|

Back to Blog

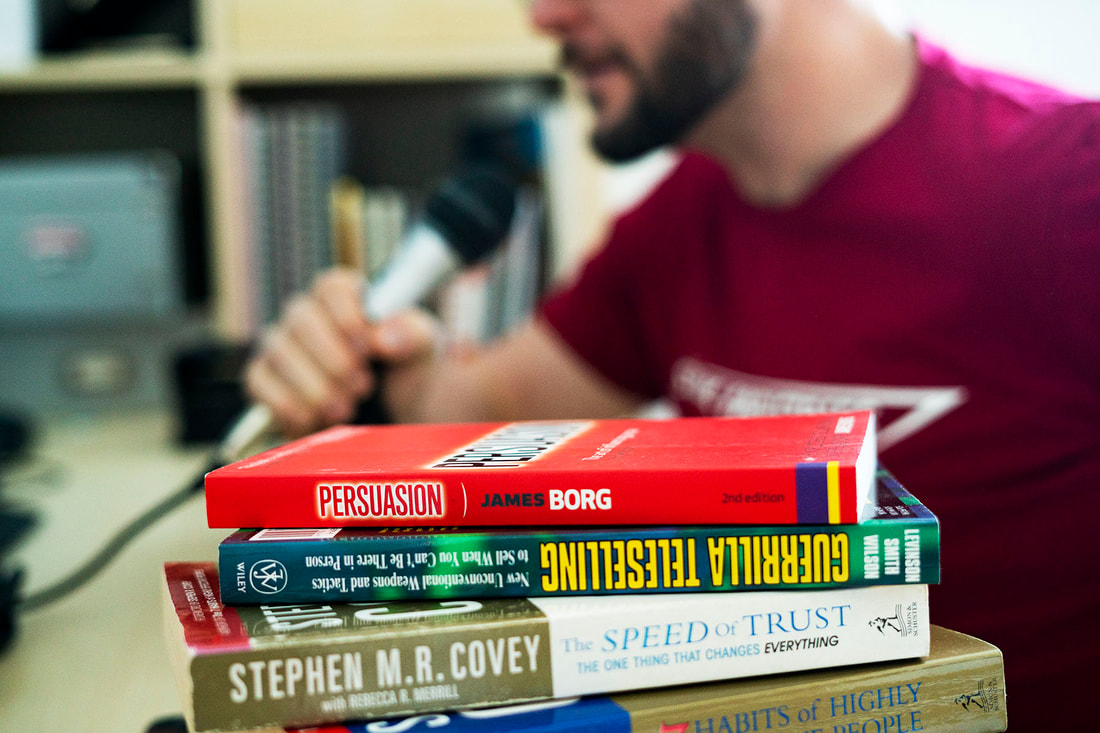

Billionaire Librarians29/11/2020

In fact all of us have access to this knowledge. We have YouTube, the internet, podcasts and a wealth of knowledge that our ancestors could only have wished they could have access to. So why aren't we all millionaires with Lamborghinis and philanthropic foundations that cure diseases? Is more information the answer?

Back to Blog

I wandered around the counters in a trance, staring at an incredible selection of food. I didn't know what to choose or even where to start! After what seemed like 20 minutes of wandering I decided I needed to limit my options. I decided to have soup and headed to the soup section. There were 20 different soup flavours to choose from. I nearly had a melt down. I was just hungry and tired! I needed food!

This is the paradox of choice. The more options there are the harder it is to make a decision. This was just deciding what to have for lunch! Can you imagine how I felt looking at investment options for the first time? Maybe you can?

Back to Blog

What is an index fund? Investor Series10/11/2020

What is an index fund? The language of investing can be hugely complex at the best of times! Even a simple term like index fund takes a lot to properly explain. If you want to feel confident investing then the first step is to build your investing knowledge and financial vocabulary. The more you understand something the more confident you will feel starting! Writing this article has doubled Katie's and my knowledge about index funds! We hope it does the same for you!

The short explanation: Index funds give you an easy and cost-effective route to diversify your investments across the globe and partake in the growth of the global economy. Sounds sexy; but what the hell does it mean! What is an index fund? What is contained in an index fund? Which index funds should I buy? Why do I care? Let's get geeky together!

Updated: 22nd June 2021

Back to Blog

What is diversification? Investor Series9/11/2020

He worked for a multi-national logistics company in aviation. His area of expertise was airlines. So he had taken his money and invested it into airlines, aviation and travel companies. In March 2020 when Covid-19 knocked the stock market sideways his stocks plummeted. When the stock market recovered in May; his stocks didn't. He had the opposite of a diversified portfolio!

What is diversification? How do you do it? Is investing in one thing diversified? First Written 09/11/2020. Updated 01/06/2021 |

DONEGAN |

We built this website to share our stories, the adventures, the amazing people and all the life lessons we've learned along the way!

SIGN UP to our mailing list

|

RSS Feed

RSS Feed