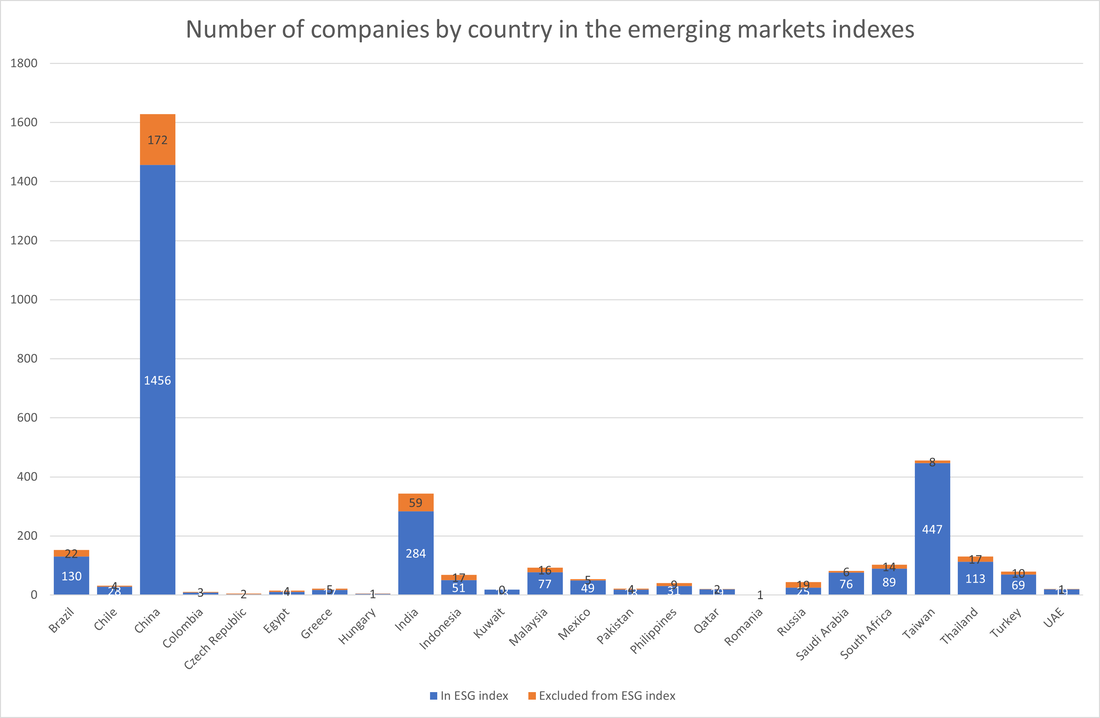

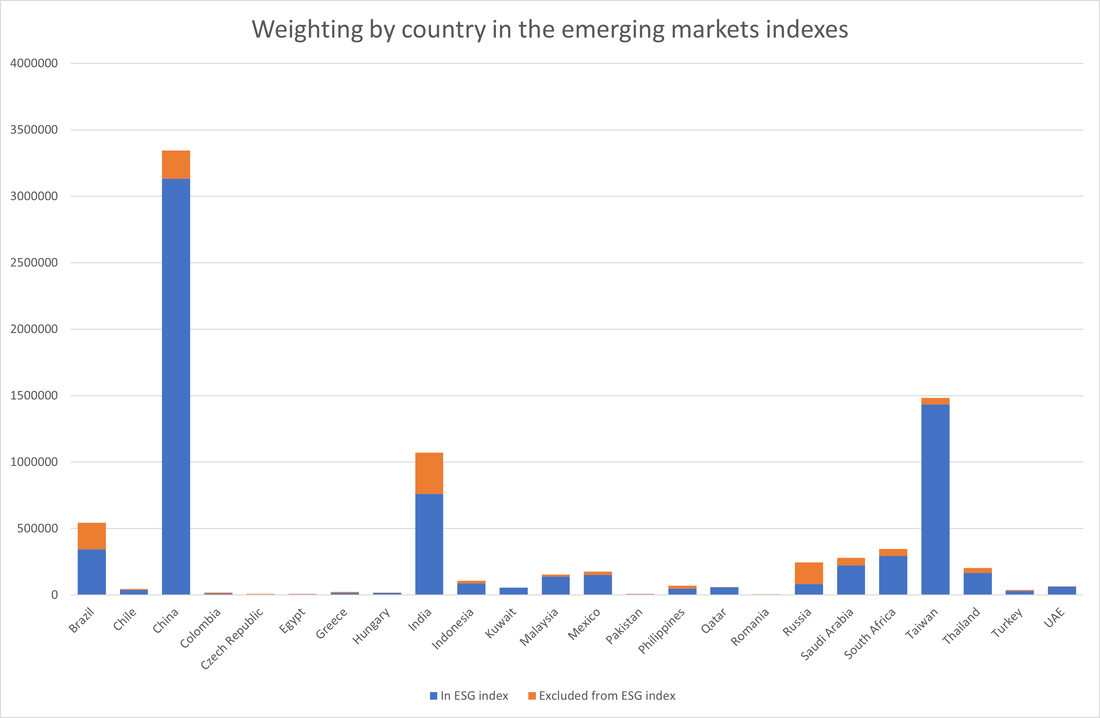

Emerging Markets This first set of charts analyses the standard benchmark index and the ESG benchmark index for Emerging Markets. In the graph below, you can see the countries that make up the markets (China is the biggest bar). Each bar is split into two colours, blue and orange. The blue shows the companies that remain in the ESG index and the orange shows the ones that where removed from the standard fund. The total bar shows the total number of companies in the normal fund

The things I noticed in this first chart is that the fund is dominated by three main countries, China, India and Taiwan. By sheer number of companies, China and India have had the most removed in the ESG fund.

The graph below shows the same data but weighted by company market cap rather than absolute number of companies.

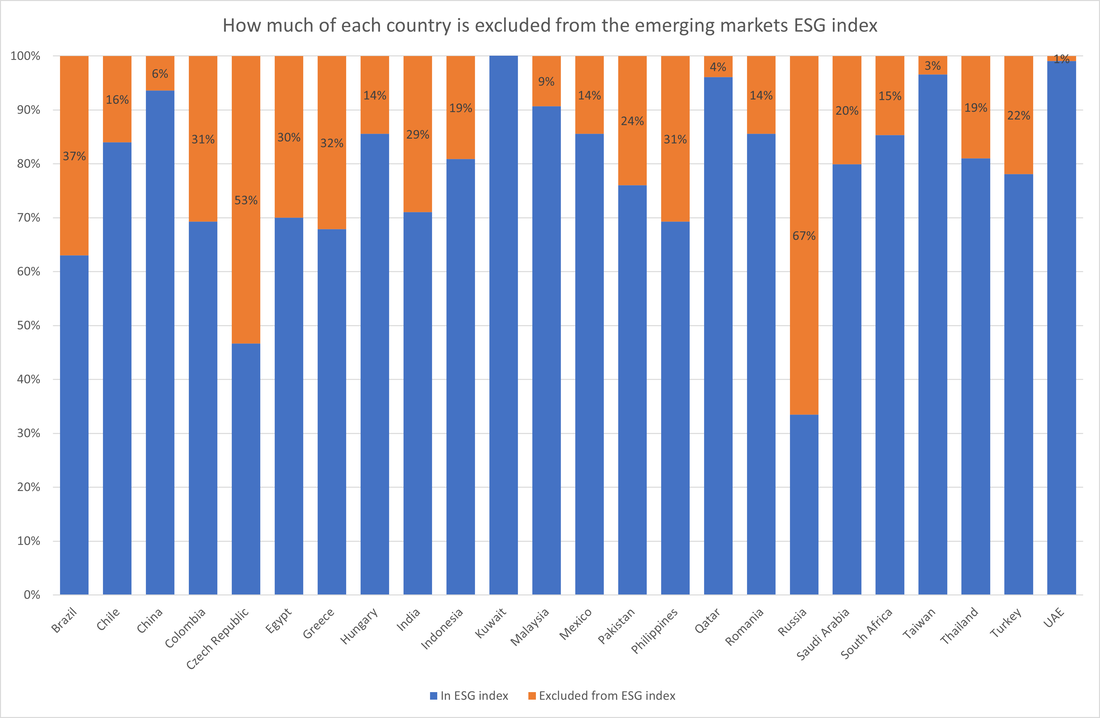

Then the final chart here Katie created for the emerging markets fund shows a fascinating look at what percentage of each country is removed by weighting. This shows you what percentage of the countries companies in the fund (by size) have been removed as they fail to live up to the ESG funds standards!

This gives you the real "naughty" list of countries! Naughty Emerging Market List

If Santa had a list and he was checking it twice these countries would only be getting a lump of coal for Christmas!

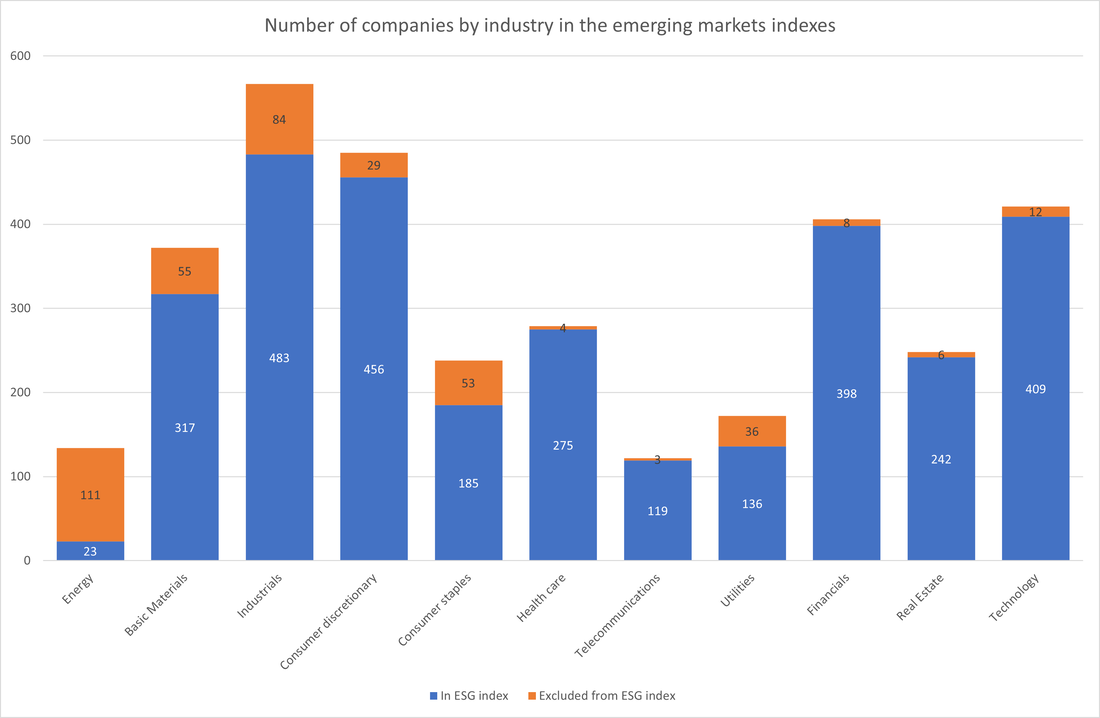

Emerging markets by industry

The next three charts show the same emerging markets fund but by industry rather than country. The first chart shows number absolute number of companies. You can see that Energy had 111 companies removed, Industrials had 84 companies removed and then Basic Materials had 55 companies removed.

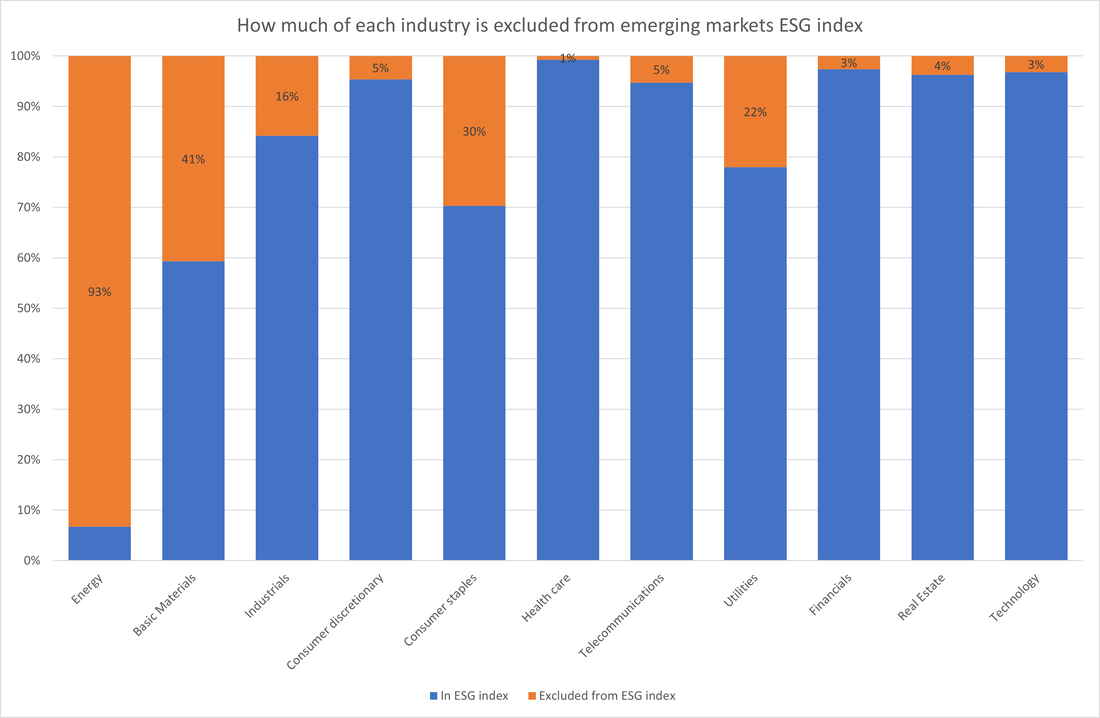

The next chart shows the same data but by weighting rather than absolute number of companies. You can see that 93% of Energy companies were excluded from the ESG benchmark index for Emerging Markets.

The final chart for the emerging markets shows the data as a percentage of each industry. I think this really highlights the industries that are most heavily excluded from the index.

What gets removed from the global ESG fund?

Here is the next set of super exciting charts from Katie! Yay. She has gone away and analysed the global benchmark to see what comes and goes between the standard version and the ESG version.

The first chart shows number of companies by country. You can see clearly the top three countries, USA, China and Japan have the most companies in the index. The full bar represents the total number of companies in the global benchmark and then the orange shows you what is excluded to get down to what is left in the ESG fund (blue).

This second chart really brings home what a huge percentage of the global fund is made up by the USA. If this surprises you then you need to read our article: How Global is your Global Index fund. The graph shows the companies in each country by weighting of company.

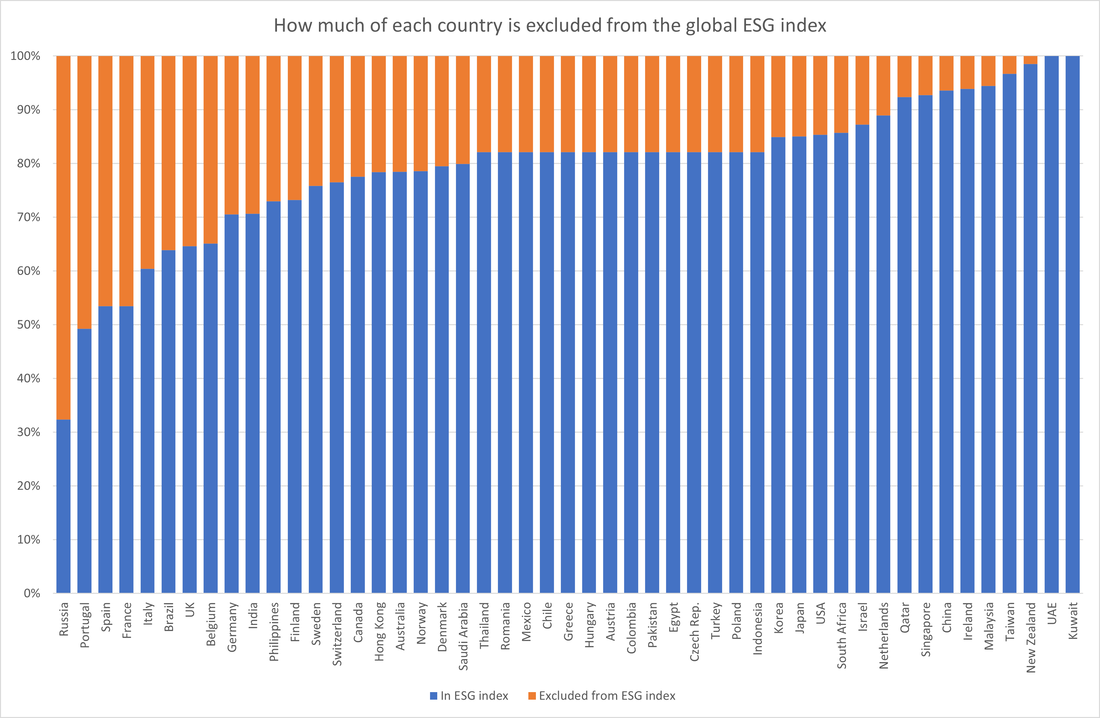

If you were looking at this graph in isolation then you would think that the USA has a really big proportion of companies excluded from the ESG fund and should be on the very naughty list. However, the following chart shows it as a percentage of the companies in that country by weighting and you will be surprised to find out where the USA actually is in the rankings!

The following chart looks at each country and shows how much of that country gets excluded from the ESG fund based on the size of the company. The bigger the orange bar the more of that country's companies is removed based on size. The USA is way down the list in 32nd position!

Santa's naughty list for 2022 is currently:

These are the countries that had the most excluded from the ESG fund by weighting! What I got from this is if I just bought the USA total stock market I am actually buying one of the better nations in terms of ESG companies. I never would have imagined that. The global fund by industry

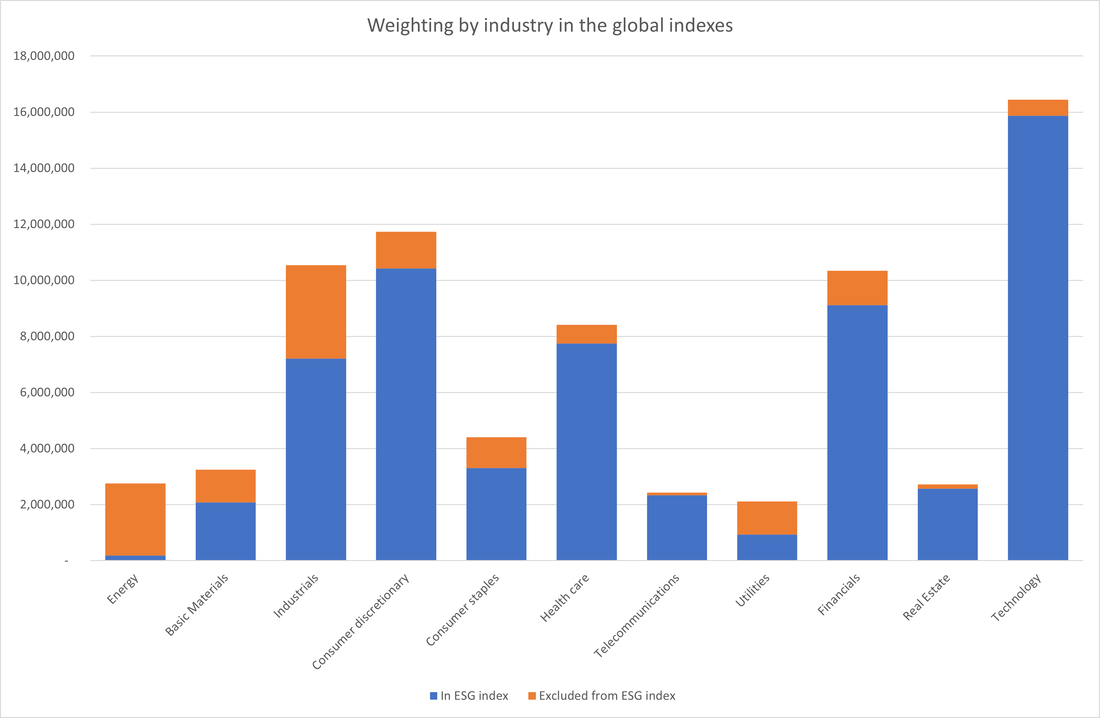

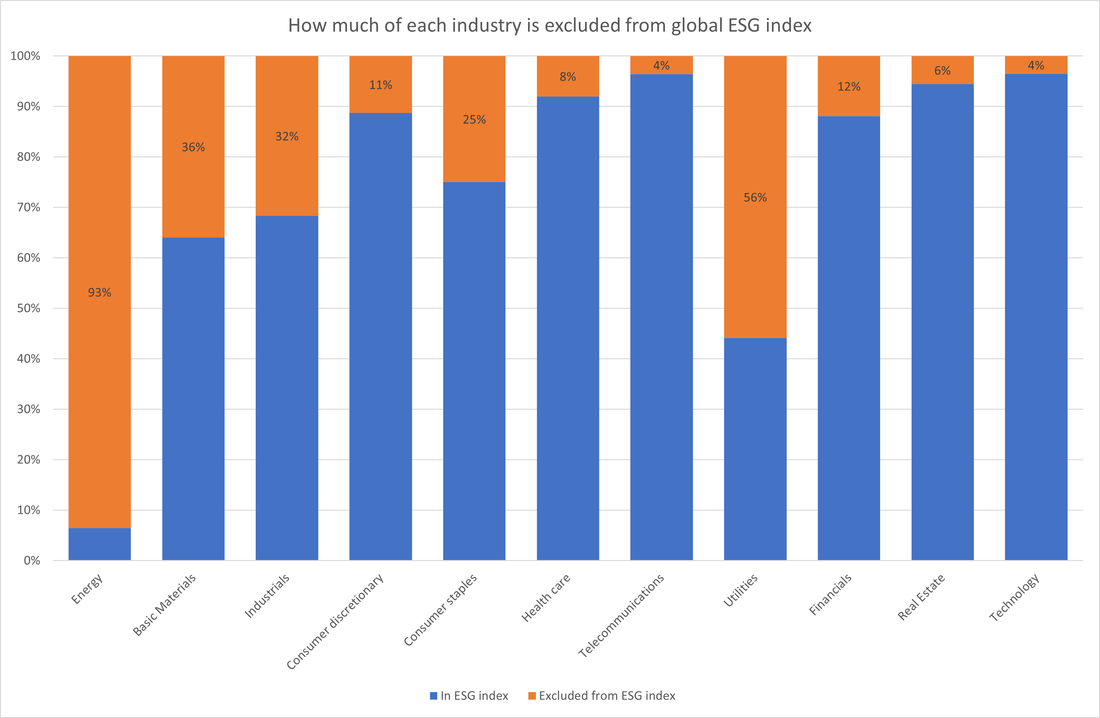

These next 3 charts show the same data for the global standard benchmark fund but by industry. You can see that by sheer number of companies industrial and energy have had the most companies removed from the index.

When you analyse the data by weighting (value of the company) you can truly see how much of the energy sector is removed from the fund. Nearly all of this sector is excluded from the ESG fund.

Showing the same data but as a percentage of the companies removed by weighting from the fund you can see clearly 93% of the energy sector is removed from the fund! 56% of the utility companies are excluded from the global ESG fund as well.

The main things I got out of looking at these charts is that the criteria applied really do distort what sectors and countries the ESG funds end up investing in. Katie and I are HUGE believers in index funds and the fact you can't beat the average returns of the market over the long run. I can't help feeling that ESG funds distort this and are going to lead to worse performance over the long run.

Big hitters excluded from the ESG funds

We were curious to look at a company level and to see how many of the big companies in each country have been removed from the ESG funds. So we looked at the top ten by market cap to see what was taken out!

We were shocked by the results in the UK. Here is a list of the top ten companies in the UK index by market cap.

How many of those do you think are removed from the ESG fund? Can you guess which ones get stripped out? They are removing non-renewable, vice and weapons. The answer is that 7 are excluded from the ESG fund and all but 3 remain! These are the only 3 that remain in the ESG fund.

Seems like the UK is a hot bed for illicit and bad companies! lol. They removed 7 of the 10 biggest companies from the UK top ten. This is insane. 7 of the biggest drivers of the UK economy have been removed. You have taken out 7 of the most profitable, largest companies from our index. These companies account for 21% of the UK companies in the standard global fund by weighting. Overall, 63 UK companies are excluded from the ESG benchmark and these account for 36% of the UK companies in the standard global fund by weighting. Meaning that you are excluding over ONE THIRD of UK companies from the ESG benchmark. This concerns me massively. If I buy the ESG fund I think that I am getting a strong ethical fund but I am not told that I am giving up some of the largest drivers of the economic engine in the UK! Did you know this? Are you willing to do this? Katie and I don't drink alcohol but we have no problem anyone else drinking it and yet the ESG fund automatically strips out Diageo (Johnny Walker, Guinness, Baileys etc.) from the fund because it sells alcohol. Which brings us to the crux of the matter; what makes an ethical, sustainable company is subjective. Some people will decide they have no problem with alcohol companies and others think they are evil. So far based on Alan's original assumptions this is looking more and more like stock picking. Performance - Profit

Do ESG funds outperform standard index funds? This is the biggest question and one of the assumptions I have about them.

Alan's assumption is that because this is a form of stock picking, ESG funds will do worse over the long term and are less profitable. Time for some research again! I started googling if they were more profitable or not and the first few articles I found seemed to show they were. I found an article "Here's more evidence that ESG funds outperformed during the pandemic" which I read first. I had several problems with the article. The first was the short time frame. We are investing for decades not 18 months which the article covers. There are always going to be ups and downs where one sector out performs and others do badly. This is normal. I am not looking for short term data. I want longer data. The thoughts that then came to me were "when were ESG index funds created" and "what's the longest time frame I can compare over"? So I started to search for the longest running ESG funds. A brief history of ESG or SRI funds

I started searching for the first ESG funds and found that they weren't always called ESG funds. They used to be called Socially Responsible Investing (SRI) funds. Let's start at the beginning.

Since then, there has been an explosion in funds that are called ESG. All with different criteria and different ideas of what ethical investing is. Some focused on climate change and others focused on driving board diversity and equality. You can choose a fund to match any type of ethical investing. Why am I telling you all this? Because we need a fund that we can track over the long term (a decade plus) to compare to the market returns of standard index funds. If you compare over just 18 months the time frame is too short to really tell us anything. The interesting thing is that you don't always know what you are going to get inside these ethical funds. The Friends Provident Stewardship Income Fund has 20% in corporate bonds kept inside the fund to balance out their riskier investments. I managed to find 10 year data on the Friends Provident Stewardship fund that we can compare to the standard Vanguard index that Katie and I invest in. if you had invested £10,000 in the Friends Provident that would have grown to £20,955 by December 2021. Not bad I hear you saying! Doubling my money in 10 years is pretty good. Sounds good but when you compare it to the Vanguard FTSE Developed World ex UK fund that Katie and I invest in; it doesn't look good. £10,000 invested in the fund we invest in would have grown to £37,596 over the same period; almost quadrupling. I hear you screaming "money isn't everything Alan!" And you are right, money isn't everything but that kind of growth can mean the difference between hitting financial independence and not. It can mean the difference between having enough to retire or not. I would rather have the extra profit and then spend it on doing good in the world! Ideally I would love to do a proper comparison of 100s of ESG funds with the standard broad based Vanguard funds but that is a huge task. Maybe I can hire someone to do that with me? I have compared the Vanguard Dev World with the Vanguard ESG Developed World All Cap and the results are interesting. £10,000 invest in the ESG fund would have returned £35,231 over the same 10 year period which is pretty good! Now you are only talking about a difference of 24% over 10 years. I mean that is still significant and depending on how tight your income is could really affect your progress but it is a price you might be willing to pay for ethical investing.

What we have looked at is past performance and as every single advert for investments tells you "Past performance is no guarantee of future growth!" So the question becomes which fund will do best in the future?

This is where I get my crystal ball out and start making predictions. Only joking. Every time I have tried to predict the market I have got it spectacularly wrong which is the whole point of index investing. With index investing you don't have to predict the market, you just invest your money in every business in every market and leave it to grow forever. I have no idea if ESG funds will outstrip standard funds in the future or continue to underperform them. The one thing that I can tell you is that if the ESG companies outperform the non-ESG companies then they will naturally make up a bigger and bigger percentage of the standard index anyway. If you bet on the total index you will see the upside of the ESG companies but if you bet ESG you will not see any upside from the non-ESG companies as they are by definition excluded from your index. From the research I have done for this article my conclusion is that the further you stray from the principles of index investing the worse performance you get. What I mean by that is the more you go towards the stock picking end of the spectrum the worse percentage return you get on average over the long term. If it was a purely monetary decision I would not move from a standard index fund. What do other FI authors think of ESG funds?

Last year we ran a Rebel Finance School teaching people to invest and take control of their finances. We had so much fun. If you want to find out about the next one sign up to my mailing list.

On that course we had three special guest speakers, Mr Money Mustache, JL Collins and Millennial revolution. Here is a very brief overview of what they told us on the course.

Will investing in ESG funds actually make a difference?

This is where it becomes difficult. No one really knows. I am going to give you my opinion.

At the annual Rebel Retreat one of the Rebel Board members started discussing ethical investing and how he was getting involved in several actively managed ethical funds. He felt like he was doing the right thing for the environment and helping people to invest ethically. I felt like he was tackling the problem from the wrong end. In my opinion if you want to have the most impact on the environment you should change the way you spend your money not how you invest your money. If there is a company that we can all agree is bad for the environment and is causing problems and we all decide not to spend money with them what will happen to that company? They will either go bankrupt as they will lose all their income or they will change their ways pretty quickly, tell the world they are now ethical and sustainable and start to sell what the market actually wants. If we change our investment and don't invest in that company but it still has all its customers and is making a decent profit then what happens to that company? Nothing. it will continue to trade because it can make a profit. Over the decades, humans have clearly shown that if they can make a profit doing something they will. If they can't make money doing something then they won't. If you want to change the world then change where you spend your money and persuade other people to change where they spend their money. This will have a BIGGER and faster impact than "ethical" investing every will. If we all changed to spending money with "ethical" companies then the main index would change to reflect that in a matter of mere months. Having thought a lot about this and argued the point with a lot of people my thoughts are:

I am not convinced that by me shifting my money to an ESG fund it will actually have the impact that people hope it will have. Did writing this article changes Alan's assumptions?

This ended up a ling article didn't it! Are you still there? Still with us?

Here are Alan's assumptions from before the course and whether he has changed them:

What an epic article. And there is more to come. Katie and I know this is a complex subject and we are working to simplify it for you. It is going to be a journey to say the least. We are planning more articles to break down the differences in funds, the terms and more to make it as easy and simple as possible for you to invest. I hope you enjoyed the article and the biggest thing you can do for us in return is leave a comment with your questions below (this will help us strengthen our articles) and then share the article if you think it has value. Thank you for reading. Thank you for working on you own finances and Katie and I wish you all the success in the world Have a wonderful week! Alan and Katie Disclaimer: This is not financial advice. Katie and I are not trained financial advisors, nor to we pretend to be one online. Read our full disclaimer here. Next Rebel Finance School

Alan and Katie run 1 or 2 Rebel Finance Schools each year. If you want to find out when the next one is going to be running please enter your details below and joining the mailing list!

|

DONEGAN |

We built this website to share our stories, the adventures, the amazing people and all the life lessons we've learned along the way!

SIGN UP to our mailing list

|

RSS Feed

RSS Feed