|

Back to Blog

Debt Warning18/5/2021

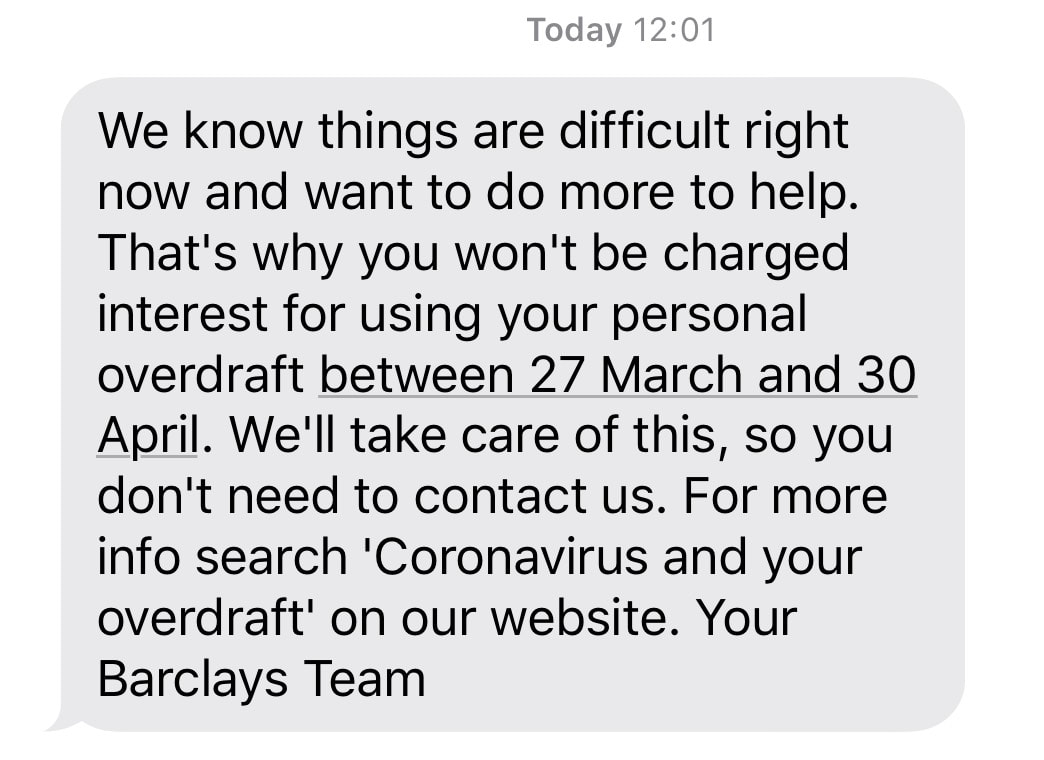

This is a warning against unscrupulous companies that are going to try and take advantage of you during this time. They are going to do it under the guise of helping you through the pandemic but in reality they are going to leave you far worse off in the long run than if they didn't help at all! A year after I wrote this last paragraph I have now begun to realise that it is not just in moments of crisis that they will try and take advantage of you. They are out their right now taking advantage of people; it just feels more shocking at the height of a pandemic. There are teams of people currently working out the best way to get you to take on more debt. Update 25/08/2020: This was written just as lock down was starting on the 25th of March 2020 and this is still going on now and always will do. Car dealerships make more money on the financing and insurance than they do the car itself. Online catalogue companies offer you "anything you want" buy now, pay later at 39.9% APR. Companies that lend money make more, when you pay slower! The debt warning isn't just for the height of a pandemic it is something you need to be wary of always! Update 18/05/2021: They are still after you. Nothing has changed. In fact they are getting smarter at putting you into debt. This warning is needed now more than ever. I get the feeling when I review this article in a year's time I will be writing that it is even more needed then. Debt WARNINGI don't want to get dramatic but the decisions you make over the coming weeks and months are going to affect you for the rest of your life. Debt, loans and credit cards have to be paid back and can effect you for decades after you have spent the money. Let's take an example: Things are tight, you need to buy food, stuff for the house and more whilst there is a slump in income. You put it on your credit card. If you had a balance of £5000 after three months of lock-down and then you paid back the minimum amount over the coming years how much would you pay back and how long would it take to pay it back? If you paid just minimum payments it would take you 30 years to pay back that amount! 30 years!!! You would pay £21,500 in interest back to the credit card company (based on an APR of 21.1% which is typical at the moment). 30 years of your life and £21,500. Can you see how the decisions you make in the next three months can control the rest of your life if you get it wrong? Not only this but there are companies actively marketing to you to give you debt! There are teams of highly educated and highly motivated people who work to get you to take on debt as it makes them money. Banks trying to put people into debt

In 1 month's time is this all going to be over? (update we know this didn't happen!) Am I going to have a high paying job and be able to pay it off in one lump sum and before the deadline they set? Or are they trying to take advantage of me? Put me into debt at my most vulnerable time and then make me pay it off over the coming years? I am shocked at the number of payment holidays (you still pay interest), "free" overdrafts and loans that are being offered currently. Thanks banks for helping me go further into debt at my most vulnerable time. Be careful of offers that are disguised as help over the coming days and weeks. There are companies without morals that are going to profit out of our vulnerability. Overdrafts

As part of week 4 we ask for a case study. This real life example allows us to help the individuals in question and gives everyone on the course a real life example which is always the best way to learn. This time I was SHOCKED to my core when we analysed the numbers. The individuals we were supporting had two overdrafts from their banks and had set them to minimum repayments. We discovered that by doing this they would NEVER pay off their overdrafts and not only that the interest that they were paying was growing faster than they were paying them down. If they left this like this after 6 years they would have paid £62,198 interest on a overdraft that was initially only £11,500. I thought this kind of loan sharking was only done by pay day loan companies but I was even more shocked to find out it was two of the UK's most trusted banks Halifax and Barclays. They were charging 50% and 40% interest respectively on these overdrafts. I can't believe this. These are the banks that over you overdrafts to "help" you in times of crisis and then put you into financial slavery for the rest of your life. Beware offers of help and support in times of crisis from financial institutions that stand to profit from your situation. The UK government has set up the Coronavirus Business Interruption Loan Scheme which aims to lend you up to £5m if you run a viable business to help you through the tough times. They are offering you debt to get through the hard times that have arrived. You will have to pay this debt back within 6 years. You will get up to 1 year interest free. I have not been able to find anywhere on their documentation what interest rate they will charge you. They are asking you to take on debt without any idea of the terms of repayment? The UK Government are also offering other schemes, grants and protection of jobs for employees but very little else for the self-employed. Do they expect us to all take on debt to survive this and spend the next 5-10 years paying it back? I guess that is exactly what we are going to have to do as a country right now. We the British people are borrowing a huge amount of money to offer these schemes and it is the tax payer that is going to have to pay it all back eventually. It all comes down to us paying for this virus somehow...…...... Government loan schemesTake any other option rather than debtI know the situation is tough. We are feeling it too. In March 2020, Rebel Business School lost all it's income over night and £250,000 vanished! The tenants from Katie and my flat in Basingstoke have written and said they aren't paying the rent for three months! Things are tough. Make debt a LAST resort. Do anything else you can rather than go into debt. Use the government benefits system, apply for the grants and take support wherever you can, just not debt based schemes. Now is not the time to be proud and suck it up. Now is the time for us all to work together to get our way through this. Be careful as debt is given lots of other pretty names by marketing teams. They call it funding, finance, loan schemes, overdrafts, credit and more. They dream up lots of more palatable names to disguise debt. A bank can call in an overdraft at any point. They can ask for it back without notice. Different types of debt are going to be worse for you than others. A high interest credit card is going to cripple you for far longer than a low interest bank loan! A high interest overdraft might rinse you for tens of thousands of interest! PLEASE be vigilant of unscrupulous lenders that are going to disguise debt as help. Please be aware that you are going to have to pay back these loans, credit cards and offers. Please do everything you can to stay out of debt and do not sacrifice your future at the cost of today. I would love to know what companies are offering you and how they are doing it. Please screen shot the offers that are being made to you and put them in the comments below. Let's all stay safe and debt free. In normal timesDebt at any time is something to be avoided. Think of debt as the hangover for the good night out. You get the credit card and you buy a load of stuff. you are going to have a financial hangover for years to come to pay that back. You buy the car of your dreams on finance because you can't really afford it. You are going to have a financial hangover for years to come dealing with that decision and getting your finances in control again. Debt is the hangover from decisions you made in the past. If you have debt now you are paying for the decision past you made. Please don't put future you in debt. They will have to pay if off or deal with it. I am so glad that past Alan avoided most of these schemes. Don't get me wrong he fell for a few, but in general past Alan has worked hard for current Alan to live a financially free life with very minimal debt. Please take care of future you by making financially savvy decision in the current moment. What's nextKatie and I are currently running a course called Rebel Finance School designed to help you get to grips with all the different elements of money. We have done half the course but it isn't too late to join if you want to. Over the past weeks we have been writing more and more about managing your money and getting on top of your finances. If this is the first blog post you are reading then try these next:

Taking control of your finances is one of the most important steps to building the future you want to build. Katie and I have been spending the last decade transforming our finances to the point we never have to work again if we don't want to and we "retired" 25 years earlier than the average. You can do extraordinary things when you learn, focus and implement. The extraordinary belongs to those that create it so take control of your finances and start to build an extraordinary life. Have fun taking control of your finances and let us know if we can help in anyway! Alan Thanks to Mike Cohen for the blackboard overdraft picture

|

DONEGAN |

We built this website to share our stories, the adventures, the amazing people and all the life lessons we've learned along the way!

SIGN UP to our mailing list

|

RSS Feed

RSS Feed